Who's still buying ASX bank shares? Are they cheap? The answers will surprise you!

If there’s one thing I’ve learned over 30 years of investing, it’s that Aussies love their bank shares. I bet you’ve got at least a couple of them in your portfolio right now. This love affair between mum and dad investors and Aussie bank shares has always intrigued me.

Whenever I’ve turned bearish on banks over the years (yes, there’s been long periods when bank shares have underperformed), my sell calls usually fell on deaf ears: "We don’t sell our bank shares when they go down, mate – we only look to buy more…move on with those silly charts of yours Carl…"

I get it! Bank shares have generally been reliable investments over a very long time, paying lucrative fully franked dividend yields typically better than what you’d get if you’d put your cash in one of them. But this doesn’t mean they’ve always been the best investments – and finding the best investments at any time is what I’ve usually been tasked with over my career.

So, the latest data on who’s buying and selling Aussie bank shares is fascinating to me. Bank shares are on the rise, they’ve been so for a while now, and it seems it's causing usually devoted Aussie mum and dad investors to take profits – at an increasing rate.

Let’s investigate who’s still buying Aussie bank shares (after all, they are going up), who’s selling them, and check broker consensus and the charts to see if bank shares can keep rising.

Institutions have been buying (reluctantly!)

Who’s buying Aussie bank shares? According to a report released Wednesday by Macquarie titled "Australian Banks: Money Talks - Reluctant buying", institutions have been the main buyers, big time.

The term "Institution" is usually used to describe investment funds managed professionally, and includes those run by major financial institutions, superannuation funds, and even the Future Fund of Australia.

Macquarie notes domestic institutions were "significant net buyers of most banks" in the June quarter. Overseas domiciled institutions were also net buyers. Interestingly, Macquarie also points out that index funds were responsible for much of the flow.

Index funds are those that try to track the performance of a benchmark index like the S&P ASX 200. They are referred to as "passive funds", because their sole purpose is to match and not beat their relevant benchmark.

Passive funds don’t do research into company valuations, they don’t pick stocks expected to deliver superior risk-adjusted returns – but they do offer a very cost-effective way of achieving quick and broad exposure to a particular market.

"Active funds", on the other hand, are those that utilise the skills and experience of their managers to select the optimal subset of a market or markets with the goal of delivering superior risk-adjusted returns to a selected benchmark. Invariably, one pays a premium in terms of higher fees when investing in an active fund.

Macquarie is implying it’s possible that to some extent, Aussie bank shares are rising because they’re rising. Consider that as the share prices of Aussie banks increase, so too does the proportion of their weighting within the S&P ASX200 – therefore causing index funds to buy even more of them.

This possibility could be construed as "dumb money" buying, that is, with no consideration of the fundamentals. But Macquarie also points out that there’s plenty of active (so called "smart money") also buying. This could be less to do with fundamentals, though, and more to do with active fund managers generally being underweight the banks previously.

The issue here is that active fund managers can’t afford not to buy some bank shares to gain access to the sector’s strong performance. This is because bank gains are adding index points to the S&P ASX 200, and for managers who use this index as their benchmark, not buying increases the risks of their underperformance. Underperformance in active fund manager land equals less fees (and smaller bonuses!)

Ironically, it seems that the strong performance of Aussie bank shares is forcing both passive and active fund managers to keep buying them.

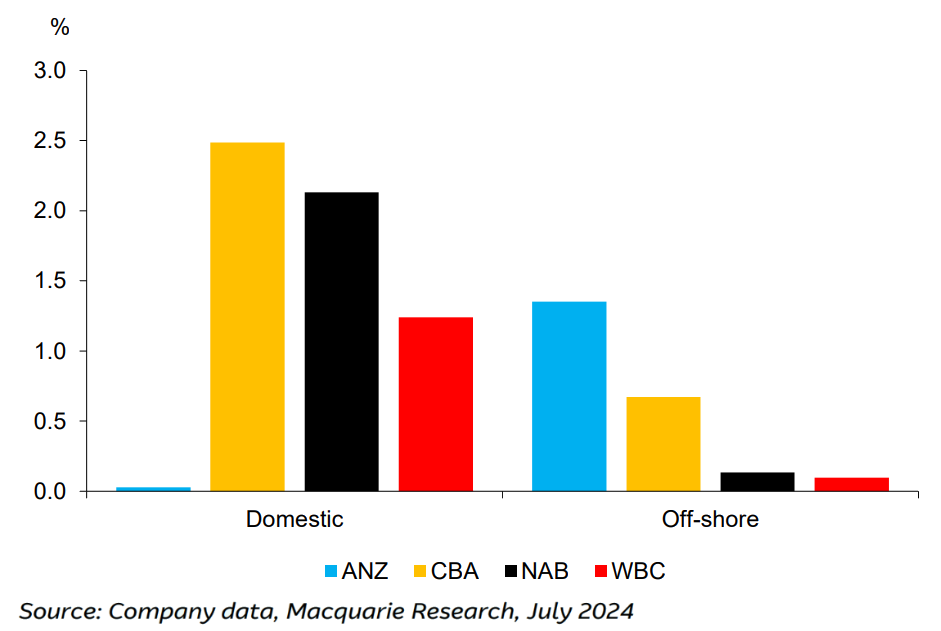

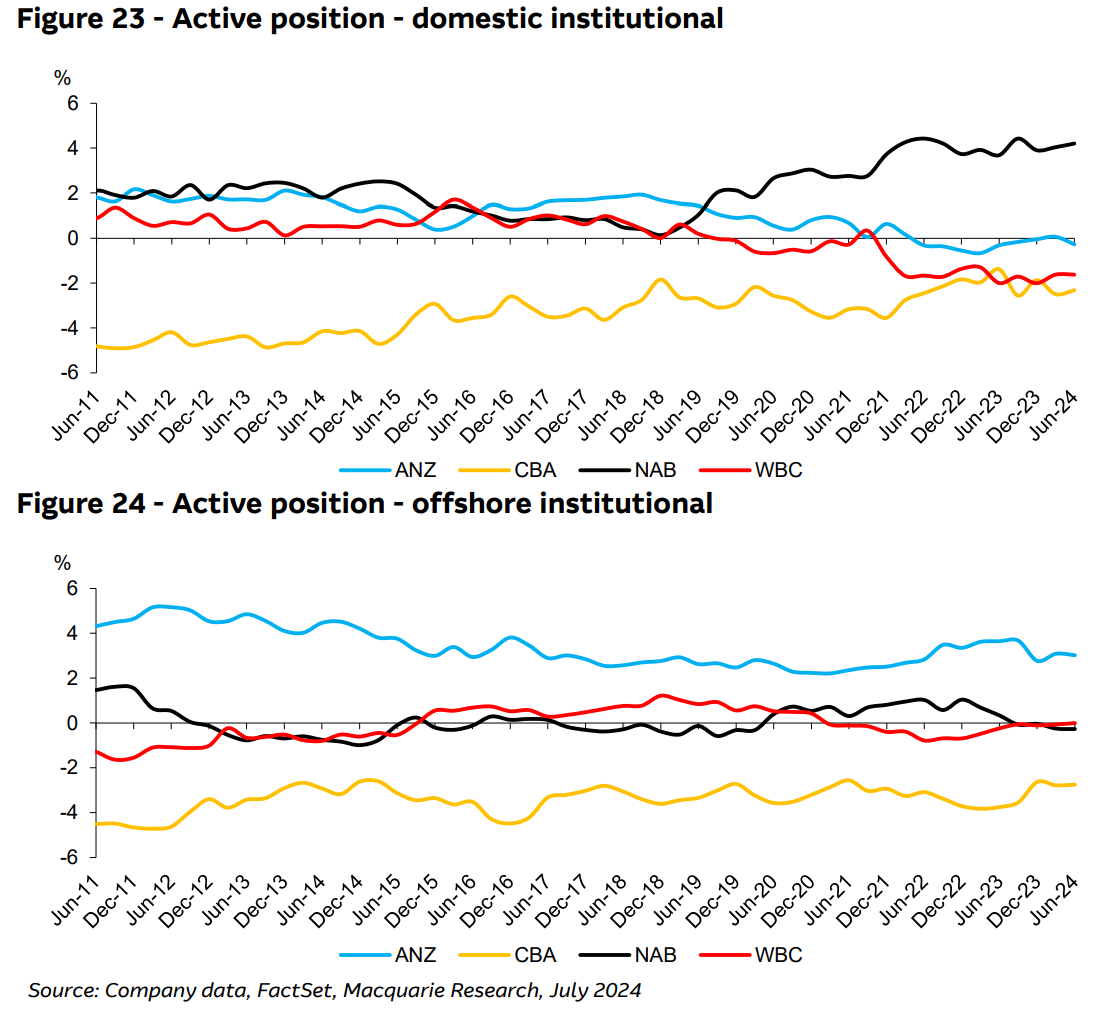

The figures above from Macquarie shows that active positioning in the Big 4 remains negative for ANZ, CBA, and WBC for domestic institutions, and NAB and WBC for offshore institutions. This means active fund managers are underweight these banks relative to the respective weighting for each in the S&P ASX 200. Both groups of institutions are most underweight the best performing bank – CBA.

Looking forward, it is conceivable that those banks with the most underweight positioning could see the greatest catch up buying from active funds if their share prices continue to perform strongly.

Mum and dad investors keep taking profits

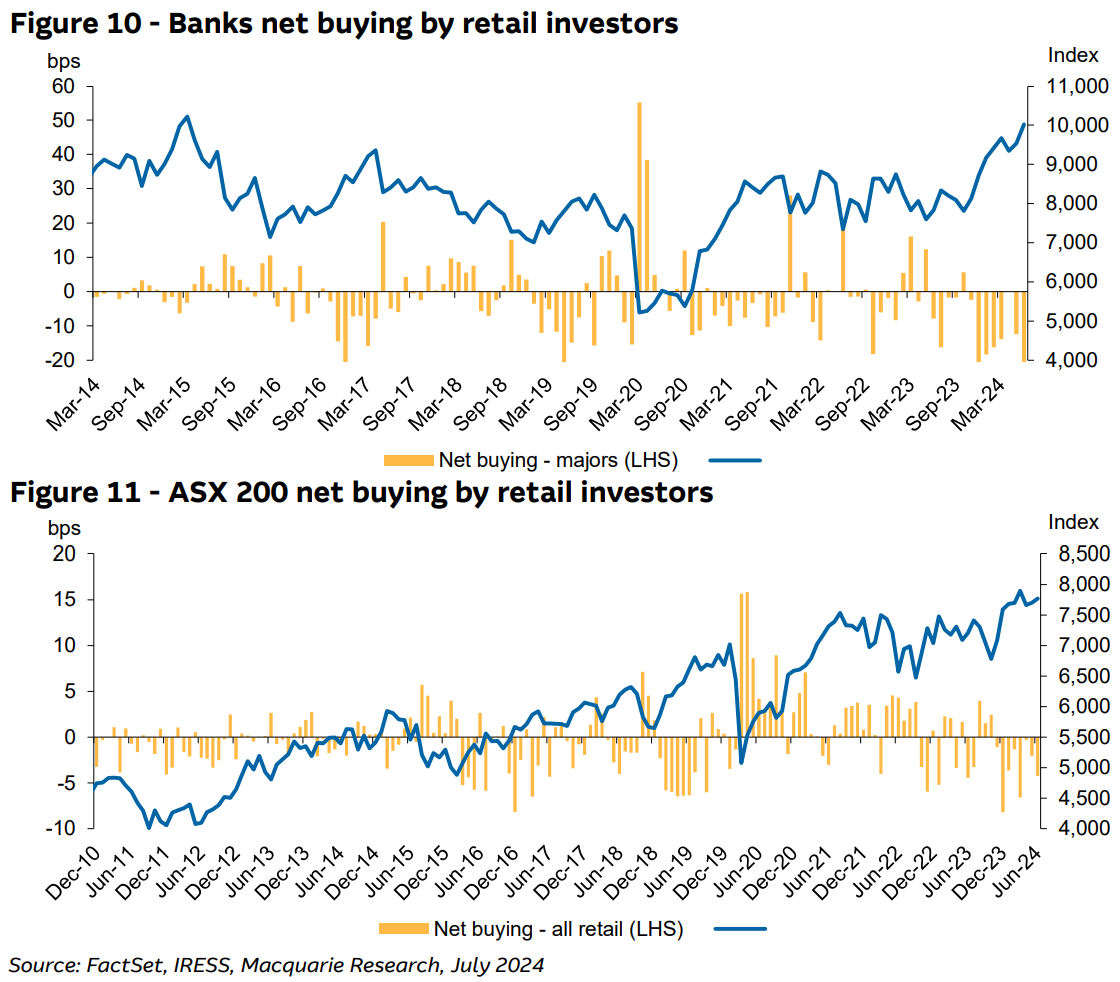

So, who’s selling? For every buyer there must be a seller, right? Yes, and it’s mum and dad investors who are offloading. "Retail investors continued to be net sellers of banks in the June quarter", notes Macquarie.

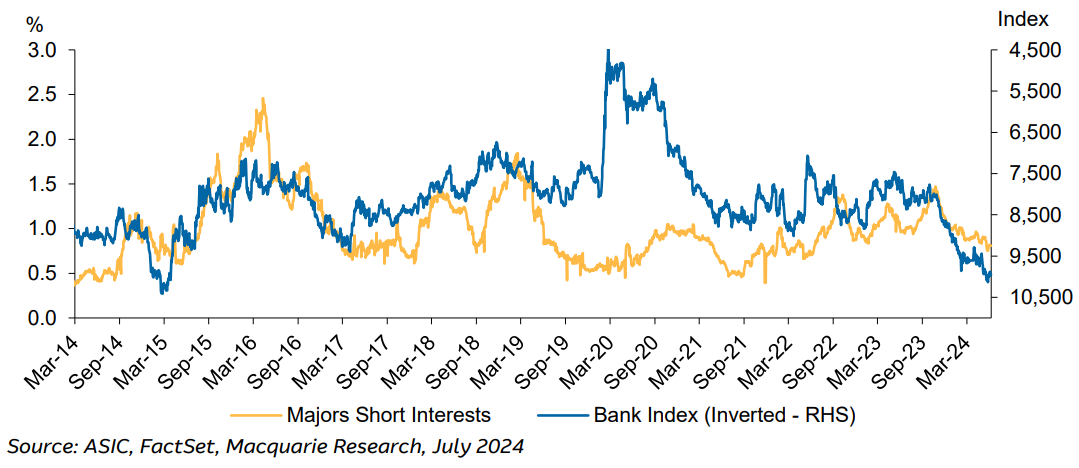

This is quite typical of retail investors. Figure 10 from Macquarie below shows that over the last 10 years (and for much longer I predict), retail investors have tended to buy into weakness in bank share prices and sell into strength. With each of the Big 4 Aussie banks trading at multi year highs, the recent period appears to be the most frenzied period of retail selling in the sample.

Looking at Figure 11, it appears that retail investors don’t tend to do a great deal of buying of anything when prices are rising (the S&P ASX 200 is trading at record highs). This is fine if there’s a big dip coming and they can buy back cheaper, but it also potentially implies retail investors are likely to underperform the market during a period of prolonged gains.

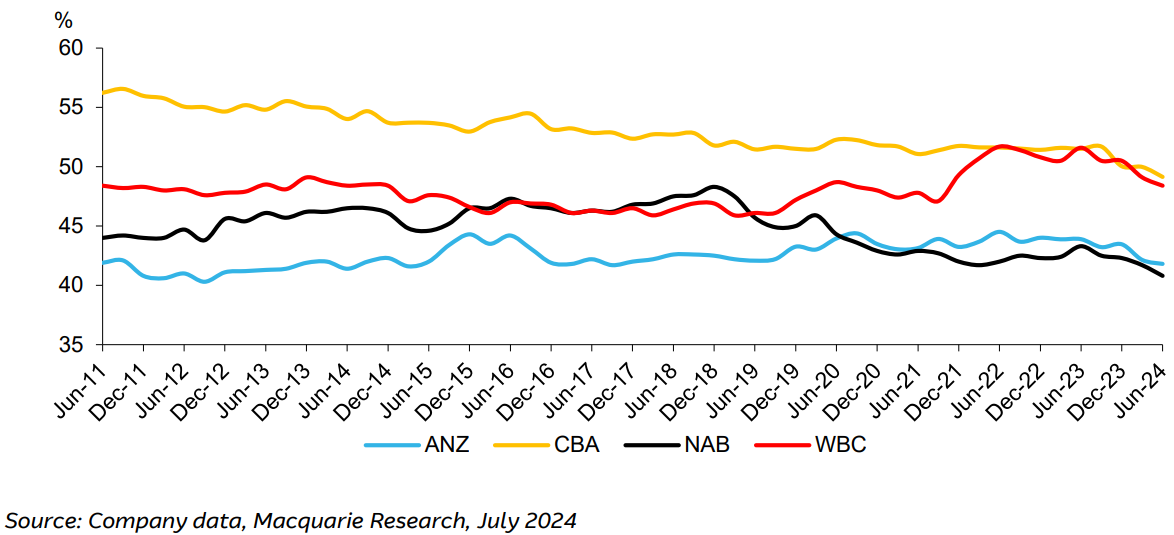

The upshot of all this institutional buying and retail selling is the ratios of these parties across bank ownership is changing. The ratio of retail ownership among Aussie banks, particularly star performer CBA, is steadily decreasing. CBA’s retail ownership just dipped below 50% for the first time since 2011.

Watch those shorts!

We’ve covered retail and institutional selling and buying, but what about those investors wishing to go one step further – and bet against Aussie bank shares? The short sellers!

Short sellers aim to profit from a fall in a company’s share price by borrowing shares from a long term holder, selling them in the market, and by buying them back at a lower price (they then return the shares to the original owner and the price difference less borrowing fees is their profit).

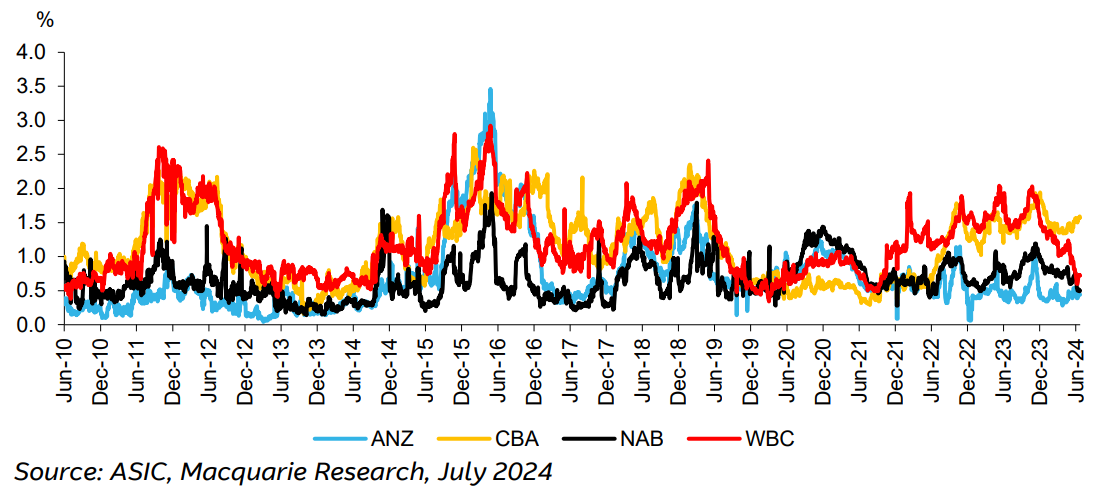

Overall short interest in Aussie banks share is growing, says Macquarie – but to only look at the chart above is deceiving. This is because short interest fell for most banks during the June quarter, but this was more than compensated for by increasingly bearish bets on sector leader CBA.

Which banks have the best broker ratings?

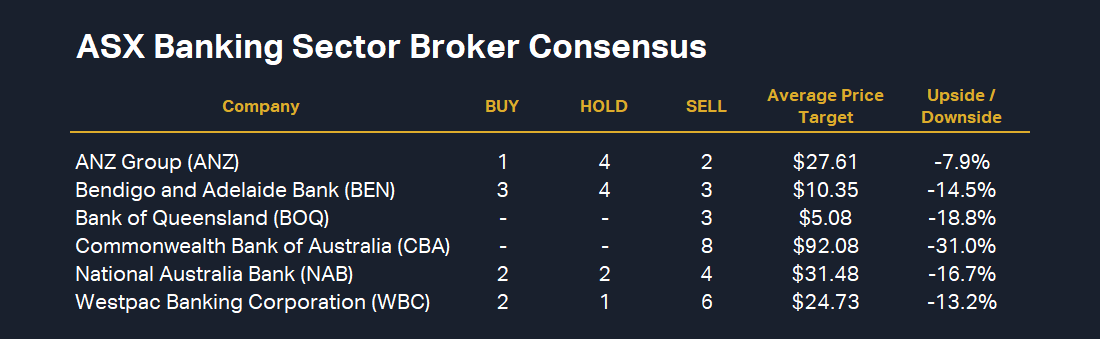

Bank share prices "have run well ahead of earnings", suggests Macquarie in their report. Macquarie is particularly bearish on Aussie bank shares, however. They currently have an "Underperform" rating on all of the majors. But it seems when looking at the table below, Macquarie is not alone in its bearish view of the sector.

The data in the table comes from all broker research reports we have on file since 1 May, so they’re very recent, and the upside / downside is calculated based upon the 17 July close of each stock.

ANZ and BEN have fairly balanced ratings views, but both still show up as overvalued based upon their average price target among the brokers (7.9% and 14.5% respectively).

Brokers are unanimous in their disapproval of BOQ and CBA, with solely sell or equivalent ratings, and these are the two most overvalued banks based upon average price target too (18.8% and 31% respectively).

NAB and WBC have ratings that are skewed to the sell side, more so for WBA, and their shares appear to be substantially overvalued also (16.7% and 13.2% respectively).

Which banks have the best charts?

I suggest it’s conclusive: The big brokers (with their best fundamental analysis) have mostly got it wrong with respect to their calls on Aussie bank shares over the last few months.

Was there another way for investors to tell if bank shares had the potential to outperform over this time? You know I’m saving the best for last here!

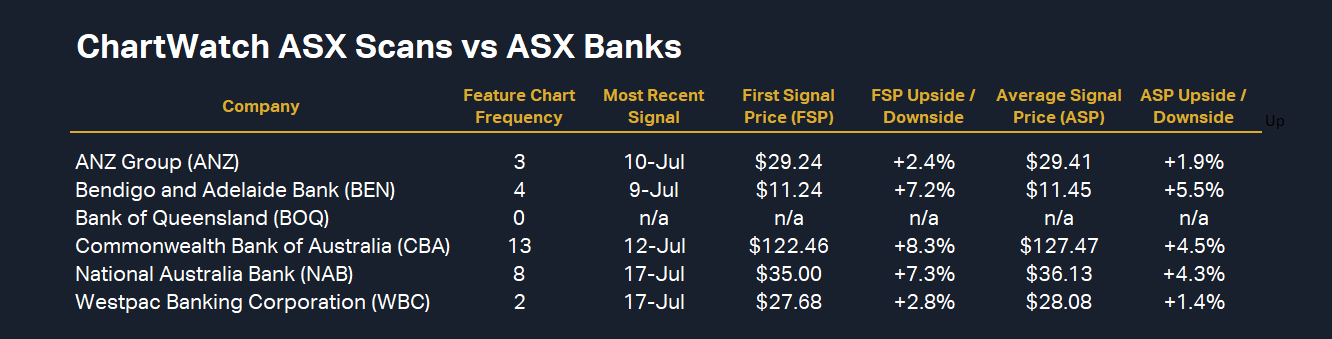

The trends, price action, and candles in Aussie bank share charts, particularly the Big 4 of ANZ, CBA, NAB, and WBC, have been almost exemplary for the better part of a year now. They are a picture of excess demand – everything I look for in a chart. Personally, I would have had nothing but a buy rating on all four over the same time as the brokers were calling them sells.

%20chart%2018%20July%202024.png)

"Good for you Carl", I bet you're muttering right now…"That’s the past, what about the future, smarty pants?"

As I say every time I’m asked about the future direction of stock prices: Where they go from here is anyone’s guess. What I can say with confidence is that the technicals I monitor are as good today as they’ve been any time over the last 12 months for each of the Big 4.

Unfortunately, I can’t tell the future – we could be at the top right now and I’d never know it. But trend followers don’t fear buying at the top, we just trust the trend and accept we’ll get it wrong from time to time.

You can keep tabs on my technical views on the banks and other ASX stocks by reading my daily ChartWatch ASX Scans articles. I’ve been publishing these since 23 May, and Aussie bank shares have made frequent appearances in my Favourite Uptrends List. The table below shows each time I’ve run an Aussie bank share as a Feature Chart (highest conviction).

This article first appeared on Market Index on Thursday 18 July 2024.

5 topics

6 stocks mentioned