Why Australian investors should diversify beyond property

Many Australian investors are heavily invested in the property market, and would benefit from diversifying their portfolios into higher yielding fixed income assets such as private debt to reap a superior return on their money without elevating their risk position.

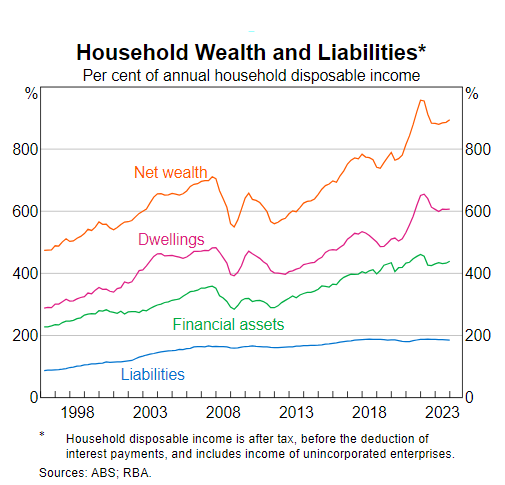

Reflecting Australians’ love affair with property, data from the Australian Bureau of Statistics (ABS) reveals that household net wealth sat at an all-time high of $16.2 trillion in the March 2024 quarter, boosted by record property assets worth $11.0 trillion. Residential property accounted for around 67.9% of Australian household wealth, up from 61.7% in December 2020.

Households also held $1.46 trillion directly in equities, $1.73 trillion in cash and deposits, and $3.88 trillion in superannuation. However, the key driver of household wealth gains in recent years has been concentrated gains in property, as the chart below reveals.

Looking at self-managed superannuation funds (SMSFs), they too are heavily exposed to property assets.

Australian Taxation Office data reveals that they had almost $150 billion invested in Australian property investments alone, with residential and non-residential property investments totalling a record $141.8 billion in the March 2024 quarter, up from $133.5 billion in the December quarter. That represented 15% of total SMSF net assets.

SMSFs had also invested a near record of $145.1 billion in cash and deposits, or around 15% of total assets. Another $287.1 billion was invested in Australian and overseas shares, or around 31% of total assets. SMSFs invested just $9.5 billion directly in debt securities and $6.5 billion in loans, so there is clearly room for a greater allocation to fixed-income assets and it is time for SMSF to consider diversifying their portfolios more efficiently.

Investors need to consider greater diversification

Retail investors and SMSFs would arguably benefit greatly from investing more in private credit assets, which can deliver more attractive yields at similarly low volatility. Importantly too, private credit loans are typically floating, so investors would benefit from further rate rises.

Unlike yields on residential property, which generally fall below 5%, the yields on private credit investments can be around 10% p.a. and like property, there is generally lower risk of capital loss.

In contrast, with the official cash rate having increased 4.25 percentage points since early 2022, residential property prices could consolidate from their current levels, as the Australian economy slows and higher interest rates feed through the economy. For investors keen to preserve their capital, this raises the importance of diversifying into assets outside of property and cash into higher yielding assets.

In contrast to property, investing in private credit does not require a large capital investment or deposit. Nor does private credit investment attract a stamp duty tax like buying a property. You can invest much smaller amounts of money in private credit funds and there are no holding costs such as land tax, council rates, insurance, maintenance as is the case with direct property investment.

Reaping consistent income

An allocation to private credit can potentially enhance risk adjusted returns and provide investors with a consistent income stream. That is why it is so important for retail investors including retirees to better understand the resilient returns offered by private credit. The key for investors is to conduct due diligence and scope a specialist investment manager that can deliver attractive risk-adjusted returns from private credit, over time.

Also very important for investors to consider, private credit returns are not closely correlated with either bond or share markets, so the asset class offers a powerful source of portfolio diversification and stability, while delivering a much higher income than property, without extra risk.

5 topics