Why China's reopening means the equity rally can continue

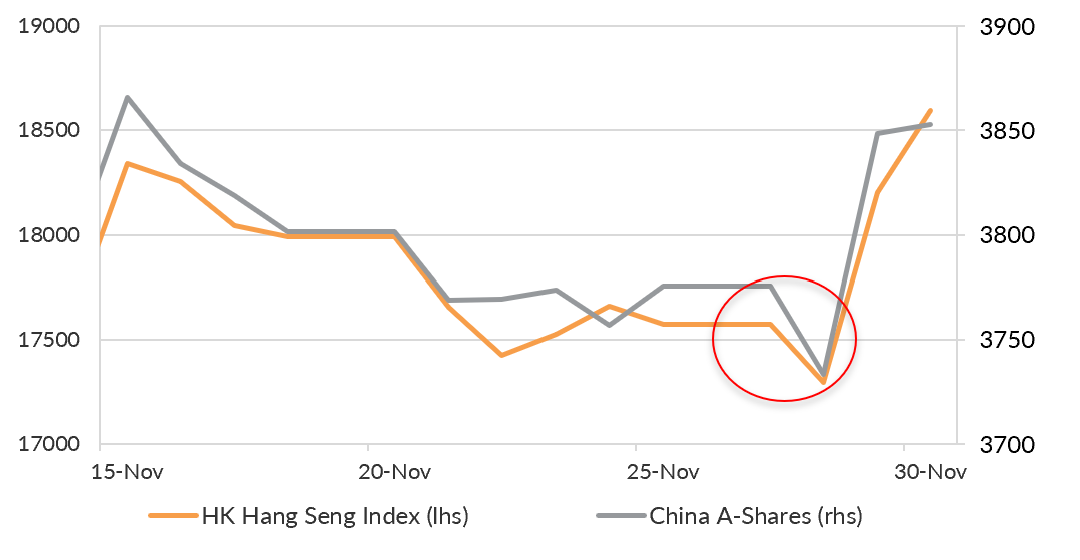

China’s recent protests against the strict zero-COVID policies were a major focus for international news media. But China’s A-share market closed 1.1% lower and the Hong Kong Hang Seng Index was just 1.6% lower. It's barely a wiggle in the grand scheme of China’s typically volatile share markets.

In this wire, I look at the economics, the monetary and fiscal policy response, and the evolving zero-COVID policy to explain how to think of China for the coming year.

We do not expect protests to derail the reopening that has been underway for several months. And that means China could be an important driver of returns in a diversified portfolio in 2023.

Chart 1: China’s markets had only a limited reaction to weekend protests

China is currently in a recession

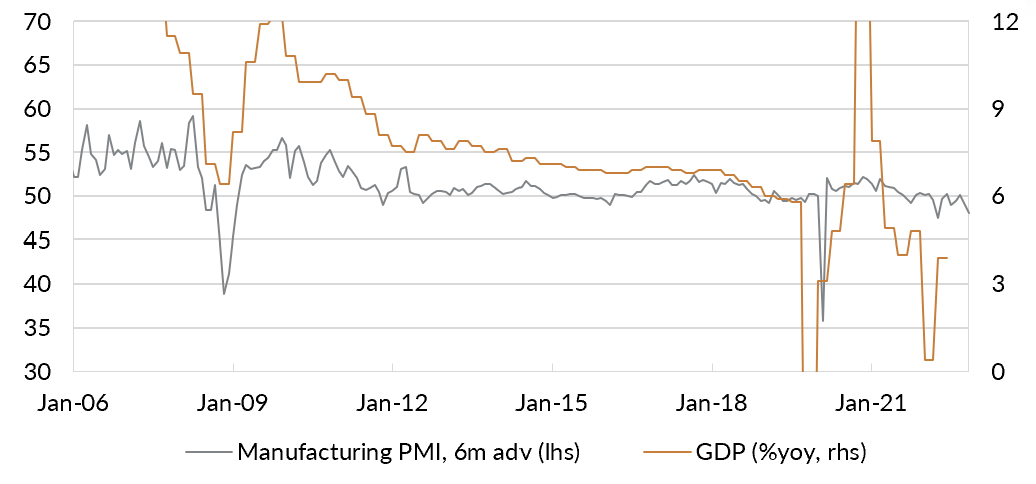

China’s growth has slowed to be well below the 5.5% target. Recent PMI data confirm manufacturing and services sectors' growth has slowed dramatically. Household demand has been curtailed by widespread lockdowns.

The zero-COVID policy has done considerable damage to China’s economy through 2022. This is not a recession in the sense of two negative quarters of growth. This is a China-flavoured recession and we think it is closer to its ending than its beginning.

Chart 2: PMI data suggest China’s economy has been in recession for some time

Monetary policy has become more supportive

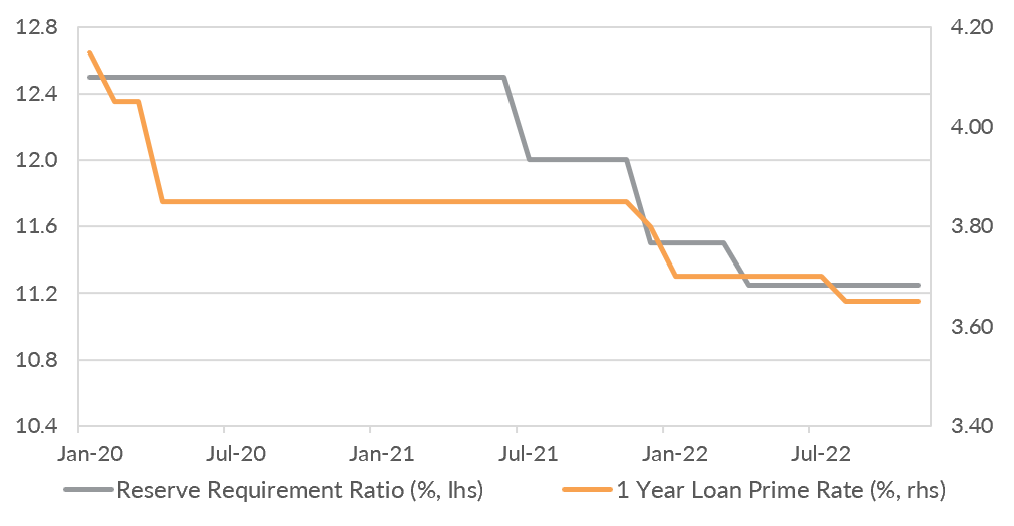

China’s authorities entered 2022 with policy headroom to support the recovery from the recession. Loan Prime Rate cuts provided some support through to Q3 2022.

Since then, a second Reserve Requirement Ratio cut has been announced, further freeing up liquidity to support recovery. It shows the central bank is responding to the recession. Further easing could be cautiously implemented given the focus on credit and fiscal support, alongside the boost to the economic outlook as China reopens.

Chart 3: RRR cuts and Loan Prime Rate cuts have been supportive for the economic recovery.

Fiscal policy has become supportive

In early November China issued a 16-point plan to support the property sector. The plan was wide-ranging, and included credit support for housing developers, financial support for homebuyers, and assistance for construction companies. The goal of the plan is to promote stable and healthy development of the industry - shorthand for preventing the crisis from worsening. The announcements have been followed by concrete action from China’s financial sector and property sector that marks a line in the sand in China’s approach to the crisis. It is important to note that the support is unlikely to drive a property-led boom. But it provides tailwinds for a broader economic recovery and is a clear, and important, turning point.

Zero-COVID will end, gradually

The prevailing western thematic that China will remain in zero-COVID forever is not credible. We have encountered deep scepticism from investors outside of China that zero-COVID policy will end. But of course it will end. This is not a policy that will remain indefinitely. And most importantly, the signs of a roll back have been there for some time. Signs include President Xi leaving China for the first time in 3 years, foreign politicians entering China for the first time in 3 years, and internal mobility (HK-Macao-China mainland) increasing. Throw in the vaccination commitments announced this week, and the exit ramp is in sight.

Timeframes are difficult

The recent protests in China make it difficult to gauge a timeframe for complete reopening. But the briefing on the day after widespread protests made it clear there is a commitment to reopening. And a commitment to bringing that forward via a renewed focus on targeted zero-COVID, and increased vaccinations. The protests are an important reminder that reopening will be a volatile affair.

In China, as in most countries, zero-COVID will be wound back in time. We have seen what happens to economies and equity markets when economies begin reopening. It is bumpy as the economies learn to live with the crisis, but ultimately there is a surge in pent-up demand that drives positive outcomes.

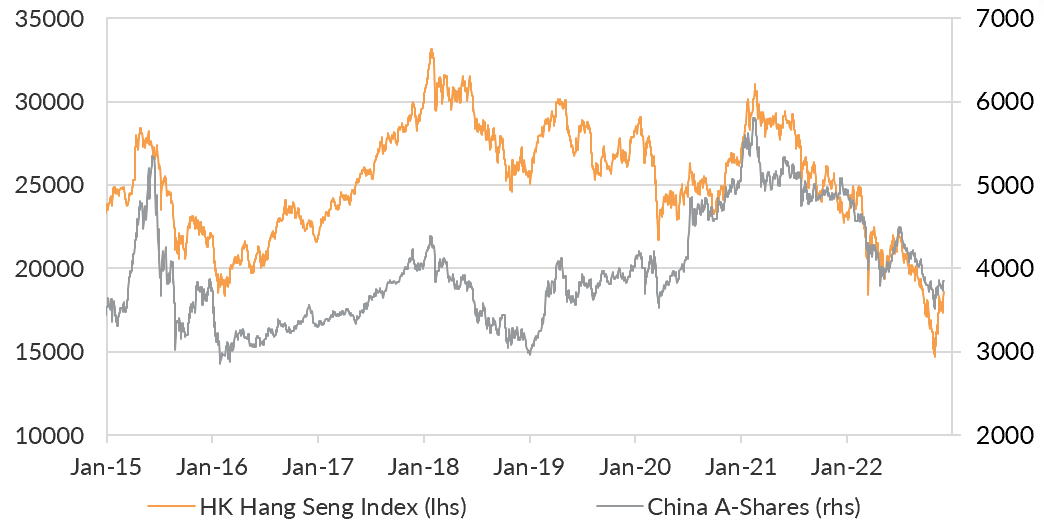

Equity markets have priced a recession, now the recovery is upon us. China A shares fell 40% peak to trough, and China H shares fell close to 50% peak to trough. This has priced in the recession that has already happened.

Chart 4: China A-shares and H-shares have fully priced a deep recession, and a recovery is close.

The gnashing of teeth in financial media following the weekend protests overwhelmed the reality that markets closed only very modestly lower. And then recovered to be considerably higher in the following two trading sessions. This is a timely reminder that we should be investing for the medium term, not implementing knee-jerk reactions to short-term news flow.

What does it mean for my portfolio?

The combination of a clearer commitment to gradually rolling back zero-Covid19, combined with fiscal and monetary policy support, and at a point when the economic cycle is closer to the end of a recession, which equity markets have already fully priced? This is a set of conditions that bode well for the Chinese equity market outlook. We do not think the recent rally is a dead-cat bounce. But the shift upwards will not be a smooth ride. This is a volatile market. It will take a commitment to the medium-term and appropriate risk tolerance to implement. We continue to expect Chinese equities to be a source of alpha for a diversified portfolio in 2023.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics