Which ASX companies have sustainable dividends and strong technical trends?

A while back, my colleague Carl Capolingua penned a wire on how Aussie investors could get their slice of the $50 billion ASX dividend pie, while also avoiding the dividend traps.

In that wire, he committed me to running some scans for you, focusing on stocks with strong earnings growth potential and the ability to maintain their dividends.

In that vein, I put together a scan with the following factors;

- 1-year forward yield above 5%

- 2-year forward yield above 5%

- DPSg 1-year forward above 3%

- DPSg 2-year forward above 3%

- EPSg 1-year forward above 5%

- EPSg 2-year forward above 5%

- Market cap above $750 million

The factors are straightforward in terms of what they are trying to achieve.

The forward yield above 5% ensures companies are expected to have healthy dividends, above the market average (otherwise you might as well just buy the index), over the next two years.

Expected dividend per share growth (DPSg) above 3% is simply to capture companies that are expected to grow their dividends two years out. Why 3%? No particular reason, other than going any higher than 3% saw the list shrink considerably.

Expected earnings per share growth (EPSg) above 5% captures companies that are expected to grow their earnings to help support future dividend growth – it’s tough to increase your dividends if your earnings are flat or going backwards.

Finally, a market cap above $750 million ensures companies have the balance sheet heft to help them through whatever the market cycle may bring.

Running that scan over the ASX delivers just nine companies. Given this is an exercise in quality over quantity, that's not a bad thing. And remember, aside from market cap, this is all forward-looking data based on consensus estimates from research analysts. If your favourite dividend stock is not in there, it's because it doesn't meet the hurdle rates highlighted, based on consensus estimates.

Below is the list of stocks and some commentary on each, coupled with Carl's analysis of the charts.

THE LIST

The list below should not be considered recommendations. We highlight them for educational purposes only. Always do your own research and remember that past performance is not a reliable indicator of future return.

Please scroll to the right for full data.

| COMPANY | CODE | Yield 1-yr |

Yield 2-yr |

DPSg 1-yr |

DPSg 2-yr |

EPSg 1yr |

EPSg 2 yr |

MktCap ($m) |

| GQG Partners | GQG | 8.07 | 9.21 | 49.64 | 14.09 | 51.88 | 14.78 | 7472 |

| Dalrymple Bay Infrastructure |

DBI | 7.04 | 7.37 | 5.7 | 4.61 | 14.69 | 9.69 | 1547 |

| Chorus | CNU | 6.44 | 6.65 | 20.19 | 3.22 | 369.26 | 143.53 | 3524 |

| IPH Limited | IPH | 6.06 | 6.46 | 5.19 | 6.57 | 89.98 | 6.97 | 1616 |

| Aurizon | AZJ | 6.05 | 6.6 | 18.33 | 9.07 | 11.44 | 7.88 | 6111 |

| Harvey Norman | HVN | 5.26 | 5.72 | 10.38 | 8.72 | 13.39 | 10.82 | 5744 |

| Beach Energy | BPT | 5.2 | 9.46 | 45.35 | 83.47 | 179.86 | 41.73 | 2578 |

| Monadelphous | MND | 5.2 | 5.5 | 7.66 | 5.68 | 9.81 | 6.69 | 1178 |

| Stockland | SGP | 5.02 | 5.52 | 3.98 | 10 | 145.55 | 10.97 | 12151 |

Note: The data above is sourced from Halo Technologies and is accurate to 9/9/2024

GQG Partners (ASX: GQG)

Not long back, I pulled together the bullish commentary on GQG. It is available in the wire below:

Of the broker coverage we can see, all of them have a BUY, ADD, OUTPERFORM, or OVERWEIGHT rating, with target prices anywhere from 20-45% above the current market price. The most aggressive target price belongs to Morgan Stanley, at $3.30, which noted that GQG's 1H profit beat MS' forecast by 4%.

%20chart%2011%20September%202024.png)

Carl’s TA View: The short-term (ST) trend (light pink zone) has turned down, but the long-term (LT) trend remains very much intact. The LT trend ribbon (dark green zone) is doing its job of offering dynamic demand (i.e., “support”), and the candles in / pushing out of the LT trend ribbon are of a strong demand-side nature (i.e., white-bodied and or downward pointing shadows). The price action (presently falling peaks and falling troughs) is consistent with the ST downtrend, and both confirm the supply side is in control of GQG’s price for now.

I am encouraged by the demand-side candles at the LT trend ribbon, but I would prefer to wait for further signs the demand side is regaining control of the price, for example, a return to rising peaks and rising troughs as well as the prevalence of several more strong demand-side candles.

Dalrymple Bay Infrastructure (ASX: DBI)

When interviewed back in June, Plato's Dr Don Hamson provided a comment on DBI, saying "Some people think that the commodities it deals in might no longer be here eventually, but I think they're going to be here for longer than people think".

Earlier in the year, Forager's Steve Johnson said that DBI is “about as safe as they come” and offers reliable income - despite not holding the stock.

“This heavily regulated Queensland coal terminal yields about 8%. The regulatory regime means that yield should rise in line with inflation and the long-term nature of the agreements means there is no commodity price risk,” said Johnson.

%20chart%2011%20September%202024.png)

Carl’s TA View: One of three very strong ST/LT uptrend combinations in this list (the other two are CNU and SGP). I note a predominance of demand-side candles, rising peaks and rising troughs, rising trend ribbons, and dynamic demand reinforcement at the trend ribbons. Put all of these key components together, and it’s hard to argue the demand side isn’t in control of DBI’s price. Further, there’s nothing in this chart to suggest this cannot continue.

Chorus (ASX: CNU)

Chorus has come up in wires I've written recently for a couple of reasons. It appeared in a wire about stocks with forward P/Es over 100 and another titled 5 ASX dividend stocks to weather what might be coming next.

The stock also rated a mention in Macquarie's recent reporting season predictions, being featured in a list of stocks that consensus expects to see more than 100bps of profit margin expansion next year, despite poor earnings momentum in recent times.

Macquarie remains one of the most bullish brokers on CNU, with an OUTPERFORM rating but no target price. Of the recent results, Macquarie analysts noted that FY25 dividend guidance of NZ57.5c is well ahead of their own expectations, as the company moves to a new policy to pay an ordinary dividend of 70-90% (versus 60-80%) of net cash flow from operating activities, less sustaining capital expenditure.

%20chart%2011-September%202024.png)

Carl’s TA View: Another picture of demand-side control. I note again, predominantly demand-side candles, rising peaks and rising troughs, rising trend ribbons, and dynamic demand reinforcement at the trend ribbons – all the “good stuff” I believe investors should ask of the charts of their favourite stocks!

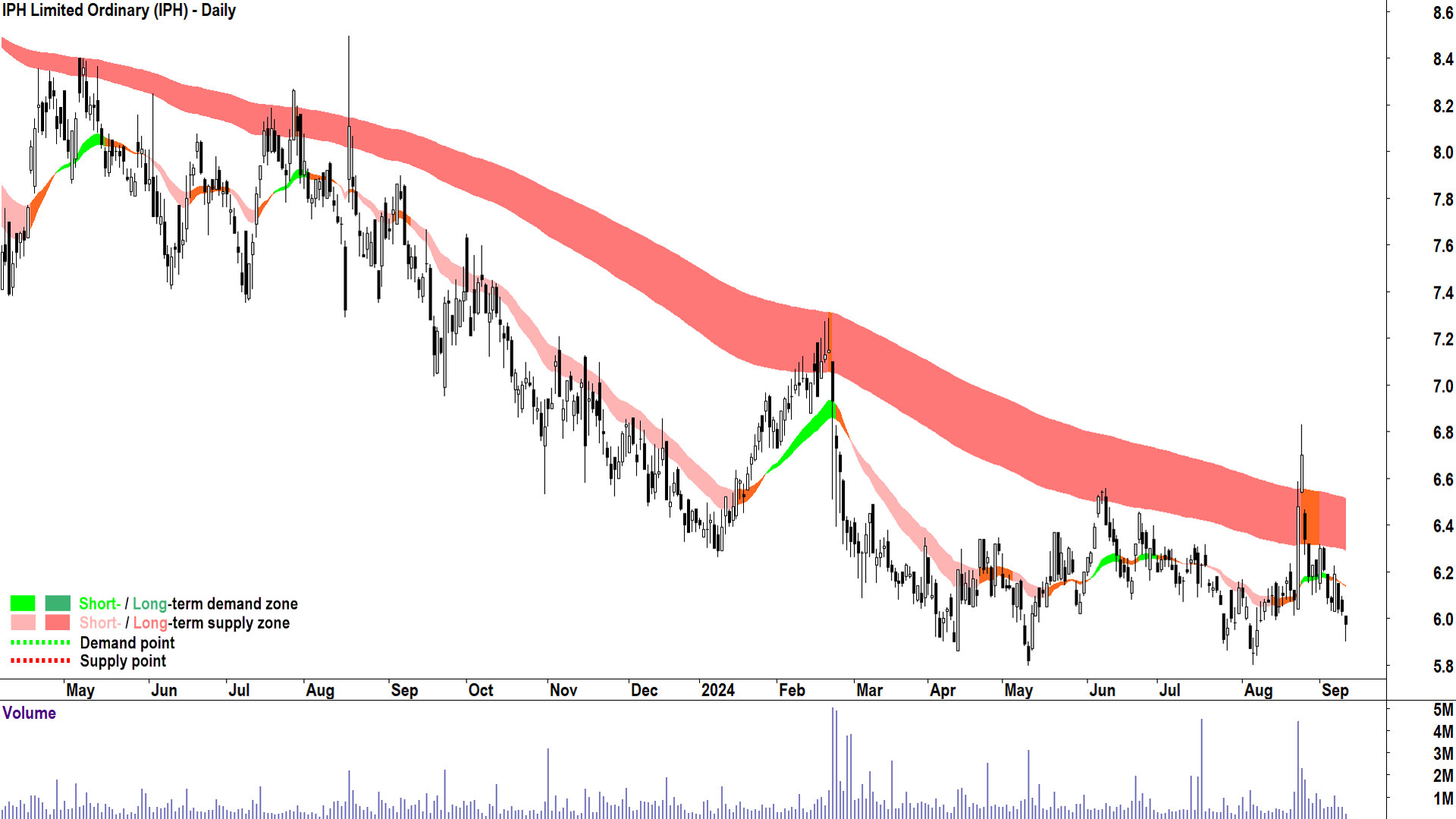

IPH Limited (ASX: IPH)

IPH popped up in Macquarie research in June, as a company where underperformance has masked an improvement in FY25 earnings expectations, whilst Morgan Stanley highlighted IPH as a "labour saver" in its research in May.

Earlier in the same month, IPH was discussed on an episode of Buy, Hold, Sell - with LSN Capital's Nick Sladen rating it a BUY, saying:

It's a downtrodden growth stock. It's traditionally had - and still does - a really strong market position in the industries it operates. It's made a range of acquisitions both in Australia and Canada over the last 18 months. And those acquisitions have been in integration mode. As they get closer to completion, we're expecting integration to start to deliver earnings growth. And we think that the business is considerably under-earning and considerably undervalued.

Elston's Justin Woerner was less convinced, rating the stock a SELL and saying "We try to stay away from acquisition-led growth. We much prefer to see organic-based growth".

%20chart%2011%20September%202024.png)

Carl’s TA View: The opposite of DBI and CNU: a predominance of supply-side candles (i.e., black-bodied and or upwards-pointing shadows/wicks), falling peaks and falling troughs, short and long-term downtrend ribbons, and dynamic supply reinforcement at the trend ribbons (the ribbons are repelling the price lower, i.e., “resistance”).

Note that technical analysis (TA) does not make any judgements on the quality of a company, merely it seeks to interpret the demand and supply for that company’s shares. It is clear to me from the IPH chart, that there is presently a high degree excess supply of its shares.

This could change with today’s candle, and my brand of TA does not prognosticate, it only reacts. Should I see a return to predominantly white candles, risking peaks and rising troughs, rising trend ribbons, and dynamic demand reinforcement at the trend ribbons, IPH would then be back in the good books.

Aurizon (ASX: AZJ)

Aurizon has been receiving a lot of love following its recent earnings. The stock was upgraded by two brokers, despite dropping sharply on the day of the release.

IML provided the following commentary on a recent podcast:

"Profits were up 11%, but it was a little bit below expectation on the back of higher interest costs. So the stock was down 8% on the day. Really, if we look at the underlying performance of the business, we think it’s performing well and we see some really good medium-term growth coming through their land bridging business"

Meanwhile, Martin Currie Australia's Reece Birtles penned a wire in early August that highlighted AZJ as a stock with "resilient earnings and good pricing power".

%20chart%2011%20September%202024.png)

Carl’s TA View: I have to go ditto with IPH here. As a trend follower, I must abide by the prevailing trends. So, it’s a “not right now” for me with respect to AZJ’s technicals. Again, technicals can change, and they can change quickly – so at least I have listed here the critical markers of demand-side control.

Harvey Norman (ASX: HVN)

There hasn't been a great deal of commentary about HVN on the Livewire platform in recent times. The company popped up in some Macquarie research as a name that could benefit from AI.

Macquarie has an OUTPERFORM rating and a $5 target price, as does UBS, with the latter believing that the outlook for Franchisees looks better and the international operations, while under-appreciated by the market, are facing a tough consumer environment.

Citi is even more bullish, rating the stock BUY with a $5.50 target price, believing that strong earnings growth should materialise throughout FY25.

%20chart%2011%20September%202024.png)

Carl’s TA View: HVN is more like GQG, that is, it’s more of a “stuck in the middle” chart compared to the decisive demand-side control charts of DBI and CNU, and the decisive supply-side control charts of IPH and AZJ.

There’s some good stuff going on here, though, like the prevalence of a LT uptrend and strong demand-side candles appearing around the LT uptrend ribbon so far (i.e., dynamic demand reinforcement). I am less enthusiastic about the neutral ST trend and falling peaks and falling troughs. If those two factors reverse, it would indicate the demand side is once again back in control of the HVN price. Until then, it’s just a case of wait-and-see.

It’s also worth making a quick note about long-term trend change here, more specifically how long-term uptrends transition into long-term downtrends. Note what happened when this occurred in the charts of IPH and AZJ – it started with a close below the long-term uptrend ribbon, and then the long-term uptrend ribbon began to offer dynamic supply reinforcement. It would warrant greater caution if this were to occur on HVN.

Beach Energy (ASX: BPT)

Beach Energy didn't fare so well post-reporting season, with two brokers downgrading the stock, and six brokers cutting target prices by 10% or more.

Unsurprisingly, there hasn't been much chatter about BPT from fundies on the platform. As for the brokers, Morgan Stanley has one of the lowest target prices in coverage, at $1.18 - still about 10% above the current market price.

MS updated its research towards the start of the month, anticipating a softer year ahead for both oil and LNG exposures on the ASX and lowering its industry view to IN-LINE, down from Attractive. BPT is the least preferred exposure and MS has an UNDERWEIGHT rating on the stock.

%20chart%2011-September%202024.png)

Carl’s TA View: Double ditto versus IPH and AZJ here. All I can see is total supply-side control, and whilst that remains the case, I prefer to focus my efforts and analysis elsewhere.

Monadelphous (ASX: MND)

Of all the stocks on this list, MND has the least commentary. Hardly a surprise given it has the smallest market cap, coming in at around $1.2 billion.

Brokers don't seem to mind the stock, with target prices anywhere from 15-35% above the current market price for the research we can see.

Citi is most bullish, with a $16.20 target price. It says MND's commentary following the FY24 results was "upbeat," particularly given that the company is typically conservative.

The reason for the optimism is the securing of $3 billion in contracts in FY24, which effectively covers around 1.4 years of revenue based on the broker's FY25 forecasts.

%20chart%2011%20September%202024.png)

Carl’s TA View: A milder set of downtrends compared to some of the others in this cohort, but a clear set of downtrends, nonetheless. Good TA is consistent TA. We shouldn’t try to force what is not there. The technicals here are consistent with excess supply, and until they change, let’s simply note where they're at and move on to the next one.

Stockland (ASX: SGP)

Following reporting season, Tyndall Asset Management's Brad Potter highlighted that "there are signs of improvement in certain segments of the market, such as residential sales enquiries, particularly in New South Wales and Victoria. Stockland (ASX: SGP) has flagged they are experiencing a pickup in residential sales enquiries which was well received by the market".

Michael Skinner from Blackwattle Investment Partners sang a similar tune, saying "New home enquiry levels are stable, with signs of potential growth despite broader market challenges".

The brokers are less convinced, Citi and Morgan Stanley have BUY and OVERWEIGHT ratings, respectively, but their target prices - at $5.30 - are only slightly above the current market price. Meanwhile, Ord Minnett and UBS both have a target price of $4.70.

%20chart%2011-September%202024.png)

Carl’s TA View: What a fantastic note to finish on! Another great example of total demand-side control: is predominantly demand-side candles, rising peaks and rising troughs, rising trend ribbons, and dynamic demand reinforcement at the trend ribbons. Now, if you think I am sounding repetitive – that’s my intention! Remember: Consistency, consistency, consistency!

Over to you

What's your 'go-to' dividend payer - one that delivers year-in and year-out?

Let us know in the comments section below.

5 topics

9 stocks mentioned

8 contributors mentioned