Where to find opportunities in large companies

Clime Investment Management

There is so much confusion about the stocks in the ASX’s large-caps index, the ASX 50. Some investors see them as ‘blue-chips’ by virtue of their size and longevity, and thus see them as long-term portfolio holds. Others think the ASX 50 is largely useless: a motley, concentrated index of variously cyclical, ex-growth or expensive growth companies, and in any event inferior to the global growth names on Wall Street, in Europe and China.

In today’s opinion piece we explode these myths and generalisations about the ASX 50 and present the index and its constituents for what they really are. You can make adequate returns, for the risk assumed, in large Australian companies if you have a realistic understanding of what drives each one and how to invest in cyclicals, turnarounds, banks, insurers, miners and secular growth stocks.

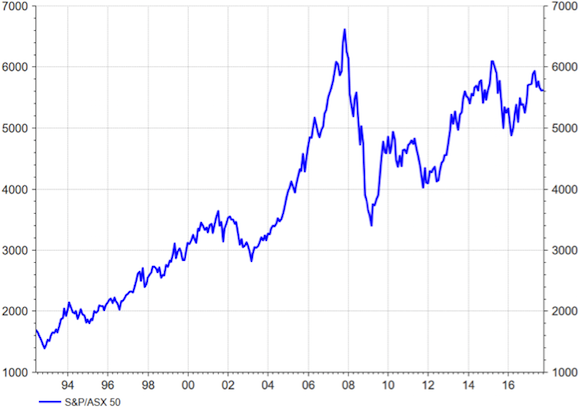

Let’s start with the index itself. The chart below shows the index pre-dividends over the last 10 years.

Figure 1. ASX 50 Index, last 10 years

Source: Thomson Reuters Datastream

This is quite disappointing. Despite 10 years of economic growth, population growth and massive monetary stimulus here (sustained record low cash rate) and offshore (same, plus quantitative easing) the index is still lower than it was 10 years ago. At least there has been a substantial recovery from GFC lows. The picture looks better if we go back further to the early 1990s:

Figure 2. ASX 50 Index, since 1992

Source: Thomson Reuters Datastream

This very long-term uptrend is more consistent with what we should expect from the largest companies in an economy that has grown every year since 1991. With the passage of time the GFC-era crash in the index is starting to appear as an overshoot to the downside from the accelerated bull market that began the day the US-led coalition invaded Iraq in March 2003. This was subsequently fuelled by China’s industrialisation and growth in demand for iron ore, and rallies in a small group of ASX leaders including CBA and Macquarie.

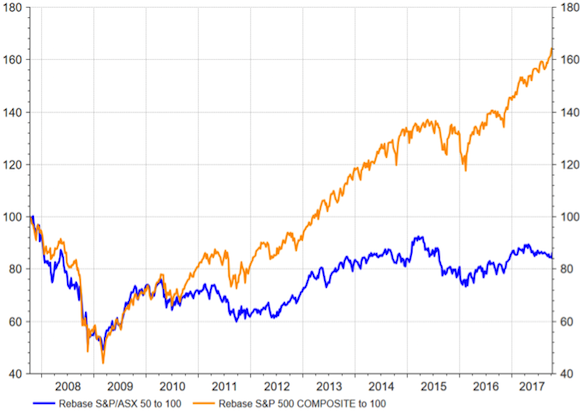

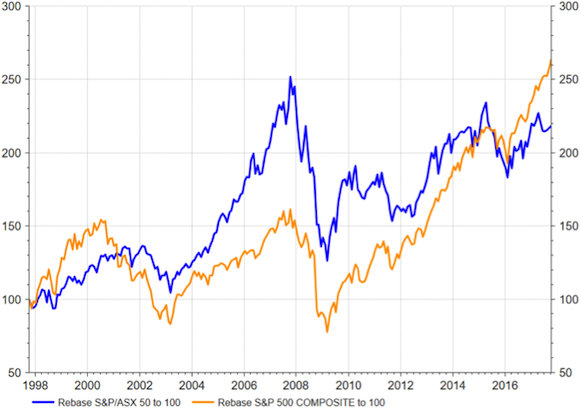

Australia’s largest stocks have substantially underperformed Wall Street indexes (before currency effects) since the end of the GFC…

Figure 3. ASX 50 Index vs S&P 500 since the GFC

Source: Thomson Reuters Datastream

…but over the last 20 years the ASX 50 outperformed for most of the time as the China-driven bulk commodities boom lifted the market’s base:

Figure 4. ASX 50 Index vs S&P 500, last 20 years

Source: Thomson Reuters Datastream

Over the last 20 years the ASX 50 index has even outperformed a composite of world equity market indexes:

Figure 5. ASX 50 Index vs MSCI World, both hedged into US$, last 20 years

Source: Thomson Reuters Datastream

These charts disprove the increasingly popular notion the ASX’s largest stocks should always have a lesser role in growth portfolios than in the past, when large companies dominated retail portfolios by default because direct investors did not have access to international equities or access to research and managed funds for small-cap equities. The truth is relative returns depend heavily on the period. Over the 40+ years most Australians save for retirement there is no reason, based on the historical record, to underweight large ASX companies as a group all the time.

The case for active stockpicking within the index also remains as strong as ever. While the index itself might rise or fall by 5-15% over an average calendar year, this masks large movements in individual ASX 50 names within a year. Over the year to 11 October, 22 large-caps rallied by more than 10%:

QAN-AU 99.4%

ALL-AU 40.3%

CPU-AU 34.6%

S32-AU 30.9%

RIO-AU 29.8%

CSL-AU 28.3%

LLC-AU 27.8%

IPL-AU 25.3%

TWE-AU 25.2%

ORG-AU 24.2%

ORI-AU 21.3%

AGL-AU 20.6%

GMG-AU 18.3%

MPL-AU 17.7%

IAG-AU 15.3%

BHP-AU 13.6%

TCL-AU 13.6%

ASX-AU 12.9%

NAB-AU 12.8%

MQG-AU 11.1%

SYD-AU 10.8%

MGR-AU 10.3%

Figure 6. ASX 50 stocks that rerated by 10%+, year to 11/10/17

So it is entirely possible to make attractive returns in Aussie large-caps, including relative to offshore large-cap indexes.

How to make money in large caps: first, understand them for what they are

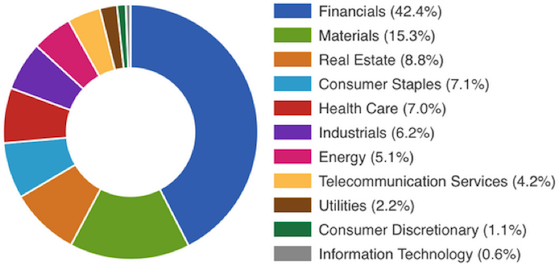

With the inclusion of Aristocrat Leisure in June (at the expense of Seek, which was demoted), the ASX 50 index now includes all GICS sectors. A valid criticism of the index is its notorious concentration in banks and miners:

Figure 7. ASX 50 sector weights, 1/07/17

Source: ASX50List.com

For us however, the main conclusion from this chart is not to dismiss large-caps entirely but instead to avoid index investing. Active management is essential to find and ride those reratings in Figure 6. Passive indexing leaves investors heavily exposed to cyclicals like banks and miners at the tops of their cycles.

The worst mistake with large-caps is to treat them all as permanent portfolio holdings because they are large, familiar names cultural to Australian investing. For example, we were sorry to hear the reasons why many direct investors held on to BHP Billiton as its share price and dividend more than halved over 2014-15. These investors because they saw BHP as a “blue chip”, safe to hold indefinitely and incapable of disappointment on this scale. For us BHP was just another mining stock, and therefore highly cyclical, and we sold out in the StocksInValue model portfolio in April 2015 at $32.70.

No large ASX company is a permanent hold just because it is large, old or has a heritage brand. There are no bottom-drawer, set-and-forget stocks in the ASX 50. All stocks of any size require constant monitoring for emerging downside risks and overpricing by the market. This is a demanding task requiring a powerful research database, a robust valuation framework, access to investor relations and the ability to ask the right questions.

Even so-called quality/defensive/lower-risk stocks with secular growth can be risky investments if they become too expensive. When Ramsay Health Care reached $74.90 in June, where it traded on a 26 PER and above our $73 valuation with a growth slowdown ahead in FY18, we trimmed the position and explained our reasoning in the next fortnightly model portfolio report. The subsequent guidance and result quality disappointments, then the recent bout of media management, misinformation, distortions and spread of misunderstandings by short-sellers, gave us opportunities to rebuild the position as low as $61.20. Today’s package of private health insurance and prosthesis price reforms announced by the Federal Health Minister is a net positive for private hospitals and RHC closed 3.9% higher today at $66.08.

A more productive way to work out when to buy, sell and hold large companies is to use the “Type” ratings in StocksInValue, for example:

Figure 8. Top section of Key Stats tab for RHC

Source: StocksInValue

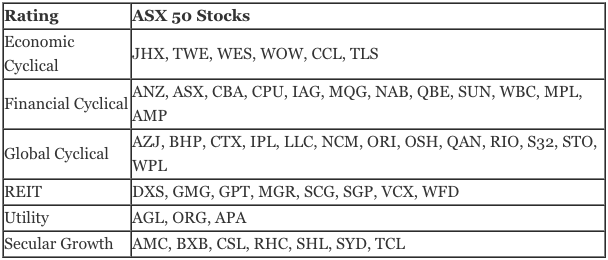

Using this scheme we classify the ASX 50 as follows:

Figure 9. ASX 50 stocks by investment type

Source: Clime Asset Management

Some of these ratings are debatable and depend on personal opinion. TWE’s recent superb run of growth might give the impression it can deliver secular growth but our long memories go back to the collapse in wine shares in the 2000s, after an earlier similar rally when too much capital flooded into the industry at the top of the price cycle. SYD and TCL enjoy steady growth in their operating metrics but might as well be considered as part-financial cyclicals given their security prices are closely (inversely) correlated with bond yields. This is why they are known as “bond proxies”. Higher interest rates encourage substitution away from their attractive distribution yields and this weighs on the security prices. WOW is more defensive than building materials supplier JHX but its business is so mature it can’t deliver the kind of secular global growth CSL can. BXB could be on the cusp of becoming more cyclical as competition in pallets in the US heats up and dampens the benefits of steady growth in consumption of consumer goods transported on pallets. TLS used to deliver slow but steady growth until competition increased and the NBN cut its legacy margins. CCL supplies branded consumer goods but is in structural decline as consumers turn away from sugar. All REITs are partly cyclical because they invest in property. AGL is exposed to fluctuating gas and electricity prices while ORG exports LNG, so there are cyclical themes here as well.

The point is a hardheaded approach to each ASX 50 name, rather than labels and generalisations, is required.

The good news about investing in large-caps: identifying stocks for research is easier!

Investing in large companies is harder because they are complex and take more time to understand, but is easier because they tend to revert higher eventually after disappointing or going through cyclical downturns. Heavy share price falls in small companies can be a sign of impending insolvency but in large companies they normally precede cyclical recoveries or turnarounds. Your author’s all-time favourite favourite investing strategy is the ASX large-company turnaround, as these nearly always work and drive meaningful share price reratings. Large companies are widely owned by institutions themselves under pressure to perform, so underperformance is not often tolerated for long. There are some exceptions like AMP and CCL.

Time for equities research is limited for all of us but at least with large companies it’s relatively easy to identify the ones to research: those out of favour. Typically within two years you’ll find most of these have rallied. Of course the ones in structural decline don’t and this is where the research skill comes in.

The search for quality at a fair price: how do large-caps rate?

‘Quality’, a word from popular culture, has become almost cultural in investing. The word is constantly mentioned in investing research and conversations with little discussion about what in particular the analyst means - and whether the quality features of a company are already priced into the stock by an efficient market. Always remember a company can be ‘quality’ but its share price can be high-risk if the earnings multiple is so high that a heavy share price fall looms if earnings disappoint. The model portfolio will continue to trim or exit positions in quality companies if their shares become too expensive.

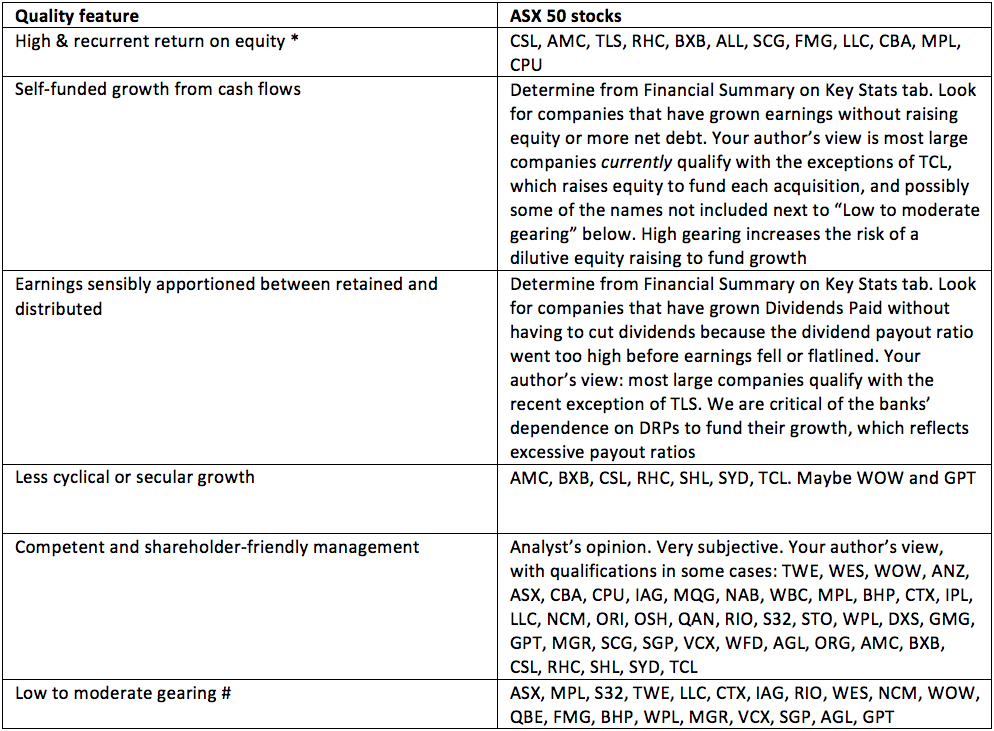

We define quality in a company as:

- High & recurrent return on equity, enabling value creation

- Self-funded growth from cash flows

- Earnings sensibly apportioned between retained and distributed

- Less cyclical or secular growth

- Competent and shareholder-friendly management

- Low to moderate gearing.

Stocks with these features do tend to outperform over time and fall less than others in bear markets, so it is worth searching for quality in companies of all sizes. Let’s see how the ASX 50 stocks rate:

Figure 10. How the ASX 50 stocks score against quality criteria

Source: Clime Asset Management

* Defined as 15%+ average NROE over the last five years. Names are from a filter search in StocksInValue.

# Defined as Net debt/equity of less than 40%. Names are from a filter search in StocksInValue.

This analysis demonstrates no ASX 50 stock meets all six quality criteria though a good proportion meet some and most would have a decent average if all six criteria were combined into a score. The conclusion is a more sophisticated approach is required than hoping to find standout high quality in the large companies, especially if the investor wants to pay a fair price. The large companies are so well-researched by scores of sell-side and buy-side analysts that quality is highly priced at this end of the market, creating the risk of heavy share price falls if earnings disappoint.

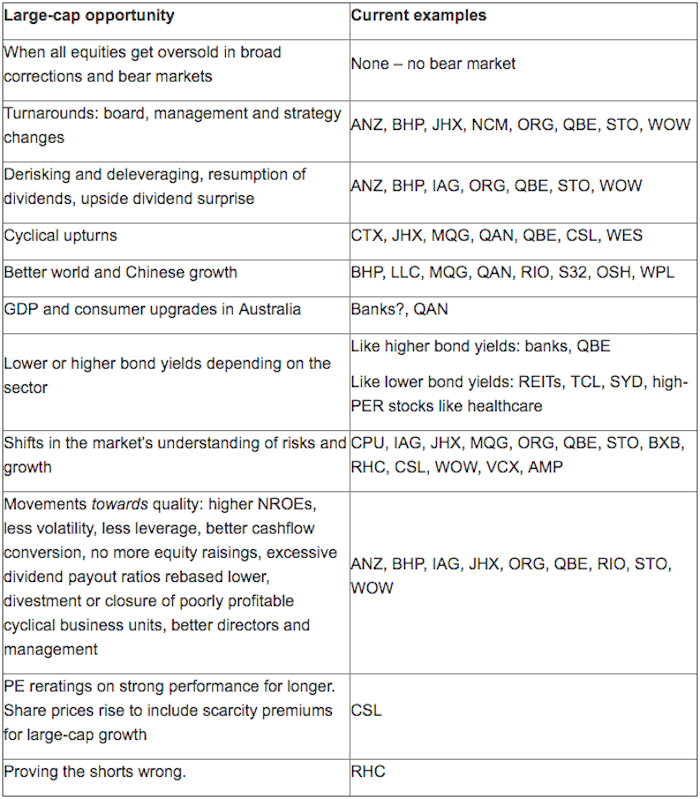

Where the opportunities in large-caps are

Drawing together this analysis of quality, and the six rating categories above, we can arrive at a summary of where the opportunities in large caps are. The following are the reasons large company share prices move:

The intense research coverage of large companies ensures the market only has to get a sniff of any improvements to profitability and the stock will rally. This means investors don’t have to wait when they are right about a large stock but it also means they have to be set early.

The model portfolio will continue to include the best opportunities as we see them.

4 topics

49 stocks mentioned

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.

Expertise

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.