Why discretionary stocks are a contrarian opportunity (and 7 ASX-listed ideas)

Global investors know Australia for three things - our houses (the property investment opportunity), our holes (the massive mining sector), and our beaches (and let's face it, our sharks).

But the truth is that the Australian economy is driven by a much larger force than the property or mining sectors can muster - the consumer.

Consumer spending makes up about 50% of Australian GDP, according to the OECD, and consumer stocks (discretionary and staples combined) make up about 11% of the ASX 200. After the miners and CBA, consumer stocks are the most closely-watched sector every February and August reporting season.

On the macro front, the Reserve Bank has consistently called out the resilience of the consumer in its commentary. In particular, the RBA Board likes to say that longer-term inflation expectations remain well-anchored, adding, "It is important this remains the case."

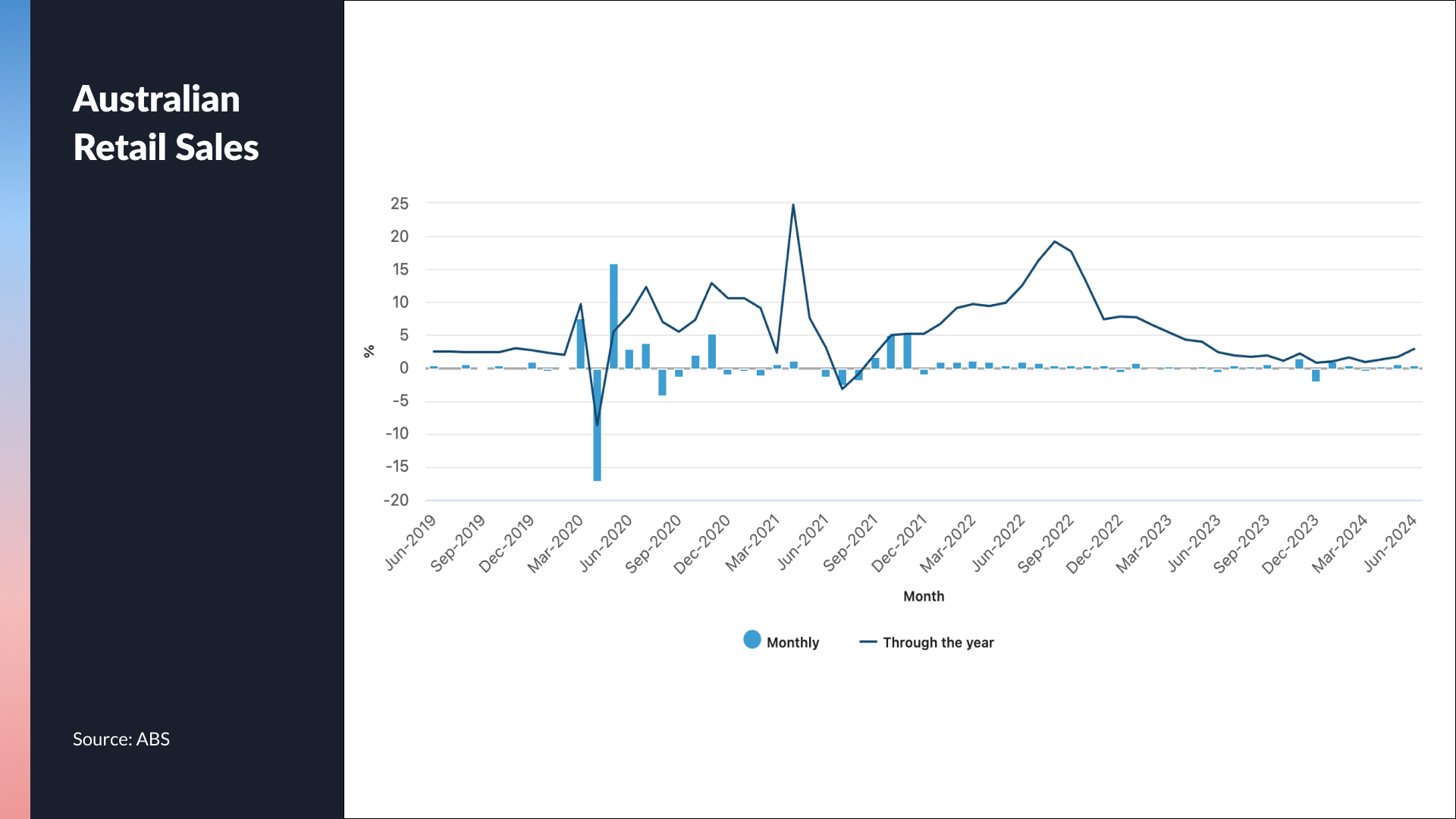

But the central bank also cannot deny the reality that retail sales are sluggish, noting in its most recent post-meeting statement that "there is a risk that household consumption picks up more slowly than expected."

So is the Australian consumer really that resilient?

This episode of Signal or Noise will attempt to answer that question and glean some investable insights. Joining me and our resident economist, AMP's Diana Mousina, this week are:

- Richard Schellbach, Strategist for Australia and New Zealand at UBS

- Ben Clark, Portfolio Manager at TMS Capital

Note: This episode was taped on Wednesday 14 August 2024. You can watch the episode, listen to our podcast, or read the edited summary.

Other ways to listen:

Edited Summary

Topic 1: The three charts strategists look at most closely

We asked each panellist to tell us which chart they find the most investable signals in and why.

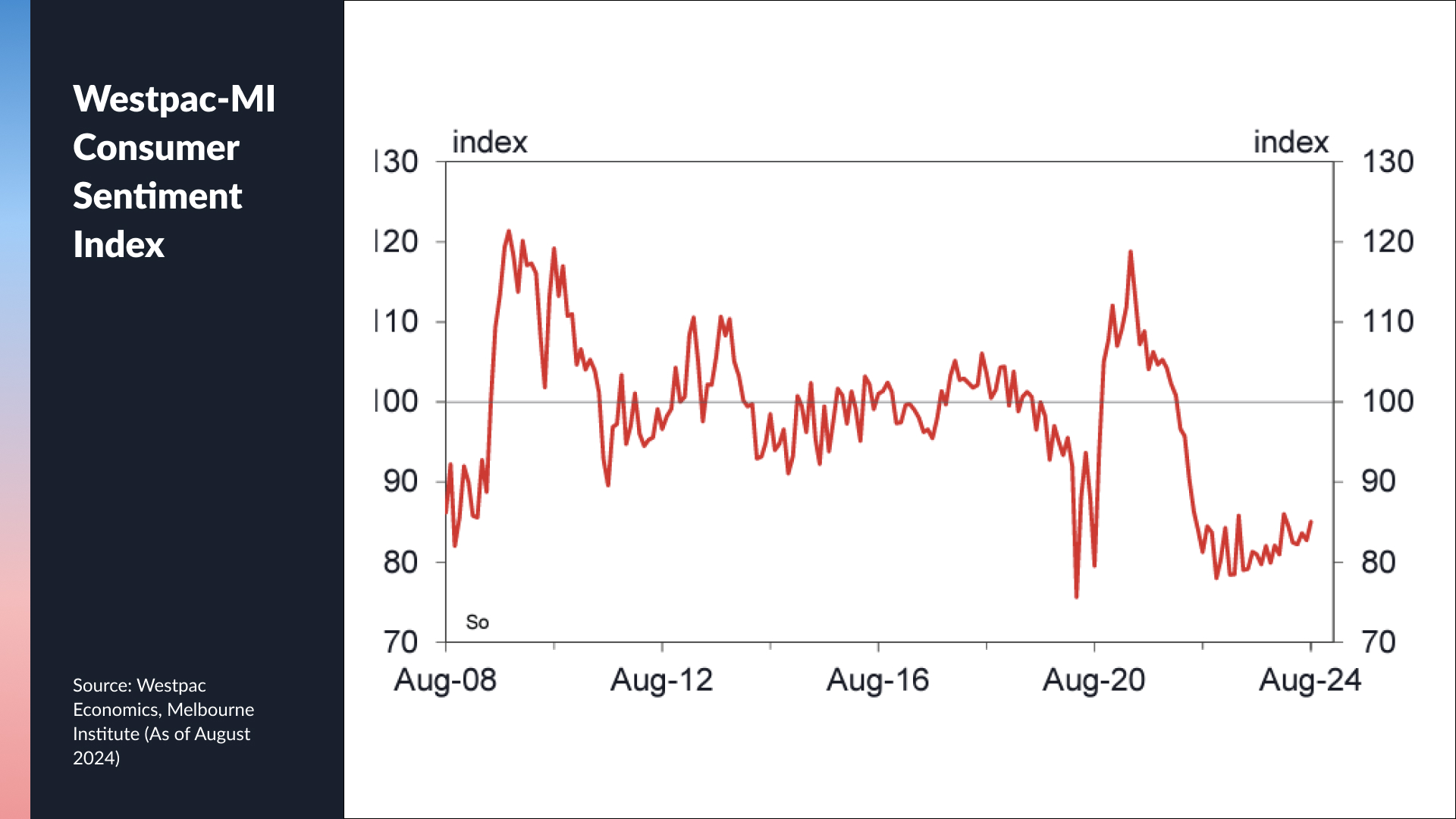

Diana: RETAIL SALES - This chart demonstrates the issue at the heart of the Australian economy. There has been no growth in volume terms over the last two years. While the consumer sentiment chart may also present some signals, the effects of the cost of living crisis on consumers are uneven.

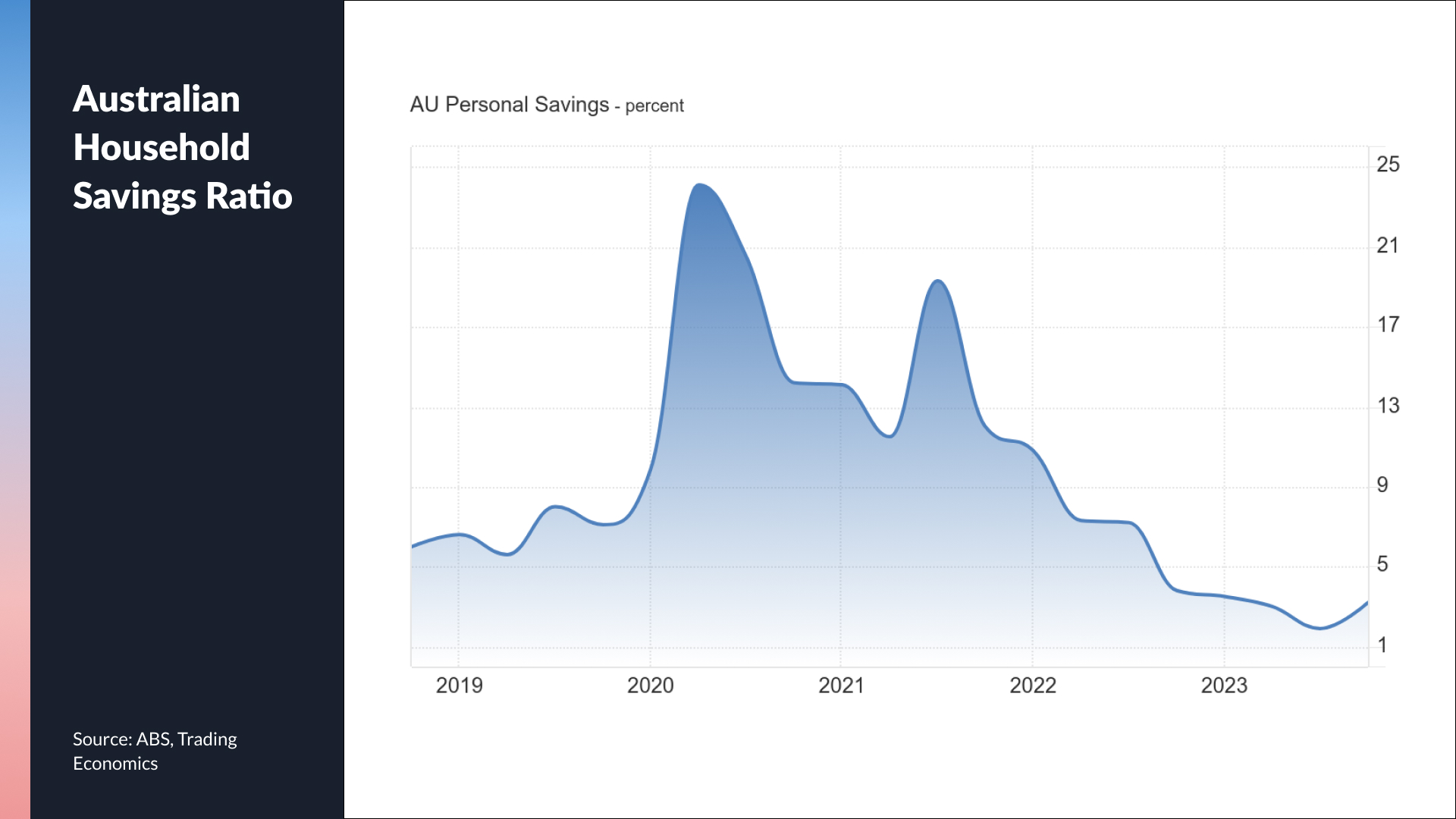

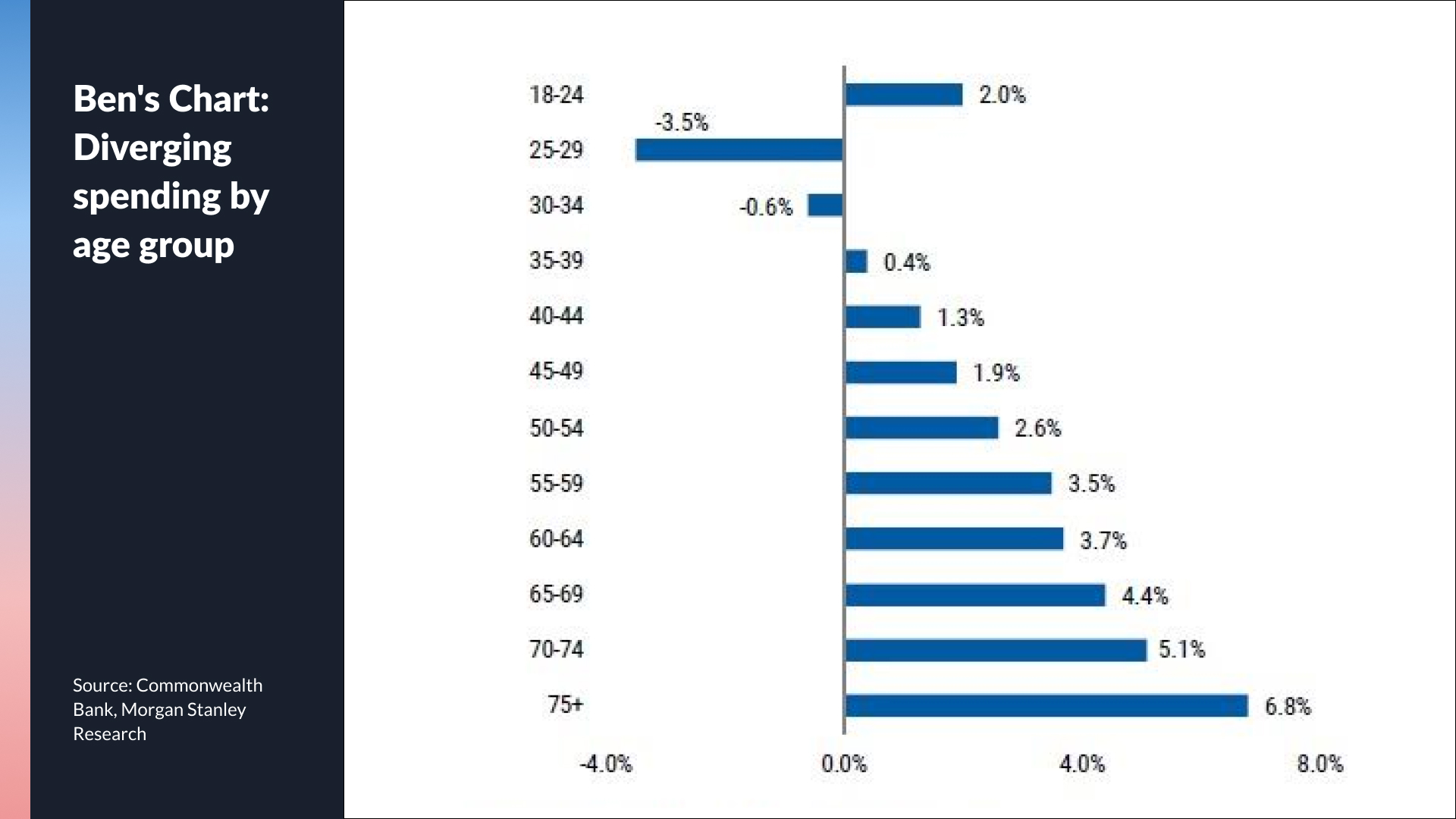

Richard: RETAIL SALES - This chart really proves that consumer savings are now exhausted and that the average consumer is also now dealing with quite the hangover. But being someone who turns macro into stock analysis, Richard says the bifurcation in the consumer means it's now more important than ever to separate the best operators (retailers) from the average ones.

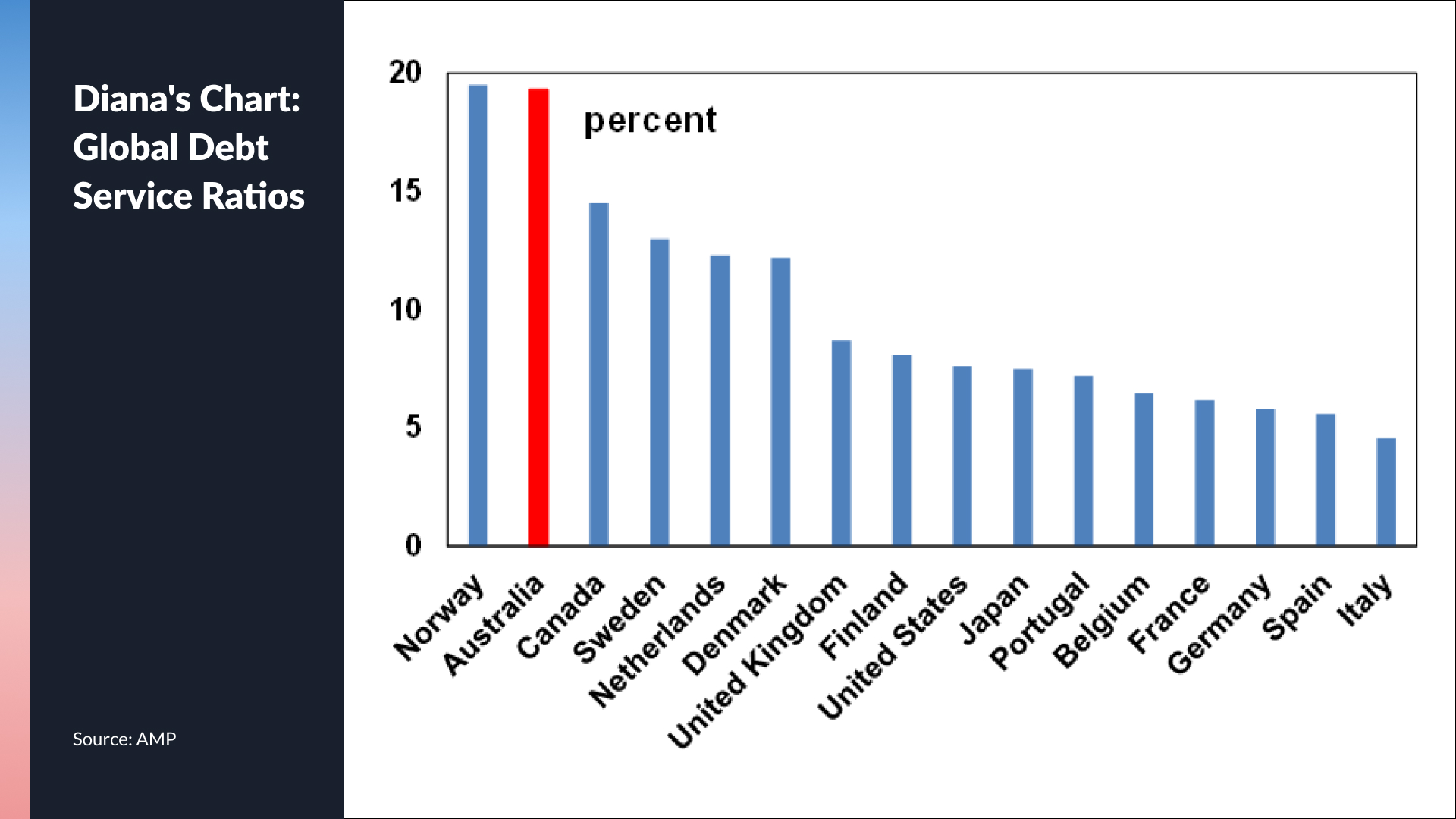

Diana's Chart: The other key economic data point she watches for changes in consumer activity

Topic 2: NAB survey reveals 36% of respondents plan to save their Stage 3 tax cuts

Ben: NOISE - While this should sound like a signal, it's all a bit of noise. Even if humans have the best of intentions, the reality is that they will likely spend most of it.

Richard: NOISE - UBS ran a survey of their own and found the total opposite! Their findings suggest that all of the tax cut cash will eventually be spent.

Diana: SIGNAL - The NAB survey was not the only one to reach such a conclusion - the Melbourne Institute found 75% of the people it talked to would also save their cash. But the bigger question, in Diana's mind, is whether any spending will have a material impact given the average household only gets an extra $75/month and that the pressures on the consumer from a rising unemployment rate and high interest rates continue to exist.

Ben's Chart: Who's spending the most? Not the young workers!

Open Discussion: Are consumer staples or discretionary stocks the better play right now?

Both Richard and Ben said that consumer discretionary stocks are the better play right now but they both had different ways of accessing that theme.

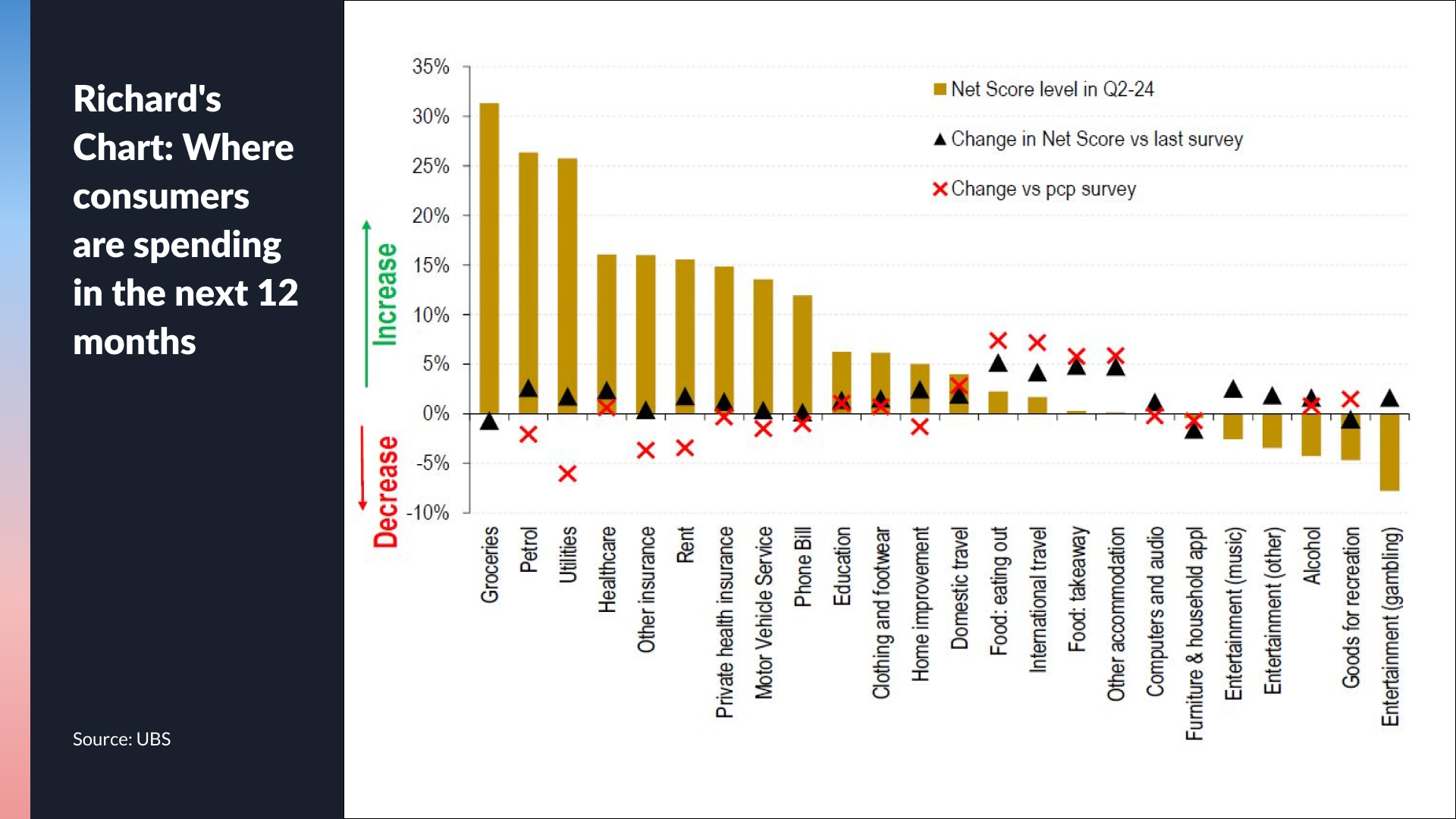

Richard and the UBS team have had an out-of-consensus OVERWEIGHT call on consumer discretionary stocks for two months. But he is keen to emphasise that this is not predicated on a view that the consumer will accelerate, but rather that the existing view is so "unrealistically" downbeat.

Two of his top calls in the space are Super Retail Group (ASX: SUL) and Universal Stores (ASX: UNI). He also brought along this chart to explain what the team found in their own survey of 1,000 consumers:

Ben also said he'd rather be in discretionary stocks but not necessarily in the retailers (bar Wesfarmers (ASX: WES), which is one of his fund's top five positions.) He looks to consumer-adjacent companies that have thrived in past downturns like home improvement and gaming. He also points to businesses that have exposure to the global consumer - as the global consumer will likely recover faster than the Australian consumer.

Some of Ben's other consumer-adjacent picks include gaming plays Aristocrat Leisure (ASX: ALL) and Light & Wonder (ASX: LNW) and recent additions Block (ASX: SQ2) and IDP Education (ASX: IEL).

Diana closed the show with her thoughts on the Australian consumer. While she thinks the weakness in the consumer data may continue over the next 6-12 months, that doesn't mean there isn't divergence. A case in point is the impact of the Albanese administration's migration policy and how that affects retail sales (in volume terms and only for specific goods and services).

Signal or Noise returns September 2nd with our global multi-asset show, focusing on the August snap sell-off and the lessons for investors. Joining Hans will be Thomas Poullaouec of T. Rowe Price, Kellie Wood of Schroders, and Arvid Streimann of Magellan Group.

5 topics

7 stocks mentioned

2 contributors mentioned