Which is better for your portfolio: Gold or Bitcoin?

It has been a tumultuous week in global financial markets since Donald Trump and his Republican party stormed last week’s US elections. Few pundits had been tipping the probability of the so-called “Red Sweep” which describes the Republican party’s candidate taking out the presidency, as well as the party taking control of both houses of US Congress.

Investors have scrambled to pick up assets they feel are best placed to take advantage of the surprise election outcome, including those most likely to benefit from President-elect Trump’s “Make America great again” mantra. So far, stocks with the greatest exposure to the US economy and with US dollar earnings have soared, sending major US stock indices to fresh record highs.

Another asset class that has benefited from the Red Sweep – and few probably realise has been delivering returns that put those seen in the US stock market to shame – is Crypto (short for cryptocurrency). Doing particularly well in this regard, and setting its own fresh record highs, is the original crypto, bitcoin.

In comparison, there have been several major asset classes that have found themselves on the wrong side of the US election result. President-elect Trump’s promise of up to 60% tariffs on Chinese imports into the US have dealt a major blow to the prices of bulk commodities like iron ore, copper, nickel, zinc, crude oil, and coal.

Interestingly, there has been another casualty of the Red Sweep that has very little to do with an impending global trade war – gold. Gold prices have tumbled since the election result became firmly understood, and this is even more curious given it was one of the best performing asset classes in the last 12-months leading up to the election.

This article will investigate the reasons for bitcoin’s recent ascent as well as gold’s recent demise, it will also consider the outlook for each under a Trump administration. Finally, it will take a look at how investors can get exposure to each asset for their portfolios.

What is bitcoin?

Bitcoin is a digital currency created in 2009 by an unknown person (or group of people) using the pseudonym Satoshi Nakamoto. Unlike traditional currencies, it operates without a central bank or single administrator – meaning that it is decentralised. Transactions are verified by a network of nodes through cryptography and recorded on a publicly distributed ledger called a blockchain.

There were just 21 million Bitcoins originally created, and they have been gradually unlocked/distributed since Bitcoin’s inception as a reward for a process known as mining. Mining involves using computational power to solve complex mathematical problems (i.e., cryptography). This innovative system aims to provide a secure and transparent method for tracking and verifying Bitcoin ownership, and therefore for transferring value between two parties.

The ability to transact without an intermediary such as a bank or a government institution is the greatest attribute and attraction to Bitcoin and other cryptos. Users are anonymous, identified only by their Bitcoin wallet address (“key”) which is a unique alphanumeric character identifier.

Bitcoin challenges traditional financial systems, as well as the governments that would prefer to regulate and monitor them. For this reason, its introduction and burgeoning growth over the last 15 years has been controversial.

What is the case for owning Bitcoin?

The main reason for Bitcoin’s recent success is the attention afforded to it by President-elect Trump during his election campaign. A former critic of Bitcoin and crypto in general, this year President-elect Trump embraced a new pro-Bitcoin stance, touting its potential as a hedge against inflation and a tool for financial innovation.

He has advocated for a more favourable regulatory environment that will encourage growth and adoption of digital currencies, even threatening to sack the current Secretary of the US Treasury Gary Gensler who is widely considered to be crypto sceptic, and to replace him with someone who is more pro-crypto (President-elect Trump has claimed he will do this “on day one” of his presidency no less!).

Other pre-election claims hinted at policies focussed more on supporting blockchain technology and integrating cryptocurrencies into the broader financial system. President-elect Trump has espoused the importance of positioning the USA as a global leader in cryptocurrency innovation, and therefore promoting economic freedom and technological advancement.

%20chart%2011%20November%202024.png)

Add up all of the above, and it begins to explain the stellar run that the Bitcoin price has experienced since early last week as the nature of the US election result began to sink in. Bitcoin investors are betting on a new era of increased adoption, and therefore demand for the digital currency, whose supply is severely limited by the fact that never more than the original 21 million Bitcoin can exist.

Note, of those, it is estimated that as many as 4 million Bitcoin have been lost to theft and lost keys over the years. Another roughly 1 million Bitcoin are held by Satoshi Nakamoto, and it’s generally assumed these will never be claimed or used due to this entity preferring to remain anonymous forever.

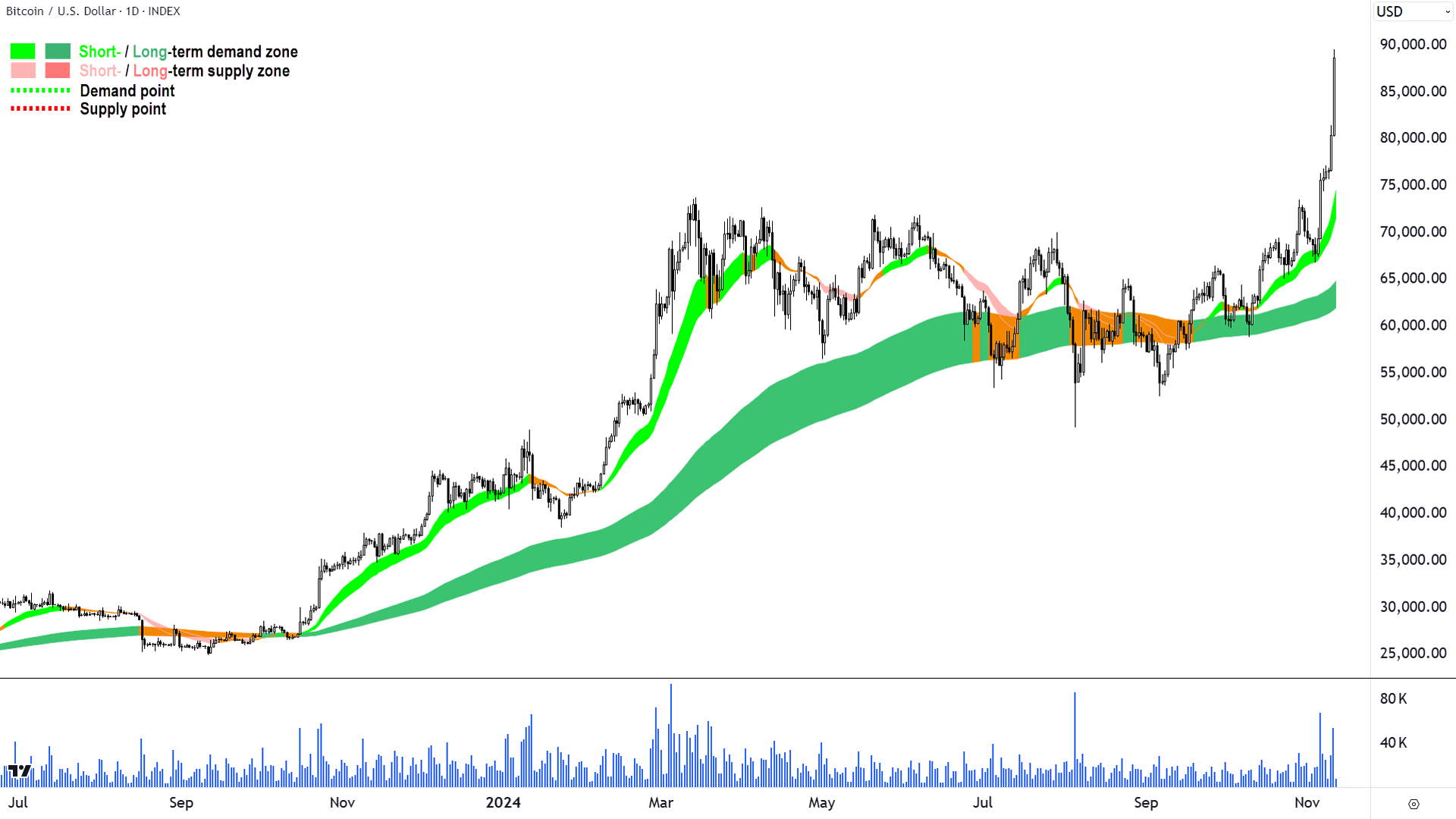

At the moment, the Bitcoin price is at the mercy of the most basic tenet of economics: demand versus supply. There is simply far more demand for the crypto in the wake of the US election result than there is supply to meet it. For now, this is causing its price to rise, and from a purely technical standpoint – the trends, price action, and candles are all indicative of strong demand side control.

Given that Bitcoin is trading at record highs, there are no major historical points of supply for it to contend with. As a technical analyst, I then defer to major round numbers which tend to create excess supply around them simply due to the fact that many investors opt to sell within their proximity. The most obvious major round number that is now within close proximity of the current Bitcoin price is US$100,000.

Whether it gets there or not is out beyond the scope of my brand of technical analysis – which is trend following, not trend forecasting! I simply identify this level as the next-most logical overhead target.

What is the case for owning gold?

Current macroeconomic trends potentially also underscore the importance of owning gold. Arguably, the world is again on the cusp of another prolonged period of looser monetary and fiscal policy aimed at stimulating slowing economies on both sides of the Atlantic, and in China.

The upshot of looser monetary policy, that is as central banks print more money, is fiat currency debasement. This occurs when the supply of fiat currency increases and causes currency values to diminish against hard assets with relatively stable supply-demand dynamics like gold. Greater economic stimulus can also stoke inflation.

Gold has for many generations been widely considered to be a reliable hedge against inflation and currency volatility.

The other upshot of stimulatory fiscal policy in particular, is growing government debt levels. This too can undermine confidence in currencies of countries viewed as having unsustainable public debt. The USA is considered particularly vulnerable in this regard, and this is leading to a growing global de-dollarization trend.

Increasing distrust in the U.S. dollar, coupled with geopolitical shifts towards non-US-bloc-style economic cooperation (e.g. BRICs), further enhances gold’s appeal as a stable store of value.

Over the last 12 months, investors have recognised gold's historical resilience and its ability to preserve wealth in uncertain times, making it a prudent addition to any portfolio. The price of gold has outperformed many other traditional asset classes during this time. However, over the last week following the US election result, gold prices have staged a sudden about-face.

From a purely technical perspective, gold's short term trend is under severe pressure. The price has closed below the short term trend ribbon, which has neutralised, and the price action is falling peaks and falling troughs. The candles since the US election have been decidedly supply-side in nature (i.e. those with black bodies and or upward pointing shadows). Overall, these factors are consistent with short term supply-side control.

There is a historical point of demand at the 10 October trough low of US$2,618 that is at threat of being broken. It will need to hold to stave off a potentially deeper probe into demand towards the US$2,500 August-September consolidation zone. I note dynamic demand from the long term uptrend ribbon will also likely kick in around that price.

In conclusion, the gold price remains in a strong and well-established long term uptrend, but is experiencing a short term correction that may target the points of demand identified above. A return to demand-side candles (i.e., those with white bodies and or downward pointing shadows), rising peaks and rising troughs, along with a close back above the short term uptrend ribbon is required to resume the short term uptrend.

Why gold is struggling since the US election?

The gold price and the Bitcoin price have moved in almost the opposite lock-step direction since the US election. Whilst President-elect Trump’s policies are widely seen as greatly beneficial to Bitcoin, they are somewhat less certain for the ongoing prosperity of gold.

Firstly, the emphatic nature of President-elect Trump’s win removes a great deal of uncertainty as to US policy direction at least until the mid-term Congressional elections in 2026. Gold is traditionally seen as a hedge against uncertainty, and therefore it has naturally been marked down on this point.

Secondly, given the Red Sweep is generally accepted to be very bullish for US economic growth, Trump-Republican policies could also turn out to be inflationary. This has put in question the need for the US Federal Reserve to continue on its recently embarked interest rate cutting cycle. The upshot of this factor is that US bond yields have spiked in the wake of the US election.

Unlike Bitcoin which can be lent out for a return of interest, Gold does not have a yield. In fact, it’s generally quite expensive to store and insure physical gold holdings. This means there is usually a substantial opportunity cost to holding gold.

As risk-free rates rise (US bonds are considered to be risk-free investments bearing a guaranteed return), the opportunity cost of holding no-yield gold increases. This has been the major trigger for gold’s price weakness over the past week.

Is digital gold (Bitcoin) better than actual gold?

Gold is considered to be the age-old hedge against economic uncertainty, a handy hedge against inflation, and generally a sound way to diversify one’s portfolio. Bitcoin is the relatively new kid on the block (or blockchain to be more precise!) offering many of the same benefits.

Once the volatility in bond markets subsides (should it do so) broader and longer term macroeconomic trends like rising inflation, fiat debasement, and de-dollarisation, may continue to drive further long term gains in gold. Bitcoin, with its similar stable supply-side stands to also benefit from these very same long term macroeconomic drivers.

Both gold and Bitcoin have their pros and cons, but there does appear to be a case for both assets to perform well given the current environment – and therefore a case for both to earn a place in a well balanced portfolio.

How do I buy gold and Bitcoin for my portfolio?

Investors may be remiss if they do not consider all of their options when it comes to investing in alternative asset classes like gold and Bitcoin. Fortunately for Australian investors, there are some great options to do exactly this available on the ASX.

Investors can choose from several exchange traded funds (“ETFs”) that aim to provide exposure to physical investments in each asset, including:

- BetaShares Gold Bullion Hedged ETF (ASX: QAU)

- Global X Physical Gold Global X Physical Gold (ASX: GOLD)

- iShares Physical Gold ETF (ASX: GLDN)

- Perth Mint Gold (ASX: PMGOLD)

- Vaneck Gold Bullion ETF (ASX: NUGG)

(For a full explanation of the key attributes of each, check out this article)

- DigitalX Bitcoin ETF (ASX: BTXX) - The ETF is physically backed by Bitcoin. The investment objective is to track the performance of Bitcoin in Australian dollars before expenses and fees (Management fee: 0.49% p.a.)

- VanEck Bitcoin ETF (ASX: VBTC) - Aims to give investors exposure to the price of Bitcoin via the MarketVector™ Bitcoin Benchmark Rate which is a composite reference rate for the price of Bitcoin in US dollars before fees and other costs (Management fee: 0.49% p.a.)

This article first appeared on Market Index on Tuesday 12 November 2024.

5 topics

6 stocks mentioned