Why 2025 could be the year to rethink your portfolio

Following two solid years for shares markets, investors could be in for a bumpy ride in the year ahead. The complexities of a second Trump administration and changes to global trade relationships are all set to impact the investor agenda for 2025.

If inflation reemerges under a Trump presidency, we may not see interest rate cuts from the US Federal Reserve, which could set back share markets. The risk of recession too still lingers in Australia if the central bank decides to leave interest rates higher for longer.

In addition, earnings growth for many Australian companies, especially the big banks, is showing weakness. Market consensus expects earnings growth in 2025 for ASX 200 listed companies to be moderate and among the investment banks, Morgan Stanley has joined UBS in predicting the benchmark will hit 8500 points in 2025 as its base case. JPMorgan is less optimistic, recently predicting that the ASX 200 will fall to 7900 points by the end of 2025, claiming that Australian shares look expensive, and the earnings growth implied by current high valuations may not be achieved.

As a result, investors may need to consider rebalancing portfolios with a greater allocation to defensive assets to protect their portfolios.

Private lending is gaining traction among Australian investors as an attractive income investment strategy. Any slowing in share market gains in 2025 could accelerate the flow of investment funds into this defensive asset class.

Firstly, what is Private Credit?

Most people associate loans with banks. Investors deposit funds with the bank who then lend these deposits (at a margin) to borrowers. In these circumstances the bank assumes the credit risk.

Private lending is not a foreign or new concept. In fact, it is the earlier form of financial intermediation where someone that has money lends it to someone that needs it. Over time this process has become more sophisticated.

Private credit consists of privately originated corporate loans. Unlike corporate bonds, these loans are not traded on the public markets.

Real estate private credit behaves similar to mortgage back securities. They provide a predicable income stream secured against residential, commercial, retail and industrial real estate with geographic diversity. Security is further enhanced with guarantees provided by individuals and companies.

The private credit asset class has experienced exponential growth. With banks constrained by regulatory and capital adequacy requirements, small to medium size enterprises (SME’s) have turned to non-bank private credit providers to procure funding.

For investors, private credit's appeal as a defensive asset stems from its ability to deliver attractive income stream while being less susceptible to shares market swings. Private credit assets have also historically demonstrated lower volatility of returns compared to shares and bonds and are therefore considered defensive.

According to the IMF, which has researched the global private credit sector extensively, it has grown rapidly since the global financial crisis (GFC), taking market share from bank lending and bond markets following an extended period of low interest rates, which drove a huge expansion of alternative investment strategies.

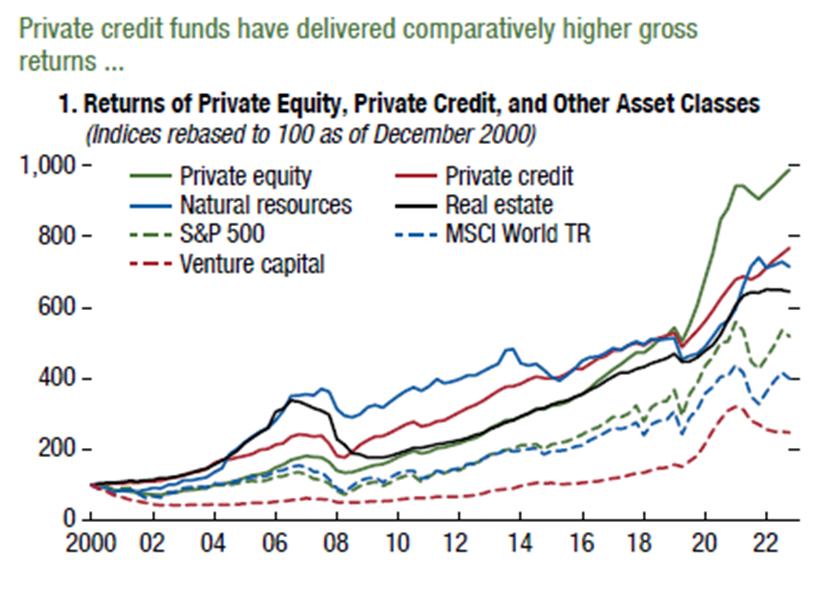

“In this context, private credit has appeared attractive, with some of the highest historical returns across debt markets and appears to be relatively low volatility,” the IMF said in a 2024 report, The Rise and Risks of Private Credit in its Global Financial Stability Report.

The chart below, sourced from the IMF, details private credit’s low volatility compared to share markets and real estate. The IMF has noted that the sharp growth of private credit asset allocations, with the asset class having delivered “high returns with what appears to be relatively low volatility.”

Source: Sources: Bank of America Global Research; Bloomberg Finance L.P.; PitchBook LCD; Preqin; S&P Capital IQ; and IMF staff calculations.In panel 1, the private capital indices are rebased to 100 as of December 31, 2000, and are available until June 2023.

Diversification enhancement

Australia’s largest retirement funds are increasingly allocating funds to private credit to diversify their portfolios and pursue higher returns, while providing protection against share market volatility. This trend is most evident in the growing private credit holdings of major Australian superannuation funds such as AustralianSuper, Australian Retirement Trust (ART), Cbus, and Hostplus.

In addition, private credit transactions often include strong downside protection through security and covenants, with most deals being secured to assets such as cash flows, hard assets, or property.

Typically structured with floating interest rates, private credit also allows investors to capitalise on rising interest rate environments. As interest rates have climbed in recent years, private lending returns have reached as high as 8% to 12%, outperforming the returns delivered by many other fixed income products, including corporate bonds. Floating rates also provide protection against higher interest rates and act as an inflationary hedge.

Importantly, private credit enhances portfolio diversification for investors due to its low correlation with other asset classes such as the share and property markets. By including private credit, investors can potentially mitigate their overall portfolio risk if share markets fall in the year ahead.

While private credit offers potential benefits, a thorough understanding of its mechanics and potential downsides is crucial before investing. Investors need to note there are risks to consider. Private credit's illiquidity, for example, poses a challenge for investors who might need quick access to their funds.

For this reason, investors need to conduct due diligence and scope a specialist investment manager that can deliver attractive risk-adjusted returns from private credit, over time.

5 topics