Who is correct, iron ore or BHP, RIO?

The iron ore price continues to post fresh multi-year highs belying the many doubters who have been calling a top for the bulk commodity basically since I can remember. It’s a simple scenario to comprehend, post COVID the world is aggressively stimulating their economies led by China from an iron ore consumption perspective and until the spending pump is turned off iron prices should enjoy this significant tailwind.

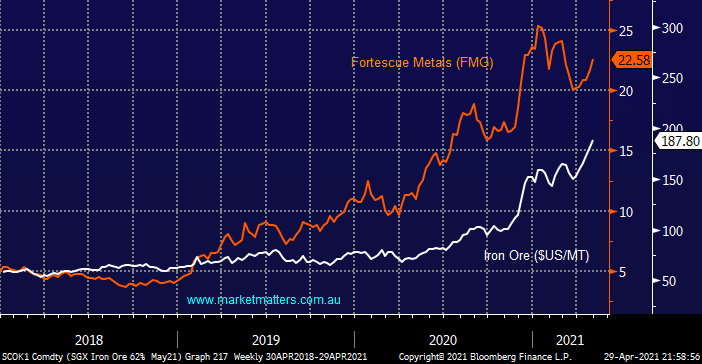

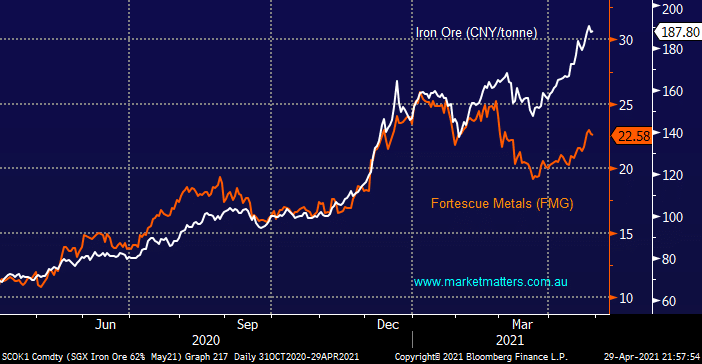

Interestingly Australia’s primary pure iron ore producer FMG has corrected over 20% even as the underlying commodity pushed ever higher, although it did pay a whopping $1.47 fully franked dividend in mid-February. Usually, we would back the stock to be leading the commodity but in this case, MM feels that investors keep underestimating how much money the likes of FMG will make with iron ore at current prices. The correlation between FMG and iron ore over recent years illustrates that stock has outstripped gains by the bulk metal but until China can satisfy its needs elsewhere (which they are working hard to do) FMG still looks fundamentally good value into any pullbacks.

MM is bullish FMG medium-term

However when we look at the correlation between FMG and iron ore over the last few months the picture is very different with the stock failing to embrace recent gains in the commodity, our current preferred scenario is some catch up by FMG probably back above $25.

The local large-cap resource stocks have underperformed the ASX since early March, today we have taken a quick look at 3 major global producers to see if we feel they will also play some catch up moving forward.

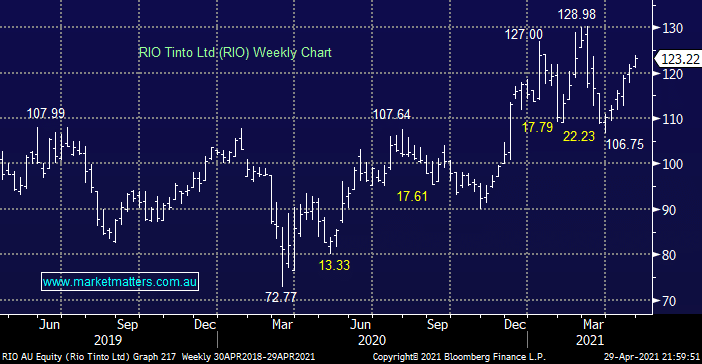

RIO Tinto (RIO) $123.22

Mining goliath RIO enjoys the majority of its revenue from iron ore but similar to FMG it corrected over 17% from its March high showing that it doesn’t matter how good the story is if everyone’s long a stock will struggle. This month's RIO result was solid with no surprises and the stocks forecast yield of over 5% fully franked is extremely attractive in today’s environment – hence our holding in the MM Income Portfolio. We feel the recovery in RIO will be ongoing with a test of $130 our preferred scenario over the months ahead.

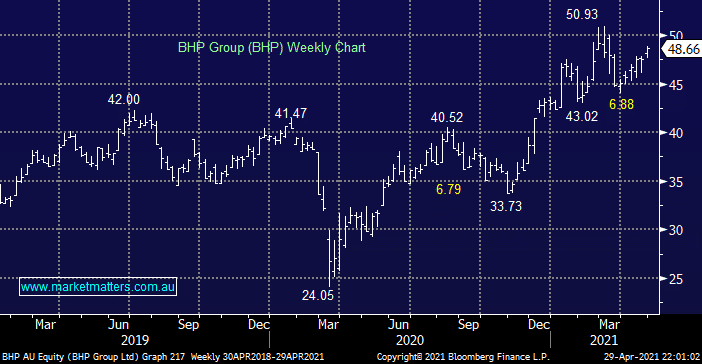

BHP Group (BHP) $48.66

BHP is dancing to the same tune as RIO and FMG, after correcting almost 20% MM is targeting fresh all-time highs above $50 – again a forecasted yield in excess of 5% fully franked should have the miner on many investors menu with its next dividend scheduled for early September. We hold BHP across 3 MM Portfolios.

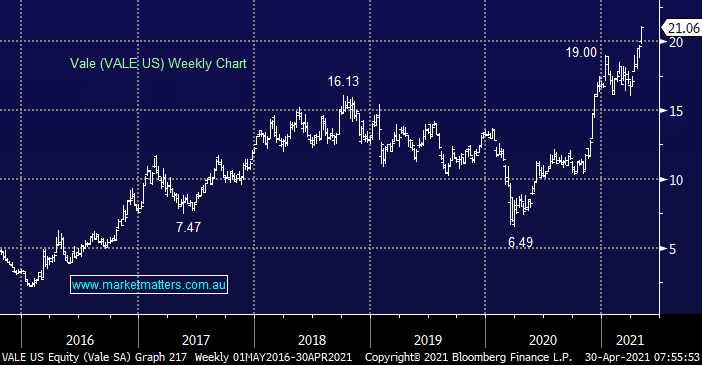

Vale (VALE US) $US21.06

Vale is the worlds 2nd largest producer of iron ore after RIO Tinto (RIO), we feel its showing the direction for Australian producers moving forward after breaking to fresh 2021 highs in the last few weeks. We hold Vale in our International Equities Portfolio.

The Bottom Line

- MM believes local stocks will play catch up with the iron ore price but we believe the recent aggressive pullback throughout the Australian sector is a warning that investors are very prepared to sell the sector at these relatively elevated levels.

- We are bullish on the Australian iron ore stocks short-term targeting new all-time highs through 2021.

- However bulls shouldn’t be married to long-term outperformance as has been illustrated by recent sharp pullbacks, this is another sector which we feel can be sold in 2021 into strength.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.