Which ASX insiders have been buying and selling their own stock?

It's that time again when we dive into the most significant insider moves of the past quarter. For anyone new to the series, you can check out previous instalments below;

-

The most important ASX insider buys and sells for the September quarter

- Directors went Christmas shopping: Insider moves for the December quarter

- Insiders love buying when their stock is cheap - so who has been making moves?

Today, we take a look at the following;

- Companies that have seen multiple insiders buying and selling during the period;

- Analysing which directors have been buying into weakness or momentum, and vice versa;

- Companies with the largest buys and sells, relative to their market cap.

Multiple insiders making moves

When multiple insiders buy or sell, it can tell an interesting story. Don't forget that these insiders are all sitting around the same boardroom table and responding to the same stimulus.

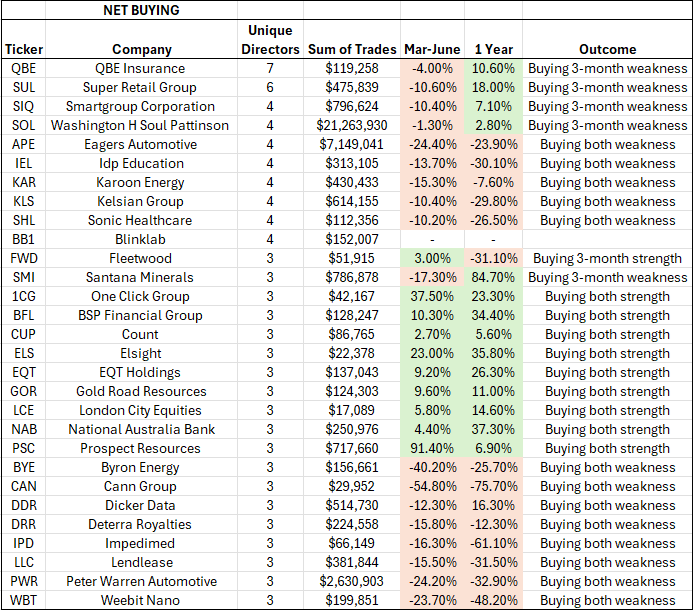

During the March quarter, 39 companies (up from 32 in the prior quarter) had three or more different insiders making moves - they are listed below. I've also analysed under what type of circumstances the transactions occurred, based on 3-month and 1-year performance share price performance.

As explained in the first wire that introduced this series, research shows that the percentage of insider trades decreases as the share price moves from 52-week lows, towards 52-week highs. Put simply, insiders buy more when their stocks are incredibly cheap, and buy less when they are expensive (or, as will be seen below, start selling)

It should come as no surprise then that the main set of conditions under which insiders in the table above were buying was "buying both weakness" - which translates to buying stock, when the share price is down over BOTH a 3-month and 1-year period.

Please note that these are simply observations based on the data. We cannot possibly know the true motives of why any director buys or sells stock in their own company.

Transactions that involved BUYING

- Of the 29 sets of transactions that involved buying, 13 of them saw that buying on both 3-month and 1-year weakness - these are insiders buying when their stock is 'cheap'

- 9 instances saw insiders buying on both 3-month and 1-year strength - these are the momentum riders

- 5 instances saw insiders buying on 3-month weakness (despite 1-year positive performance) - this cohort is 'buying the dip'

Transactions that involved SELLING

- 4 instances saw insiders selling on both 3-month and 1-year strength - these are insiders selling when their stock has rallied, with the 12-month performances of the respective stock being +84% (WAF), +59% (NWL), +30% (WTC), and +129% (DUG)

- 3 instances saw insiders selling on 3-month weakness despite longer-term gains - perhaps locking in profits

- 2 instances saw insiders selling on both 3-month and 1-year weakness - perhaps, in the case of VIT, getting out whilst they still can

The big counts

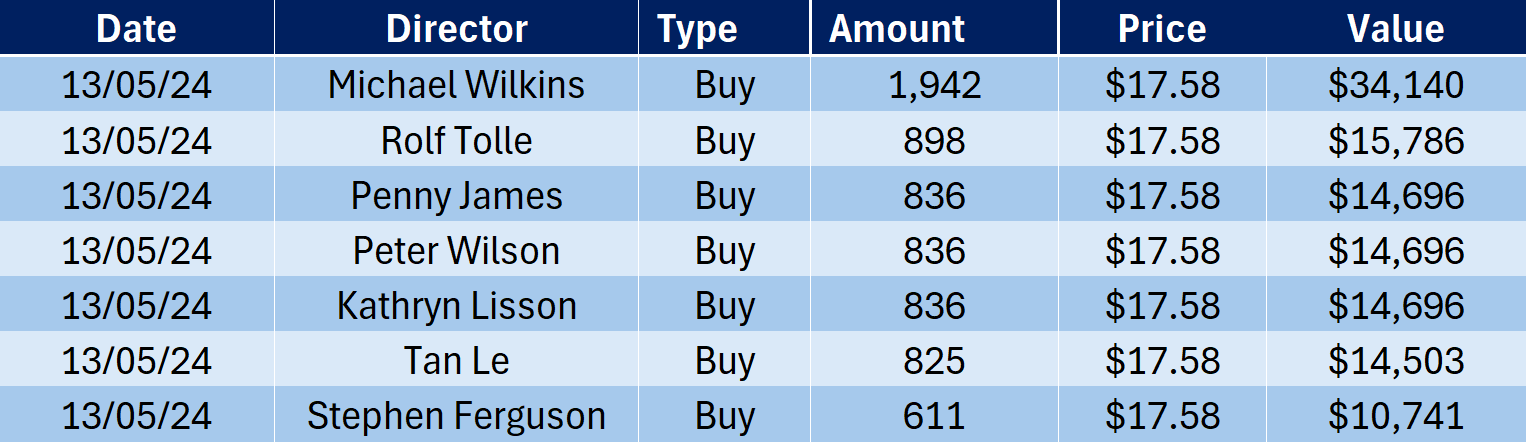

QBE Insurance (ASX: QBE)

In the June quarter, we saw seven directors buying QBE. The sum of the trades was $119,258 and the transaction date has been highlighted on the chart below.

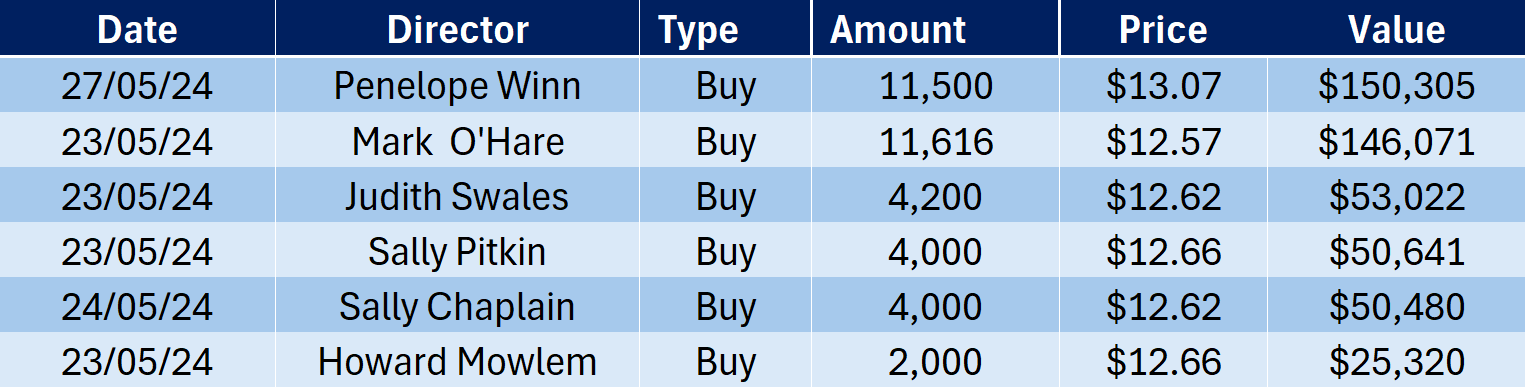

Super Retail Group (ASX: SUL)

.png)

In the June quarter, we saw six directors buying SUL in a classic "buy when your stock is cheap" scenario. The sum of the trades was $475,839 and the transaction dates have been highlighted on the chart below. So far, so good in terms of share price performance.

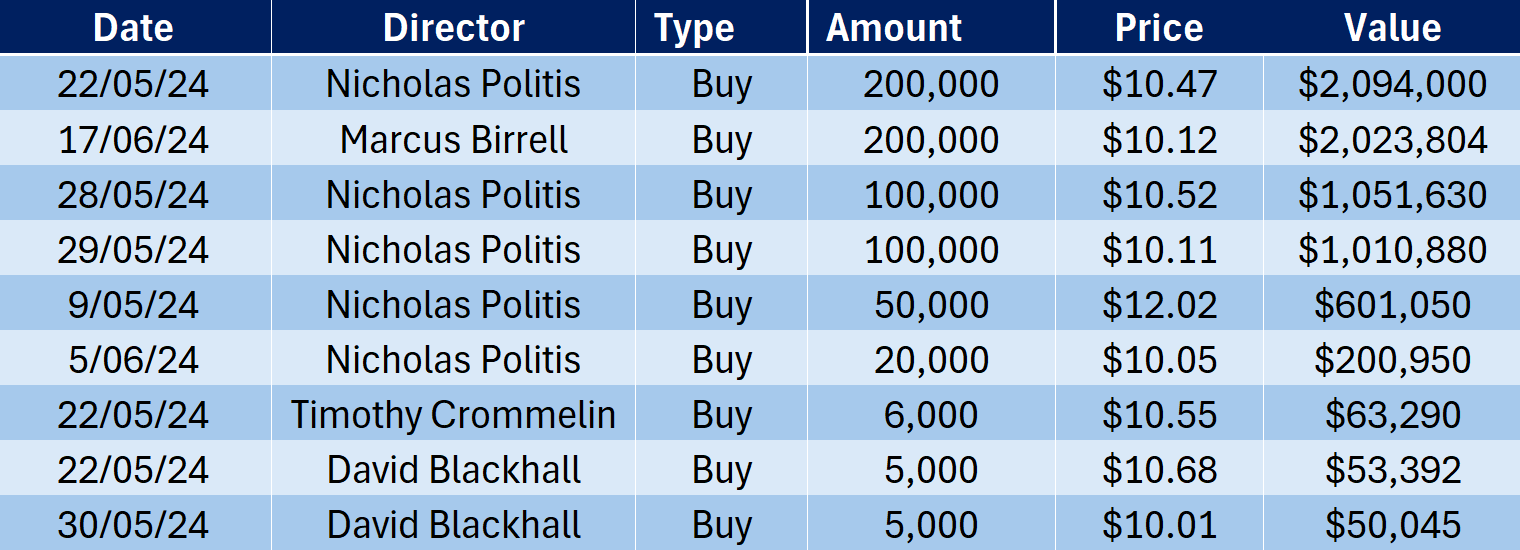

Eagers Automotive (ASX: APE)

In the June quarter, we saw four directors buying APE in another "buy when your stock is cheap" scenario - although this one isn't working out quite so well just yet. The sum of the trades was $7,149,041 and the transaction dates have been highlighted on the chart below.

Big Relative Buyers and Sellers

While Wisetech Founder Richard White and Co-Founder Maree Isaacs sold $331 million worth of shares in the June quarter, this represents approximately 1% of the company's market cap, and Mr White still owns roughly 35% of the company.

Rather than focusing on director trades with high dollar values that may appear shocking at first glance, examining trades based on their percentage of market cap might be more insightful.

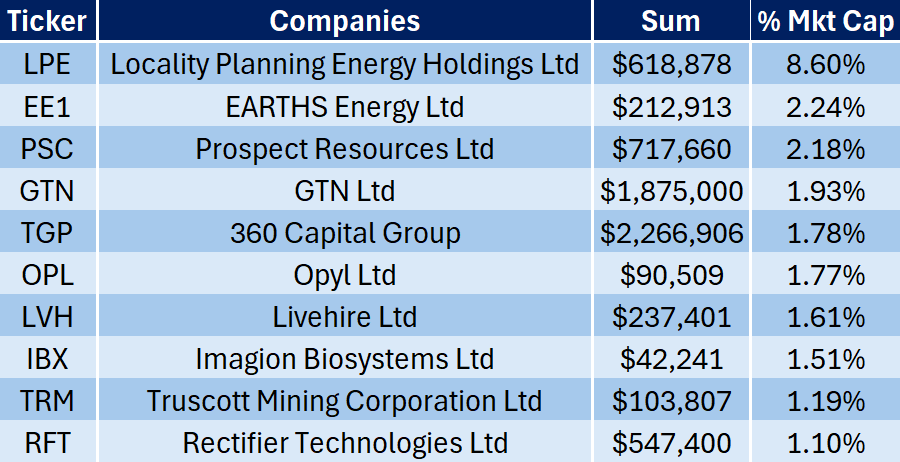

Let’s look at the largest buys from this perspective:

You’ve probably never heard of most of the companies on this list. But they have some rather intriguing fundamentals.

- Locality Planning Energy is an electricity provider to strata communities (buildings divided into ‘lots’ such as an apartment or townhouse). Its latest quarterly guided to a full-year net profit of $1.6-1.8 million, which is significant relative to its $20 million market cap. The company is currently under takeover offer from River Capital at 10.5 cents per share. Interestingly, the latest buy from Non-Executive Simon Tilley (at 13 cents) may suggest a bid rejection. LPE is seeking to return capital back to shareholders and improve liquidity via a share buyback and dividend.

- Earths Energy, a recent backdoor listing on 7 February 2024, is developing geothermal energy projects in South Australia and Queensland. The company is progressing a number of project development activities including exploration, securing grid access and exploring potential JV opportunities. The stock has traded relatively flat, around the 1.4 cent level, since listing.

- Livehire (not to be confused with Livewire) is a recruitment platform with an $8 million market cap. It's CEO Christy Forest bought 10 million shares at 2 cents a piece on 8 May, or a massive 32% premium. The on-market buy did not drive an immediate share price reaction, and the stock has only received tipped above the 2 cent level.

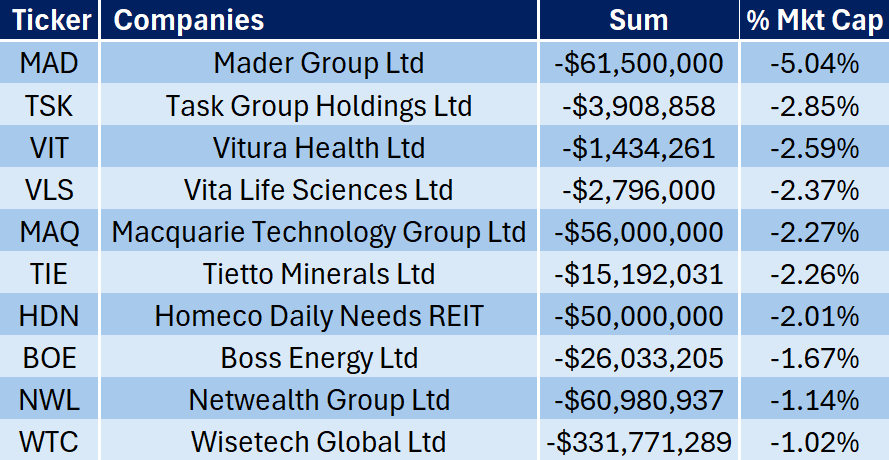

And here are the largest selldowns:

A number of these trades reflect notable changes in company ownership or M&A, including:

Mader’s Founder and Executive Chair Luke Mader offloaded 9.75 million shares ($61.5 million) to a ‘tier one global financial services company’ with over US$2 trillion in assets under management. The details about this new strategic investor has yet to be revealed.

Task Group is a tech company that develops customer loyalty apps for fast food restaurants. The company entered into a scheme arrangement to be acquired by NYSE-listed Par Technology. The cash offer of 81 cents per share was a 103% premium to its closing price on 8 March 2024. Non-Executive Director Phillip Norman offloaded his entire holding in the first two weeks of June.

4 topics