Why froth can't burn your tongue

Spatium Capital

The origin of the term "frothy" - in an investment context - is disputed, but many attribute it to Alan Greenspan. The former Chairman of the US Federal Reserve is believed to have normalised the word in his response to the state of the US housing market in 2005.

Since the global financial crisis, the use of this word when referring to the markets has been looked upon ominously.

In early 2019, the buzz surrounding the state of the frothy ASX was a lasting discussion.

A frothy market is a state in which markets begin trading well above their tangible asset values, often because investors are ignoring fundamentals and making emotionally driven and speculative decisions (periods of which can endure for many quarters, if not years).

The reason frothy markets are often so topical is historically these periods precede a burst of a market bubble.

At least this was the case for the dotcom bust in 2001 and the housing crash (GFC) of 2007-2008. Given the almost two years since COVID-19 first disrupted our lives, perhaps this latest episode is also one for the history books.

The current argument we are seeing is the significant growth and interest in alternative ‘asset’ classes, mirroring the speculation-style dotcom and housing market catalysts for the two most recent frothy periods that preceded a burst bubble.

With our eyes firmly on equities, we couldn’t help but notice that Bitcoin, the most mainstream of the cryptocurrencies, took the quickest time (12 years) to reach $US1 trillion in market capitalisation.

Bitcoin now joins an elite club of trillionaires alongside US household giants Microsoft (44 years), Apple (42 years), Amazon (24 years) and Google (21 years).

Whether cryptocurrency will be the catalyst for the next bubble popping will likely only be realised in hindsight, however at the risk of playing into a false causality (falsely assuming events appear related and therefore causing one another) we prefer to remain impartial and observe.

So are equities frothy right now? When comparing the equity markets amongst peer asset classes, there is some potential explanation to the current upward trend(s) that have occurred.

Considering that many fixed income yields are currently heavily compressed, property rental yields in Australia aren’t shifting nearly anywhere as quickly as the capital growth trend line and that bank term deposits are a heartbeat above zero, there is an argument to suggest that the stock market’s liquidity, prospective growth profile and risk (in comparison to viable alternatives) is the beneficiary of this struggling peer group.

Further, there is an argument to be made that equities, in contrast to some of these alternatives, might fare better in a rising inflation environment – a topic for another wire.

This enduring low yield environment does however shed light as to why some investors have found themselves including cryptocurrency as part of their asset allocation; when looking at the state of asset classes in this current environment the options for return (via speculation or yield) have become suddenly fewer.

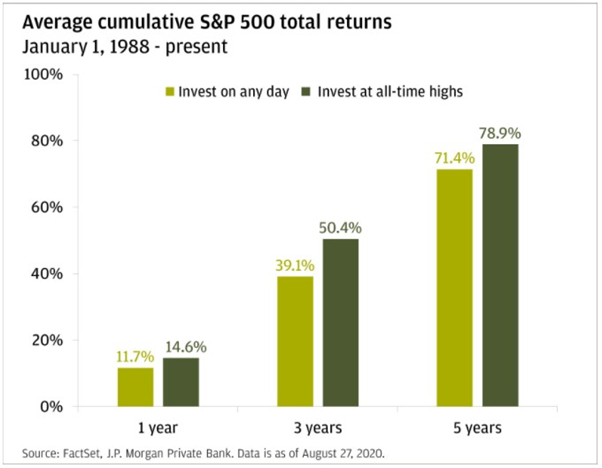

The

final point we would add goes hand-in-fist with frothy markets; investing at

all-time highs. Let’s look at the below graph and reference what JP Morgan

found when investigating all-time highs.

As illustrated, it has been more lucrative over the last 30 years to invest at all-time highs, rather than shying away from these points and thereby attempting to market-time.

We feel this is somewhat of an underappreciated phenomenon; whilst the brain naturally seeks out patterns in charts that highlight drop-offs such as the GFC, or the COVID drawdown (and consequently drives feelings of fear aversion and a flight to safety), it fails to identify the many, many times a market reaches an all-time high, and then continues to rise further.

Startlingly, on average, key markets such as the US S&P500 set 16 new all-time highs a year.

Like with all risk assets, including property, fixed income, shares and others, the long-term success of these asset classes has stood the test of time.

The only true certainty is that diversification and patience are your best friends. Further, if diversification and patience are your best friends, conviction likely follows closely behind.

As a fund manager, we approach each trading day with the pursuit of identifying mispriced equities and not trying to time this up or down movement of the broader index.

Nor do we seek to fluctuate our cash weighting by keeping the fund’s total assets 98-99% invested at all times.

This approach minimises the human tendency to buy assets when prices are rising (and potentially overpaying) and selling when things get scary (and potentially selling at a discount).

By maintaining a smooth and consistent approach to investing, irrespective of the asset class, one can work against this natural tendency.

In conclusion, whilst the market might be considered frothy right now, we suggest in light of the above information that this might not necessarily be a bad thing.

As Peter

Lynch so famously said, "Far more money has been lost by investors

preparing for corrections or trying to anticipate corrections than has been

lost in corrections themselves."

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics

As co-founder and Director of Spatium Capital, Nick has an affinity for physics and mathematics whose principles have influenced the creation of the Fund’s investment strategy. As Director, Nick’s responsibilities are predominantly focused on...

Expertise

As co-founder and Director of Spatium Capital, Nick has an affinity for physics and mathematics whose principles have influenced the creation of the Fund’s investment strategy. As Director, Nick’s responsibilities are predominantly focused on...