Why capital preservation (and not growth) should be your top investing goal for 2024

Markets entered 2024 priced for perfection. The US Federal Reserve’s commentary helped stoke expectations for slowing inflation, steady growth, and surgical rate cuts throughout the year. US Treasury yields plunged. That boosted US equities. And the US Dollar quickly became out of favour.

The consensus has turned to generating further outsized returns, even after a very strong 2023. We think investors should instead worry about preserving capital through 2024. In this wire, we suggest four actions that could help achieve that goal this year.

The market priced itself for perfection

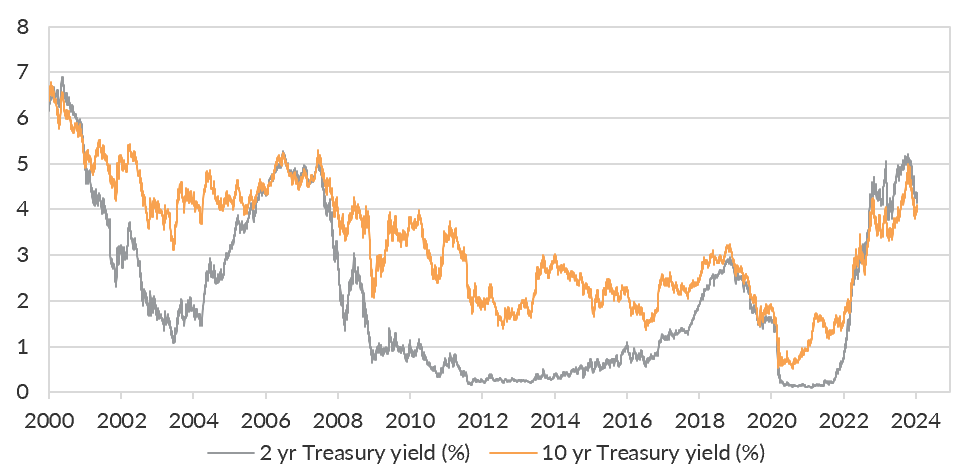

In early 2024, US and Australian equity markets got within striking distance of all-time highs. The surge from lows in late October was matched by a collapse in US Treasury yields. Both the US 2-year Treasury yield and the 10-year Treasury yield fell more than one full percentage point since late October.

Chart 1: US Treasury yields collapsed in late 2023

Source: Bloomberg LP, Oreana.

The catalyst was a growing consensus that the Fed would achieve a soft landing through surgical rate cuts beginning as soon as March. The narrative was that slowing inflation would allow the Fed to cut nominal rates but leave the real yield at restrictive levels. Market pricing moved to price a total of seven rate cuts through 2024 – which investors increasingly believed would allow a soft landing in the US.

The Fed has pushed back on market pricing

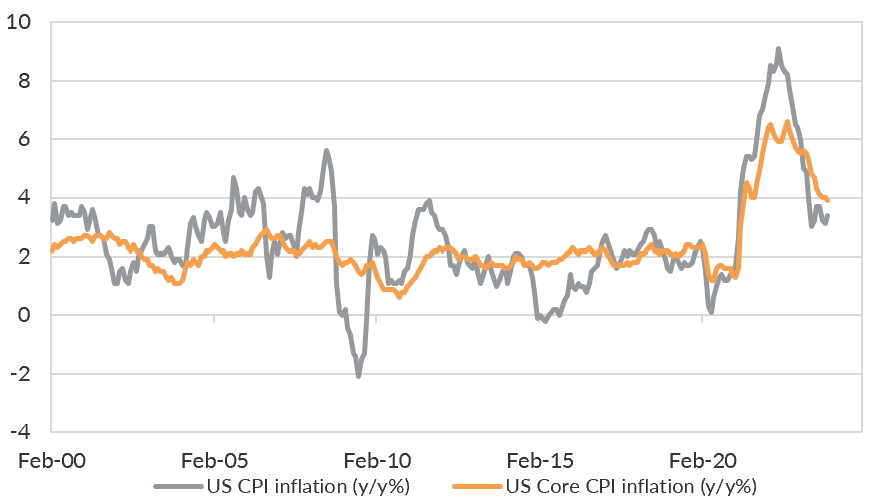

In recent days, the Fed poured cold water on market hopes for cuts to begin in March. CPI inflation was stronger than anticipated. Retail sales remained resilient. The labour market added more jobs than expected. Fed speakers have reiterated their view that rate cuts will come later and be fewer than currently priced in the market.

Chart 2: US inflation is still too high to justify a March rate cut

Source: Bloomberg LP, Oreana.

We now have a genuine disagreement between the Fed and the market. The Fed believes it can achieve a soft landing with only three rate cuts this year. The market believes a soft landing will require six or more rate cuts. To the extent the Fed can impose its view on markets, we may see some challenging periods in markets to start off this year.

Rate cuts remain likely, but not a soft landing

In a previous wire, I explained why I think a soft landing is relatively unlikely. In November, I wrote that the Fed could end up cutting as many as 8 to 12 times through 2024. The economic data were deteriorating, inflation was slowing, and a recession could begin as soon as March 2024. I reiterated our view that US Treasury yields would collapse as markets moved to price that in.

And yields have collapsed. But equities rallied. That has increased the vulnerability of equities to any repricing in rate expectations.

Recent volatility could continue

If the Fed manages to convince markets that it will not hike at the March meeting, there are three important implications for asset markets.

1) Treasury yields may move higher in the near term: The unwinding of rate cut expectations has already pushed Treasury yields higher from recent lows. We think there is scope for further unwinding, with 10-year yields potentially climbing back to 4.50%.

2) Equity prices may need to move lower to reflect worsening fundamentals and higher rates: Slow earnings growth is at risk of slowing further if margins are not expanded this year. A move higher in Treasury yields could catalyse a focus on weaker fundamentals, resulting in a sudden shift lower in US equity valuations.

3) The US dollar may strengthen as Treasury yields increase: A stronger US dollar means AUD weakness – and that could be exacerbated by any increase in risk aversion.

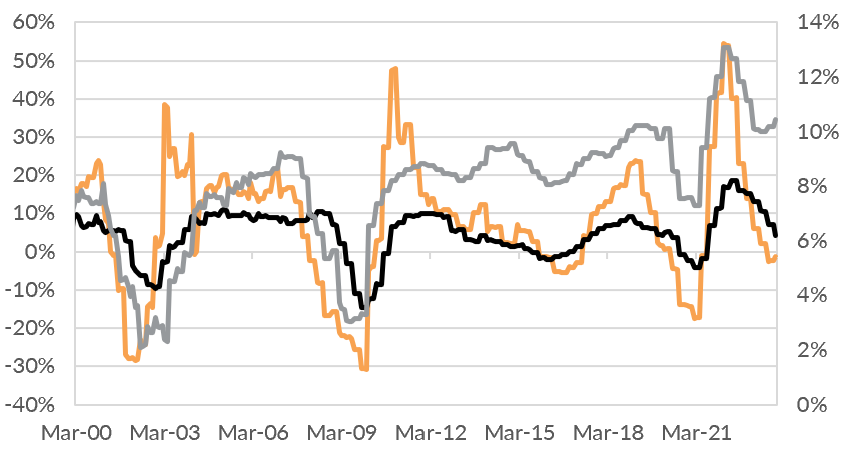

Chart 3: Margin expansion has helped offset weaker sales growth for US equities

Source: Bloomberg LP, Oreana.

What can investors do?

2023 delivered healthy returns for diversified multi-asset portfolios. After a good year in 2023, investors’ expectations for a soft landing have left a clear focus on finding assets with reasonable growth in 2024. I think the focus needs to be on preserving capital. Here are four actions to consider as we kick off 2024.

1) Consider adding government bonds as yields back up. Shorter-dated government bond yields will provide a buffer against downside economic and market risk. If yields move higher, there is an opportunity to add exposure to longer-dated government bonds and enjoy potential capital gains when the Fed is forced to cut.

2) Consider reducing equity exposure as valuations remain elevated. The surge in equity prices supported strong returns in 2023. Now is a time to lock in some gains at valuations that look stretched. With US and Australian prices near all-time highs, risk is skewed to the downside.

3) Review your hedge ratio for international equities. Australian investors holding international stocks should consider their hedge ratio. The AUD looks subject to further downside, and that is not reflected in futures pricing. Currency could play an important role in returns through 2024, so it is important to be comfortable with the exposure in your portfolio.

4) Prepare to be nimble if markets move aggressively. We think equities look overvalued. But a material move lower would provide opportunities to add risk at better valuations. Having a clear process for adding exposure even as prices decline is an important part of adding value over your investment horizon.

5 topics