Why Filecoin will be one of the largest start-ups in the world

Holon Global Investments

“Show me the incentive and I’ll show you the outcome” – Charlie Munger

Web 3.0 innovation, Filecoin, is a decentralised cloud platform that is set to become the ‘AirBnB’ for cloud storage. Like AirBNB, Filecoin lets you rent out storage space on your computer. It is creating a decentralised storage network.

We believe Filecoin’s potential is enormous and will provide investors with vast opportunities. It is likely to be one of the largest startups in the world. FIL, the blockchain’s native currency, will also hold significant value. And Filecoin has the potential to disrupt cloud storage Mega Caps, including Amazon, Google, Alibaba and Tencent.

If investors can understand what underpins Filecoin — basically a huge ‘incentive machine’ — they will better understand its opportunities and disruptive potential, and the need for investors to move quickly to maximise their wealth generation from this megatrend.

The allure of Web 3.0

As investors, a large part of what we try to uncover are incentives so we can understand the forces that drive value into businesses. In Web 3.0, incentives are what drives adoption, and adoption, in turn, often drives utility, so a natural network effect forms.

Blockchains — the basis of Web 3.0 and Filecoin — are networks. Blockchains have a very unique ability to coordinate participants of a network to provide useful services for pay without central management.

It is an amazing feat but understandably difficult to grasp initially. Blockchains are, in simple terms, “Incentive Machines”. This is one of the most alluring aspects of the Web 3.0 space.

Because blockchains are global by nature, with the right incentives and the right value proposition, they can scale incredibly fast, making them disruptive to legacy business models.

Traditional investors often struggle to see the value in Web 3.0 because often, particularly in the early stage, the value proposition is not obvious. Networks take time to develop and they become more valuable as time passes.

Metcalfe’s law describes the value of a network being proportional to the square of the number of connected users of the system. But this is not as new as you may think, we have seen this before — Social media platforms all started the same way, with little network effect and little value.

Who wins? The incentive business model

If you dig a bit deeper into the Web 3.0 space it becomes clear that incentives are driving the development of networks like Filecoin. And that, unlike traditional investments in Web 2.0 (the social web) that spawned companies like Google and Facebook, can spur on very different supply versus demand forces that give value to the ‘coin’ (the network’s currency).

More simply, in Web 2.0 the network gains significant size, but then a company will look to monetise the network. With social networks this is advertising, which has been dominated by the likes of Google.

But in Web 3.0 the value is driven into the coin, not a company. That means the early adopters, who help drive the network effect and the value, will benefit. This shift is incredibly important because it rewards early adoption of protocols.

Filecoin’s 3 major levers

When it comes to Filecoin, its economic design incentivises early adopters to build the infrastructure and thus the network. Below is a detailed outline of three of the major levers driving Filecoin adoption and thus FIL value.

1. Encouraged to adopt early

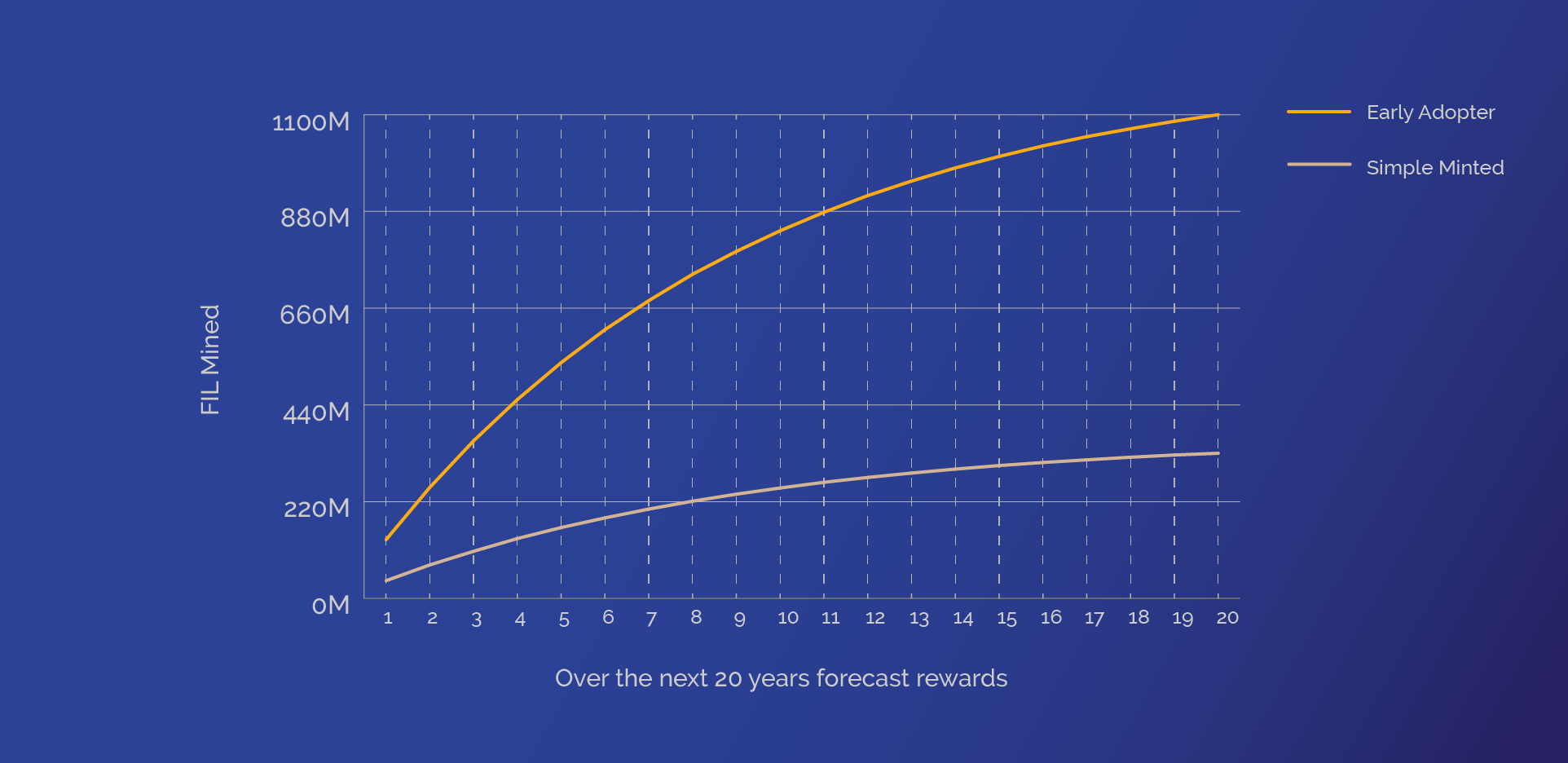

As a means to bootstrap the infrastructure development of the Filecoin network, the protocol itself rewards those who provide storage capacity to the network. You can see below the rate of FIL available for rewards is on “an exponential decay model”, giving a proportionally larger reward to those that adopt early.

Incentives on offer to start early

Source: https://filecoin.io/blog/filecoin-circulating-supply/

2. Skin in the game

Filecoin creates a very attractive proposition to encourage ‘miners’ (Holon being one) to provide storage capacity to the network. In return, ‘miners’ earn a cryptocurrency FIL.

But unlike Bitcoin mining, on the Filecoin network ‘miners’ are forced to first put up Collateral before they can earn rewards. That is, the business model of Filecoin drives miners to have significant skin in the game, whilst adding value to the network through storage capacity.

If a miner wants to earn a lot of FIL from storing data on Filecoin, they will also be significantly invested in the system. In most cases they will need to acquire FIL to scale their operation. This creates a network of participants who are now heavily aligned to the success of the network.

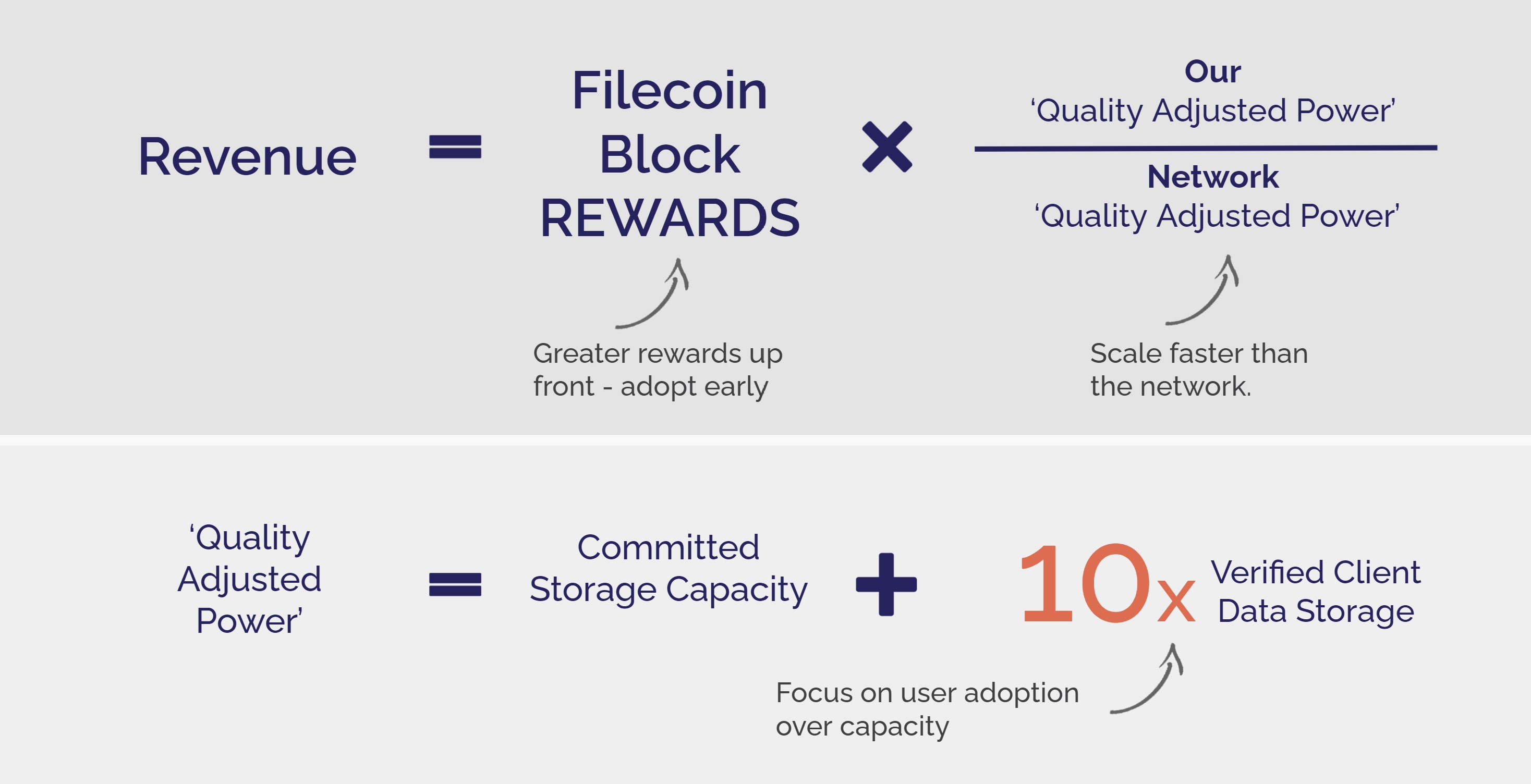

3. Utility over capacity

Another motivator in the rewards system that Filecoin makes is that the FIL rewards are amplified if a miner ensures the data stored is ‘real world’ in nature, that is, not ‘junk data’. You can see below that ‘verified client data’ is worth 10x more than just creating storage capacity itself.

This ensures that the network as a whole is again incentivised for real world adoption over anything else that it is useful to users.

The new network effect business model

The Filecoin business model is generating an ecosystem that is expanding the utility of the network, and in combination with the initial incentive structure, highlights how different investing in Web 3.0 is in comparison to Web 2.0 can be. It requires significant time to understand these incentives, how you can participate in network adoption and at the same time be rewarded.

It is why these networks will grow incredibly fast and why they will likely have very large valuations early. Because, in this case, it is not just the users that need to buy FIL, but the people and companies building the infrastructure, and the incentive machine gives the best chance for Filecoin to disrupt the cloud storage mega caps of today.

Four reasons to register for Livewire’s 100 Top-Rated Funds Series

Livewire's Top-Rated Fund Series gives subscribers exclusive access to data and insights that will help them make more informed decisions.

Click here to view the dedicated website, which includes:

- The full list of Australia’s 100 top-rated funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with expert researchers from Lonsec, Morningstar and Zenith.

- Videos and articles featuring 16 top-rated fund managers.

Mark has spent 10+ years in Financial Services, with expertise in wealth management platforms, Mark has worked across multiple start-ups and founded a digital asset research company before joining Holon as an investment analyst. Mark is focused on...

Expertise

No areas of expertise

Mark has spent 10+ years in Financial Services, with expertise in wealth management platforms, Mark has worked across multiple start-ups and founded a digital asset research company before joining Holon as an investment analyst. Mark is focused on...

Expertise

No areas of expertise