Where this $150 billion manager is finding the best opportunities right now

There are alternatives, and diversification is being rewarded. That’s the view of MLC Asset Management’s Dan Farmer, who recently spoke to audiences in Melbourne, Sydney, and Brisbane as part of MLC's Investment Forum.

Those comments compared the current market environment to the lead-up to the GFC, when the market offered “a pretty narrow opportunity set,” according to Farmer.

“You can get genuine diversification in your balanced portfolios without giving up return. It felt like, at certain points in time in the past, you could diversify but you would be giving up returns to do so.

Today, it feels like there's plenty of opportunity to diversify and there are some real, genuine opportunity sets out there - risk feels like it's getting better and being rewarded”, says Farmer.

In the following, I summarise the key points from Farmer’s presentation, including how MLC is thinking about the current environment and positioning portfolios.

.png)

THE MACRO BACKDROP

MLC assesses the market's risks and opportunities through a macro lens, focusing primarily on inflation, interest rates, and economic growth, with geopolitics as the fourth plank. The team's quarterly analysis has just been completed, and the salient points in each category are summarised below.

Inflation

Farmer points out that US inflation peaked above 9% in the middle of 2022, fell quickly to 3.5% in the first quarter of 2023, and currently sits around 3%.

“So it's been a real slow grind to get that last 50 basis points off inflation”, says Farmer.

He adds that whilst goods prices feel quickly, services prices have been more stubborn, although should continue to grind lower.

“We think inflation will come down but it will still be pretty slow. The last mile on inflation, from that 3% down to 2%, is going to be pretty hard”.

Interest rates

Against the backdrop of inflation grinding lower, the question begs: Have the central banks done enough to control inflation?

Regarding the Fed and US inflation, Farmer believes they have. MLC is subsequently expecting four cuts over the 12 months, starting in September.

In Australia, things are less clear—“a little bit murky,” as Farmer puts it—although MLC believes the central bank has done enough, even if the central bank itself doesn’t.

“We might see the RBA increase in August but we think they've done enough. But it's going to take them longer to cut.

We don't think we'll see cuts from the RBA until 2025 now”, says Farmer.

Economic growth

With inflation slowly returning to target and interest rates peaking and potentially falling in the US, what does that mean for growth?

First and foremost, Farmer doesn’t believe we’ll see a recession.

“Our central case is that we don't think there's a recession. We think we'll be able to get through this period without hitting a recession in the next 12 months.

It’s terrible to put probabilities on these things, but we model out probabilities so we think there's a 70% chance of a soft landing”.

This view is predicated on the fact that recessions often accompany some major imbalance in the economy – like a high volume of poor-quality mortgages that brought on the GFC.

“When we look around the economy today, particularly in the private sector, we don't see huge imbalances”, says Farmer.

“Corporate and household balance sheets are in pretty good shape. We see financial conditions easing”.

Geopolitics

While geopolitics is a wildcard, Farmer doesn’t pay it too much heed.

“I've been managing multi-manager portfolios for over 30 years.

There's always geopolitical risk in the background. When you look back on it, geopolitical events can have bouts of short-term volatility, but they don't often have a profound and sustained impact on markets”, says Farmer.

He also adds that they’re almost impossible to predict.

HOW MLC IS POSITIONED

Equities

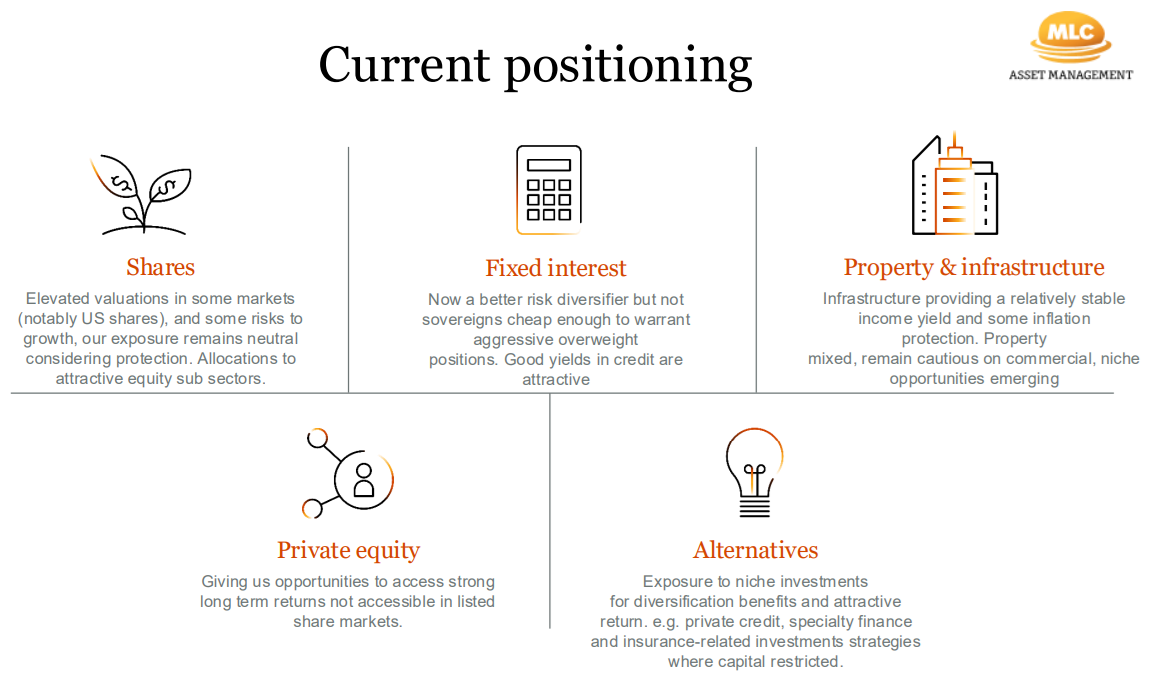

MLC is neutral on equities – a “genuine” position according to Farmer, who notes that the positives balance the negatives.

On the positive side, “underlying economic conditions are quite good. We don't see a recession, corporate fundamentals are in good shape, and corporate balance sheets are solid”, says Farmer.

However, he also believes that the 18%, 12-month forward earnings growth that the market is forecasting in the US is “probably too high” and that valuations – particularly in the US – are stretched.

“We're seeing US forward PE at 20x – 50% of that is the Magnificent Seven but, nevertheless, valuations are quite stretched”, says Farmer.

Farmer adds that MLC has been neutral for the past 12 months, although today the team is “leaning more cautious, looking at protection strategies as those valuation pressures lean on us a bit more”.

That said, Farmer likes certain sub-sector allocations, such as Aussie small and mid-caps, which are “quite attractive.”

“We’ve recently gone to a 12% allocation to Aussie mid-caps, with specialist managers, and we’ve got a 7% allocation to small caps”, notes Farmer.

Private Equity

Farmer notes that private equity is an illiquid asset class, so it is not one that you “tilt in and out of,” but MLC structurally likes private equity for the "control and the breadth of the investment universe it offers.”

He adds that while private equity has lagged very strong global listed markets over the past 12 months, some PE valuations are now “looking a little more attractive.”

Fixed Income

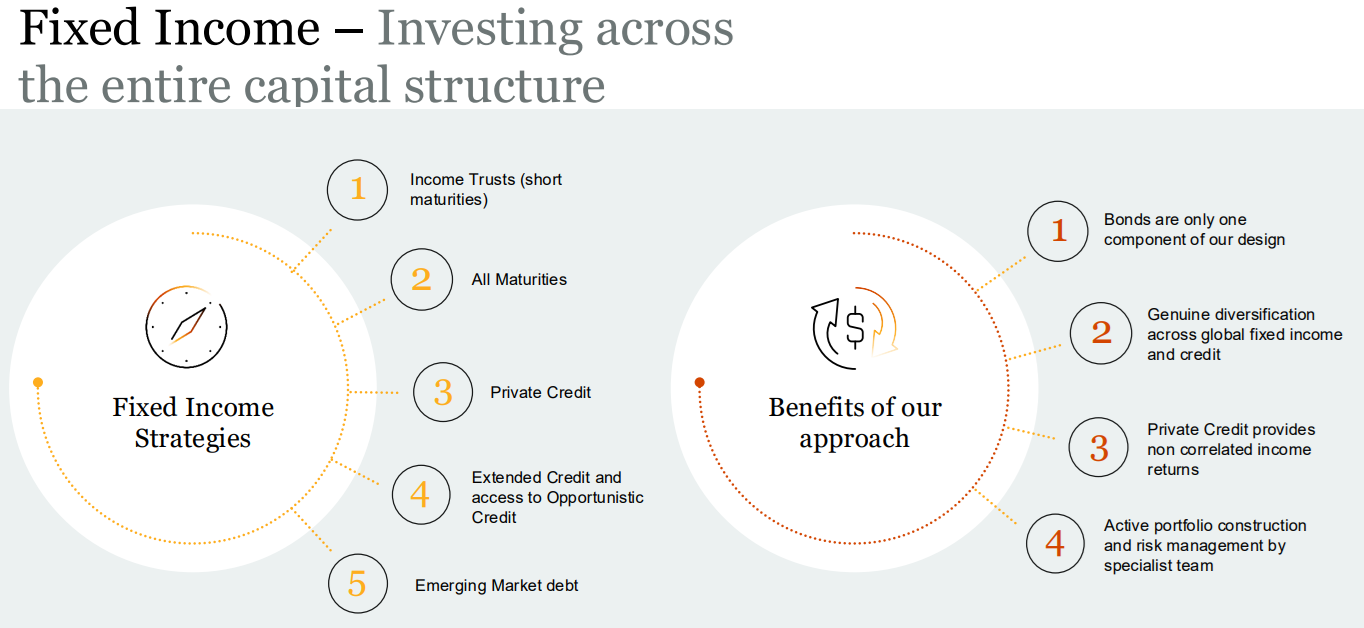

During the presentation, Farmer spent extra time focusing on fixed incom, given the volatility we’ve all witnessed over the past few years and the current opportunity. Suffice it to say, he’s bullish on the space.

“We think there's elevated potential there, a real opportunity to get involved and think about fixed income portfolio construction in some of the sub-sectors. It's been a pretty rich alpha area for us”.

Farmer adds that while fixed income is often viewed as quite simplistic, there are nuanced opportunities in the space. He highlights five subsectors (see graphic below) that MLC has exposure to, which create the building blocks for “genuine diversification” that, when coupled with active management, offer “real return potential.”

According to Farmer, examples of this include the 6.3% running yield the team is currently getting on investment-grade fixed income with three—to four-year maturities, or the 9.6% running yield currently offered in some high-quality, investment-grade private credit.

“Fixed interest is not just government bonds”, says Farmer, adding that “there's a real opportunity to diversify across multiple dimensions, be it liquidity, be it credit quality, be it maturity and duration”.

Property and infrastructure

“Our unlisted property portfolio is really diversified”, notes Farmer, adding that it comprises Aussie and global property spread across commercial, industrial, retail and some specialty sectors like storage and medical.

All that said, MLC is moderately underweight unlisted property. Whilst valuations have come down and cap rates have gone up, Farmer still thinks some more adjustments need to be made.

“If you look at the unlisted property benchmark return, that was down 5.4% for the year. So there has been some work done but we think there's a little bit more to go - a bit more creep up in cap rates and we'll probably see - particularly in the office space - some sales coming on market” says Farmer.

MLC likes infrastructure, which it is moderately overweight. Farmer highlights strong fundamentals, with “some inflation protection embedded into their revenue streams.”

Alternatives

As Farmer notes, Alts is a broad church, and MLC is very selective in the space, working only with managers with specialist skill sets.

One of the areas that MLC has been allocating to is reinsurance of weather risk.

Farmer points out that whilst it is incredibly niche, it is uncorrelated to anything else. As he explains;

“Large insurers want to get weather risk off their books. Think Florida hurricanes… they don't want the risk of five hurricanes hitting at once. They sell off that tail risk.

So if you've got the specialist skills, that area offers really attractive returns.

We generated 16% in that space last year and we've been running that for 15 years. We’ve never had a negative return over calendar year”.

STAYING ACTIVE

Overall, Farmer sees a “pretty rich opportunity set, and a pretty good environment to get diversification”, but adds that active management and active allocations play an important role for investors.

“I've been in active management my whole career, so active management with the managers themselves, but also we think being active with your asset allocation, particularly in this environment, can be very fruitful”.

3 topics

1 contributor mentioned