Where to now for US stocks: Recession, Magnificent 7, Presidential Election

Major broker Citi describes the prospects for the US stock market heading into 2025 as “Constructive, but complicated”. They’re modestly bullish, seeing “further upside” for the benchmark S&P 500 as we close out 2024, but also note that gains are likely to come at a “moderated pace” compared to the heady gains of the first half.

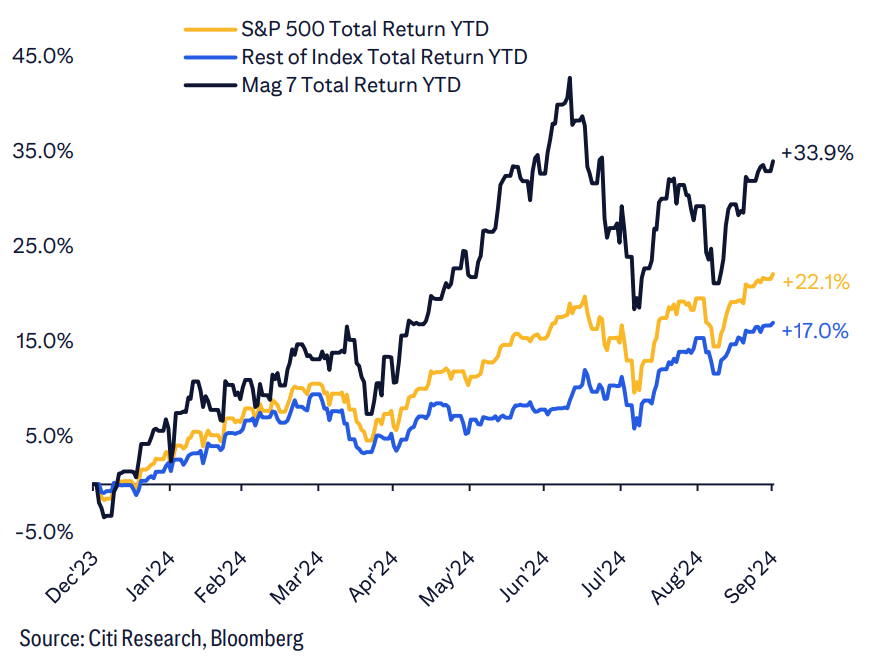

The chart above puts 2024 for US stocks into perspective. The S&P 500 total return index (i.e., measures capital gains and dividends) rose 15.6% in the first 6 months of the year, and is another 6.2% higher since then, for a total running 2024 gain of 21.8%. This compares to an average annual total return of 12.3% since 1926.

2024 can continue to be a good year or a closer-to-average one depending on a handful of risk factors, suggests Citi. Let’s investigate the three main risks the broker is watching closely into year end.

1. Recession concerns

Citi believes the US economy is heading for a “shallow recession” in the final quarter of this year and the first quarter of next year (a recession is typically defined as two consecutive quarters of negative GDP growth). This will cause the US unemployment rate to peak at 5.2%, up from the current 4.1%, by the end of March.

The economy will recover from there, the broker notes, supported by recent and ongoing interest rate cuts by the Federal Reserve. Citi’s economists are predicting another 0.25% cut in Nov, followed by a subsequent 0.50% cut in December. The broker expects the Fed’s official cash rate will reach 3-3.25% by the middle of next year (currently 4.75-5%).

Citi forecasts US GDP will bounce back to an annualised 2.7% p.a. growth rate in the June quarter, but slow to around 1.8% p.a. by the end of 2025. The US unemployment rate should steadily pare back to around 4.6% by then. Importantly, the broker’s forecasts also suggest inflation shouldn’t pose any further major risks to the US economy, with core CPI holding in a 2.2-2.4% range in 2025.

2. Performance of the Magnificent 7

Citi notes that on a market capitalisation basis, the Magnificent 7 (Apple, Microsoft, NVIDIA, Alphabet, Amazon, Meta, and Tesla) are up 33.9% year to date. Given these stocks’ massive influence on the S&P 500, this translates to nearly half of the benchmark’s total gains for the year.

The “Mag 7” as Citi calls them, have been, well, magnificent, but the broker notes the rest of the index is still performing well. Citi sees the non-Mag 7 S&P500 up 17% this year, which it believes reflects the broadening call it “advocated” for earlier this year.

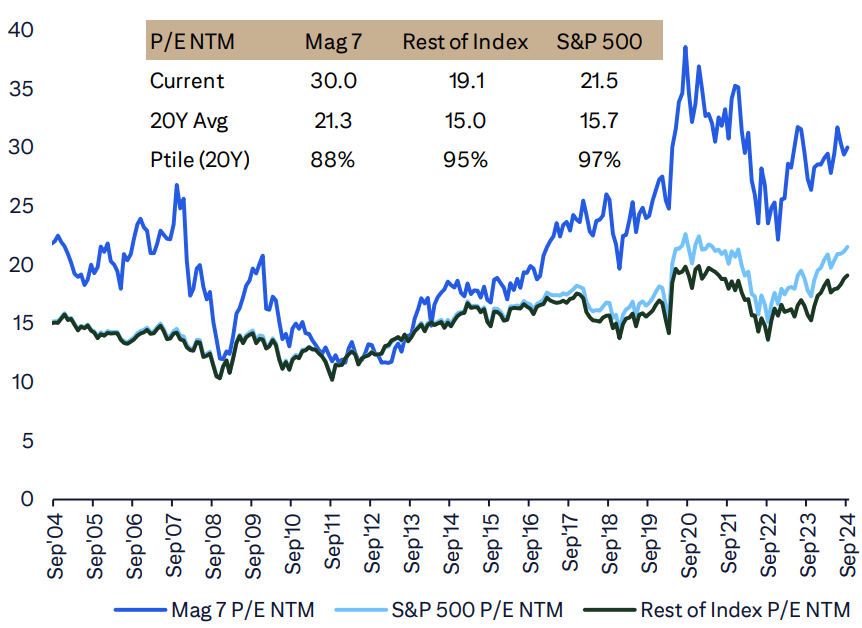

Going forward, Mag 7 valuations could continue to make or break US equity market performance, implies the broker, who prefers a pragmatic approach to this important sector of the market. The broker concedes valuations in the Mag 7 are “high by historical comparisons”, but also that it’s “important to consider the earnings growth trajectories” of these companies.

The broker is forecasting a Mag 7 P/E Ratio of 30x in 2025 versus 19.1x for the rest of the S&P 500, up from the 20-year averages of 21.3x and 15x, respectively. On this basis, it might appear the Mag 7 is more stretched from a valuation standpoint, but Citi notes the Mag 7 next 12 months P/E Ratio is at the 88th percentile compared to the “Rest of the Index” equivalent measure sitting at the 95th percentile.

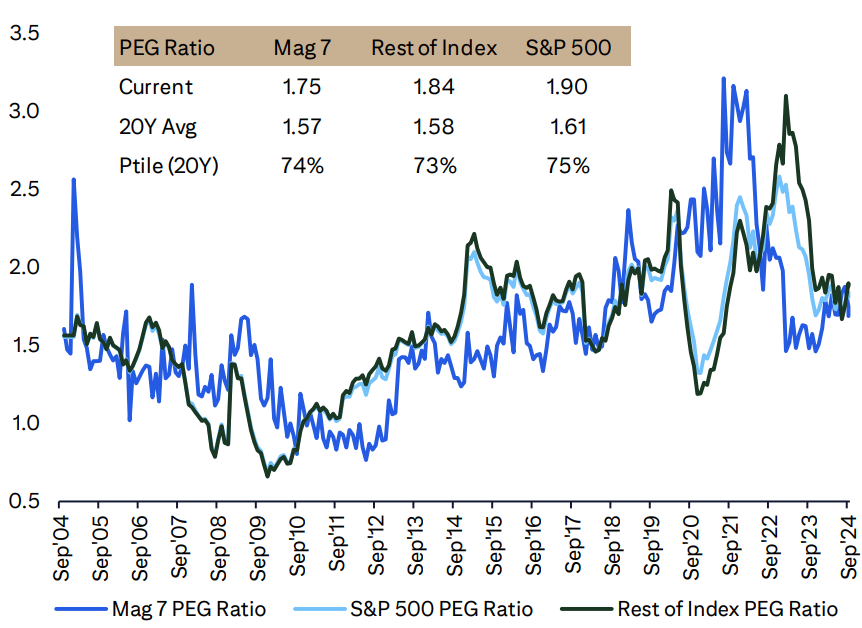

As the broker suggests, when we consider how quickly earnings are growing – and therefore over time lowering P/E Ratios closer to long-term norms – both Mag 7 and “Rest of the Index” valuations aren’t nearly as stretched as implied by P/E Ratios alone. “Tech bubble analogies are unfounded in our view”, the broker concludes.

The Mag 7’s PEG Ratio (i.e., P/E Ratio divided by EPS Growth Rate, note lower is better) of 1.75 is at a narrower premium to its 20-year average of 1.57 compared to the “Rest of the Index” at 1.84 and 1.57 respectively. In terms of where each group sits relative to their historical PEG ranges, the Mag 7 is at the 74th percentile compared to the “Rest of the Index” at the 73rd percentile.

Citi notes, “PEG ratios indicate multiple expansion has come alongside a steepening of fundamental growth expectations”, and as a result, valuations are “not as stretched” as many believe. Still, there are some risks attached to current valuations, says Citi, because there is now greater “pressure on fundamentals to deliver”.

3. US election outcome

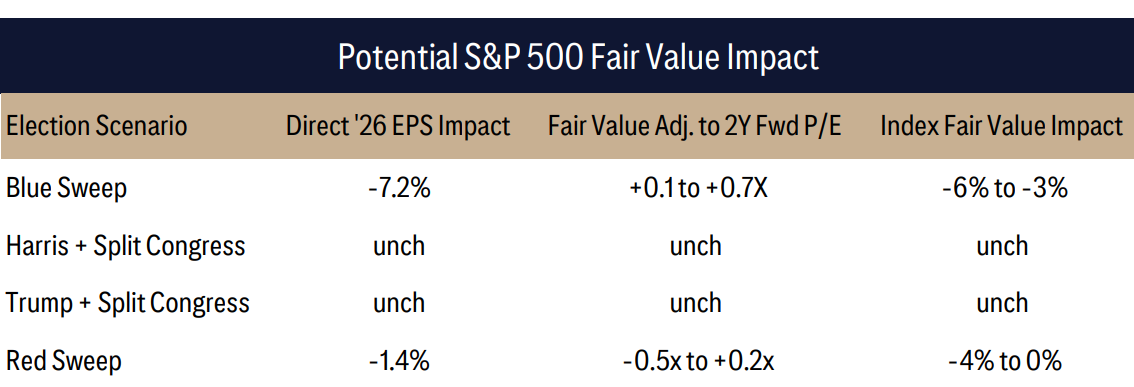

The November presidential election is the final and most imminent risk to the US stock market that Citi is monitoring closely. Outcomes here depend less on the winner, Harris or Trump, and more on the nature of House/Senate control, suggests Citi.

The above graphic summarises Cit’s analysis of the various President-Congress scenarios. The broker believes the best outcome for the US stock market – regardless of who sits in the Oval Office come January – is a split Congress. This would likely have nil impact on S&P 500 earnings.

On the other hand, a “sweep”, that is a candidate winning and their respective political party controlling both houses of Congress, would likely result in an inevitable loss for US stocks. A Trump-Republican sweep would be the least detrimental, suggests Citi, only reducing S&P 500 earnings by 1.4% and stock prices by up to 4%. On the other hand, a Harris-Democrats sweep would likely knock as much as 7.2% from earnings and as much as 3 to 6% from share prices.

Citi’s US stock market forecasts

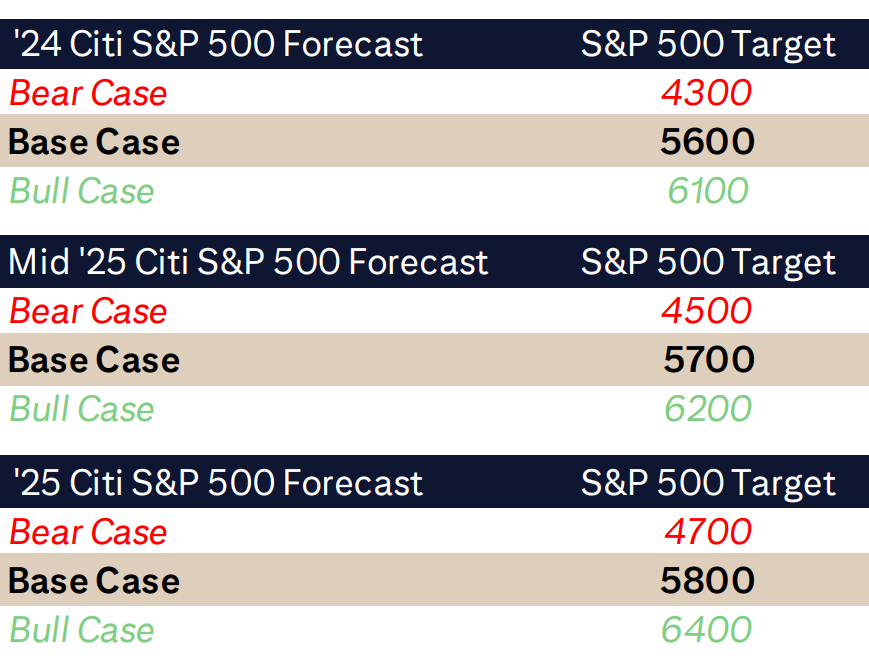

Given the above-mentioned risks, Citi sees the S&P 500 ending the year at 5600, around 150 points or 2.6% lower than Friday’s close of 5,751. Their “Bear Case” is a disturbing 4,300 (-25%), and their “Bull Case” is 6100 (+6%). This implies Citi sees a significantly asymmetrical risk-reward for US stocks in the near term.

Looking further out, the ratio of upside to downside improves slightly, accounting for moving past the US Presidential Election and Citi’s view of a looming US recession. The broker’s mid-2025 S&P 500 forecast rises to a still-modest 5,700, and Bear/Bull Case forecasts tighten/rise to 4500/6200 (-21.7%/+7.8%).

By the end of 2025, Citi sees continued modest improvement in US stocks, with its S&P 500 forecast rising to 5800 and Bear/Bull Case forecasts tightening/rising to 4700/6400 (-18.2%/+11.3).

This article first appeared on Market Index on Monday 7 October 2024.

5 topics

7 stocks mentioned