Why everything has to go right this ASX reporting season (and 4 must-watch stocks)

We are about to enter the most important month on the calendar for Australian investors. And it's not a far stretch to say that there is a lot at stake for the ASX 200 over the next four weeks.

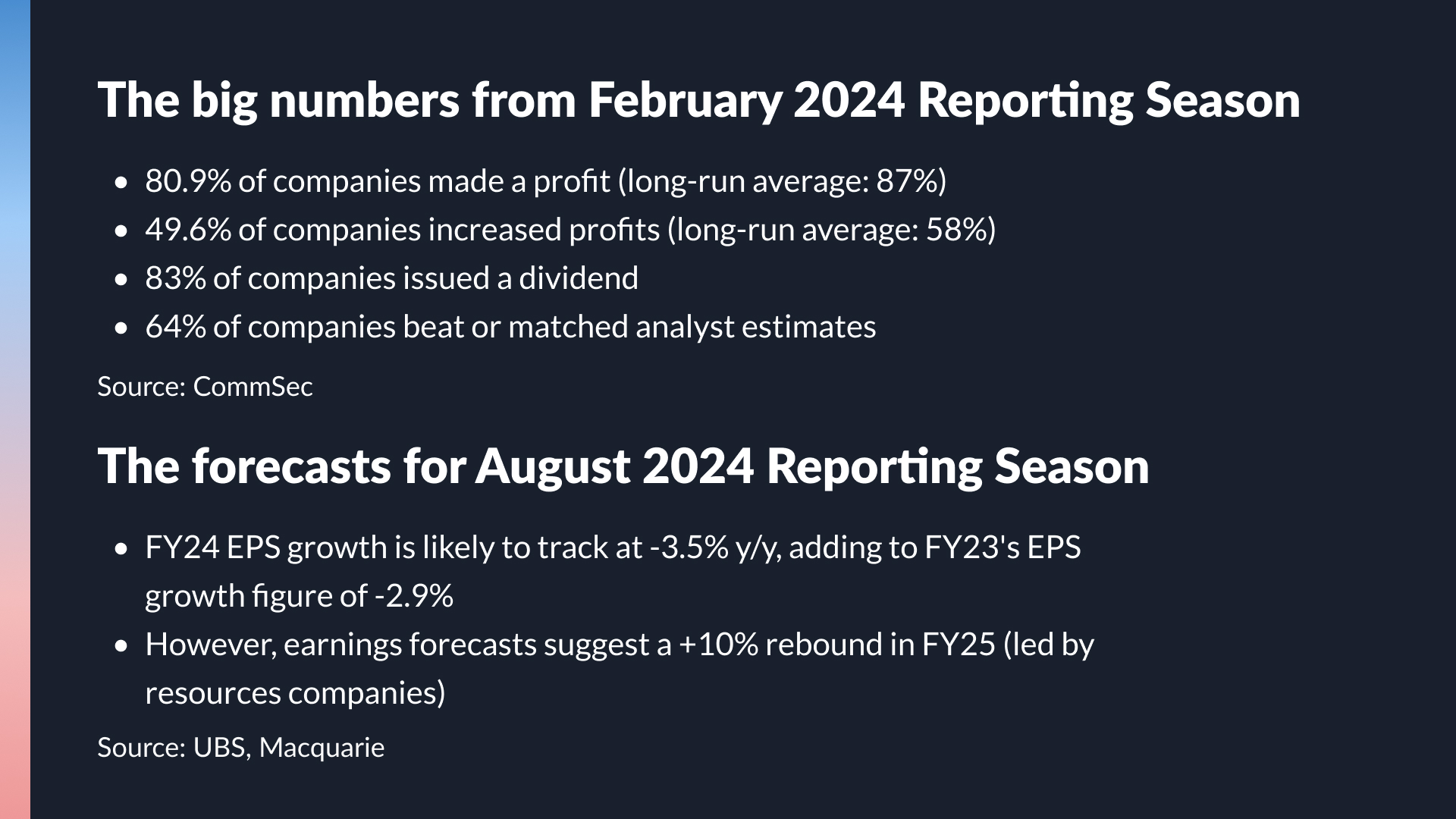

At the last reporting season in February, over 80% of ASX 200 companies made a profit. That number sounds good until you realise that is a) well below the long-run average and b) represented a third consecutive reporting season of declines for this metric.

Moreover, the balance between companies growing earnings and companies not growing earnings is now 50-50. And of course, while a chunky dividend payout can help soften the blow of an otherwise rough earnings result, experience shows that earnings misses are often met with savage selling which has an impact that lingers long after the results day.

Doomsayer, I hear you say! Stop with all this negativity, I hear you cry!

Well, I'll offer you a silver lining. The bad news is that most sell-side analysts believe that ASX 200 aggregate earnings will fall by between 3-4% for the full year, to add on to the circa 3% decline we saw in FY23.

The good news is that analysts believe there could be as much as a 10% earnings rebound in FY25 (if you believe Macquarie's view) - and the right individual stock selections could help you even exceed that figure.

But first, we have to make it through this month.

To help you on your way through August and beyond, Signal or Noise returns from its winter hiatus with its annual August Reporting Season preview show. Joining me are three of Australia's most astute investors:

- Aaron Binsted, Portfolio Manager on the Australian Equity Strategy at Lazard Asset Management

- David Cassidy, Head of Investment Strategy at Wilsons Advisory

- Shane Oliver, Chief Economist and Head of Investment Strategy at AMP

Stay tuned to hear Binsted and Cassidy share four stocks they are watching this August as well as Shane's pick of the sectors.

Note: This interview was taped on Wednesday 31 July 2024. You can watch the show, listen to our podcast, or read our edited summary.

Other ways to listen:

EDITED SUMMARY

Topic 1: Will this August signal the end of the profit crunch?

Shane: SIGNAL - This is an important reporting season with this financial year's earnings declines likely to follow last financial year's declines. While he tends to think we will see the bottom for the earnings trough this August, the next financial year will start to see a lift in profits once again (though not likely to the 10% figure Macquarie is suggesting).

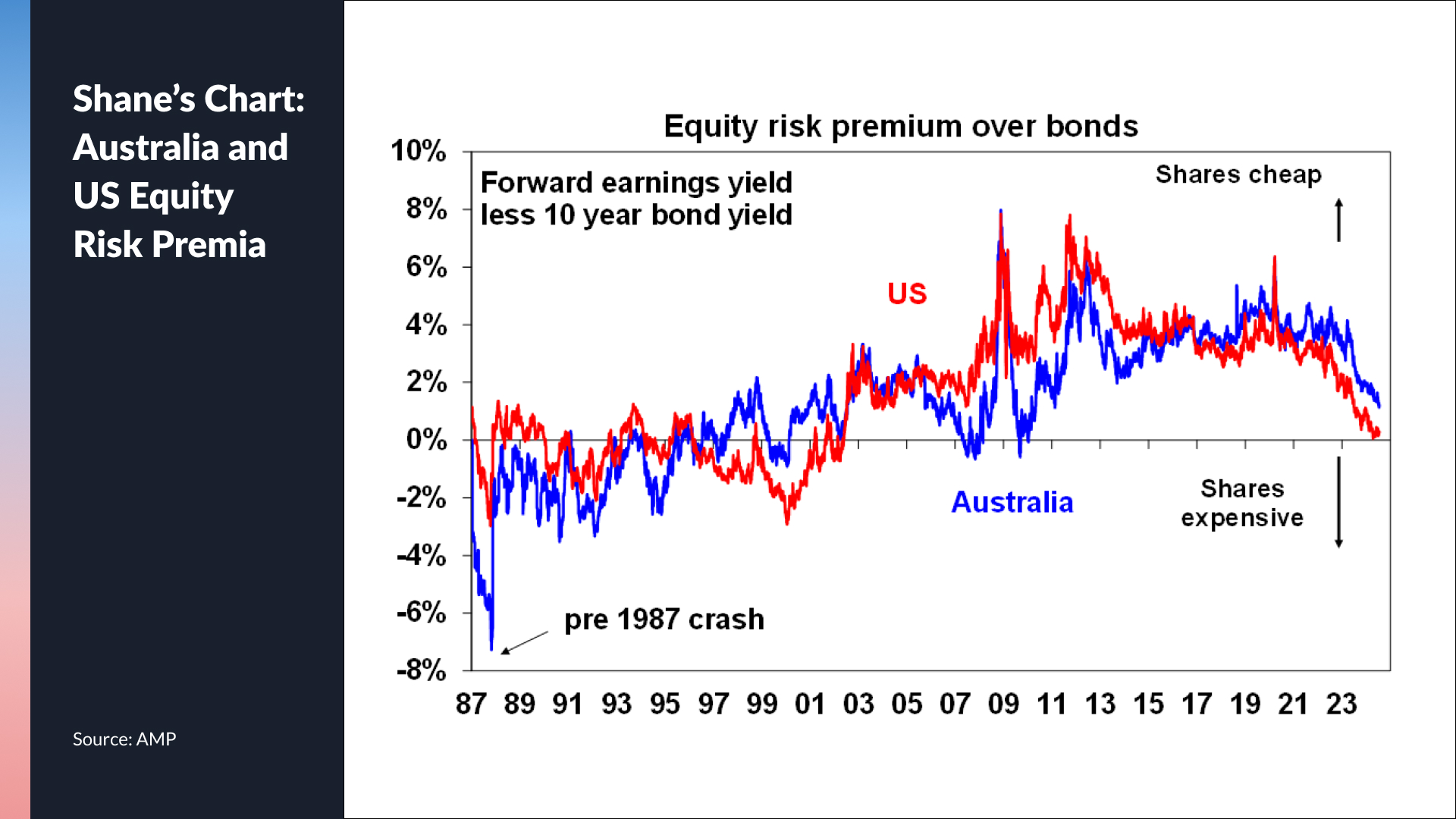

Shane's Chart: Equity Risk Premium

Aaron - NOISE: Although he finds some signal in Shane's equity risk premium chart, the idea of finding an aggregate earnings bottom will likely come down to commodity prices - especially the energy companies and the Big Three iron ore miners.

David - (Weak) SIGNAL: There will likely be a mathematical bottom but even an upturn for earnings this month will likely be "anaemic". David also shares Shane's view that earnings will rebound next year - but nowhere near the 10% figure being expected by some analysts.

Topic 2: Will resources stocks provide some upside surprise?

Aaron - SIGNAL: While Aaron thinks that resources stocks can surprise to the upside over the long-term, it won't be immediately seen this reporting season. But given individual commodities and individual resources stocks are moving in different directions, stock selection will be key.

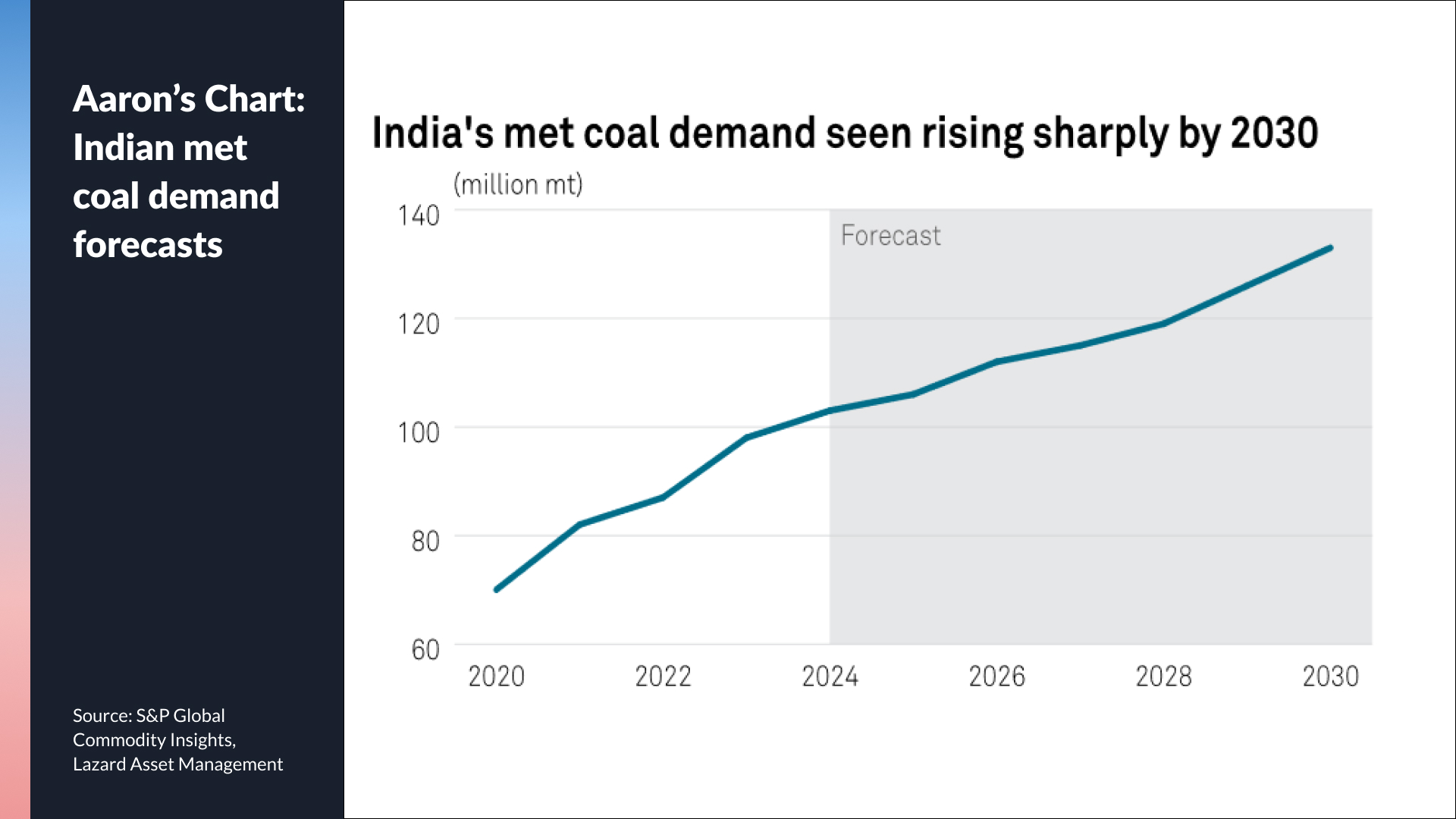

Aaron's Chart: Indian met coal demand

Note: The most liquid ways to play metallurgical coal through the ASX are Whitehaven Coal (ASX: WHC), Coronado Global Resources (ASX: CRN), and Stanmore Resources (ASX: SMR)

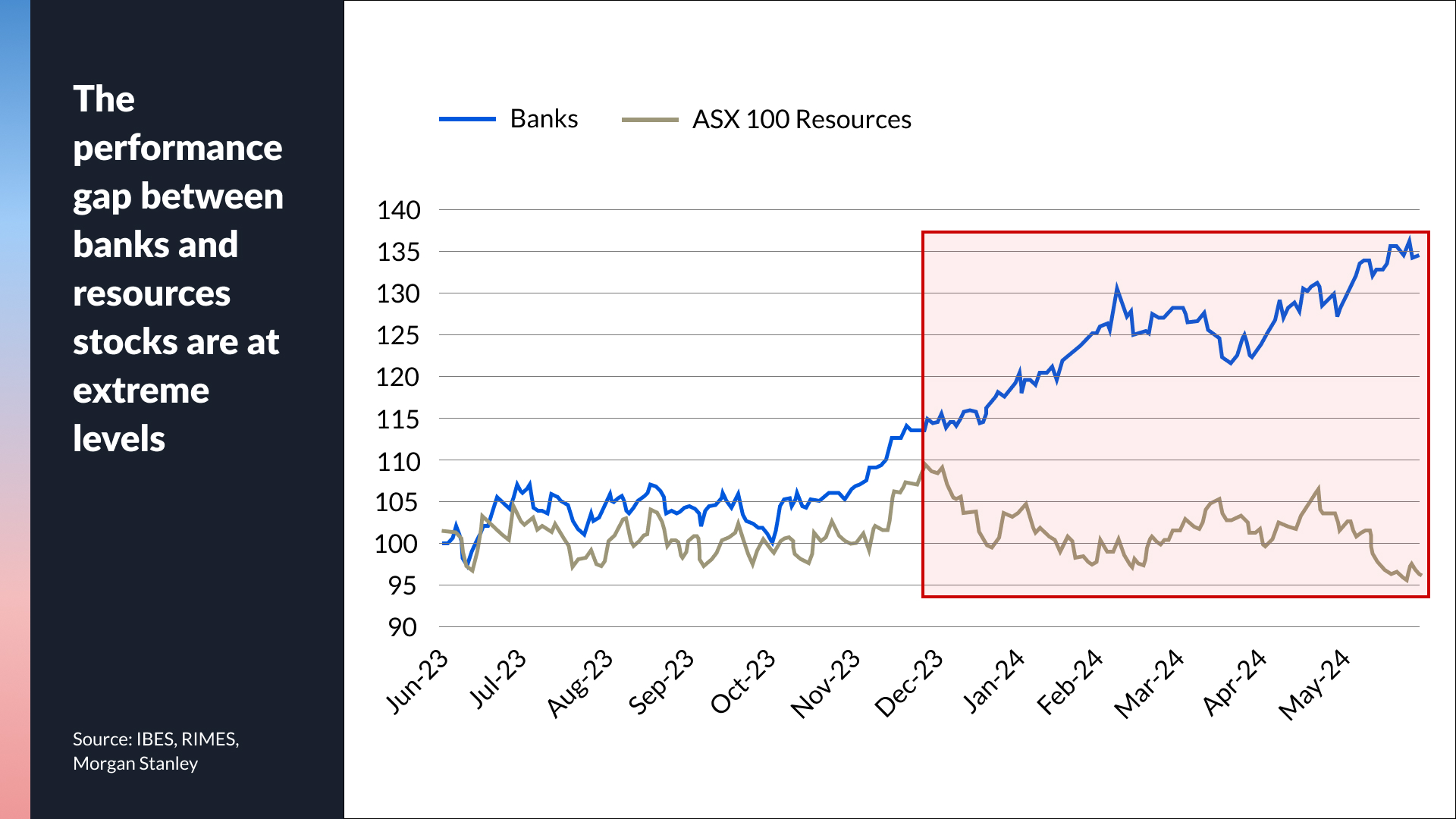

David: NOISE - David's view is that the performance gap between banks and resources seen in the show (chart below) has more to do with the huge run-up in bank share prices than it does with the falls in resources stocks. More specifically, it shows just how overvalued the banks have become - especially Commonwealth Bank (ASX: CBA).

Shane: (Weak) SIGNAL - Over time, Shane expects the resources sector's earnings profile to rebound. Ironically, Shane finds a bigger medium-term signal in Aaron's met coal demand chart, arguing that it proves there is an economic life after China (much like how we moved on from our over-reliance on Japan or the UK.)

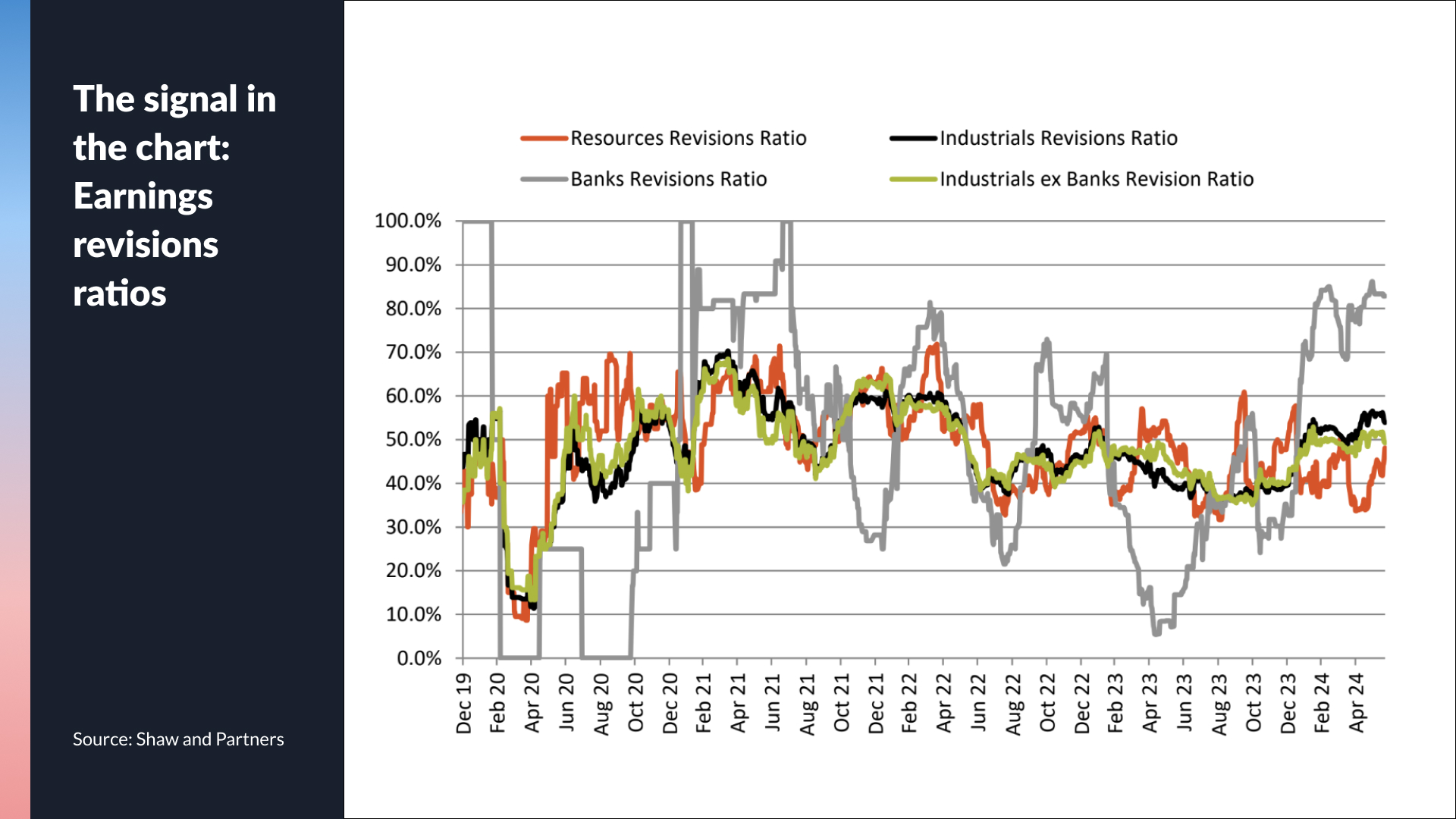

Topic 3: The Signal in the Chart - Earnings Revision Ratios

David: NOISE - The measure of earnings revision ratios can vary from firm to firm. In David's view, the Shaw and Partners chart shows the number of bank stocks seeing upgrades versus downgrades - but not the magnitude. Earnings upgrades are not correlated with valuations, for example, CBA can have a 1% earnings upgrade but a 20% move higher in its share price. Similar things could be said for the other banks as well. Put all together, David believes the market is angling for further earnings upgrades from the Big Banks. If it doesn't pan out the way it hopes, then watch for a correction to come.

Shane: (Weak) SIGNAL - At some point, there will be a mean reversion in this chart - that is, financials (which are currently in the lead) will slump and resources (currently at the bottom) will move up. While it may not become apparent this reporting season, it will turn up just as the economic cycle changes!

Aaron: NOISE - Context matters. From December 2023, the Banks have had 5% worth of positive earnings revisions but it's still down 12% from December 2022. Yet, bank prices are up 20% despite EPS being down 12%. It's, in short, a short-run data point that's noise.

David's Chart: Large Cap EPS Growth

Stocks and Sectors to Watch

Aaron is watching two stocks that have experienced share price trouble in recent times.

One is Bapcor (ASX: BAP), which has been the victim of "internal cost in escalation". While the top line continues to chug along, management challenges have led to an unforced increase in costs. In Aaron's view, "Expectations are low. If they can show any progress that costs are coming down, that could be relevant to the share price."

The other is Domino's Pizza (ASX: DMP), where the share price has been savaged off the back of numerous earnings downgrades. But if the share price has finally found a floor and management can convince the market that earnings can rebound, then there may be a deep value opportunity here.

David called out CSL (ASX: CSL) from a profit perspective. While the share price has struggled in a range, a good report with a demonstrated recovery in margins could provide it the tailwind it needs to break out of that range.

Both Aaron and David are also focusing intensely on the insurers. Aaron, who has been watching the insurers closely over the last 12 months, says "good earnings growth is in the bag" until 2025. The only change is that share prices are starting to reflect the earnings runway. He is happy to hold. Specifically, David called out the potential for IAG (ASX: IAG) and argued that while premiums are nearing their peak, that will likely take a while to show up in the share price.

Shane, as an economist, nominated the consumer sector to watch closely. With a majority of the Australian economy driven by consumer spending, this season will be particularly telling for retailers as the impact of higher-for-longer interest rates has to be balanced out against the huge rise in immigration.

Signal or Noise will return on August 19 for The Australian Consumer show. Hans will be joined by AMP's Diana Mousina, UBS' Richard Schellbach, and TMS Capital's Ben Clark.