Why invest in ASX tech stocks?

Betashares

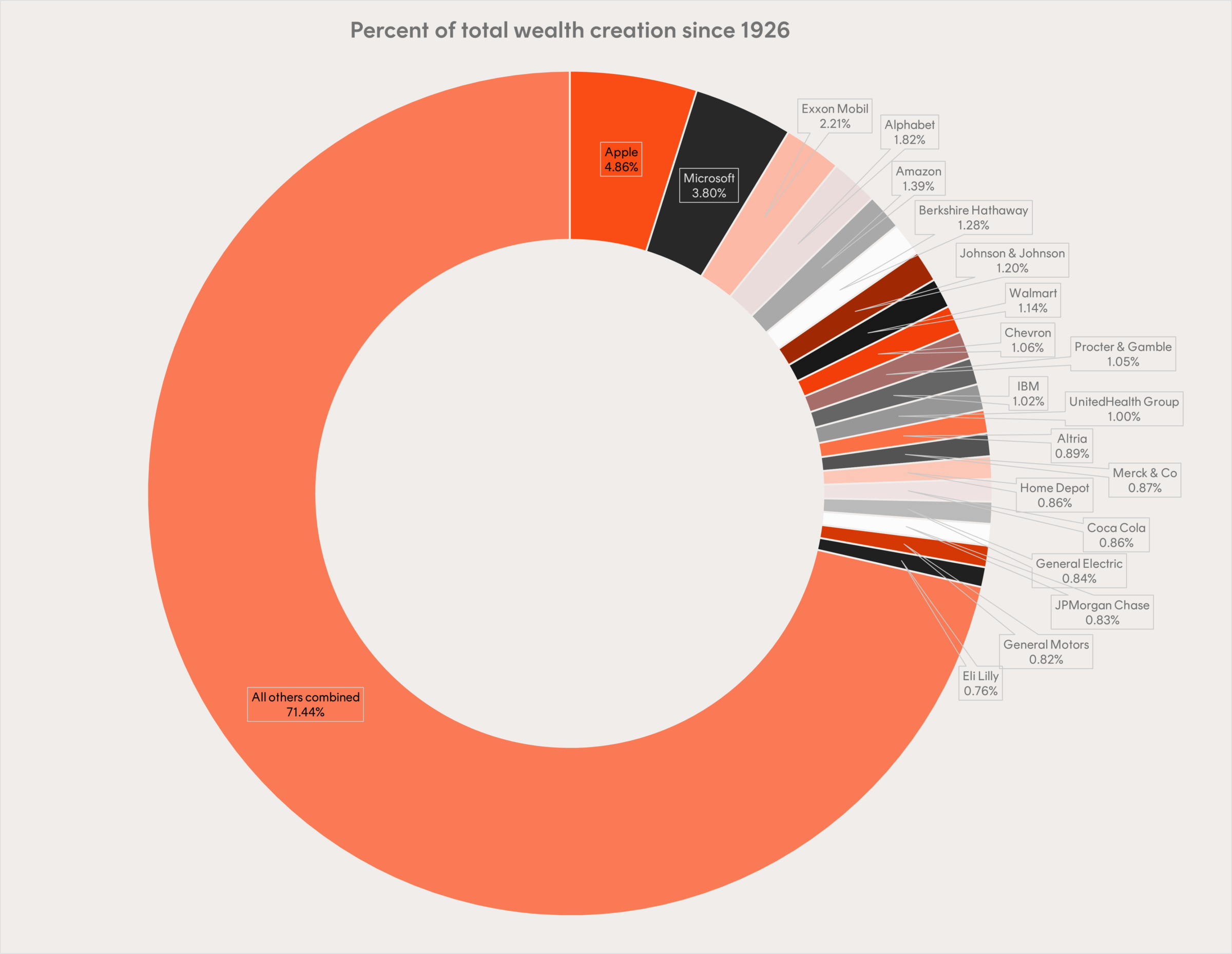

The strong performance of the Nasdaq-100 Index underlines an important lesson. The technology companies can produce big winners. In fact, the tech sector has produced some of the biggest wealth-creating stocks of the past century.

In 2023, Arizona State University business professor Hendrik Bessembinder updated his famous 2017 study, which found only a handful of stocks explained much of the wealth created by the US stock market. His expanded study covered the performance of US stocks between 1926 and 2022. He found that just 72 stocks accounted for half of the net wealth creation since 1926(1).

Of the top five firms with the largest shareholder wealth creation, four were tech stocks. The highest representation by sector. All are household names: Apple, Microsoft, Alphabet, and Amazon.

Source: Hendrik Bessembinder, Betashares.

Australia’s low exposure to tech stocks

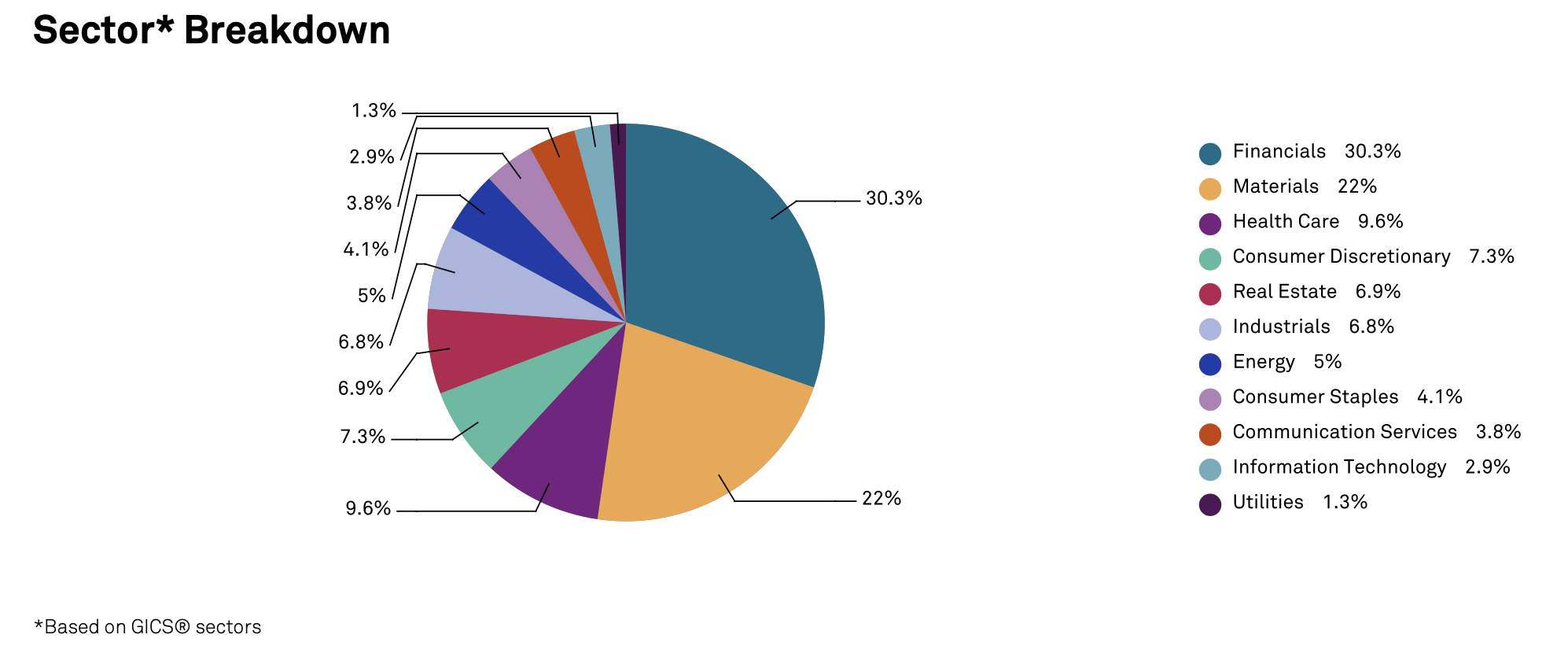

Thus, not having exposure to technology stocks might be suboptimal for your portfolio. This can be a problem for Australian investors, given the low presence of tech stocks in the S&P/ASX 200.

Australia is known for its big banks and big miners, which are reflected in the stock market.

Source: S&P Global, as of March 28, 2024

Financials and materials companies make up over 50% of the S&P/ASX 200. Information technology only 2.9%(2).

For comparison, the same two sectors make up only 15.6% of the US S&P 500 index, while information technology comprises 29.6%(3).

Thankfully, there are ETFs available on the ASX today for Australian investors seeking exposure to local tech stocks.

The S&P/ASX All Technology Index tracks Australia’s leading tech businesses. And Betashares S&P/ASX Australian Technology ETF (ASX: ATEC) is the only ETF traded on Australian exchanges offering exposure to this index.

Let’s canvas reasons why you should consider ATEC (ASX: ATEC).

Australia’s underrated tech sector

- 42 million people visit Carsales websites a month (4).

- 49 million applications are placed through SEEK’s platforms a month (5).

- 2.7 million Australians visit realestate.com.au every day (6).

Australia, despite its association with resources, is home to multiple dominant tech firms. But the local tech sector has flown under the radar. That may be a boon.

The success of the ‘Magnificent Seven’ over the past year has attracted plenty of attention and stoked high expectations. But with these few companies already accounting for large portions of many investors’ portfolios, it may make sense to diversify technology exposures by looking closer to home.

ASX tech sector’s outperformance

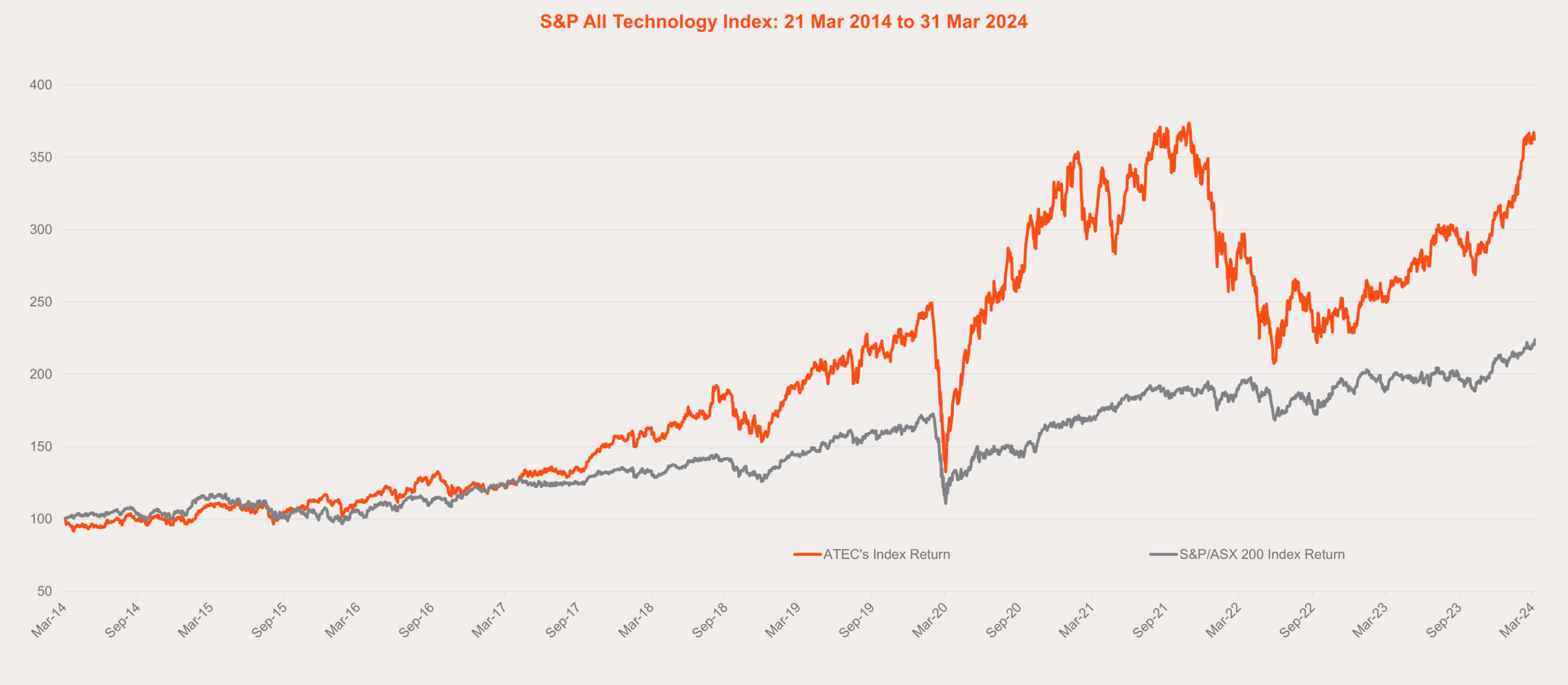

The S&P/ASX 200 Index set a record high earlier this year. Yet it has still underperformed the local tech sector over the last decade.

ATEC outperformed the broader S&P/ASX 200 over the year to March 2024, gaining 40.77%, while the S&P/ASX 200 gained 14.4%. Over the five-year period to March 2024, ATEC’s index returned 13.2% p.a.(7), beating the S&P/ASX 200’s gain of 9.2% p.a..

Source: Betashares, Bloomberg. Since common inception. ATEC’s index inception date is 21 March 2014. Chart shows performance of the S&P All Technology Index and does not take into account ATEC’s management fees of 0.48% p.a. Past performance is not an indicator of future performance. You cannot invest directly in an index.

Tech sector’s strong year

Why the strong outperformance?

Some of this can be attributed to the excitement around the tech sector emanating from the US. Big rallies in the US tend to reverberate locally, too.

Other factors include global excitement about artificial intelligence (AI) and the expectation of falling interest rates.

The US is not the only market featuring AI stocks. Both WiseTech Global (ASX: WTC) and NEXTDC (ASX: NXT) — large components of ATEC(8) — gained in 2023 as investors boosted revenue growth expectations driven by AI. WiseTech was up 35% over the past year. NEXTDC was up 40%(9).

In February, logistics software firm WiseTech reported a 32% increase in revenue and an 8% increase in profits for the first half of FY24. In an earnings call following the results, the company’s CEO and founder Richard White said WiseTech is “putting enormous amounts of investment into forward product development using AI, machine learning, big data, [and] automation.(10)”

And at its latest annual general meeting in November, data centre infrastructure provider NEXTDC also talked up the growth potential of servicing AI demand[11]:

At present, artificial intelligence is stimulating unprecedented demand for data centre services globally. It’s encouraging to note we’re yet to experience AI’s full impact on demand at NEXTDC. The wave of artificial intelligence infrastructure deployment is just arriving in Australia.

Expectations of falling interest rates are helping the sector too as tech stock valuations are highly sensitive to interest rates.

Other factors are home grown.

Australian tech companies like Carsales (ASX: CAR), REA (ASX: REA), Xero (ASX: XRO), and SEEK (ASX: SEK) hold dominant market positions in their segments. Their competitive advantages lead to strong operating margins and pricing power.

There is local innovation, too.

Take medical imaging software firm Pro Medicus (ASX: PME), one of the largest components of ATEC(12). Pro Medicus has been a quiet success story, gaining over 8,000% since listing in 2000. It has continued to grow sales each year, cementing a leading position in its industry. FY25 analyst estimates have the firm boasting a Return on Equity of 48.8%(13).

Tech stocks may grow further

In the long run, stock prices tend to follow earnings. And many of Australia’s leading tech stocks — like Pro Medicus — are highly profitable. This bodes well for the long-term potential of many of these businesses and the sector as a whole.

For instance, constituents of ATEC’s index are expected to outpace the sales and earnings of S&P/ASX 200 constituents.

As of 10 April 2024, consensus estimates have ATEC sales growing 17.4% in CY24, 9% in CY25 and 9.3% in CY26. Yet S&P/ASX 200 sales are expected to rise only 4.5% in CY24, 2.8% in CY25 and 3.8% in CY2614.

Summing up

With the nascent adoption of AI, cloud computing, big data, automation, and the internet of things, there’s a good chance that the next decade’s major winners will come from the tech sector.

Despite Australia’s sharemarket skewing heavily towards financials and resources, investors can gain direct exposure to Aussie tech stocks via ATEC.

Gain exposure to leading ASX technology stocks

All investing involves risk. Tech stocks, especially, are not immune from volatility. But you don’t have to pick individual winners. In one trade, investors can gain exposure to a basket of leading Aussie tech companies. Investing in the tech sector as a whole mitigates stock-specific risks through diversification. Why seek the needle when you can buy the haystack?

There are risks associated with an investment in ATEC, including market risk, technology sector risk and concentration risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available at (VIEW LINK).

References:

- Source: Shareholder Wealth Enhancement, 1926 to 2022. By Hendrik Bessembinder, W.P. Carey School of Business.

- Source: S&P Global Indices.

- Source: S&P Global Indices.

- Source: carsales.com FY23 annual report. Retrieved via MarketIndex.

- Source: SEEK FY23 annual report. Retrieved via MarketIndex.

- Source: REA Group FY23 investor presentation. Retrieved via MarketIndex.

- Source: Bloomberg, Betashares. ATEC’s index performance has been adjusted for ATEC’s 0.48% p.a. management cost. Past performance is not an indicator of future performance. You cannot invest directly in an index.

- As at 11 April 2024.

- Source: Bloomberg. As of 11 April 2024.

- Source: WiseTech transcript accessed from MarketScreener.

- Source: NEXTDC transcript accessed from MarketScreener.

- As at 11 April 2024.

- Source: Consensus estimates compiled by MarketScreener. Return on Equity is calculated by dividing net profit after tax by net equity.

- Source: Bloomberg, accessed on 10 April 2024.

8 stocks mentioned

1 fund mentioned

Patrick is the Editorial Director at Betashares and a member of the Investment Strategy and Research Team. He has over 15 years of finance and financial media experience with past roles at Livewire, netwealth, Link Group, and others.

Expertise

Patrick is the Editorial Director at Betashares and a member of the Investment Strategy and Research Team. He has over 15 years of finance and financial media experience with past roles at Livewire, netwealth, Link Group, and others.