Why commodities and banks may lead the next bull market in equities

The economic historian Charles Kindleberger is best known for his analysis of financial market bubbles. Kindleberger argued that bubbles burst for three reasons:

- Fantastic stories creating extreme valuations

- Extreme levels of debt

- And... the most important one of all: the removal of cheap money.

Investors have been seeing the effects of that last factor play out over the better part of a year, as growth-oriented assets like equities fall sharply and bonds come back into vogue as a genuine income play. But Longview Economics' Chief Market Strategist Chris Watling argues that the end of emergency monetary policy also marks the beginning of something much greater - the unwinding of financial repression as dictated by central banks.

"We've had 12+ years of financial repression where central banks have bullied investors into risky assets and pushed them out of income yielding assets. This stuff won't unwind in 12 months. It takes time for investors to decide to reallocate and it takes time for them to take money out of equities into money market funds," Watling recently said in a webinar.

Watling adds that on most major indicators, the US equity market is still very expensive and that analysts' expectations for earnings season (kicking off later this week) are still too rich.

"The forward consensus earnings are still too rich. They still need to adjust and price in a recession and a normalisation of margins."

In this wire, I'll take you through Watling's latest thinking on long-term asset allocation. The result is some very good news for ASX investors and some red flags for holders of US equities.

US equities are (still) too expensive

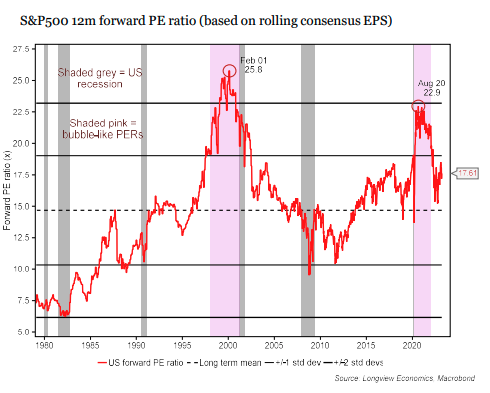

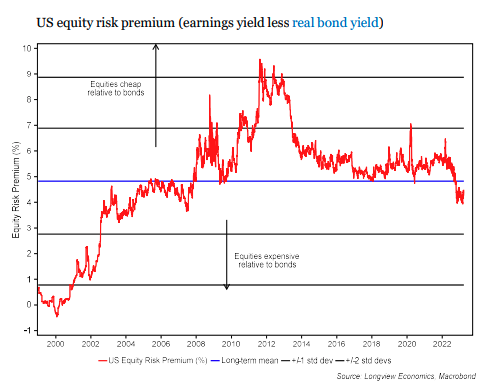

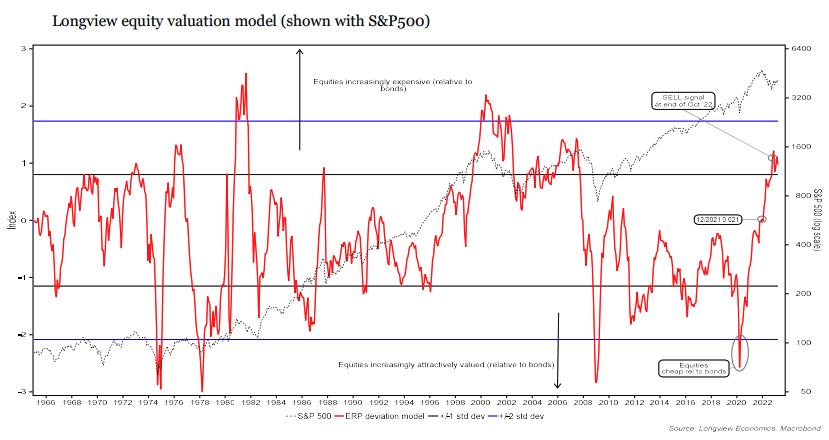

For this first section, I'll share three charts from Watling's presentation. Each chart is directly linked to a commonly used valuation metric and all three present the case for why the US equity markets are still too expensive especially at the mega-cap level.

- On a forward P/E basis, the S&P 500 is still trading at 17x earnings. In the decade before the pandemic, the S&P 500's P/E ratio averaged 15x. The ratio is higher than where it has been for 65% of the time since 1980, according to an analysis by economists at Goldman Sachs. All this adds up to the argument that, at least against history, the S&P 500 is still pricey.

Source: Longview Economics, FactSet

2. On a risk premia basis, equities are creeping back towards relatively expensive territory especially against bonds. For the most part since 2008, equities have been very cheap compared to bonds thanks to near-zero rates. Now that rates are rising, that pendulum is swinging back.

Source: Longview Economics

3) On Longview's own valuation model, equities barely became cheaper last year despite the double-digit falls at the headline level. In fact, its own model suggests equities have been a sell since October 2022 - the first time that's occurred since the end of 2006.

Source: Longview Economics

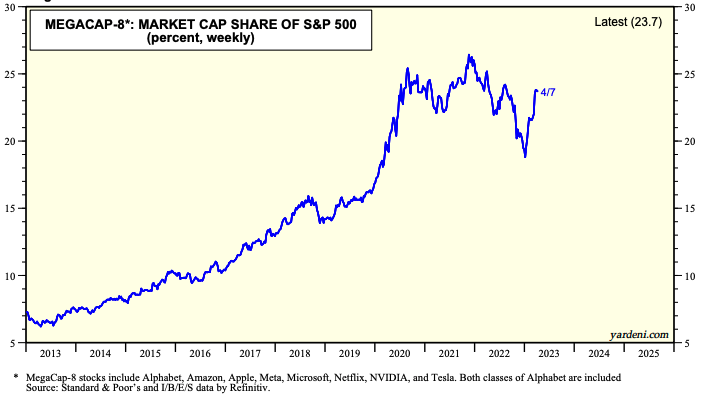

But it's not all expensive

All these charts so far pertain to the S&P 500, the benchmark equity index in the US. But the S&P 500 is dominated by mega-cap tech stocks. Yardeni Research tracks the so-called MegaCap-8 (Alphabet (NASDAQ: GOOG), Amazon (NYSE: AMZN), Apple (NASDAQ: AAPL), Meta (NASDAQ: FB), Microsoft (NYSE: MSFT), Netflix (NASDAQ: NFLX), NVIDIA (NYSE: NVDA), and Tesla (NASDAQ: TSLA)) and its weight on the S&P 500's composition. As of April 7th 2023, these eight giants make up nearly a quarter of the S&P 500.

Source: Yardeni Research

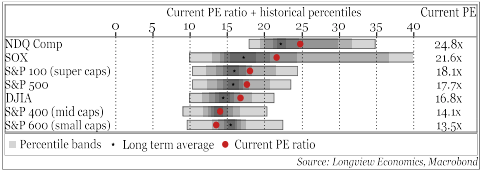

But what about the S&P 500 beyond these eight mega-names? A closer look finds that the S&P 400 and the S&P 600 (mid-caps and small-caps respectively) are actually much more attractive from a valuation standpoint.

Source: Longview Economics

Watling argues that this just highlights the enormous divergence at both the style and individual stock level. The Longview team use a distribution curve to identify where individual stock valuations are at versus the market. To their surprise, the curve looks a lot like 2000. Put another way, most stocks (especially defensive names) are actually cheap if you just look beyond the major names.

"The mass of stocks are cheap," Watling argues. "Within the US market, there is a lot of valuation disparity."

The next round of American corporate earnings starts later this week with the major Wall Street bank reports. 52% of the S&P 500's constituents are reporting profit margins that are at or just below record highs. Only 6% are reporting "normal" or "low" margins. All this is to say that margins have remained at abnormal levels - but how long can it stay like this? If expectations for these are anything to go by, earnings estimates will continue to drop as markets normalise and sell-side analysts finally work out what recession pricing actually looks like.

The next five years

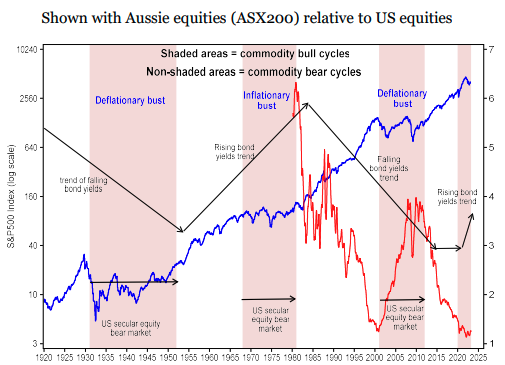

Above all, Watling believes we are at the beginning of a very different market. He thinks we'll start to see a rotation out of US equities into a more global selection over the next five years.

"We're changing leadership in the global stock market and in the global asset allocation market. We're entering new secular cycles different to the ones running into the pandemic and the five to ten years before that," Watling says.

For the last five years, big tech has obviously been the sector to be involved in. But now, the paradigm shift is happening at both the professional and retail levels. To illustrate this, Watling looks at the proportion of household flows going towards Treasuries or money market funds as supposed to equities. The spike in recent quarters simply suggests that a risk-free return is officially back on the cards.

So who will be the next tech - the next global sector to beat? The answer is still open-ended as this table shows.

Source: Longview Economics

One thing Watling is sure about is the rotation back into value-oriented assets.

"Now going forward, I think we're going back into a noughties-style, five to six year leadership with commodities and some Western banks coming back into play," Watling says but cautions that you may not see that positive entry point for a while as the global banking crisis continues to play out.

"The sector leadership is going to change and it will favour the UK and Europe. With that leadership, value will be favoured over growth."

One last chart: Australia in focus

Source: Longview Economics

Naturally, a commodities boom is great news for the ASX 200 (and actually, for the FTSE 100 in the UK and the TSX in Canada as well). While you shouldn't set your watch by when exactly this commodity bull cycle will flow through to Australian corporate earnings, the above chart does demonstrate the kind of market we might be entering. If we really are entering a multi-year commodities supercycle, Watling argues a secular bear market is coming for US equities.

"I think 2023 is an opportunity to re-weight your positioning into the things you want to buy over the next three to five years," he says.

If you missed it, Livewire conducted an interview with Watling when he was last in Sydney. You can rewatch that interview here:

.png)

3 topics

8 stocks mentioned

1 contributor mentioned