Where the Australian economy is headed and what investors need to know

The last few years have had their share of shocks, including the COVID pandemic – one of the largest, of course – alongside other geopolitical risks. The result has been stagnant high inflation linked to supply chain issues, sharp increases in energy and commodity prices, and the need for central banks to intervene in economies – primarily with interest rate hikes. If you’ve been reeling from the attack on your finances (let alone psyche), you may well wonder what 2024 has in store for the Australian economy.

There’s no guarantee we won’t see more shocks, but the RBA is tipping a slower year for the Australian economy, according to Marion Kohler, Assistant Governor – Economic (Acting) in a presentation to the UBS Australasia Conference on Monday. (Full speech available here.)

Subdued but not declining GDP growth for the year ahead

Tighter financial conditions are finally starting to bite when it comes to household consumption. The reasons are no surprise, with cost-of-living pressures, higher interest rates, and higher taxes all weighing on disposable income.

Running alongside this is the labour market, which has been tight but Kohler notes has begun to ease. The RBA expects a decline in average hours worked and rising underutilisation rates (that is, employees not being offered as many hours of paid work as they’d like), with employment still growing but at a slower pace than the working-age population. The unemployment rate is forecast to increase to around 4.25% in 2025.

This is all a challenge for the RBA – after all, it has a dual mandate to not just manage inflation but also maintain economic welfare through full employment – it terms this as the maximum employment level that allows for consistency with price stability.

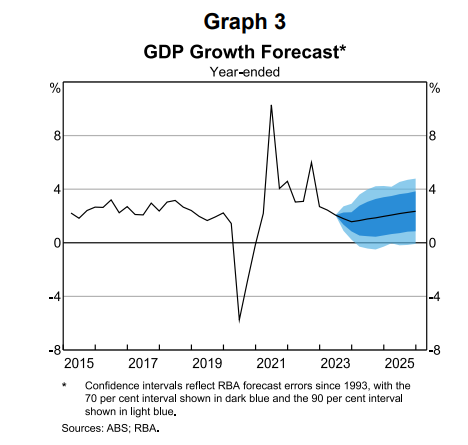

What does this mean for GDP growth?

The RBA expects GDP growth to be below trend for a while – but it is still being supported by other factors that should push it back towards averages down the track. By that, I’m referring to significant public spending programs on public infrastructure and construction, and the return of immigration and tourism numbers, which have boosted domestic consumer spending.

A farewell to inflation?

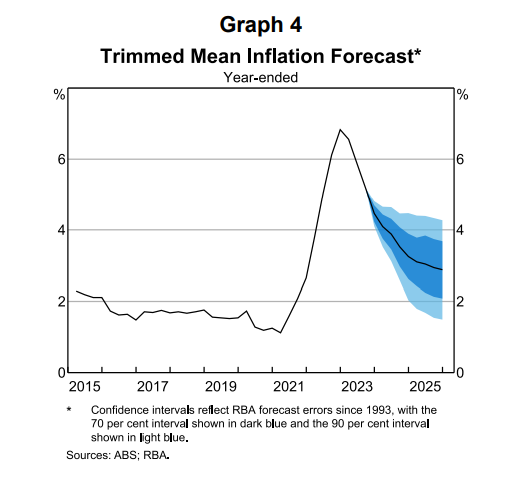

The guest that has well and truly overstayed their welcome, inflation is in no hurry to leave. It has been declining as supply constraints have started to ease and rate hikes have hit – so that is a positive. The RBA expects this to continue to decline – but not rapidly.

“We now expect this to be a more gradual process than we previously thought, due to the still-high level of domestic demand and strong labour and other cost pressures,” says Kohler.

“Nevertheless, inflation is expected to be a little below 3 per cent at the end of 2025.”

For some perspective on the RBA's latest, more gradual outlook on inflation, bear in mind that the inflation print for the September quarter this year was 5.4%. For the same period last year, it was 7.3%.

It’s not unusual to see the pace of decline slow – and Kohler points out that other advanced economies that are further ahead in the deflationary process have already had this experience.

Part of the challenge remains services price inflation, which continues to rise and experience high demand.

One of the RBA’s key risks to the decline in inflation comes down to expectations. If consumers and businesses expect high inflation to continue, it creates pressure for higher wages and business costs to manage that inflation. It becomes self-perpetuating – services and goods become more expensive as wages rise and you end up with a vicious cycle to push up inflation.

Key forecasts in summary

“We currently expect a further gradual easing in the labour market resulting from a period of below-trend growth in aggregate demand for goods and services.

We expect inflation to continue to decline, but more gradually than anticipated three months ago. Higher interest rates are working to help establish a more sustainable balance between supply and demand across the economy, which is expected to support the return to low and stable inflation,” says Kohler.

What investors need to know

It’s a somewhat dovish outlook that suggests the RBA may have reached the peak of rate hikes (furiously touching wood over here) – with caveats of course.

While slowing growth has its own challenges for businesses, more market certainty over interest rates and central bank policy can mean a less volatile investment space – particularly for equities and bonds.

There are also still drivers for domestic spending and housing in terms of immigration and tourism – in fact, Chinese tourism to Australia is tipped to reach pre-covid levels by December this year. It’s not unreasonable to think that businesses tilted towards servicing these audiences might continue to be supported in the new year – airlines, travel companies, luxury retail, just to name a few.

If we’re talking about a muted, almost ‘boring’ outlook, perhaps it’s the time to reset the portfolio, rebalance, check your goals and realign the portfolio. Either way, if we’ve learnt nothing else from the last few years, a shock is a shock for a reason, thinking long-term and carefully can’t go astray.

3 topics