Why every fixed income portfolio needs a FI-RV allocation

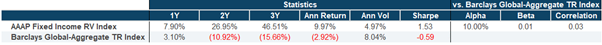

One of the most popular hedge fund strategies for our private bank partners in recent years has been Fixed Income – Relative Value (‘FI-RV’), a strategy that has increasingly (and successfully) been used as a fixed income alternative, replacement, or complement. The FI-RV funds we allocate to have materially outperformed vs fixed income, and materially enhanced portfolio performance when allocated to as a portion of fixed income allocations:

Source: Antarctica AM (AAAP Fixed Income RV Index is an equal weighted index of FI-RV funds on the Antarctica AM platform)

As some background on the strategy, FI-RV funds invest in interest-rate related securities, and generate returns from exploiting market dislocations, or predicting market movements in interest rate and related markets.

Because FI-RV managers aren’t restricted to long-only positions, they can generate profit irrespective of interest rate directions.

Furthermore, because they’re predominantly invested in hedged and often short-term positions, fund volatility is far lower than for other funds, and indeed bond and other interest rate sensitive markets.

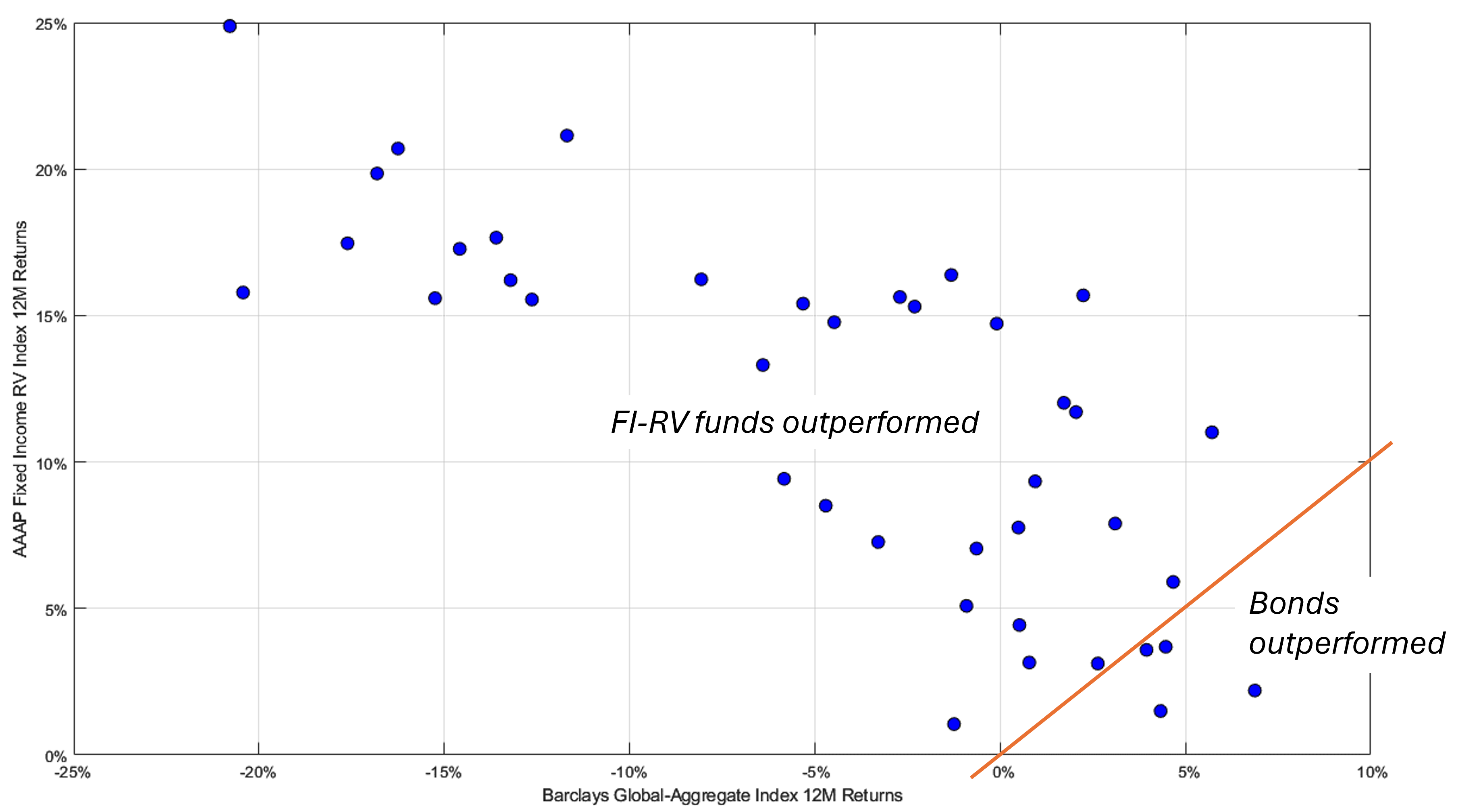

This has certainly been the case for the FI-RV funds we allocate to—the chart below shows the rolling 12-month returns for these funds vs. the Barclays Global Aggregate Bond index. From February 2020 (the launch date for the newest of our FI-RV funds), there have been less than a handful of occasions in which the bond index has outperformed these funds, and the hedge funds' outperformance vs. index is in excess of 60%, with much lower volatility.

Source: Antarctica AM (AAAP Fixed Income RV Index is an equal-weighted index of FI-RV funds on the Antarctica AM platform)

The strategy has been tested in recent years with a number of dramatic events in related markets – namely the Repo surge of 2019, and the COVID crisis of 2020, and in each case the sector has performed strongly.

In diligencing these funds, we use simulation techniques to properly benchmark drawdowns and we believe this is imperative as it offers a complement to classic risk measures such as volatility.

As a rule for fixed income arbitrage we have historically assumed a negative shock that occurs once every 10 years, using monthly times series, with a normal distribution mean of -7.5% and volatility 2.5%. This is based on the qualitative understanding of the strategy and some empirics around other such events P&L distributions and timing occurring on a circa 10Y cycle: LTCM 1998, Lehman 2008 etc. The simulated expected drawdowns, relative to the P&L of our funds during these events, was within expectations – indeed, the largest drawdown that either fund experienced was ~4%, recouped within ~6 weeks.

One of the reasons for such stable performance is that these funds allocate across a number of different sub-strategies, with different performance drivers and low correlations. Common strategies include:

Cash Futures Basis

The cash/futures basis strategy looks to exploit temporary mispricings/deviations from fair value between cash bonds, futures and the financing relationship between the two assets (repo). These distortions arise due to different actors in the cash, futures and repo markets; actors such as Central Banks (QE), Real Money investors or CTAs who are significantly larger than FI-RV funds and not as concerned about the micro fair value of these assets.

Inflation

The inflation strategy looks to exploit mis-pricings of inflation related securities, building on detailed bottom up inflation fixing forecast, combined with a top down macro view and a relative value analysis.

Yield curve RV

This strategy involves taking long and short positions at different points along the yield curve, . identifying points that are either ‘cheap’ or ‘rich’ against a forward model curve (derived from discounting the cash flows of coupon-bearing products on a bootstrapped swap curve).

Swap spreads

This strategy looks to exploit distortions between cash bonds or futures and swaps.

Basis swaps

A basis swap is an interest rate swap that involves the exchange of two floating rate instruments (3m Xbor for 6m Xbor, 3m Xbor for 3m OIS, etc.). This strategy is market-neutral and involves taking positions on the spread between different cash flow maturities in the swap market or between the average of the overnight deposit market for a certain period and its equivalent unsecured market rate.

Cross currency basis

The negative spread over the foreign currency leg rate (e.g. Euribor) versus the USD leg rate (e.g. USD Libor) in an FX swap.

Auctions

Positioning around government bond auctions, which are typically issued at a slight discount to similar bonds. Dealer pre-positioning to absorb issuance and other investor behavior can cause curve dislocation around auctions.

Looking ahead

Moving forward, we have a positive view on the FI-RV space for 2 reasons:

- Supply of capital is constrained (and has been since the GFC as a consequence of regulation), primary dealers as a percentage of global debt is low, and investment banks are only marginally moving into primary dealer roles – in summary, capital providers are advantaged when capital is scarce/reduced;

- Volatility and term premium normalization is occurring, and while this requires intermediation capital, banks and dealers are constrained, so FI RV funds are able to price attractively – in summary, there are more things to do for FI-RV funds when parts of the market are creaking or stressed.

If you would like to know more about the FI-RV strategy, please don’t hesitate to reach out.

5 topics