Why a fall in net profit is not the full story for Cochlear

Cochlear Limited (ASX: COH) announced a 16% fall in net profit today while also flagging increased operating expenses. The result seems a bad one, at first glance. Is the dominant player in hearing implants losing its edge? But Andrew Hamilton, head of implementation for equities at Antares Capital says there is good reason for the fall – and markets might be missing the bigger opportunities ahead.

“The key reason profit was impacted was really investing for growth. They invested a lot in sales and marketing to prepare for the launch of the new processor, the nucleus eight. As always, they invested a lot in research and development,” he says.

In fact, he argues the results were strong. Sales were up and revenues from emerging markets saw around 20% growth. He also points to two major scientific studies which, if the results go in Cochlear’s favour, could result in a significant step up in growth.

“Cochlear have just demonstrated they are a genuine growth company in an environment where it’s harder to find companies that can genuinely grow, due to inflation, consumer sentiment or tightened household disposable incomes,” Hamilton says.

Read on to learn about Cochlear’s latest earnings report, the risks that could be on the horizon, and the big story Hamilton believes the market is missing.

Note: The interview took place Wednesday 15 February 2023. This stock is a holding in Antares' portfolios.

COH H1 Key results

- Statutory net profit down 16% to 141.6m

- Sales revenue up 9% to $892.6m

- Operating expenses up 17% to $471.5m

- Underlying EBIT down 15% to $185.7m

- Dividends per share - $1.55

- Payout ratio 72%

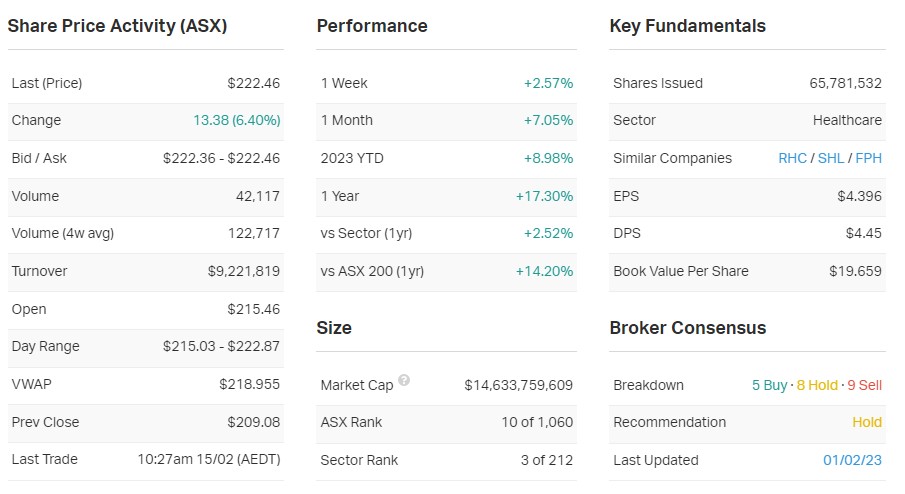

Company snapshot

In one sentence, what was the key takeaway from this result?

There are a few. The key for me is the strong growth in cochlear implant unit numbers with the launch of the new processor, the Nucleus 8. It has been launched in the US, Australia and Western Europe. The number of cochlear implant units actually grew 14% versus the same period last year which is a really good top-line growth number.

The other thing is that emerging markets grew 20%. Part of that is they’re now through the surgical backlog post-covid. By contrast, developing markets grew more than 10%.

What was the market’s reaction to this result? In your view, was this an overreaction, an underreaction or appropriate?

Appropriate.

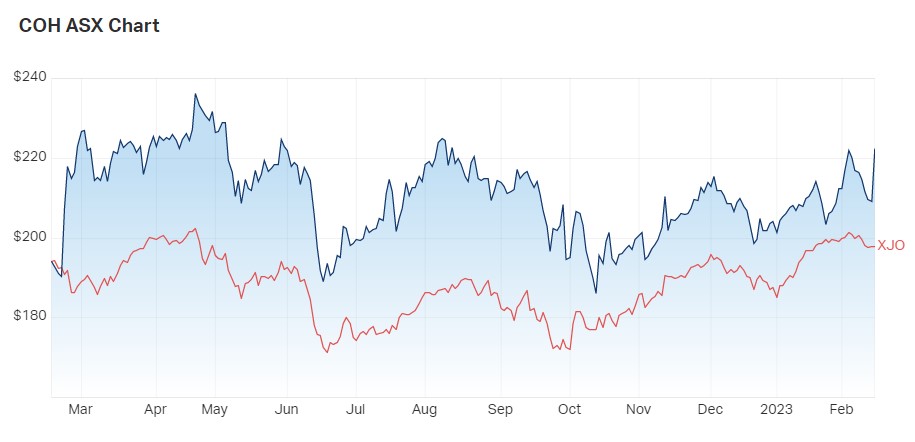

The stock is up 6.5% as we speak. It was a very strong result across the board. At a headline level, the actual net profit report is lower than this period last year, but there are a few reasons for that. It’s been about growth and growing the number of cochlear implants and their installed base. In most developed markets, once you’ve had a cochlear implant or a particular processor for five years, you can upgrade that processor to the latest technology. So, the more implants they put in, the more the installed base grows. That 14% growth in the number of installed cochlear implants is very important to them.

The key reason profit was impacted was really investing for growth. They invested a lot in sales and marketing to prepare for the launch of the new processor, the Nucleus 8. As always, they invested a lot in research and development. They look like they’re really well set up for a strong second half, which will give them a strong full-year result.

Were there any major surprises in this result you think investors should be aware of?

That’s not cochlear implants per se, it’s other products like Cochlear Osia 2 System or Baha 6 Max Sound Processor. Baha stands for bone anchor hearing aid. The Osia product is going well and looks like it’ll grow strongly for several years.

The other aspect was the announcement of an on-market buyback of $75 million over the next 12 months. They’re targeting reducing their net cash to around $200 million. Currently, they’ve got over $500 million. If they get regulatory approval to buy Ocon Healthcare, for which they announced plans six months ago, that will also reduce the cash pile.

The balance sheet is really strong.

Cochlear has just demonstrated they are a genuine growth company in an environment where it’s harder to find companies that can genuinely grow, due to inflation, consumer sentiment or tightened household disposable incomes.

Would you buy, hold or sell Cochlear on the back of these results?

Rating: Hold

We already own it so I’ll definitely hold it. We won’t be selling.

What is your outlook on Cochlear and its sector over the calendar year?

I’m very positive on Cochlear and I think there are some things that the market has missed.

There are various studies in progress that will hopefully demonstrate the superiority of cochlear implants. It’s not just in terms of hearing loss. There’s a scientific fact that if you have hearing loss, you are more likely to experience cognitive decline or even dementia.

The Journal of the American Medical Association’s (JAMA) Neurology publication released a meta-analysis that went at looked across high-quality phase-three studies of people with hearing loss who were treated with cochlear implants or hearing aids. It found that if you intervene and manage to restore some hearing, people were 19% less likely to experience cognitive decline.

The market isn’t focused on this at all and only thinks of the hearing loss aspect.

There are also scientific studies looking at the link between cognitive decline and hearing loss – it’s a scientific fact you are more likely to suffer cognitive decline or dementia if you have hearing loss.

Studies on this continue to roll out. Professor Frank Lin from John Hopkins Institute has been running a study for a few years to test for causal links between hearing loss with cognitive decline and dementia. If there was a finding of cause, it would transform the hearing loss space and the imperative for people to treat hearing loss.

Cochlear has also initiated a study at the University of Nottingham which will be published next year. That is for people who are significantly hearing impaired and comparing the use of cochlear implants with high-powered hearing aids.

If this demonstrates a better outcome with cochlear implants, combined with the potential of Professor Frank Lin’s study, Cochlear will see a step change in growth.

Are there any risks to this company and its sector that investors should be aware of, given the current market environment?

The biggest risk to Cochlear is that it’s a growth company and trades on a high multiple of one-year forward earnings. To justify the share price, it needs to grow reasonably well over the next 10-20 years. The basic ratios like the PE ratio are amongst the highest in the market because it is a growth company. Historically when Cochlear has had a blip in growth, they’ve been able to restore it.

Technical risk is one of Cochlear’s biggest concerns. They have the best record in the industry as far as the safety and reliability of their products. But that’s always a risk.

From 1 to 5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you cautious or excited about the market in general?

Rating: 2

I wouldn’t say the market is super-cheap. It’s about two, on the cheap side of neutral. The reason I say that is based on our bottom-up valuations. I can find a bit of upside in the market when we aggregate all our bottom-up valuations and target prices.

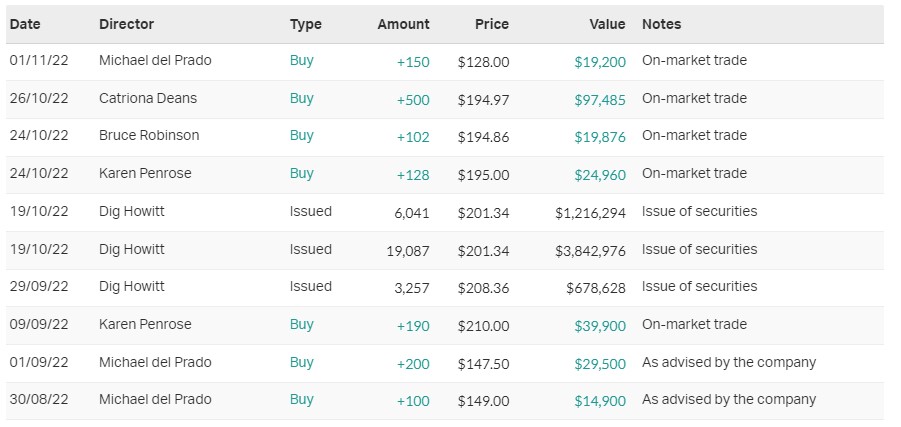

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

2 topics

1 stock mentioned

1 contributor mentioned