Where the greenies have coal wrong (and our #1 small cap pick)

We believe many investors do not fully understand the Australian coal industry and as a result, indiscriminately screen out both steelmaking and thermal coal companies on Environmental grounds (ESG).

In this wire, we attempt to reconcile some of the misunderstandings and outline how investors can best exploit the resultant investment opportunity.

Coal is not coal

Coal is formed from ancient swamps, where peat is compressed by gravity and heat over a very long time (15-200 million years). The more compressed, (generally speaking) the higher the carbon content (known in the industry as "rank"). Due to this compression, coal is mined from "seams" which often contain a range of coal types.

Depending on the rank, coal can have two primary uses (it's also used in cement but let's just put that to one side in the interests of simplicity.)

Metallurgical coal (also called met coal or coking coal) is used to make metallurgical coke. As the name suggests, it is combined with iron ore in a blast furnace to make pig iron, which is then refined into various steel products.

Met coals are all bituminous coals, and are generally bucketed into 5 main product categories, largely determined by their coking properties:

- Premium Low-Vol Hard Coking Coal (PLV-HCC)

- Hard Coking Coal (HCC)

- Semi-Hard Coking Coal (SHCC)

- Semi-Soft Coking Coal (SSCC)

- PCI Coal (PCI)

These coals are blended to create a specific recipe at the coke plant to optimise for cost and product quality (except PCI coals which are "injected" in the blast furnace as an extra source of carbon and heat.)

Thermal coal is burnt in a thermal power station to generate electricity.

Thermal coals include brown coal (otherwise known as lignite), sub-bituminous and bituminous (black or steam) coals with little to no coking properties. As these coals are mainly burnt for their energy content, the seaborne thermal coal market is largely focused on energy content (calorific value, or CV.) In Australia, we export predominantly high CV, black, bituminous thermal coal from NSW.

(Note: For those interested in learning the basics of coal quality, I'd recommend reviewing Whitehaven's June 2023 explainer presentation, which provides a really solid foundation.)

Australian coal is bad for the environment

I agree. Steel manufacturing accounts for ~8% of global carbon emissions (Mckinsey, 2020). But with over 90% of global steel production coming from a blast furnace, Australia is going to need to continue to supply the world with metallurgical coal unless we want to stop building homes, bridges, trains, and cars.

Thermal coal, used in electricity generation, is where the majority of the debate is centred. Now, don't get me wrong, this is not a political commentary. If the democratically-elected government decides that the best way to lower our emissions and fight climate change is to stop burning coal in Australia, I'll accept that and leave brighter minds to debate the relative cost of generation, reliability of renewables, relevance of nuclear power etc.

Our domestic policy aside, if reducing global carbon emissions is our concern, we should be investing more in mining Australian thermal coal.

Approximately 80% of Australia's thermal coal production is exported, with about 90% of those exports going to Japan, Korea, Taiwan, China and India. Domestic sales are already a minor factor in the Australian coal industry and if we decided to eliminate coal-fired electricity in Australia, it would have a negligible impact.

The next best alternative

If Australia decided that we were going to "encourage" these sovereign nations to transition to renewables and no longer sell them thermal coal, they'd simply buy it from Indonesia which currently exports around 15% more (by tonnage) than us every year.

The problem with Indonesian coal is its lower energy content (CV), higher moisture, higher sulphur and higher harmful trace elements result in higher emissions for every megawatt-hour (MWh) produced. And that's before we talk about the comparative mining & employment regulations - Australia has very high and strictly enforced rehabilitation requirements, wastewater management laws, safety standards, employment conditions etc.

How much higher emissions? It depends on who you ask and your specific substitutions, but I don't think there's a coal-quality scientist who would disagree with the broader comment. The best thing I've read I found on LinkedIn from consultant Commodity Insights which finds an extra 37-75kg/MWh of carbon emissions would be generated by substituting typical Australian thermal coal for the typical Indonesia sub-bituminous or low-rank coals.

If Australia decides to find alternative sources of reliable electricity, that's fine. But we should be supporting and encouraging those nations who elect to burn coal, to do so with the lowest possible emissions by supplying them with high-quality Australian coal.

Selective mining

Some have argued that we should only mine metallurgical coal. It's important to understand that coal is an organic material and different types of coal are usually found and mined together. The argument that we should only mine steel-making coal is not a practical one for many of Australia's coal reserves, with most miners producing at least two specifications, from multiple coal seams. Thermal coal sales are an important part of the project economics of many (perhaps even most) metallurgical coal mines.

Further, some semi-soft and PCI coking coals are in practice, not that different from high-quality thermal coal. In fact, in some market conditions, it may be more profitable for a miner to sell their PCI or SSCC (which usually is sold to a steelmaker) as thermal coal to a utility.

TLDR

- In our view, there's no reason to avoid the Australian coal sector on environmental or ethical grounds.

- A lack of investment demand throws up unique opportunities to buy high-quality, low-cost assets in Tier 1 jurisdictions at exceptional prices.

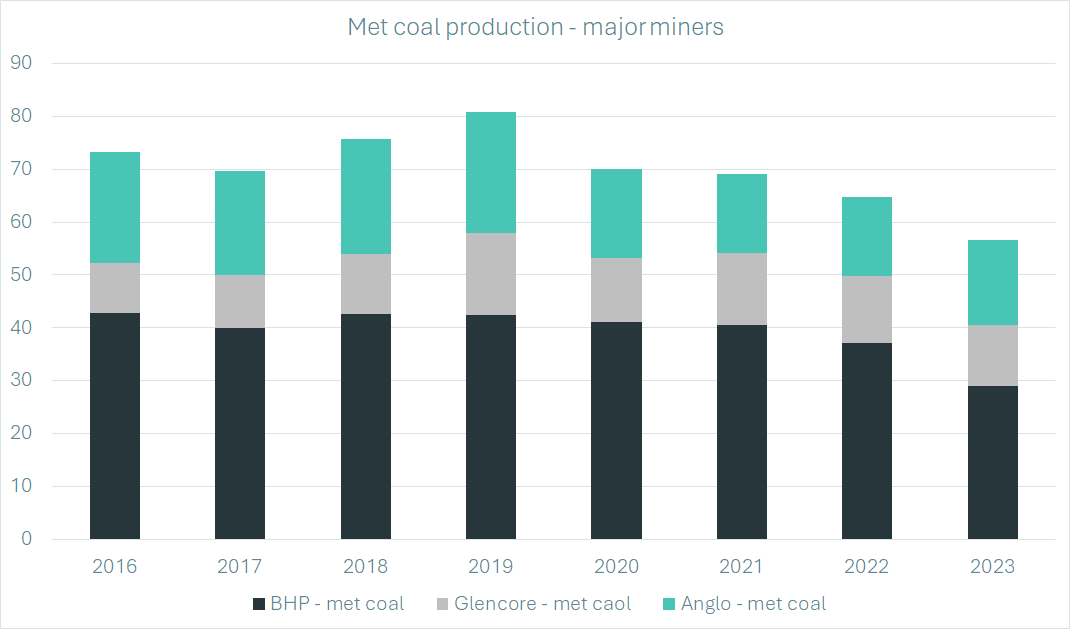

- A lack of investment in new production results in structurally undersupplied markets (see below, major met coal miners' production declining each year - these three companies account for 22% of the seaborne coking coal trade.)

- Existing operators with approved projects are in the best position to consolidate operations and constrained logistics (rail, port) and reap the subsequent benefits of scale.

Our #1 pick: Stanmore Resources (ASX: SMR)

Note: Below is an excerpt from a recently published research note on the Good Research website.

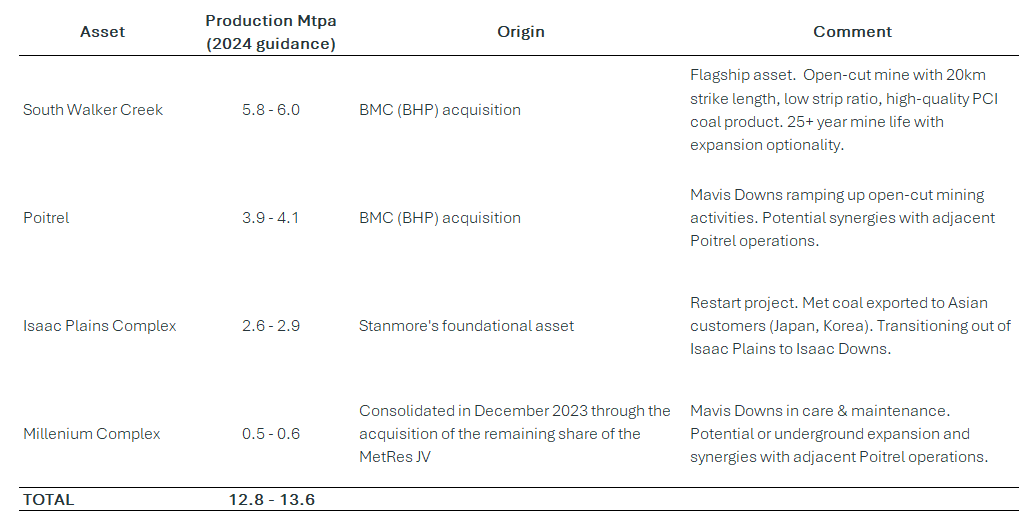

Stanmore is a steelmaking coal producer that is opportunistically consolidating coking coal mines in the Bowen Basin, Queensland and trades on 8x this year's earnings, and an 11% free cashflow yield. Its assets are priced like Stanmore is going out of business within a decade despite an attractive, increasing production profile.

Stanmore's long-life, low-cost assets were opportunistically acquired from Vale/Sumitomo, BMC (the BHP-Mitsui Coal JV) and South32 (ASX: S32) as they exited the coal business on the back of stakeholder pressure (which as outlined above, we think is unjustified.)

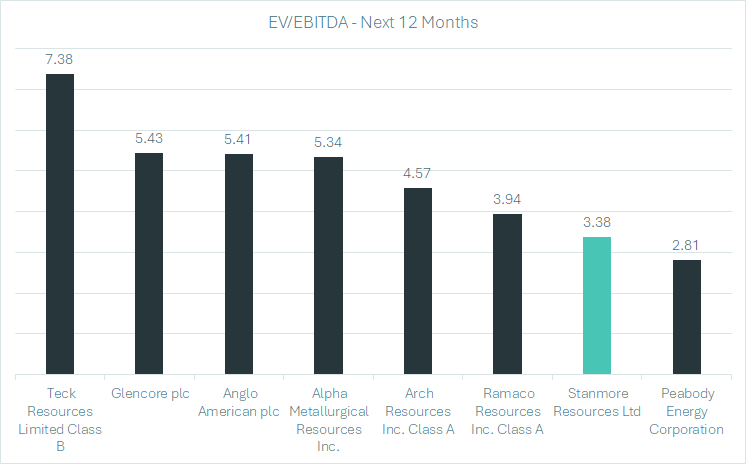

Stanmore trades on 3.4x EV/EBITDA, a 32% discount to the average of metallurgical coal peers on 5.0x.

Not only do we see the discount as unwarranted, but we think the whole sector is cheap and set to re-rate to 6-8x as ‘higher for longer’ met coal prices get factored into analyst forecasts.

At current prices ($3.70 per share), the 3 core operating mines are 20-30% undervalued and shareholders are 'free-carried' on growth projects at Eagle Downs and Wards Well, which we think on a 3-5 year view, could be largely self-funded from internal cashflow.

Stanmore continues to fly under the radar, with no bulge-bracket investment bank coverage and limited institutional ownership. We see fair value above $5.00 per share and own shares in the Seneca Australian Shares SMA and Seneca Australian Small Companies Fund.

Thanks to Ben Richards for his contributions to this article.

If you'd like to discuss this article, investing with Seneca or your portfolio, feel free to book a free consultation with me.

5 topics

2 stocks mentioned

1 fund mentioned

1 contributor mentioned