Why free trade matters

President Donald J. Trump is the ultimate paper tiger.

We should not scoff.

Trump can do truly enormous damage to Mexico and Canada.

However, he cannot do a huge amount of damage to China without severely damaging his own economy. He can definitely threaten Europe and start new wars. That is the privilege of being President of the USA, one of the worst trading nations on Earth.

If you act petulant, take your bat and ball, and run all the way home, the question to ask is who should care. The USA is the largest economy on Earth, and certainly the noisiest by a long shot, but it is also among the worst nations at global trade.

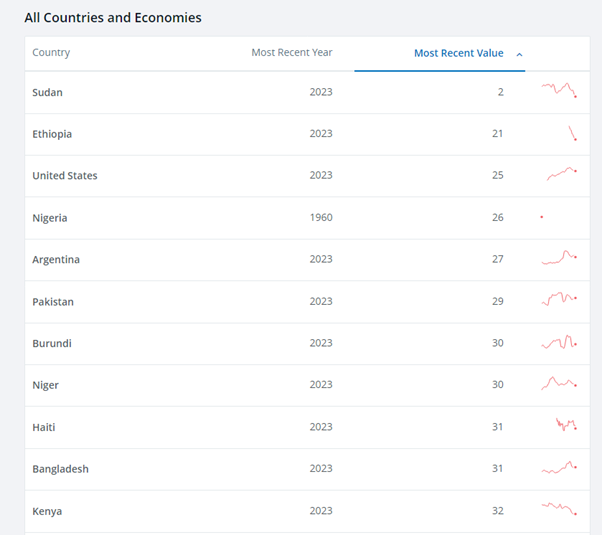

According to World Bank data from 2023, the volume of trade versus GDP for the USA is 25% which is just ahead of Ethiopia and just behind Argentina.

Understand that this is trade in goods and services.

The US global share of equity market capitalization is about 70%.

How can be the USA be so rotten at trade and so richly valued in equity?

This is due to the global division of labor, and where the profits from global activity flow. The USA has built multinationals that can monetize global trade at a level far higher than actual US participation in global trade.

The wealth of the USA flows from monetizing global trade.

There is a word for this: it is called Empire, and we now think it is unwinding.

While the USA did not worry, for many years, about hollowing out manufacturing, and the slow growth of real wages for domestic workers, it now has religion.

The trouble is the rest of the world, and they must be punished to "buy American".

However, corporate America decided that it was better to sell American-designed product, with intellectual property attached, along with licensing fees, and transfer pricing, than American-made product. The profit margins are better that way.

This has led to the current protectionist trend in US politics.

The trouble is that unless you are in the American market, and do not show up in the trade data, you have no real reason to get excited trading with the USA.

The real action in global trade is happening outside the USA in Europe and Asia.

Global trade patterns

This topic warrants a long deep dive, because the investment opportunity is huge.

However, I will content myself with a superficial introduction.

Regular readers of my wires will know that I do not rate the USA as a globally attractive critical minerals market. It is a ho hum waste of time, money, and effort.

Selling rare earths to the USA is pointless because that nation sells them to China.

The financial press in Australia is hopeless.

We can be deliberately superficial because none of this is discussed there.

The Australian financial press is the physical vacuum incarnate.

The important top-level piece of data to consider is global trade market share trends.

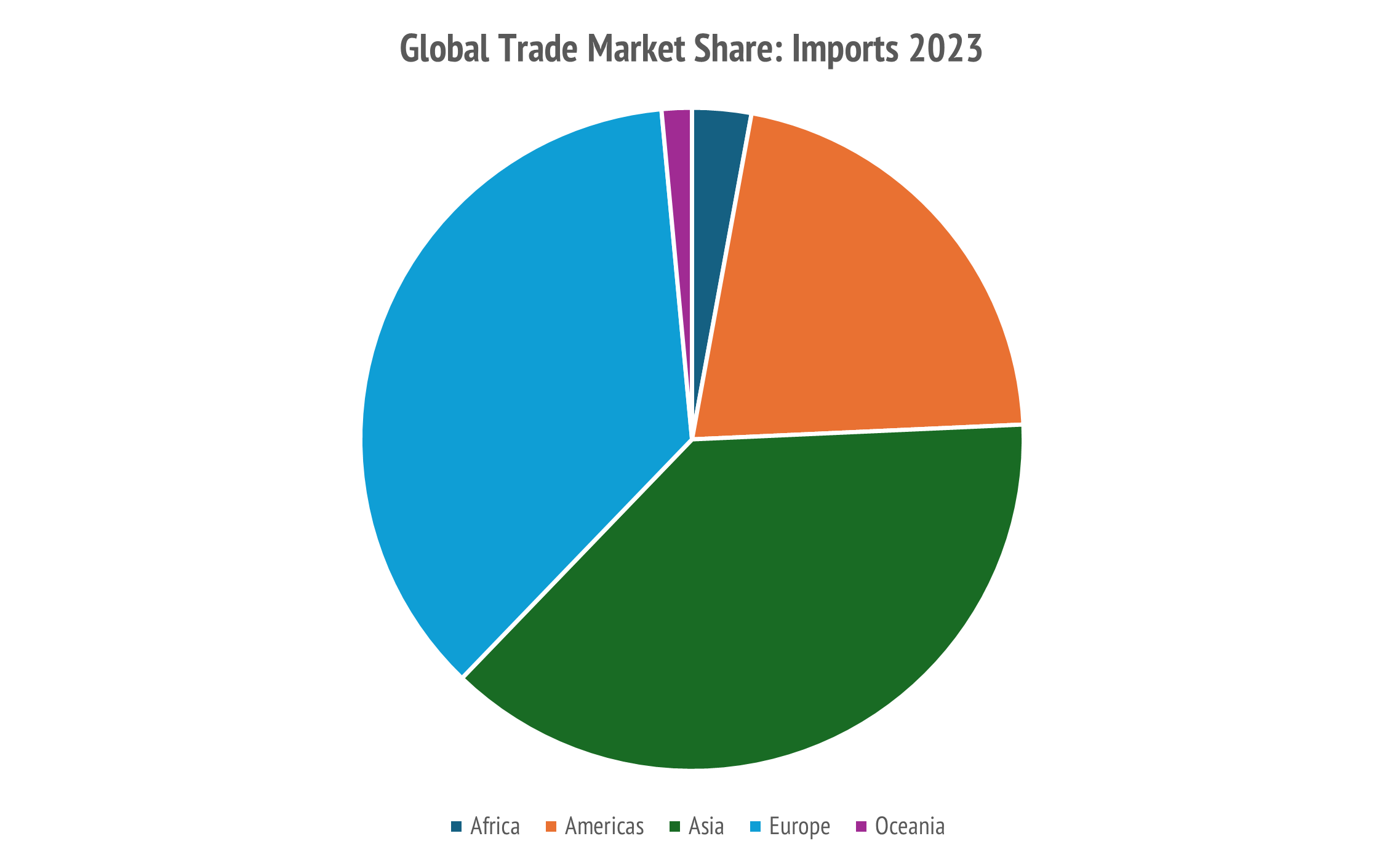

Let us start with the export snapshot for calendar 2023.

Asia and Europe dominated global exports.

Doh! It is all going to the USA.

Okay, let us look at imports, like no Australian financial journalist ever did.

The Americas wedge is now larger, as is the Asian wedge, as we know a lot of exports from Asia wind up as imports in the USA. I used the Americas region to allow for Mexico and Canada.

The fact remains: Asia and Europe dominate global trade.

No matter how you look at it, Donald J. Trump jumping up and down is a sideshow.

What matters is whether American trade is rising or falling.

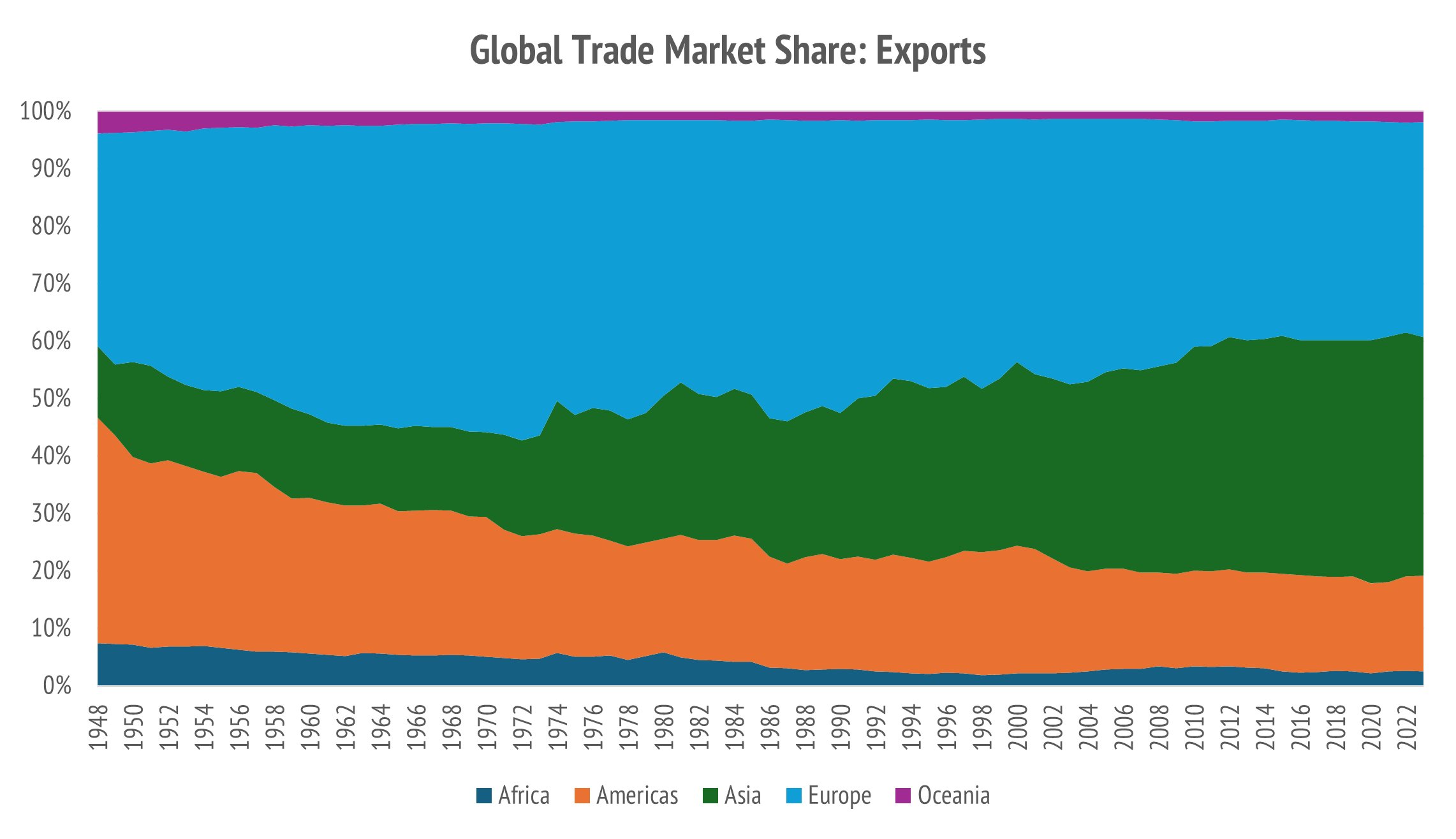

Let us look at export share trends over time.

The Americas and Europe dominated global trade in 1948. The Americas, including the USA, lost market share while Europe held share, and Asia grew share.

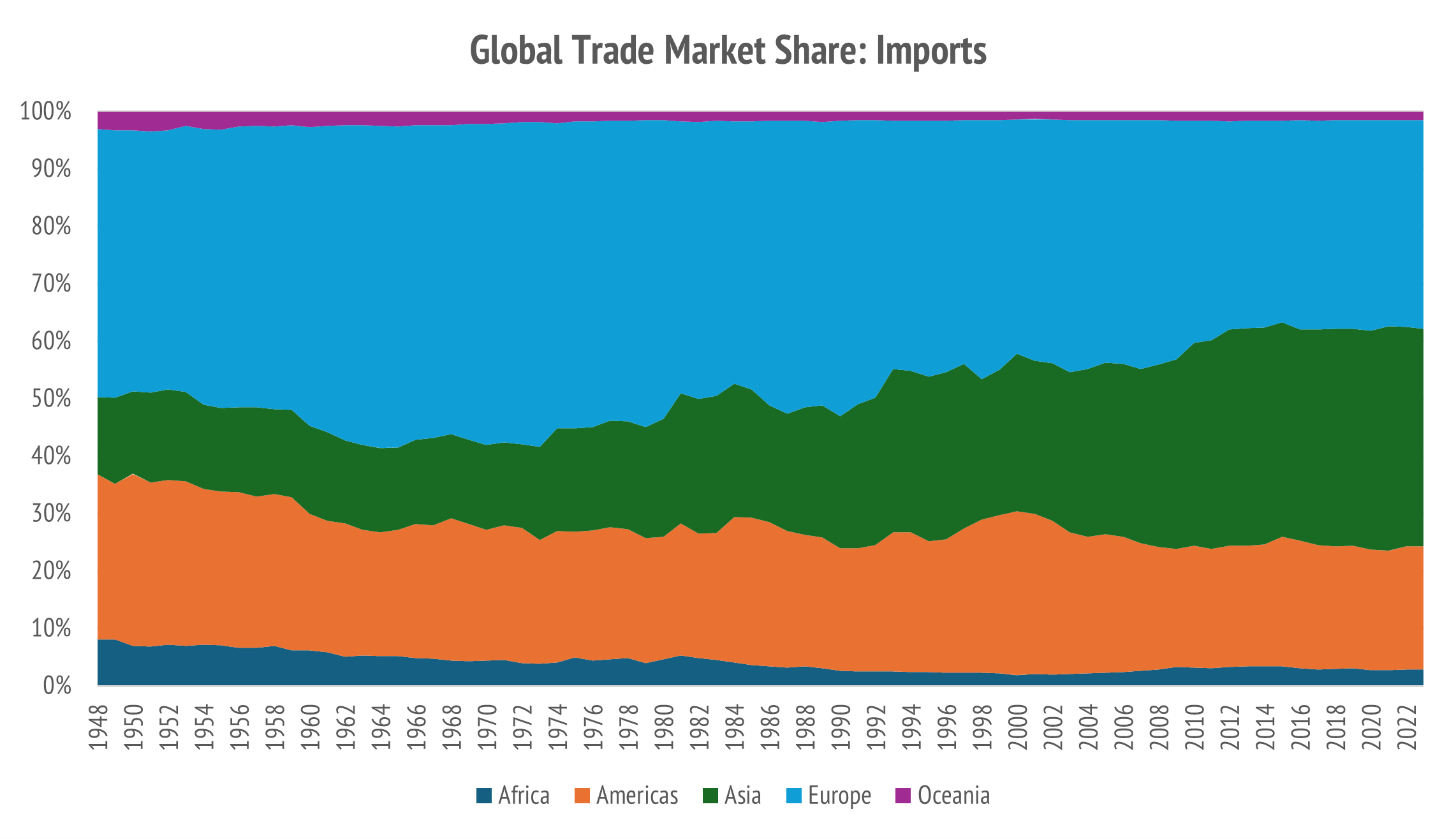

Let us look at import share trends over time.

You can see that, so far as growth is concerned, Asia is where it is at.

The trouble with poor leadership

Australia is the lucky country "blessed" with a poor record of rotten leadership.

Our politicians, journalists, and business leaders jawbone the trends of yesterday and harp on about our least important trading partners.

There are no dollars there, just noise!

The USA is an important partner for Foreign Direct Investment (FDI), which is why they have upwards of 70% of equity market capitalization with such a poor trading record.

Donald Trump is a paper tiger because he does not understand what the USA did well.

The USA is a great capitalist nation. It is a rotten mercantile nation.

China is still working out how to make a profit but is a successful mercantile nation.

Through a complete inability to comprehend what made America rich and successful in the first place, Donald J. Trump is likely to further shrink American global trade.

Conclusion

There are splendid opportunities coming but not for conventional thinking.

Asia is the growth market worldwide.

Asia and Europe are the trading blocs with runs on the board.

While Trump is busy threatening folks with tariffs, to access the US market, sensible business folk will go elsewhere to make money from trade that is welcome.

US trade will shrink. Mexico and Canada will consider their options.

Asia is the best place to do trade.

Stock picks coming.

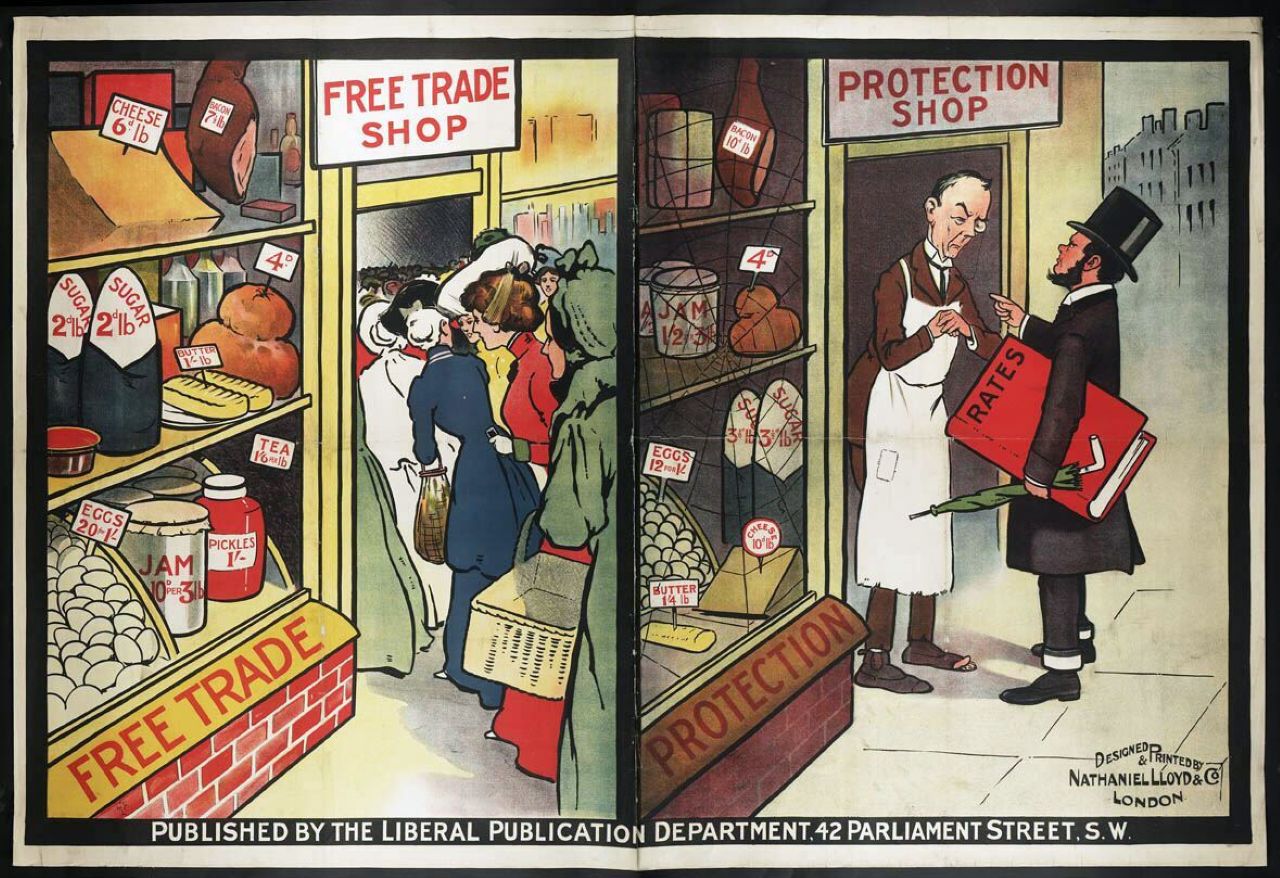

Image: Political poster by the British Liberal Party presenting their view of the differences between an economy based on free trade versus one based on protectionism.