Where to hunt for yield

Livewire Markets

After a year where growth stocks were in favour, it is great to see some optimism for income fund managers to reap dividends for their investors. Whether you’re looking to diversify your fund, or need a solid income for retirement, 2021 is shaping up into a much better year for investing in income generating stocks.

According to Plato's Dr Peter Gardner and Dr Don Hamson, there are a much greater proportion of stocks which will be returning better dividends for investors. While there will always be the need to stay agile in such uncertain times, Plato has put together their forecast for the year ahead and how to look for stocks in a low-yield environment.

With interest rates likely to remain at 10bps for the foreseeable future, investors and superannuation fund managers are on the hunt for income. The yield across all asset classes has been falling with quantitative easing (QE) bringing bond yields down to an ultra-low rate of effectively 1%, and the three-year BBB credit rating now below 2%. You can see in this chart there has been very little signs of yields in the past year.

“The Good”

Plato has classified the market into the “good, the bad and the ugly”. When it comes to income generating stocks, Plato has factored in a number of important internal and external measures for identifying the best path forward

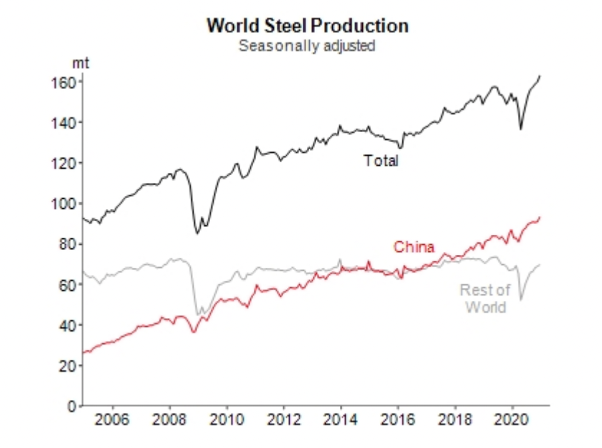

Iron ore

Global steel production has continued on its upward trajectory, brining iron ore along with it. Furthering the momentum is the fact that miners haven't been investing in new mines

This means Plato are expecting strong yields from Fortescue (ASX:FMG), Rio Tinto (ASX:Rio) and BHP (ASX:BHP).

Source: Plato

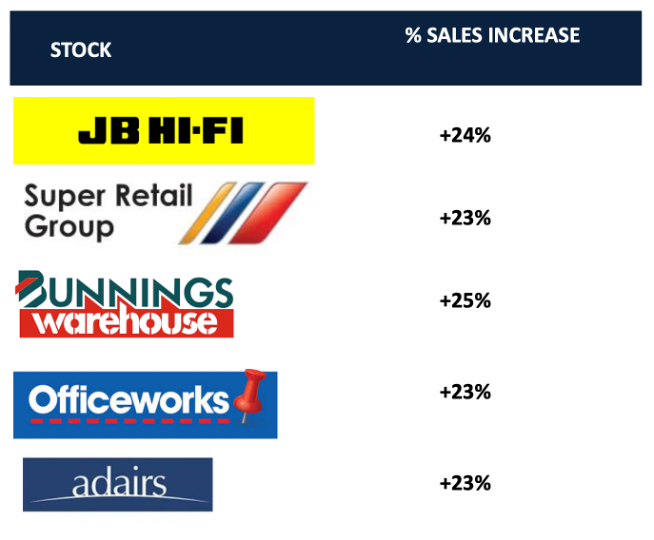

Retail

There are mixed reviews coming from the Retail sector. While there has been significant disruption to consumer spending over the last year, some companies have reaped the rewards of the COVID-19 landscape, including Bunnings, JB Hi-Fi, Super Retail (including BCF, Super Cheap Auto and Rebel Sport), Officeworks and Adairs. These companies have had consistent increases of about 23-25% in sales.

On the other hand, watch out for companies heavily driven by hospitality and tourism which are still suffering the effects of COVID-19.

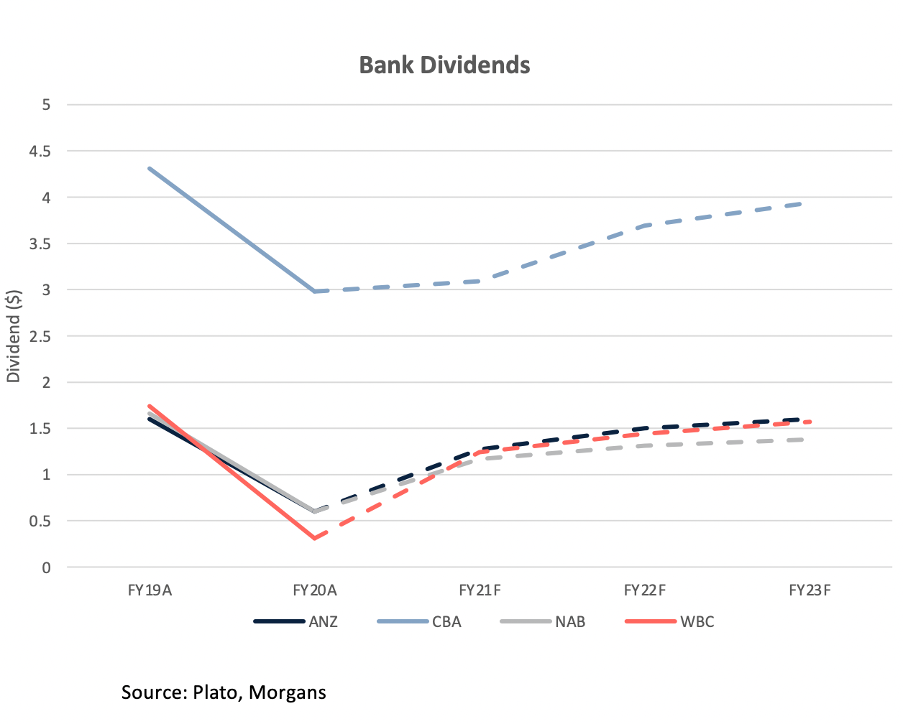

Banks

Overall, Plato's stance is "don't stay overweight on banks". While bank dividends declined rapidly last year due to APRA's announcement requiring a 50:50 ratio for earnings, the outlook is looking much better in 2021. APRA has lifted its obligation on the banking industry as of 15 December, and there is likely to be some return to normalcy for bank dividends, albeit from a lower base.

Utilities

There were a few outliers in the Outlook for this year, which are showing signs of promise:

- Telstra (ASX:TLS) is showing a stable position indicating dividends will remain the same, and

- TransUrban is showing signs of an increase to dividends this year in correlation with rising toll revenue.

The Bad and the Ugly

While many investors are hoping for some sort of return to normalcy, there are still a few traps to watch out for amid the early signs of hope for the year ahead. Plato has categorised these stocks as the “ugly stocks”, which have been negatively hit by extenuating factors, like COVD-19 and geopolitical tensions. But Gardener notes there is a significant increase in the proportion of “good” stocks than there was last year.

Recent market favourite for growth, CSL (ASX:CSL), is looking to be under pressure from the rising AUD, since their earnings are in USD. CSL and Cochlear (ASX:COH) are both going to see ongoing strain to their revenue as elective surgeries stay low due to COVID-19.

Treasury wines (ASX: TWE) have been hit by the recent tariffs out of Beijing. “I think Australia has been a victim of the Chinese-US trade spat because China agreed to buy more products from the US, and so they're probably going to buy more US beef and wine, which means I buy less Australian ,” said Hamson.

Understandably, REITs which are heavily exposed to retail and office asset classes have fallen into Plato’s “ugly” category. Vicinity (ASX:VCX), Scentre Group (ASX:SCG) and Sydney Airport (ASX:SYD) are likely to see cuts in the dividends they paid last year.

Source: Plato.

Ask the experts your dividend questions

Livewire's next Buy Hold Sell video series is all about income and dividends. Send us your questions via this short survey and we will ask the experts to share their insights.

More about Plato

Plato Investment Management is an Australian owned boutique equities fund manager specialising in maximising retirement income for pension phase investors and SMSFs. To find out more click "contact" below.

3 topics

14 stocks mentioned

2 contributors mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...