Why high stock prices are here to stay

Persistently low interest rates and a structural decline in economic growth mean global equity valuations should remain high for at least the next decade, says Credit Suisse’s Jonathan Golub.

COVID-19’s onslaught since March 2020 has amplified many of the challenges facing markets around the world. But the seeds were sown more than a half-century ago, says the asset manager’s chief US equity strategist, who was a keynote speaker at the Credit Suisse Global Supertrends Forum on Wednesday.

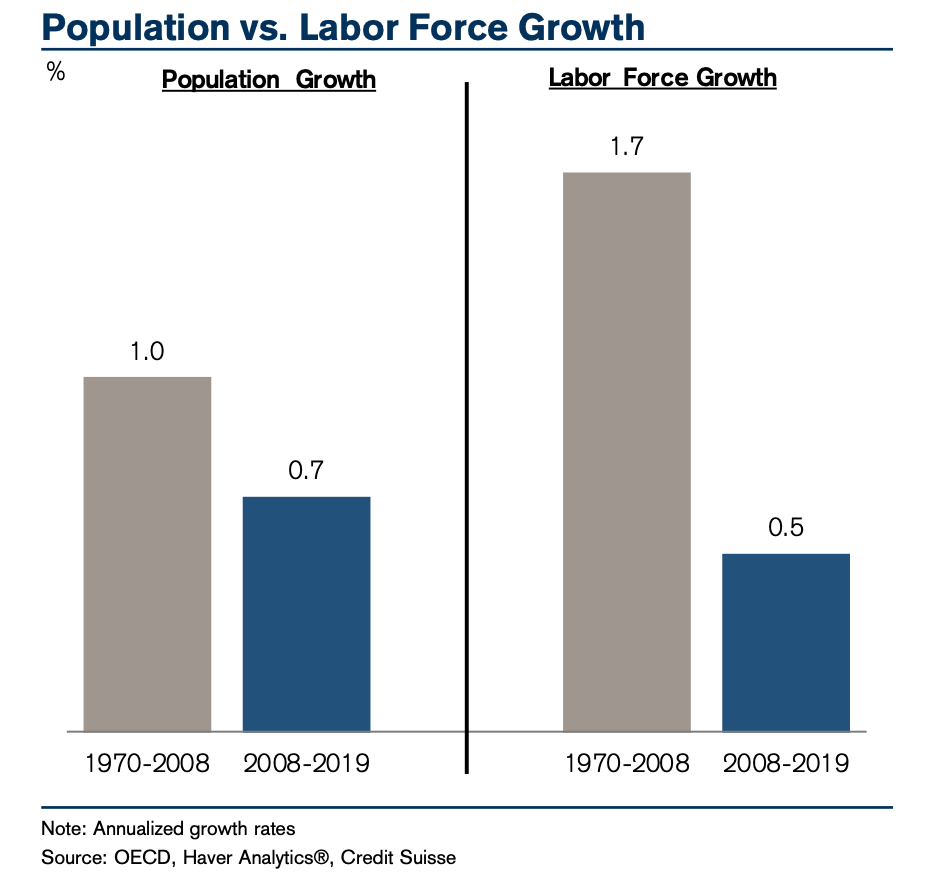

The lower average birth rate since the contraceptive pill was introduced in 1960 is one of the reasons labour growth fell in the period after World War 2. This saw the average number of children per family fall rapidly to 1.75 from 2.5.

“Very simply put, we’re almost forced to have a persistent weaker trend of economics than we had before,” Golub says.

“All else being equal, this doesn’t sound like a brilliant starting point when you think about stock returns.”

Turning to equity market valuations, there are two key views. Historically, periods of high PE multiples have been followed by lower average returns over the following 10 years.

“At a PE of 22.2 today, that suggests the return over the next decade is going to be less than zero – and that’s not giving me a warm feeling,” Golub says.

But the counterargument is that in the past, interest rates have never been this low both in terms of the spread and the yields from 10- and 30-year government bonds.

“That gives you an implied stock market multiple of 30, versus the 22.2 of today,” Golub says.

“The mechanics is what matters…and if you asked me to guess which is correct, my personal expectation is that we will see stock multiples in the mid-20s in the US for the next decade.”

Golub further bolsters his argument by pointing to post-GFC changes to central bank capital requirements and other banking system improvements.

Between 1990 and 2008, the US Federal Reserve believed cash reserves of about 5% of the size of economy were needed. This number was lifted after the GFC and the capital requirement rose to 25% by 2014.

He also pokes holes in the argument that the Fed’s policy of quantitative easing since 2008 will hit market valuations.

“It wasn’t the Fed’s bond buying which caused the problem, it was the actions taken afterwards to try to create economic growth that wasn’t there,” Golub says.

“This increased the balance sheet, but it didn’t actually work.”

And he also finds flaws in the argument that the ballooning debt of global governments – more recently in responding to COVID-19 – will cause stock market PEs to fall.

“In the mid- to late part of World War 2, the US had debt of about 105% of GDP.

“More recently, since 2008-9-10 we’re now seeing debt at about 100% of GDP in the US…and many economists expect this figure will get to 110%.”

While these numbers become “frightening” in their scale, Golub uses the example of Japan’s debt level to explain why he believes US debt will continue growing.

“Why should we expect the US government to stop at 100%. If Japan did this – they’re now at 300% – so why can’t we keep going and going and going?”

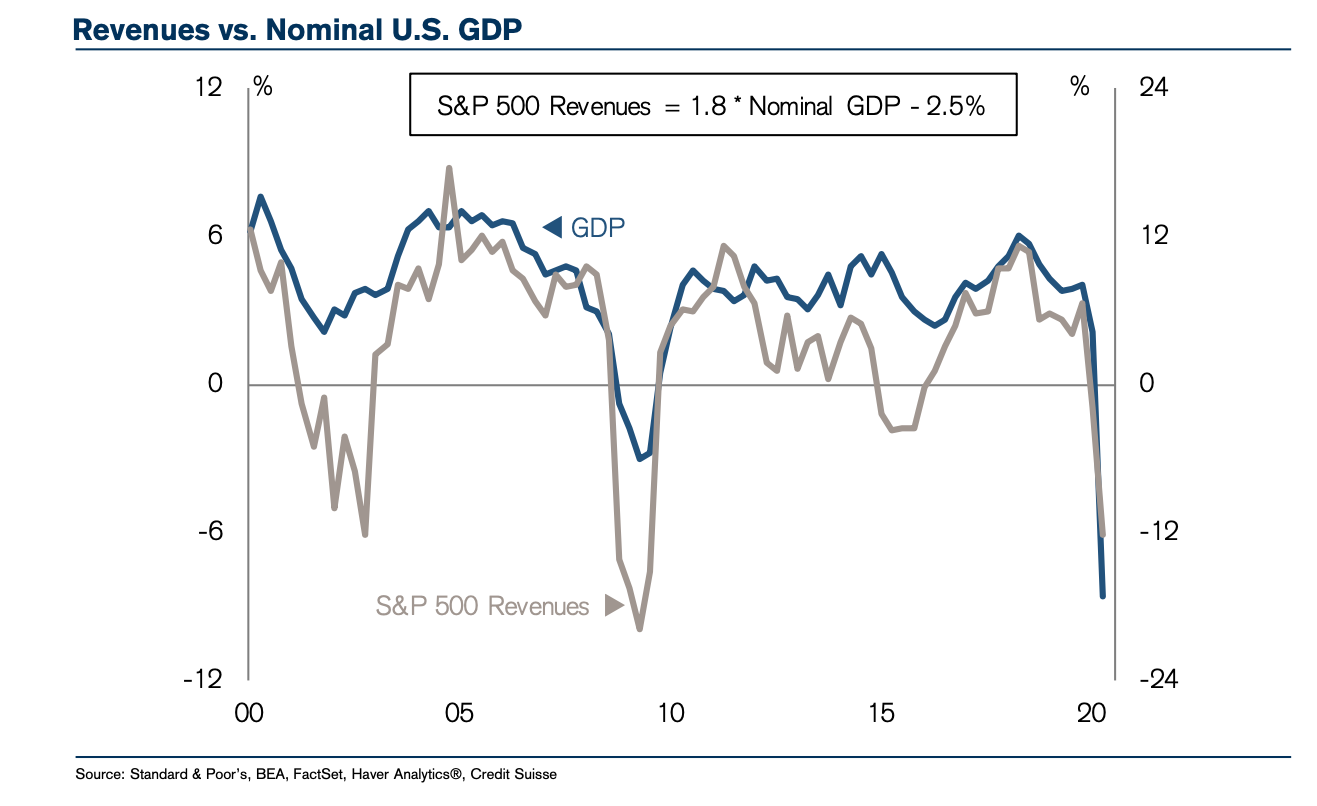

What does this mean for corporate profits?

“Many are going to say that this backdrop is not going to be a positive one for stocks,” Golub says.

“But what I’m saying is that weaker growth, more cashflows and a slightly different makeup of the market, including a lower discount rate, will lead to higher multiples that will be positive for some stocks.”

Growth stocks, and particularly those companies in the technology sector, will be the greatest beneficiaries of the above trends. “They will win versus value stocks and those old-economy companies – and the US has more of the things that are likely to win,” Golub says.

Answering concerns about whether there is another tech bubble inflating: “I don’t see something fundamentally broken,” he says. “I think perhaps this is a setup for something that’s a bit healthier.”

More broadly, Golub says markets are currently trading at attractive buying levels. “Would I be buying now? Yes. But do I think you might have an even better entry point ahead than you do at the moment? That’s probably a yes as well.”

Hit the 'follow' button below to be notified every time I post a wire, and don't forget to also click the 'like' button.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

5 topics