Where will capital flow after the Magnificent Seven party ends?

In July/August 2007 the ASX 200 plunged 12%. Bear Stearns had just liquidated two of its hedge funds. They had exposure to ‘collateralised debt obligations’.

The credit crisis was just getting started.

But guess what?

The market didn’t care.

After the brief panic sell-off stocks bottomed on 16 August. From the intra-day low, the market rallied 25%.

It reached a peak on 1 November. It was a peak that investors wouldn’t see for another 12 years.

In hindsight it was all so easy to see. The global credit bubble, built on easy money and inflated property prices, was an accident waiting to happen.

But at the time no one knew how it would play out.

I point this out not to predict that we could be experiencing something similar now.

Rather, it’s to highlight that the shift in psychology from bullish to bearish takes time to unfold. Despite evidence of building risks, investors don’t see it in real time.

The recent mini-panic now seems like an isolated event. The market is back to all-time highs.

The reporting season reflects continued bullish investor psychology. That is, expensive stocks that deliver get more expensive. Capital continues to crowd into ‘quality’ names, no matter the price.

‘You can’t go wrong buying quality!’

And cheap stocks continue to get cheaper.

For example, coal companies are the best value sector in the market. They have strong balance sheets and strong cashflows. Structurally higher coal prices (both met and thermal) are likely.

Yet these companies trade on single digit P/Es and 10%-plus free cashflow yields.

The market is often a head scratcher in the short-term. But in the long run, common sense tends to prevail.

If your time horizon is beyond six months, or six weeks for that matter, the recent panic and bout of volatility is a warning sign. The investment narratives that have sustained markets for the past few years may be coming to an end.

This isn’t unusual. Markets are forever changing. Narratives gain prominence, become wildly popular (and fully priced in) and then give way to the next story.

These narratives create share price expansions and contractions. The link to intrinsic value is sometimes tenuous.

Long-term investors need to consider whether we’re at the starting point of another narrative shift.

That is, are mega cap tech stocks moving from capital-efficient, to higher capital intensity business models.

Consider this excerpt from a recent Financial Times article:

‘Big Tech companies have boosted their capital spending by 50 per cent to more than $100bn this year, as they race to build the infrastructure supporting artificial intelligence, despite growing scepticism from Wall Street about the returns on the unprecedented investment.

‘Microsoft, Alphabet, Amazon and Meta all revealed massive increases in spending in the first six months of 2024 — totalling $106bn — in their latest quarterly earnings reports, as their leaders brushed off stock market jitters to pledge further investment hikes over the next 18 months.’

For example, Alphabet’s latest quarterly cap-ex annualised to around $50 billion. This represents one third of the existing value of its plant, property and equipment!

What does this mean for investors?

Well, companies create value when they generate returns on invested capital that are above the cost of that capital.

Mega cap tech stocks that sell globally relevant products and services have for years generated exceptional returns on capital.

As a result, the market valued these companies at a high multiple of their equity value.

As a general rule, the greater the return on capital, the higher the multiple of equity a company will trade at.

For years, these strong returns on capital have justified the rich valuations. Sustainable high returns on capital are rare. It is very difficult to compete with these global tech stocks.

As more and more investors came to realise these returns were enduring, and that regression to the mean might not play out, more capital piled in, pushing prices higher.

But now, with the emergence of AI, these companies are getting into the data centre game.

Data centres are capital-intensive. You need to buy land, build the centre, and stuff it full of very expensive chips, which use a lot of energy. In years to come, these companies will also probably have a small nuclear reactor supplying power so they don’t drain the grid of electricity.

Small nuclear reactors are capital-intensive, too.

What returns will all this massive capital spending generate?

As this AI/data centre theme continues to play out, it’s a question investors will increasingly ask.

Who wins loses is anyone’s guess. But AI is a race the major players must be a part of, and they need to spend up big to do so.

If that spending results in a lower return on capital in the future, it could result in a major narrative shift.

How could this play out in terms of stock market prices?

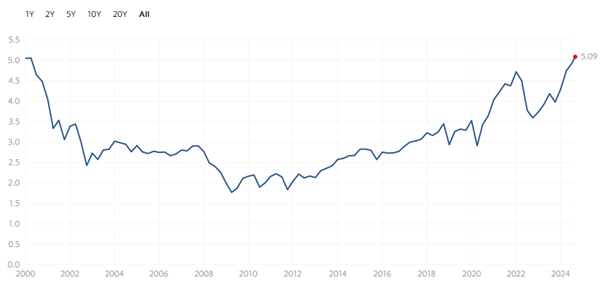

The best way to explain is to do so visually. The chart below shows the price-to-book ratio of the S&P500. It’s currently at 5.09 times.

That means every $1 of equity for S&P500 companies currently has $5.09 of market value. This is higher than the December 1999 peak, at 5.05.

S&P500 Price-to-Book Ratio

If an increase in capital investments translates into lower returns on capital in the years ahead, the price-to-book value should come down.

Where will capital flow to next?

In major narrative shifts, capital heads to areas previously shunned.

Commodities are a good example. It’s a broad asset class. But in general, you’re talking about capital-intensive businesses that involve risky construction and development phases.

Global capital hasn’t been interested in the sector for some time. Not when it can hang out with the Mag 7 instead of, say, lithium and nickel.

But everything goes in cycles, especially commodities.

The weak Chinese economy is a big part of the unpopularity of commodities right now. But that weakness is likely cyclical. And relative to the S&P500, China’s stock market is very cheap.

If China stabilises and shows signs of renewed growth, that could reinforce a shifting narrative.

Who knows how all this plays out. This is not a short-term forecast. Rather, it’s how I’m thinking about global capital flows if the market realises the Mag 7 party is over as we head into the latter parts of 2024.

Want more like this?

Enjoy unfiltered investment analysis? That's just a taste of the daily insights at Fat Tail Daily, covering everything from tech to miners to economic trends. Expand your perspective - subscribe for free here.

2 topics