Where Livewire readers are seeking returns in the year ahead

If there's one thing that irritates Livewire readers, it's the use of financial jargon and acronyms. Complex terminology used by industry insiders to make them sound clever - I get it! But when I read through the Livewire 2021 Income Series Survey results, there was one acronym that simply couldn't be ignored. I'm sorry but ... TINA!

There Is No Alternative (TINA) in financial circles refers to the reality that investors like you have been forced out of low-risk assets such as term deposits and into riskier asset classes such as equities and high-yield bonds.

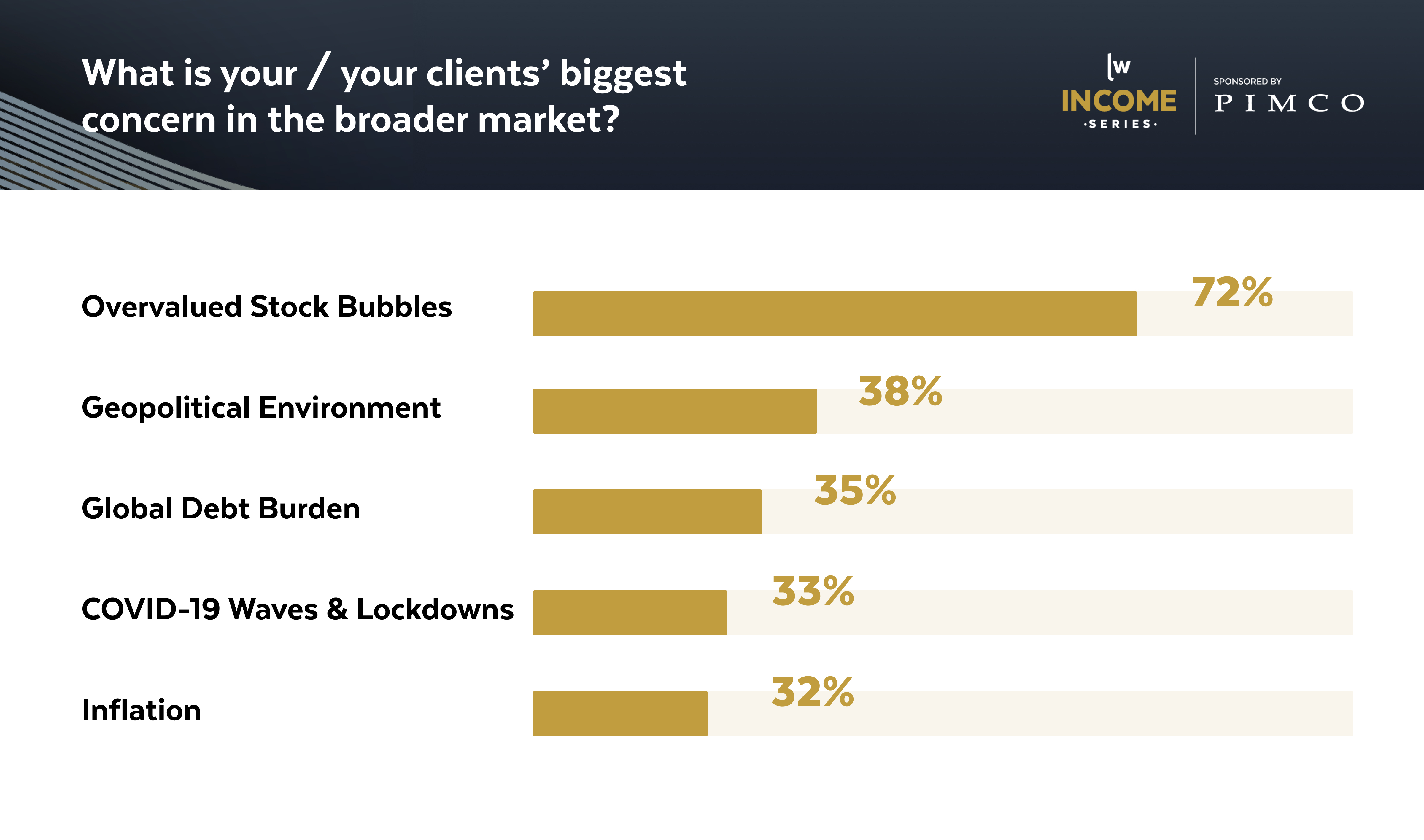

72% of the 1,430 Livewire readers that participated in the survey listed overvalued stock bubbles as a primary concern. However, 69.4% of participants said they still intend to increase their allocation to equities in the year ahead. Talk about a rock and a hard place.

On a positive note, there are lots of people thinking about alternative ways to overcome today's challenges by building diversified portfolios.

A big thanks to everyone that took the time to complete the survey. We appreciate it. We've listened to your feedback and will be speaking with a wide range of investment professionals to bring you their views on solving the income puzzle in 2021.

Below is a snapshot of the survey results, and a link to the full report is available here.

Survey quick stats

- 1,430 responses, nearly three times the number of participants compared to last year

- 75.5% of participants listed saving for retirement as the top reason for investing

- 87% of survey participants were aged 45 years or older

- 45.2% of survey participants held a portfolio of $1 million or above

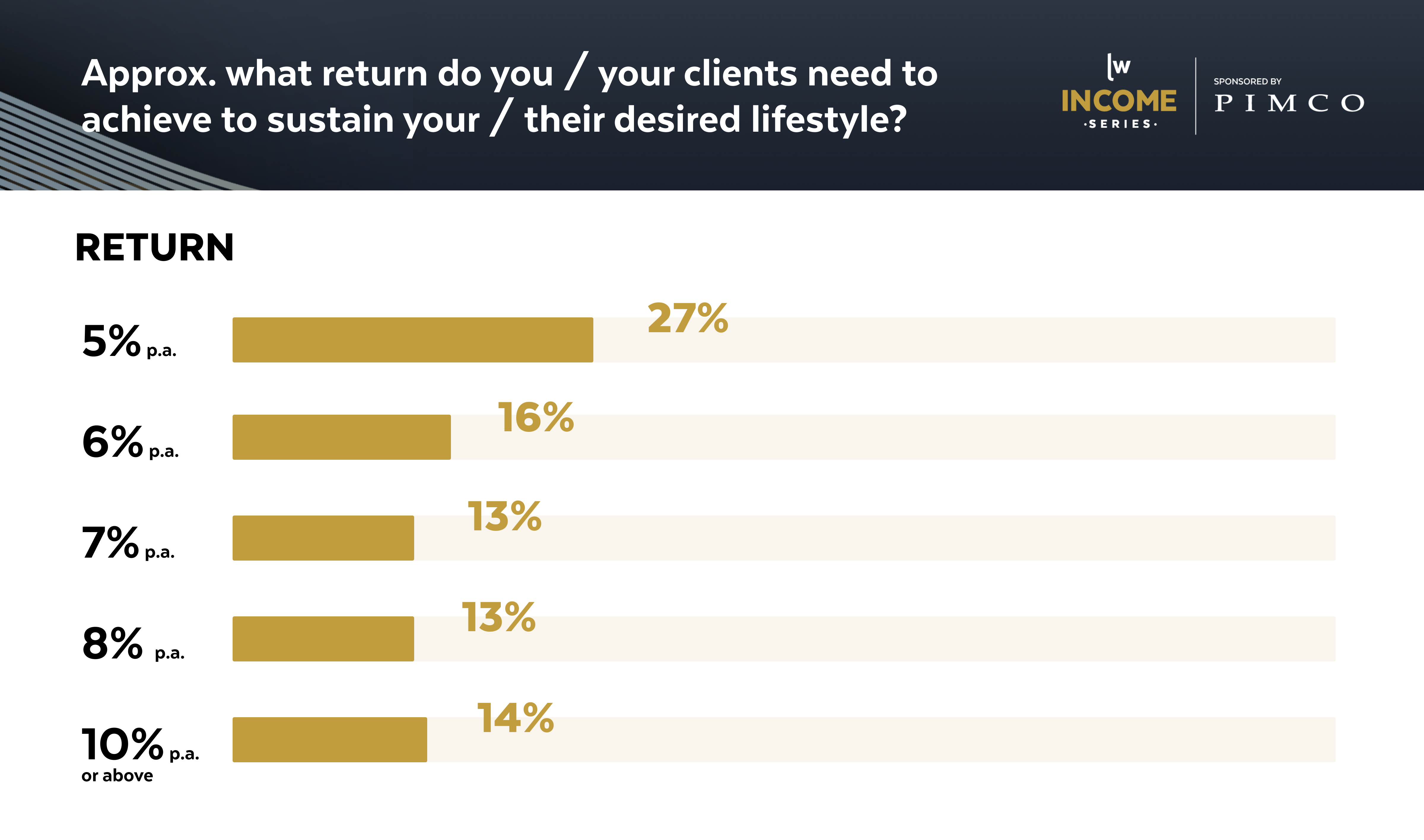

5% - 6% is that too much to ask?

42.9% of participants said that they needed a return of 5% or 6% to sustain their desired lifestyle. However, as is often the case, averages tend to smooth over the detail. When we look a little deeper, those return requirements varied greatly depending on portfolio size.

53.5% of people with a portfolio below $1 million said they were seeking a return of 7% or above. In comparison, 31% of people with portfolios of $2 million or above were seeking 7% or above returns.

Financial advisers were the most conservative on return expectations, with 74% seeking a return of 6% or lower.

Stepping up the risk curve, but only in small steps

We asked a few questions to understand your appetite and capacity to increase risk, including your tolerance for volatility, liquidity requirements, and desire to move into risker assets. I would sum up the responses as a 'reluctant acceptance'. Which, to be honest, is the reality of the current investment backdrop.

Most participants (60.1%) said they could handle a small amount of volatility. I was interested to see that there was a willingness to lock up capital to achieve higher returns.

To that extent, Private Credit and Alternatives featured prominently in current portfolio allocations. It seems that with each new day, I stumble across a new private credit or equity offering, and this will be a topic worth exploring in more detail.

Outside of equities, Listed Infrastructure (19.9%), Real Estate Investment Trusts or REITs (19.4%) and Alternatives (10.4%) feature prominently on your shopping list for the year ahead.

Your top 5 concerns

Earlier this year, my colleague Patrick Poke published an interview with Jeremy Grantham from GMO. Grantham was bearish on equities, and the article was one of the most-read pieces of the year. It seems Grantham appealed to the concerns of many of our readers, with 72% listing overvalued stock bubbles as a primary concern. It makes total sense given the heavy allocation to equities that many portfolios have.

It was interesting to note that private investors' portfolios had higher allocations to equities than portfolios managed by financial advisers.

Equity allocation by investor type

- Retail Investor - 53.3%

- High Net Worth Investor - 42.3%

- Financial Adviser - 30.9%

The geopolitical environment and global debt burden deserve their spot high on the list. And it seems we have become complacent about the prospect of inflation relative to other concerns. Perhaps we simply don't think it is likely to eventuate in the immediate future.

My take

One thing that I have learned since starting Livewire is that individual investors have a knack for figuring out a solution. The approach may differ from textbook portfolio theory, but that doesn't mean it is wrong or won't work. We all gravitate towards what we're comfortable with, and our latest survey shows that equities remain a portfolio staple.

My goal for Livewire's 2021 Income Series is to help deepen your understanding of lesser-known asset classes, so next time someone says TINA – you can tell them there is.

Why you can't miss Livewire’s Income Series:

Livewire's 2021 Income Series gives investors best in class education and premium content to build a bulletproof income portfolio.

Click here to view the dedicated website, which will include:

- The list of income focused ETFs, LICs and funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with leading fund managers.

- Videos and articles to help you perfect your income strategy.