Why investors have a lot to look forward to for the next 18 to 24 months

After a disastrous year in 2022, fixed income has exploded back onto the scene in 2023. While rising interest rates have wreaked havoc on equities markets, three-year bonds, for example, just hit a 12-month high, while term deposits and bank accounts are now paying up to 5.2% on your savings.

But how long can the good times last?

Well, according to Roy Keenan, the co-head of Australian Fixed Income at Yarra Capital Management, income investors' jobs have become a whole lot easier - and are likely to stay that way for the next two years.

"Roughly 70% of my portfolio is floating rate - so it's happy days for an income investor," he said.

That's despite Keenan believing the Reserve Bank of Australia has gone "too far" in terms of its last rate increases - which may result in the Australian economy sinking into a recession. It also comes in the face of a weakening consumer and several high yield companies struggling with higher levels of debt.

So, as part of Livewire's fifth annual Income Series, I sat down with Keenan to learn more about his read on the market, as well as where he is finding opportunities (and seeing risks today).

Plus, he shares why he isn't ready to pull the trigger on risk... yet.

Note: This interview was recorded on Thursday 8 June 2023. You can watch the video or read a summary below.

The Reserve Bank of Australia has gone "too far"

While Keenan admits he hasn't been surprised at the direction of interest rates over the past 15 months, he has been, however, perplexed by the extent to which the RBA has lifted the cash rate.

"In our view, the last couple of tightenings have probably gone too far," he said.

This means there will be some economic impact - whether it be a local recession or not.

"I think for us, because we are credit investors, we need to assess how companies and consumers perform in that environment" He explained.

"What's quite unique about this part of the cycle is that Australian companies and corporate Australia more generally has actually entered this cycle in really good shape...

"But we can see, looking 12 months out, if there is a recession caused by a policy mistake, then we need to start thinking about where we're investing. In some ways, we're defensively invested as a credit investor today, and we're getting really ready to pull the trigger on adding some risk."

However, it's not the right time to add risk.

"We're trying to avoid consumer discretionary and consumer finance, but we are happy with some sectors of the property market. For us it’s not just about assessing when's the time to add risk, but where we want to invest," Keenan said.

"It's trying to pick the right timing, trying to find those relative value trades out there."

Are current levels of yield sustainable?

In a previous interview, Keenan hinted that high levels of yield were likely to be a strong theme in 2023. But how long can that be sustained?

"That's changed in the last few weeks," he said.

"I think if you'd asked me that a couple of months ago, I would've said we're going to really have to work hard to protect that income. But with cash rates going to 4.1%, and three-year bonds recently hitting a 12-year-high, it's hard to see this not being sustained for the next 18 to 24 months."

“That makes my job easier since my fund is 70% floating rate.”

So where are Keenan and his team identifying the best opportunities to take advantage of this high yield landscape today?

"We've got 106 securities in the portfolio today from 50 issuers," he said.

"What we're looking to try and achieve is a diversified portfolio. We're obviously happy to invest in high-quality companies and allocate more of our funds to them."

In comparison, Keenan is allocating less capital to lower-quality companies with higher yields - "just in case something goes wrong."

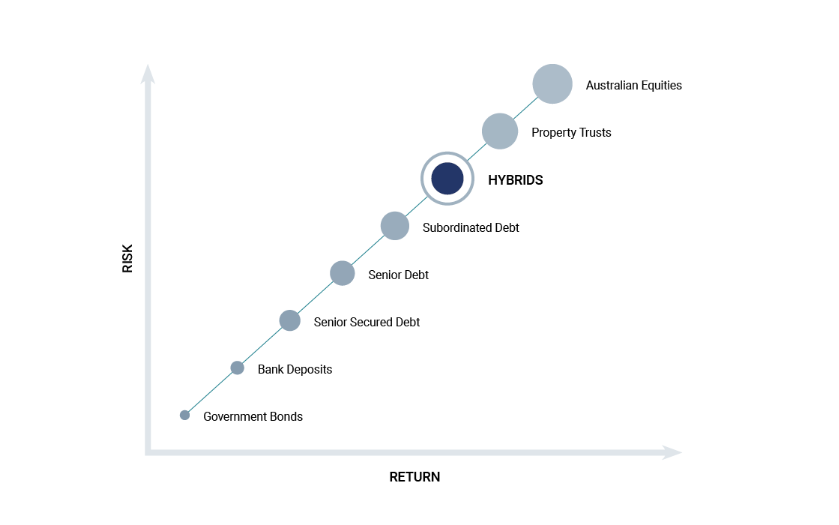

"The more risk you take, the more return you want," he said.

"If you look at the bank capital structure, you obviously start at term deposits. You can have covered bonds, RMBS from a bank, senior securities, tier two and tier one.

.png)

"We are trying to find that relative value, and ultimately my goal is to get paid for the risk I'm taking. If I'm not getting paid for risk, I won’t invest there."

However, sometimes the capital structure gets "out of whack", creating opportunities for astute investors on the hunt for value.

"That's where we're looking for that relative value trade," Keenan added.

Where Keenan is finding the best value income opportunities

With three-year bond yields at 12-year highs, Keenan and his team do not have to stretch when it comes to duration.

"We currently have the fund at about 1.5 years' interest rate duration," he explained.

"That protects my credit fund, because if the economy doesn't do well and goes into recession, you’ll then see interest rates start to turn and markets rally as central banks start to ease.”

If this does occur, you could end up seeing the credit cycle deteriorate. So having some interest rate exposure can protect investors from losing out on these credit investments.

"In today's environment, a good place to be is in investment grade, compared to high yield," Keenan said.

"If you look back through history, especially in the US, which has a lot more historical credit data than what we have, it tells you that investing into investment grade companies at this point of the cycle is the place to be."

This is because they are less inclined to experience defaults - and thus are safer than high yield investments which may have less pricing power, are more geared and have higher borrowing costs as interest rates rise.

"We just don't think it's the right time to be allocated to high yield at the moment," Keenan added.

"I'm defensively positioned, so if a good deal comes along, which might have a little bit more risk priced correctly, I'm going to be happy to look at that because I've got higher elevated levels of cash."

Keenan's read of the fixed income market

At this point in the market cycle, Keenan believes it's important for investors to take a holistic view - particularly when investing across the fixed income spectrum.

"Obviously, the consumer is a bit distressed at the moment, especially with higher mortgage costs," he said.

"But we're also seeing higher gearing in high yield private credit [assets], where there are lower credit ratings. Companies are starting to struggle with the amount of debt they have alongside higher interest costs, at a time when consumers are starting to struggle."

This means we are just starting to see some businesses take a hit to revenues, while margins are becoming more compressed and higher costs continue to funnel through.

"That being said, we think there are some really good opportunities out in the market, especially in the Residential Mortgage-Backed Security (RMBS) space. Across our business, we're probably running the highest risk we've had in RMBS for a while. We've also been allocating to fixed-rate tier two securities, which we think is a really attractive segment of the marketplace."

Access to regular, stable income

The Yarra Enhanced Income Fund seeks to deliver higher returns to investors than traditional cash management and fixed income investments. Learn more via the Fund profile below, or by visiting Yarra Capital's website.

1 topic

1 fund mentioned

1 contributor mentioned