Why dividend payouts from ASX companies won't crash (and 16 stocks fundies are backing)

Alpha is what draws investors to managed funds over, say, staying in cash or buying index ETFs. Investing with the right stock pickers or asset managers can net you a fortune beyond what is achievable by investing in passive, index-hugging options.

With this in mind, Pinnacle Investment Management recently held its annual adviser roadshow. This year's theme - appropriately enough - was "Alpha Uncovered".

In this wire, we'll see how three professional investors - Plato Investment Management's Peter Gardner, Solaris Investment Management's Michael Bell, and Firetrail Investments' Patrick Hodgens are uncovering alpha through their choice of investment style. The one commonality they share is that they all focus on Australian equities, so naturally, we'll also share some of their top stock picks right now.

No, dividends are not about to crash: Plato Investment Management

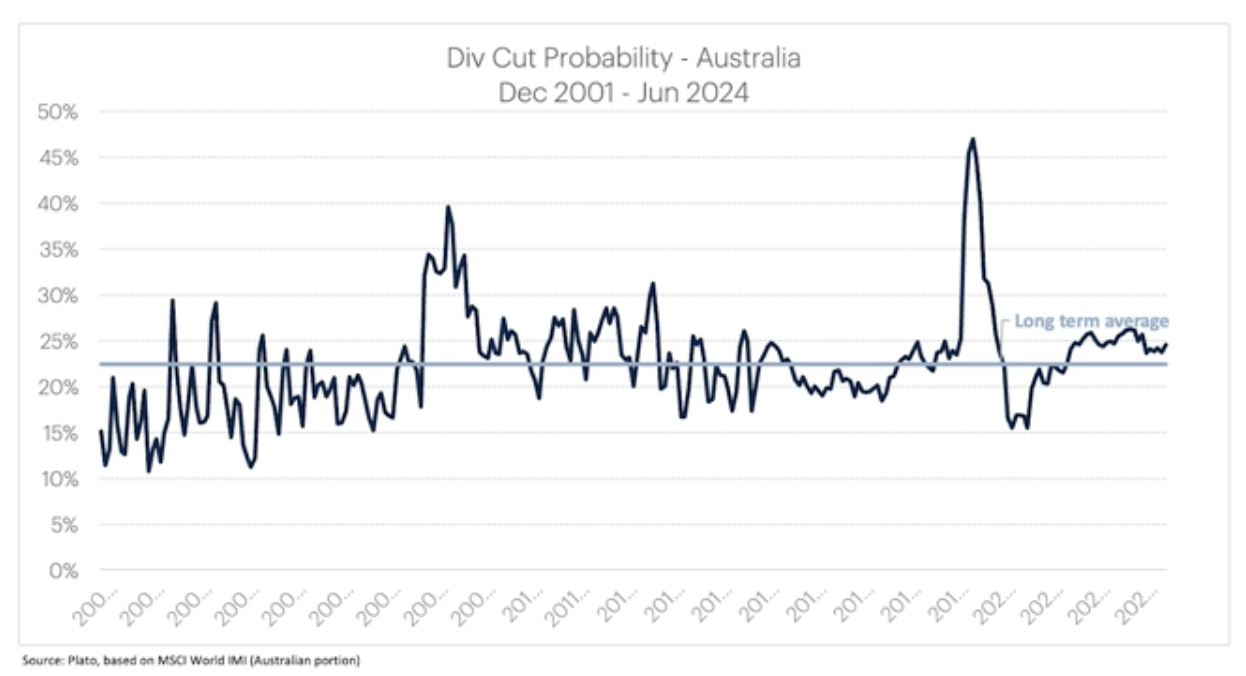

The bad news is that the economic picture looks challenging. The good news is that, as Plato Investment Management see it, the economic picture is not likely to lead to a wholesale cut in dividend payouts. Their argument comes down to this chart below:

As the Australian economy waded its way through COVID-19, this dividend cut probability figure rose sharply before coming down substantially. The recent uptick is due to the drop in commodities prices and an uptick in interest servicing charges (that is, the cost of paying off interest has gone up which naturally impacts the dividend companies can pay out.)

"We don't believe you should believe the media hype around a lot of stocks cutting their dividend. Rather, we think we are in an average period. We're not expecting huge payouts from here but a good level of dividends moving forward," Gardner said.

Founders know best: Solaris Investment Management

Many of the world's best-known companies, from Berkshire Hathaway to Nvidia, are all founder-led or were founder-led for many years. A little digging reveals that founder-led companies can vastly outperform the benchmark share market index, both globally and here in Australia. Over the last five years, the 12 largest founder-led companies on the ASX have returned 420% while the benchmark accumulation index only returned 65%.

But why do founder-led companies perform so well? Solaris Investment Management CIO Michael Bell says there are six key reasons:

- Decisive and agile: "These founder-led companies typically have low bureaucracy in them, they can make decisions quickly, and there's not a lot of hurdles," Bell said.

- Capital allocation, particularly around CEO tenure: "Founders are typically around 10-20 years. They tend to make good long-term capital decisions," he said.

- Alignment: Founders often have large parts of their wealth tied up with these companies.

- Deep industry knowledge: often with decades of experience in a specific field

- Vision and passion

- Culture: centred around how key teams have been built

Bell singled out Goodman Group (ASX: GMG) in his presentation as a symbol of all six of these values - particularly for its decision to be a first mover in data centres and management's decision to offer equity grants to many of its employees.

He also singled out Life360 (ASX: 360), a founder-led Australian company that has created one of America's most downloaded apps. But the opportunity for this company, Bell says, is not just in its subscriber base but its opportunity to turn those millions of free subscribers into paying ones.

"It has 66 million subscribers and of that 66 million, only two million are fee-paying. There's a long road to go in terms of converting those non-fee-paying customers to fee-paying ones," Bell said.

"They're looking to advertise on the 'freemium' model, concerning the 64 million subscribers that they are getting no revenue for at the moment," he added. Solaris' forecasts see Life360 reaching $400 million in quarterly revenues before the end of fiscal 2030.

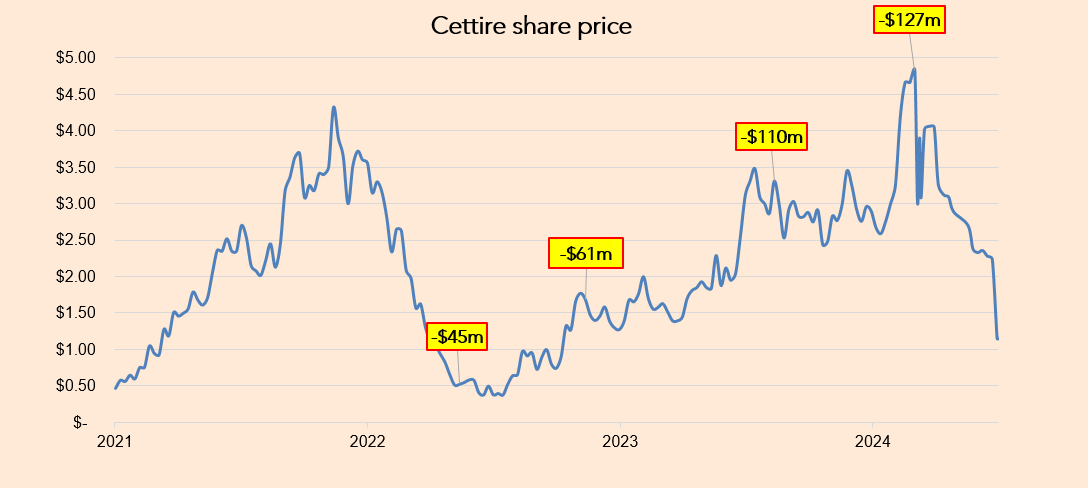

And because no strategy is entirely fool-proof, Bell pointed to some of the warning signs that stem from chasing founder-led businesses. Namely, founder selling, governance risks, and management churn. All three of these red flags can be found in one company that has made headlines recently:

"The big red flag for us with Cettire (ASX: CTT) has been the founder selling. He [CEO Dean Mintz] has been a regular seller in the last two years. Since they listed, his [shareholding] has gone from 100% to 30%. Anytime the founder sells, they reduce their alignment with shareholders," Bell added.

To read more about Cettire, my colleague Ally Selby wrote an outstanding piece back in April. It is a must read.

Finding alpha in value, growth, and quality: Firetrail Investments

Of course, investors don't always need to have a laser-specific strategy in mind. One other avenue is to have a stake in every style of investing - value, growth, and quality. This is the approach that Patrick Hodgens, Managing Director at Firetrail Investments has.

"We want the teams to have the ability to navigate cycles, to be flexible, and to be able to look at all areas of the market," Hodgens said. "It is very difficult to predict which one of these styles is likely to outperform in the next 3-4 years, or indeed which style will underperform," he added.

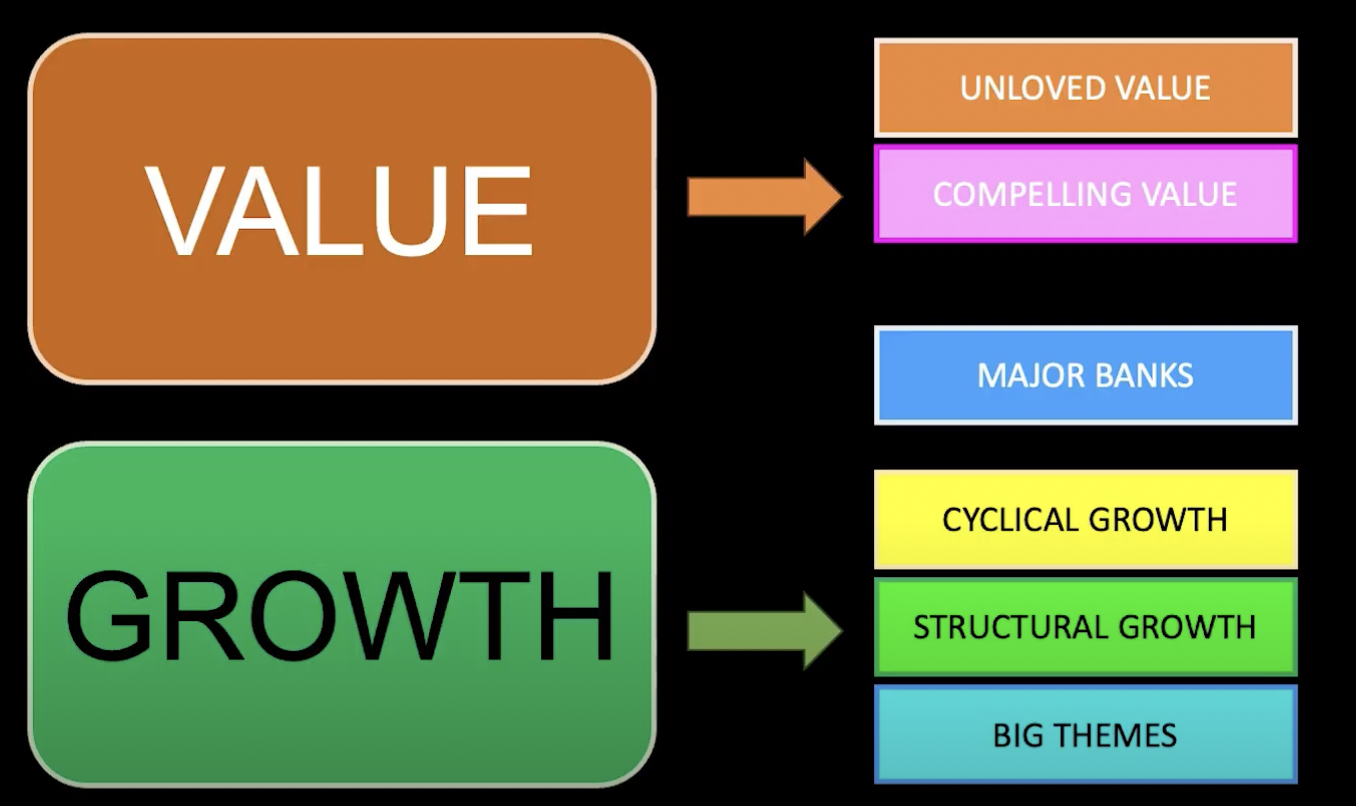

And even within those umbrella terms of value and growth, a lot has changed in the last few years. As Hodgens points out, it now pays to identify specific sub-themes within value and growth like "unloved" stocks or growth stocks with "structural" tailwinds.

From there, Firetrail builds a select, high-conviction portfolio that centres around these key themes. That is, some stocks will qualify as "unloved value" while others will qualify as "cyclical growth". And of course, given it's Australia, the Big Banks also have a place in the Firetrail portfolio (albeit, only one - National Australia Bank (ASX: NAB))

Their favourite picks, categorised by the big five themes above, are as follows:

- Unloved value - Stocks where "the market is not seeing value yet but we're seeing a clear line of sight for improving earnings and a share price re-rate": Santos (ASX: STO) and Incitec Pivot (ASX: IPL) are their key plays here.

- Compelling value - Stocks where "the market is starting to recognise these companies but remain incredibly cheap versus their history": Newmont (ASX: NEM) and Suncorp (ASX: SUN)

- Cyclical growth - "They are facing the consumer but we like companies like Treasury Wine Estates (ASX: TWE) and Flight Centre (ASX: FLT) because we are confident they have resilient earnings for 2024 and very strong earnings for 2025 and beyond."

- Structural growth - "These companies have at least 10% EPS growth at least for the next 5 years. These are the high-quality growth companies," Hodgens said. Names here include CSL (ASX: CSL), Fisher and Paykel Healthcare (ASX: FPH), and ResMed (ASX: RMD)

- Big themes - Moat, limited competition, huge EPS and revenue growth are the key themes here. Some of the names here are Infratil (ASX: IFT) and crowd favourite Wisetech Global (ASX: WTC).

Then, to top it all off, a controversial name - Guzman Y Gomez (ASX: GYG).

"There are three key reasons why we are very excited about GYG moving forward. Firstly, their franchisee profitability. Secondly, it's their store growth opportunity in the Australian market. Finally, they are expanding their addressable market."

2 topics

16 stocks mentioned

4 contributors mentioned