Why cashflow will be critical for small caps this reporting season

One of the features of the FY20 reporting season was the excellent cashflow performance of most Australian small cap companies. With the onset of COVID-19, many companies faced a liquidity crunch as revenue dried up and relief on cost saving measures, government programs including JobKeeper and rent relief took a while to kick in. This led to a flurry of capital raisings as the market recovered from April, but has also led to an increased focus on cash collections to shore up company balance sheets. In an environment where CFOs are facing potential liquidity issues, an emphasis on collecting the bills quickly rose to be their top priority!

The following quote by the Bingo Industries’ CFO on their FY20 results call sums up the response very well:

“March kicked in and the team that were already focusing on debt collections went into overdrive. Probably the cash culture and the business has improved even more so than what was sitting there. Combination of working capital management and really strong debt collections have helped drive that. And we're now in a cycle where we meet weekly with each of the business leaders and their teams on debt collection and the monthly cash conversion targets.”1

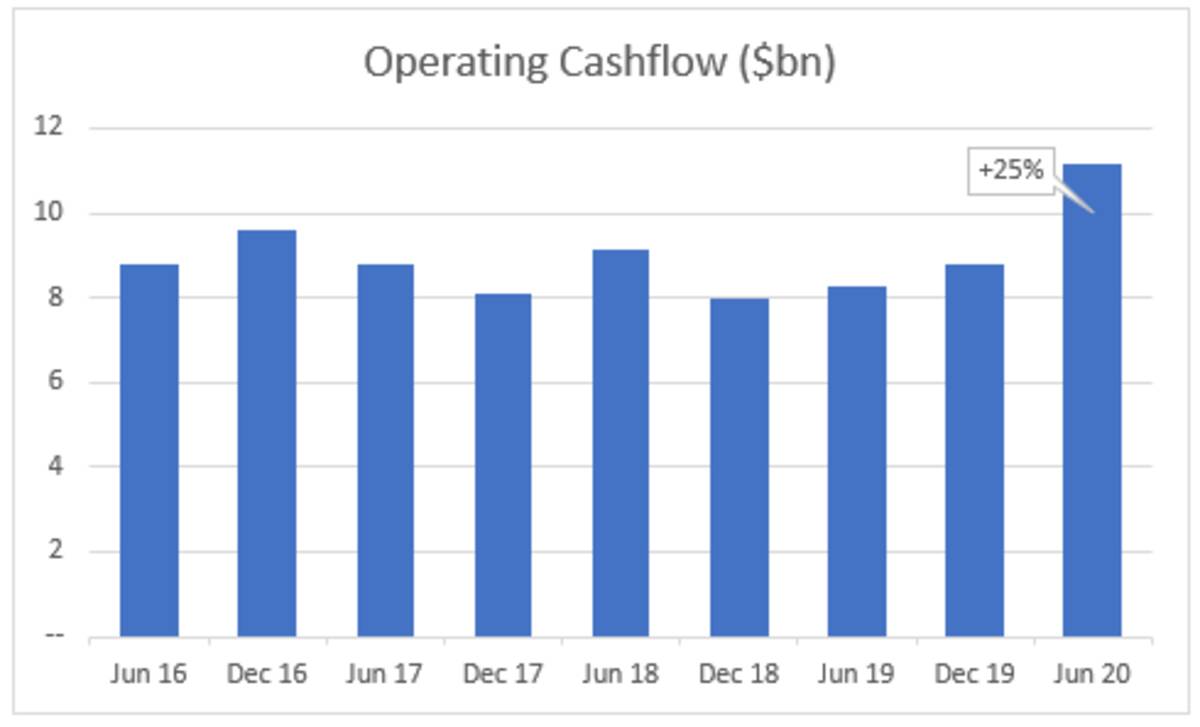

The company was certainly not alone in reporting improved cash conversion for the June half, with many other company presentations having similar comments. This effect is readily apparent when analysing the data for the Australian small cap index as a whole – in aggregate, operating cashflow for Australian small cap companies was up 25% sequentially for the June 2020 half, and well above the average over the past five years.

Past performance is not a reliable indicator of future performance. Source: AMP Capital, Factset. Data is adjusted for operating lease payments under AASB16. Data as at December 17, 2020.

Companies also held back on spending plans, deferring capital expenditure and growth projects in an uncertain time, with capex falling 23% half on half.

.jpg)

Past performance is not a reliable indicator of future performance. Source: AMP Capital, Factset. Data as at December 17 2020.

This has led to strong free cashflow generation, rising well above historic levels and providing companies with plenty of firepower for both organic and inorganic growth as they get more confident in the economic outlook.

.jpg)

Past performance is not a reliable indicator of future performance. Source: AMP Capital, Factset. Data as at December 17 2020.

Diving a bit deeper into what has been driving this strength, we find that the majority of this working capital release has come from a lower accounts receivables number, which confirms the thesis that companies have focused on collecting cash from debtors.

Interestingly, the drop in accounts payable is nowhere near as large. For many companies a large proportion of their accounts payable will relate to wages – an amount which probably dropped during the period as some employees were stood down or made redundant. Therefore it is highly likely that these companies were paying their creditors no faster, or even slightly slower than pre-COVID periods.

.jpg)

Past performance is not a reliable indicator of future performance. Source: AMP Capital, Factset. Data as at December 17 2020.

Inventory is an interesting one – it is likely that some companies have been left holding higher levels of inventory as sales dried up, while some COVID-19 beneficiaries such as retailers saw a surge in sales and have struggled with restocking inventory in a short period of time, as called out by Super Retail Group in their results call:

“The actions we undertook in April – March and April … to preserve liquidity position of the business is compounded by the very strong bounce back in sales once restrictions eased, has impacted our in-stock position.”2

It’s important to note that not all companies benefited from strong cashflows during this period – in fact many that were significantly impacted by COVID-19 experienced significant cash outflows and in some cases had major liquidity issues. Webjet (travel) and IDP Education (international students) are two examples of this – both companies experienced a significant revenue drop due to COVID-19 and the working capital outflow was swift, leading to a requirement for a capital raising to restore liquidity3.

In aggregate however, most Australian small cap companies have emerged from COVID-19 with strong cashflows and the question now turns to how long it can last. The factors that have driven the working capital release, namely better receivables collections and lower inventory, are highly unlikely to be sustainable and may reverse at some point over the next few halves. We believe it is worth keeping an eye on cashflow and working capital items at the upcoming results season to see whether this is starting or delayed to future periods. In our opinion, investors should also be mindful of analysing balance sheet and gearing metrics using figures that have been temporarily boosted by a working capital release – there will undoubtedly be companies needing additional debt and/or equity to fund reinvestment in working capital as conditions return to normal.

1Source: Factset, 26/8/20

2Source: Factset, 25/8/20

3Source: ASX

4 topics

4 stocks mentioned