Why earnings may be the most important economic data point of 2023

With the wide-ranging and conflicting views from Wall Street so far this year, it has been extremely difficult to find clarity in both equities and the economy. Depending on what you subscribe to, be it technicals, fundamentals, or top-down/bottom-up, you can find an argument for all scenarios if you look hard enough.

For economists, the official economic data shows inflation is easing and labour markets remain resilient, backing the argument for a soft landing.

For bond traders, the high volatility and deeply inverted yield curve is an ever-reliable “canary in the mineshaft” for a recession while equities traders have had huge success in the Mega Techs so far in 2023, going so far as to calling the very cyclical FAANG stocks a “safe haven” during the banking issues during March.

In this wire, I explain what metrics we are watching to form our view and why the data from earnings season could prove to be very insightful in measuring the real-world effects of the Fed’s current fight against inflation.

Profit Margins (Employment)

Over the last quarter, markets have struggled with an employment outlook as the likes of Google (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Salesforce (NASDAQ: CRM), Disney (NYSE: DIS), Dell (NYSE: DELL), and Goldman Sachs (NYSE: GS) (to name a few) have shed anywhere from 3% to 10% of their workforce. And yet, the US still has an unemployment rate of 3.5%.

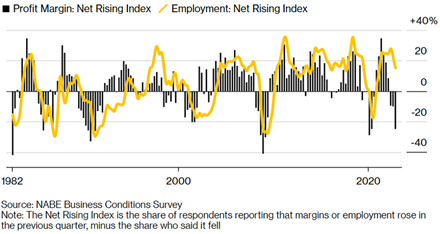

There is a genuine chance the job numbers are lagging due to redundancy packages or skewed by the huge demographic shift of “Baby Boomers” hitting retirement age. But instead of using a complicated formula involving an unknown amount of variables, we feel that the movement in profit margins is an incredibly reliable forward indicator to predict hiring/firing plans and one we will be factoring into our employment outlook.

Employment and Profit Margins - Historically, when US businesses report lower margins, they also typically employ fewer people (Source: NABE)

Capital Expenditure (PMI)

Capital expenditure is a reliable gauge of how companies think they are placed and any clues we can garner from company forecasts will be crucial to the path of equities.

As you can see by the ISM PMI vs S&P500 chart below, the performance of the stock market and business confidence are highly correlated and for now, the data seems to be lagging behind the change in CEO’s plans. CAPEX Spending Expectations, as taken in 2022 by Ernst and Young, showed businesses were still expecting growth in spending for the next 3 years. But a recent survey of some 700 economists based at large American and European firms saw expectations drop for 2023 from 6% to minus 1%.

Recently, cuts have been announced by the likes of Google and TSMC. Many companies may follow suit depending on their confidence.

US ISM Purchasing Managers Index (left axis) vs S&P500 (Source: TradingView)

Balance Sheet Strength

Another metric worth watching will be the strength of company balance sheets to determine how well companies can weather any potential consequences brought on by central bank rate hiking.

Over the last 18 months, companies in 33 OECD countries have already shown a decrease in cash holdings of over US$1 trillion. The health of balance sheets will show if the recent layoffs and CAPEX cuts have been a pre-emptive from business leaders or a reactive requirement.

Over the last 18 months, companies in 33 OECD countries have already shown a decrease in cash holdings of over US$1 trillion.

Cash and credit availability (Lending)

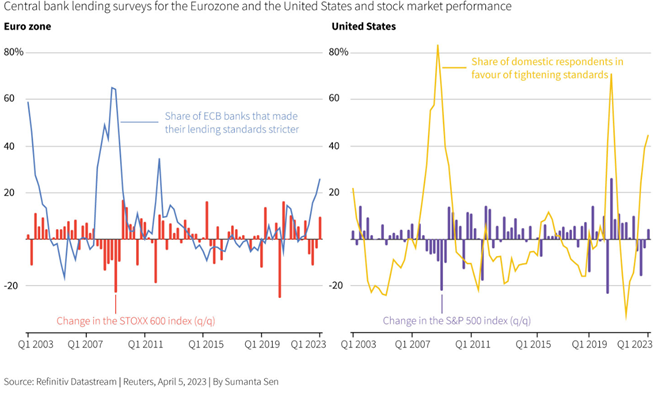

The major Wall Street banks unofficially kick things off this Friday. These companies are also the group who deal directly with the reduction in liquidity from the Federal Reserve. Capital ratios will be watched very closely and any outflows above analysts' expectations would confirm a slowdown is imminent as shown in the diagram below.

For companies outside the financial sector, they may seek to sure up balance sheets and liquidity through capital raises if they cannot access lending facilities. This will not be received well by existing shareholders so look out for any companies scrambling for capital.

Credit tightening is a good predictor of poor stock market returns

Concentration Risk

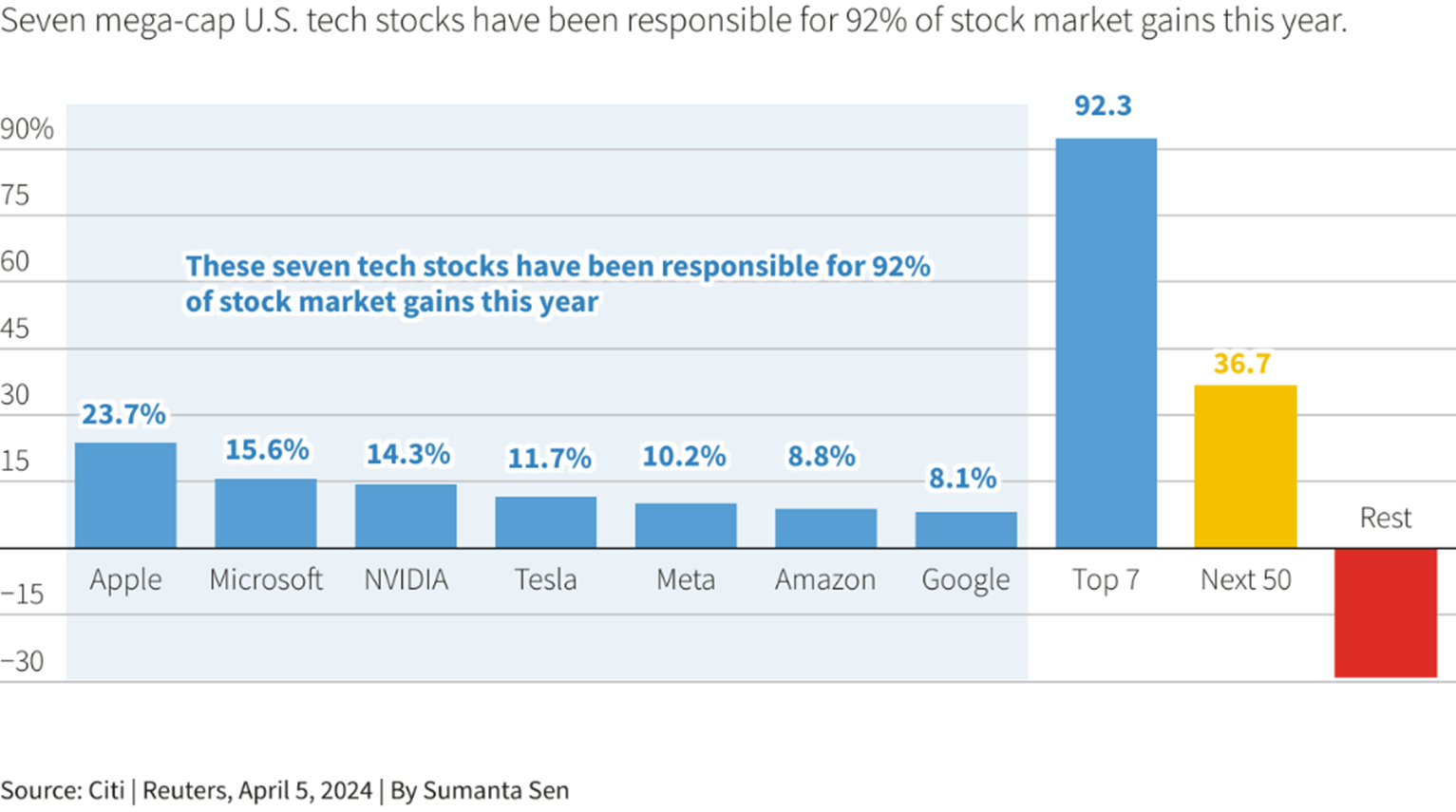

Another factor worth noting this earnings season is investor sentiment. The market has been buoyed by the positive sentiment in the mega-cap tech stocks which have been largely disguising the poor performance of the rest of the market.

It is important to realise that there will be a flood of data coming from companies of every size and in every sector in the 2 weeks leading up to when the Mega Caps deliver results and by this time, investor sentiment may have soured depending on the results.

Tech Concentration - Just seven stocks have been responsible for 92% of equity market gains this year

Given all the insights this earnings season could provide to the overall macro picture, it stands to reason that the short-term fate of the equity market may be decided by Main Street data and not the traditional economic data points watched religiously by Wall Street.

3 topics

6 stocks mentioned