Why is sustainable investing so difficult?

We complete our sustainability portfolio with defensive exposures in water, waste management, recycling, energy storage, and renewable energy, alongside our previous critical mineral selections. Our goal is to keep this updated over time, to serve as a satellite equity allocation to go alongside the more traditional value or growth core portfolio.

In this research note, we complete our earlier survey of the ASX-listed stocks that are most relevant to the energy transition, and sustainable investment. Unlike, Environment, Social and Governance (ESG) approaches to scoring companies on behaviour, we focus on the systematic examination of which firms produce products essential to other firms when navigating the energy transition. These are firms in: materials; engineering; building fixtures; waste and water management; recycling, mobility; and the generation and storage of electricity.

The stocks selected are:

- Sims Ltd SGM.AX

- Cleanaway Waste Mgmt. Ltd CWY.AX

- Infratil Ltd IFT.AX

- Beacon Lighting Group Ltd BLX.AX

- Reece Ltd REH.AX

- Meridian Energy Ltd MEZ.AX

- Genex Power Ltd GNX.AX

Our research list comprises all ASX-listed firms capped over $200M AUD and $200K average daily liquidity with some widely held firms excluded, and a few smaller companies included for completeness.

Ethical Considerations

The market offers a limited selection of investments

that reflect historical choices, sometimes from long ago, and in a different

social and economic setting. Our approach to investment ethics hews

closely to the principle of least harm. Choose that option for an

essential societal input, like energy, that does the least present harm, and

advocate for improvement wherever new investment can replace old plant.

Sustainable investing is difficult because pragmatic choices and trade-offs to

reach net-zero are hard.

Thematic Process for Cleantech

Traditional portfolio management tends to focus on the growth, value, or quality dimensions of equity market investments. These approaches are tried and true, up to a point, but tend to founder when there is a major structural change in the marketplace.

When the key driver is behavioural change, we can find ourselves at sea with what to do. The energy transition, and adoption of cleaner and less material intensive means of production, is a prime example.

Certainly, we expect new technologies to play a very strong role in helping the world achieve necessary net-zero emissions targets. However, changes in the marketplace, and basic human patterns of activity may be equally important. The recent pandemic has taught us to value time alone when the face-to-face meeting became supplanted by videoconferencing and work-from-home patterns of collaboration.

Our investment philosophy is simple:

Changes in human behaviour drive long-term opportunity.

This may seem like a tautology, but the key idea is that old ways of behaving are symptomatic of old ways of looking at the world. When new behaviours start emerging, it is helpful to name these, and to form new categories to help organize our thoughts.

The availability of investment opportunities will not change just because we think up some new names for existing activities. However, the creation of new thematic categories, new labels for every stock, alters how we are likely to think about the world.

To adapt an old, but wise, adage:

Think the change you wish to see in the world, and let your words be the catalyst for such change.

In simple terms, once we name the investments we wish to see, it becomes easier to see which ones are in short supply. Those are the likely growth areas.

Conceptual Drivers of the Energy Transition

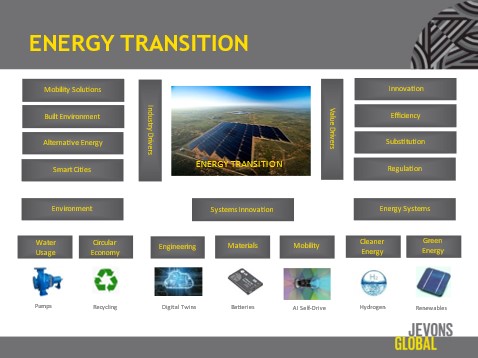

The behavioural changes we can identify today are depicted in Exhibit 1. The global carbon footprint is due to natural and anthropogenic sources. We have little control over the former but can reduce the latter. The concrete industry drivers involve capital equipment choices, such as zero-emission vehicles. The abstract value drivers relate to how society chooses to incentivize better solutions to existing problems via innovation, the pursuit of efficiency, substitution, and regulation.

This framework naturally leads us to identify three broad categories for mitigation, Exhibit 2:

- Environment

- Systems Innovation

- Energy Systems

The first refers to better use of scarce resources, like water, and better management of waste. The second involves rethinking the built environment, our use of natural resources, via materials, and the mobility systems employed to move people and goods. The last relates to non-recyclable energy systems. The laws of physics ensure that energy is used up, and or degraded in physical systems. However, we can use renewable energy sources, low carbon sources, and make use of energy storage to better match supply and demand for intermittent sources and sinks.

The resulting lower-level categories are:

- Water Usage

- Circular Economy

- Engineering

- Materials

- Mobility

- Cleaner Energy

- Green Energy

Of course, within each we can further sub-divide the activity description of different mitigation avenues. For instance, under mobility, there are innovations possible across all major systems from road, sea, air, and rail. These may involve new materials, due to the need to store electricity in batteries, or small molecules like hydrogen, as a cleaner fuel for ships and aircraft. The problem is to recognize how rethinking the system requires the coordinated development of supporting changes. Flanking the role of systems innovation, are environmental goods and services, such as clean water, waste management, and recycling. Simple changes, like fixing water or gas leaks in piping, and design of products for end-of-life recycling, could make significant contributions to system wide efficiency.

Finally, we consider energy systems, which may involve renewable energy, or better use of an existing energy source, such as natural gas. The role played by fossil fuels today is energy storage. The oil, gas, and coal we burn today are effectively the fossil remains of ancient sunlight that was fixed in a process of photosynthesis. Alternatives include the storage of energy using batteries; compressed air; pumped-storage hydro; heat pumps; flywheels; regenerative braking; and electrolytic hydrogen produced from water with renewable electricity.

Selecting Appropriate Investments

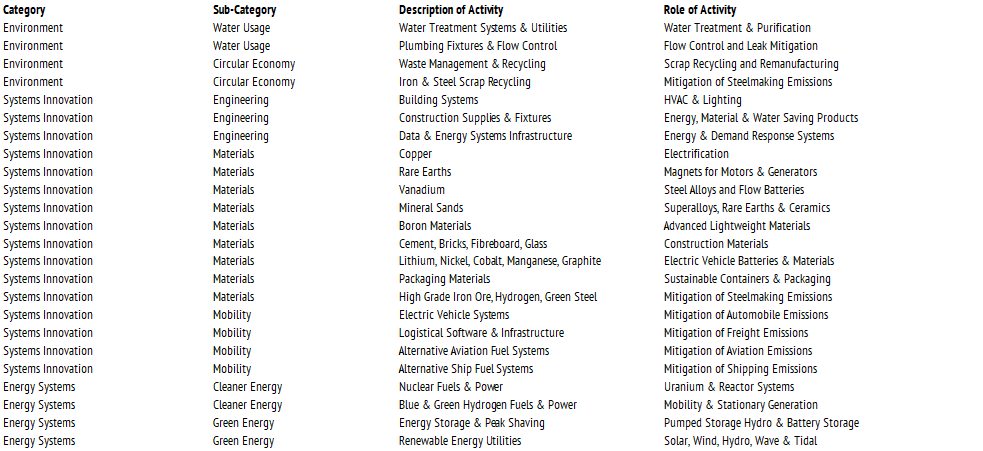

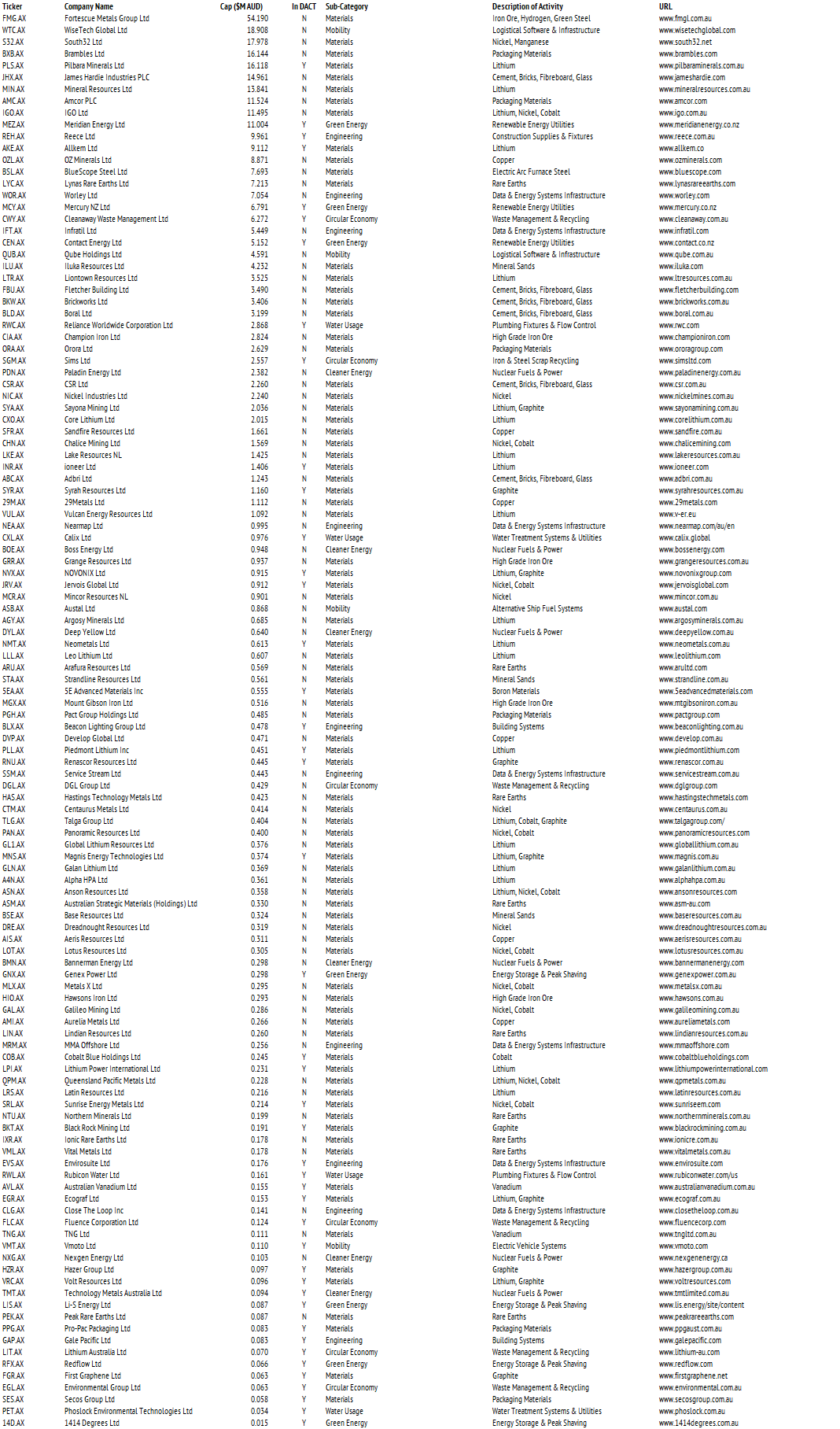

Using the above classification scheme, we made a keyword-based search across all 2000+ ASX listed companies to identify all target companies, which met a basic requirement of $200M minimum market capitalisation, and $200K minimum average daily traded value. In categories like energy storage, we allowed some companies below the $200M limit, as new battery technology is still under development. A comparison with the Deloitte Australia CleanTech (DACT) Index is included in the following tables.

Large companies like BHP Ltd, Rio Tinto Ltd, AGL Energy Ltd, and Origin Energy Ltd, were excluded. Included are Fortescue Metals Group Ltd, for their Future Facing Industries (FFI) initiative, Mineral Resources, for their lithium mines, and BlueScope Steel Ltd for their electric arc furnace business.

The lists are shown below at Exhibit 3.

Stocks that are in the Deloitte Australia Cleantech Index are shown with a "Y". Our classification is independent of theirs and does not match across all areas. This is to be expected as we do not necessarily approach climate change mitigation in the same way. the main difference is that our classification is more engineering and materials focused with a systems perspective on how many interrelated changes are required to achieve net zero.

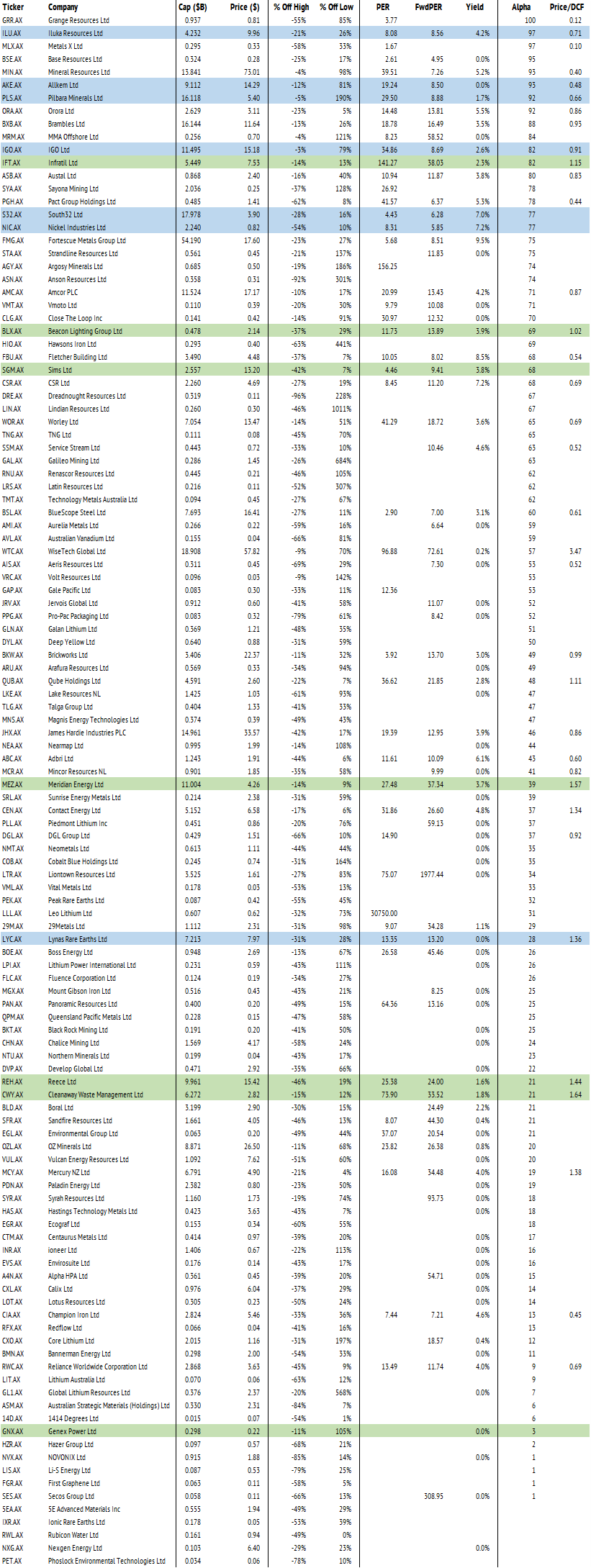

The following Exhibit 4 shows the current alpha rankings from our quantitative models. The lines in blue represent our previous recommendations for critical minerals (the electric vehicle seven). We supplement these selections with another seven in green to fill out the missing sub-categories in Exhibit 2.

Our Circular Economy selections are Sims Ltd for metal, and Cleanaway Waste Management Ltd for general recycling. Infrastructure firm Infratil Ltd, lighting firm Beacon Lighting Group Ltd, and bath and household fixtures firm Reece Ltd fill out the Engineering category. Finally, renewable energy utility Meridian Energy Ltd and pumped storage hydro firm Genex Power Ltd cover Green Energy. Reliance Worldwide Corporation Ltd remains a possible exposure in Water Usage but we defer that currently due to the weak housing market.

Sustainable investing is hard because ESG ranking systems so not guide us to consider which firms and activities will actually make a difference to emissions and materials usage. We need better stock classification schemes to surface where the real investment needs to go.

Clearly, there is a lot more that can happen in energy storage and renewable utilities, but we can take some comfort that Australia is very well positioned in critical minerals. Hydrogen is a work in progress, and we hope to review Fortescue Future Industries in a later note.

Your thoughts and comments are welcome. Please like the article if you wish to see more.

The full report is available for download at the button below.

Image Credit: Photo by ActionVance on Unsplash

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

7 stocks mentioned