Where Morgan Stanley sees value today

Nathan Lim developed an early sense of self-reliance, immigrating as a child to Vancouver, Canada. His parents moved there with Lim and his older brother when the siblings were aged three and eight.

Less than 10 years later, his parents moved back to Malaysia without the two boys: “I became very self-reliant when I was very young, I think I was probably the only kid in grade eight that could cook, clean and iron,” Lim says with a laugh, during a recent podcast interview with my colleague Patrick Poke.

Fast-forward a few years, and after Lim graduated from university, he returned to Malaysia to kick-off his professional career with a Kuala Lumpur-based stockbroking firm. At the time, the country was one of the “cubs” alongside the "Asian tiger" economies of Singapore, Hong Kong, South Korea and Taiwan, Lim caught the tail-end of the Asian boom.

In the years that followed, countries of the region suffered as the Asian Financial Crisis unfolded. As Lim explains, economies of the region suffered the consequences of:

- Excessive reliance on foreign capital;

- High reliance on corporate financiers; and

- Extreme risk-taking by retail investors.

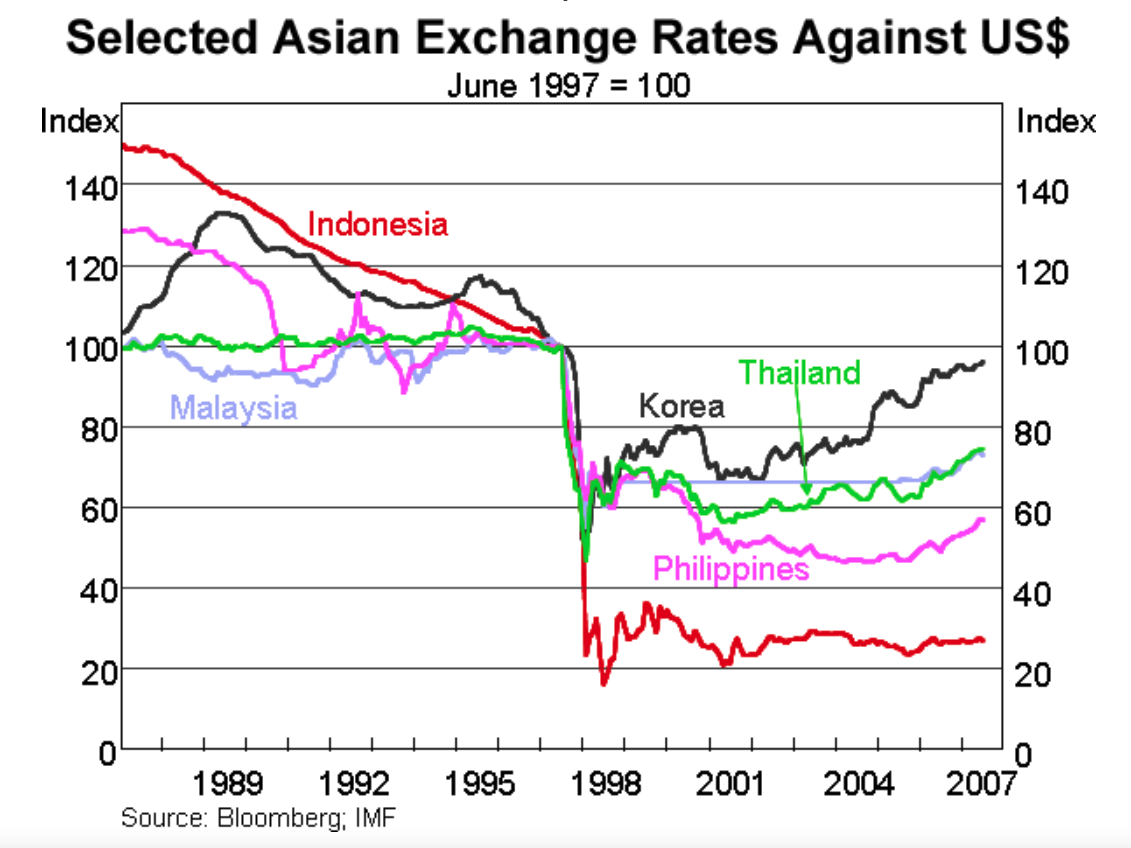

Illustrating the dramatic crash, Malaysia’s currency, the ringgit, depreciated around 35% against the US dollar overnight.

"The stock market lost 80% of its value over 12 months and the economy, after growing about 9% a year for 10 years, crashed to -7%,” Lim says. “So, my time in Malaysia gave me a real practical feeling of what risk looks and feels like when bad things happen.”

This experience may have given Lim some early insight ahead of the latest seismic market event, the catastrophic downturn and rapid rebound spurred by the COVID pandemic.

Prelude to the pandemic

In his role heading Morgan Stanley’s Australian wealth management research, Lim and his team keep a close watch on emerging markets and the broader economic cycle in China.

“By 10 February last year, one of the most important data points that came out of our research is that we were observing Chinese power coal consumption (thermal coal) was not rebounding post-Chinese New Year,” Lim says. Typically, this consumption shows a prominent dip during the Chinese New Year as the entire country closes down for a week, before resuming when everyone goes back to work.

“That didn’t happen,” Lim says.

This sounded alarm bells for Lim and his team, who (correctly, it turns out) projected that the economic cost of COVID was going to be far greater than people were anticipating at the time.

In response, Lim and his team started “de-risking” their clients’ portfolios, particularly by dialling back exposures to equities.

But just over one month later, by 30 March they recognised there was so much stimulus sloshing around the global economy, “that a Great Depression scenario was now off the table.”

“So, we were telling clients to start putting stocks back into their portfolios.,” says Lim.

“And by 11 June, the fiscal stimulus from governments added to that monetary stimulus meant a V-shaped recovery was most likely, which took us into the repair phase of the cycle.”

Where are we in the boom-bust cycle?

“If you think of COVID as an epoch (an era-defining event) we are now squarely into Morgan Stanley’s post-COVID playbook and are getting very close to moving into the recovery stage – the mid-point of the cycle,” Lim says.

Where are the best opportunities now?

Rather than making “sector calls”, MSWM uses factors to recommend specific exposures to its clients. And in the current environment, the factors Lim and his team likes are Cyclical and Value. They’re rotating portfolios away from “expensive growth stocks” towards what Lim describes as “better value cyclicals.”

He concedes the definitions of value versus growth sometimes get confused, given that value investing is often simply regarded as finding companies with low price-to-book / price-to-earnings multiples.

“But some companies are value traps because they’re in businesses that are going backward or where there is low growth,” Lim says.

“You want to look for companies that are exposed to that cyclical recovery in earnings, because earnings are ultimately what’s going to cause a re-rate in share prices.”

Alongside “boring, industrial cyclical stocks,” Lim is bullish on resources and commodities, because they reflect his team’s recovery thesis.

He calls out copper in particular, “very much an industrial metal,” getting exposure by owning the commodity itself and also via exchange-traded funds. A couple of these include:

- Invesco Commodity Composite UCITS (LSE: LGCU), a London-listed ETF providing exposure to a broad basket of commodities.

- SPDR S&P/ASX 200 Resources (ASX: OZR), an Australian ETF that invests in a portfolio of securities tracking the S&P/ASX 200 benchmark.

How do you find good funds?

MSWM follows a largely quantitative process in selecting the right ETFs for client portfolios. And in selecting active funds, the wealth manager has a comprehensive approach combining both data-driven and qualitative research methods.

The quant models are adapted by Lim and his team for the Australian market from the proprietary models developed by Morgan Stanley in the US. Both a value score and risk score for passive funds are part of the output generated by this research.

“They go beyond a Sharpe ratio, these tools are inherently predictive,” says Lim.

“They ask the question: do we think this manager will beat their peers? Is this manager good value for money? And is it doing all these things in a risk-controlled fashion”

Funds that clear this hurdle then pass through to the interview round, where portfolio management teams are assessed and scored against six fundamental factors:

- Business

- People

- Product

- Process effectiveness

- Portfolio and risk management

- Performance.

The top-scoring manager is then added to MSWM’s list of preferred asset managers, which includes at least one manager for each asset class.

“You need to get on our focus list before you are then approved for use in portfolio construction purposes,” says Lim.

And Lim believes the results of this process speak for themselves. “Knowing that roughly one in 10 active managers here in Australia will beat their benchmark, we’ve been able to achieve a nearly 60% hit rate in finding managers who will beat their benchmark.”

A handful of preferred funds

Asked to highlight some of his team’s favourite funds based on their intensive selection process and the performance they’ve delivered, Lim lists the following strategies:

- Pendal Focused Australian Share

- Capital Group New Perspective

- AB Concentrated US Equity

- Partners Group Global Value.

In conclusion: Get the earnings right

Above all, Lim maintains that the importance of a fundamentals-based approach is one of the most important things.

“One of the key lessons I’ve learned as an investor is to focus on earnings,” he says.

“If you can get that earnings trajectory on the companies right, you’re about nine-tenths of the way there.”

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a like.

4 topics

2 contributors mentioned