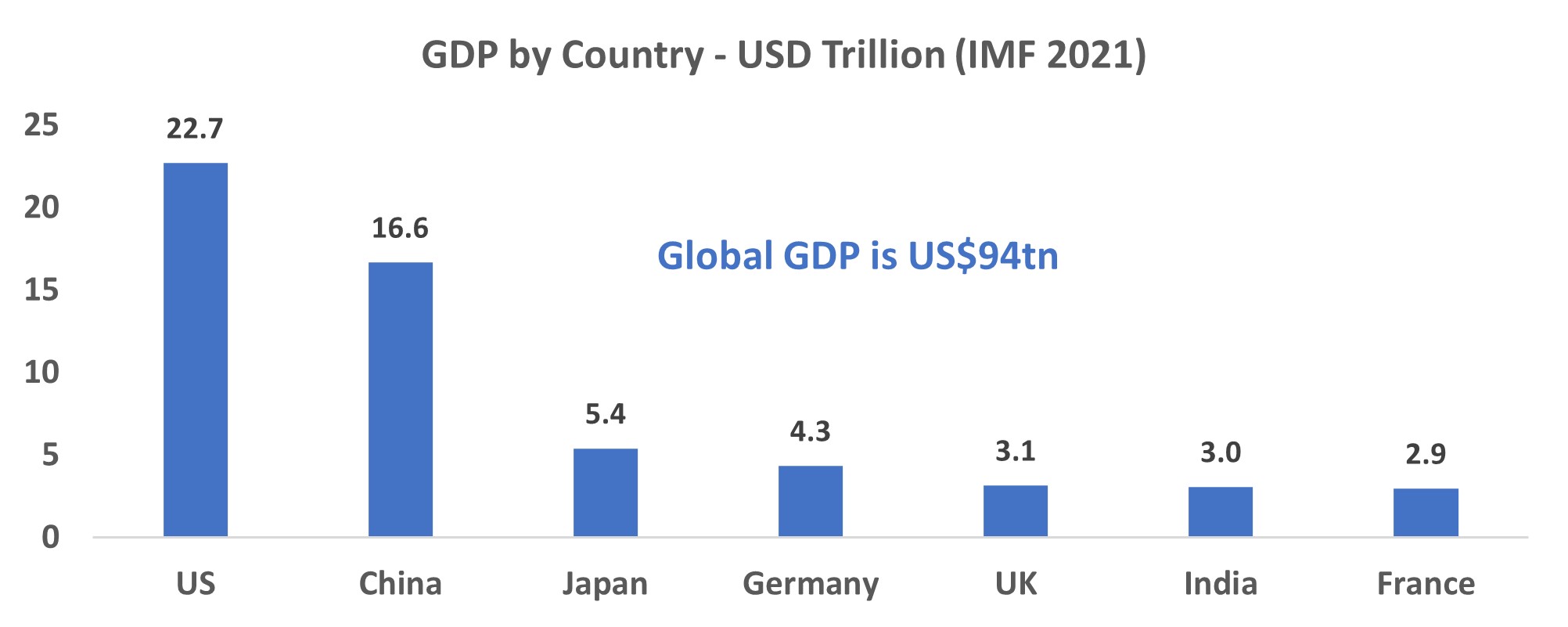

Why India could be third-placed by 2030

India is the world’s sixth-largest economy by GDP (US$3trillion) and is likely to shift closer to being the third-largest by the end of this decade (US$5-7trillion), trailing only the US and China. However, what worked in the past might not be what will drive growth in the future. Dominant themes driving incremental growth of the 2020s is likely to propel India towards economic significance in value and supply chains globally. Being early adopters of these themes can lead to a significant opportunity for investors to create wealth, rather than piling in on what has already been successful.

Source: IMF

Increasingly, the country’s equity markets are attracting investors looking for liquid, less correlated, growth investments, which are underpinned by long-term positive fundamentals of the region. The reforms attempted since the Modi-led BJP Government came into power in 2014 are likely to bring productivity gains in the future through increased financialisation, digitalisation, a broader tax net and better governance and compliance).

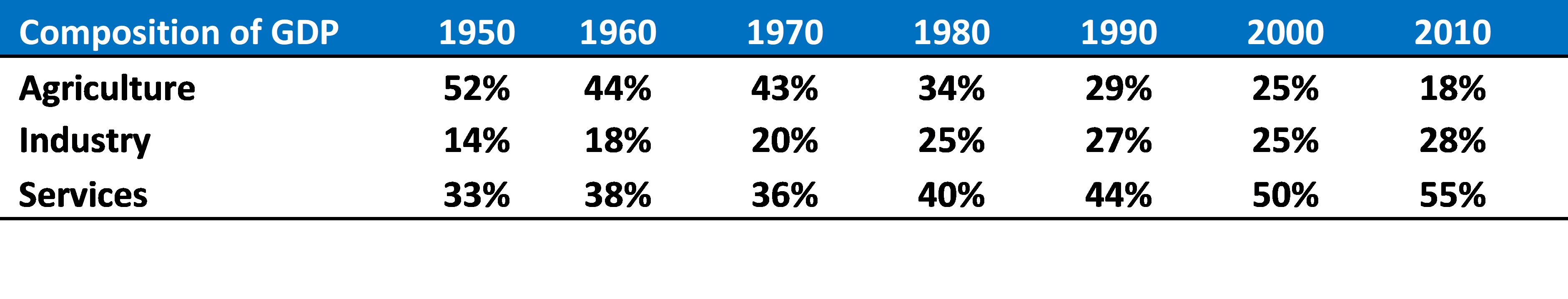

Taking a step back though, India and China were roughly at the same level of GDP in the mid 1980s. However, China went ahead through a more aggressive focus on manufacturing to drive its economy, whilst India pursued services as the key driver of its economy.

If we study the recent history of India, then its growth is dominated in the last 10-12 years post GFC by consumption via credit. This held up the economy whilst low levels of private investment and weak infrastructure, agriculture, and manufacturing sectors, given the high cost of capital and a clogged-up government-owned banking system, led to low levels of capital formation.

Source: (VIEW LINK)

In the last decade in India, growth has been driven by credit-fuelled consumption. This led to the indices being dominated by private banks and consumption companies. Today consumption and banking companies account for 50% of the market cap. Yet the Private Banks in India all trade between 2.5-5x book and Consumption related businesses almost exclusively trade at above a P/E of 40x one-year forward. Foreign investors’ universe of Indian stocks is often limited to these as they do not have the capability to do deeper research on lesser-known companies. Because of this, quite often the conclusion by Global, Emerging Market and/Asian fund managers is that India is an expensive market relative to their broader opportunity set. This is partly true given the compounding growth opportunity of India’s long-term fundamentals but is also reflective of large, liquid and investable companies for big funds being found exclusively among the Top 20 stocks by market cap. That is, they often simply pick their favourite Private Bank, Information Tech or Consumer company in India. Inevitably there will be cheaper options in other regions.

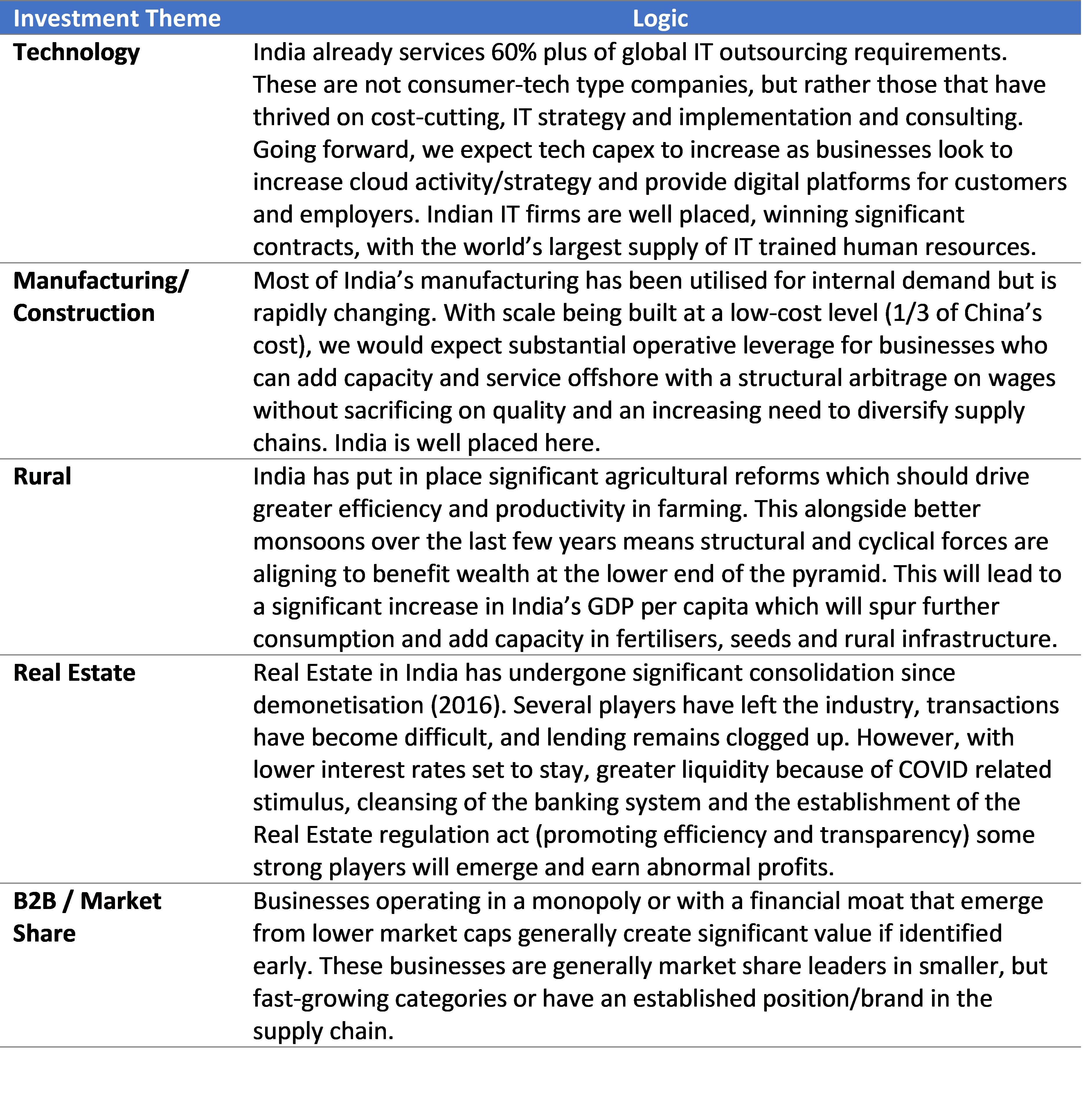

But in the midst of COVID, the most troubled sectors were in consumption and banking, given their significant customer touch business model. While they re-equip themselves via digital platforms (now possible in India through significant digital and financial infrastructure reform), the businesses that are making headway are Manufacturers/Exporters, Globally oriented Cyclicals, Information Technology and Pharmaceuticals. This means most at the top of the market cap tree. This is dominated today by Consumer and Banking stocks but is likely to make way over time for businesses that:

- have built significant scale locally and can export their value proposition overseas much more cost-effectively, or

- already have a significant overseas presence and are increasingly winning large corporate deals from large global corporations.

Going forward, some of the dynamics that played out in the past may not look the same. Why? Because of:

- Poor tax infrastructure,

- high logistics costs,

- low inflation,

- high interest rates,

- non-performing loans,

- poor monsoons,

- lack of private investment.

This combination has meant the manufacturing, export and agriculture sectors were left behind. This resulted in capital formation being poor and capacity utilisation remaining weak.

We are likely to be heading towards a period in which actively managed, high conviction portfolios of 15 to 20 stocks will pay off relative to passive investing. When it comes to India, this can be implemented efficiently in a managed fund to play out themes that should dominate over the decade.

In my view the best way to play the India story over this decade is through an India focused, actively managed, high conviction fund, focused on investment themes which should participate significantly in the incremental growth of India over the decade – this may be different to what drove growth over the last decade. India’s economy is likely to be close to the third largest in the world by 2030 and is a story which should not be ignored by investors.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics