Why it might be time to take profits on supermarkets

Keeping one's pantry well-stocked (and getting in enough toilet paper to supply a regiment) was a key focus for most Australians during the height of COVID lockdowns last year. Unsurprisingly, this was reflected in the record-breaking sales figures among Australia’s biggest listed supermarket brands, Coles (ASX: COL) and Woolworths (WOW).

The “supermarket stalwarts” reported sales growth of 7.3% and 10.6%, respectively, for the first half of 2021 on the back of stuck-at-home Aussies hoarding rice, pasta and toilet paper.

An uptick in alcohol sales also drove sales growth for the pair, with each owning sizable liquor businesses – including Dan Murphy’s and BWS at Woolies, and Liquorland and Vintage Cellars at Coles.

However, the big concern leading into the first-half earnings season for the two leading incumbents was profitability.

Heightened costs linked to COVID-19 measures – including more staff, boosted cleaning schedules, refitting of checkouts with screens and personal protective equipment – have more than offset the sales gains of grocery retailers in other markets around the world, says Martin Currie Investment research analyst James Power.

“Through covid, our expectations were similar to many others: that sales would be really strong, but there were a lot of questions around profit margin because of what costs had done,” says Power.

“But I was pleased that both companies took the opportunity to drive sales during COVID, and they were also able to grow profit margins, that was one of the main things obvious from the latest results.”

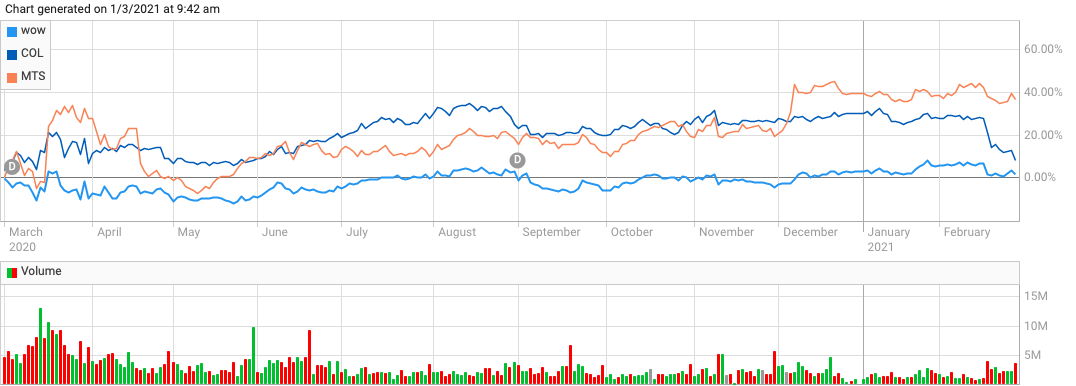

Share price comparison of WOW, COL and MTS over 12 months

Source: ASX

Which of the grocery sellers won?

Shopping habits were turned on their heads during the pandemic. Online sales skyrocketed; store visits plummeted, and CBD locations suffered while locally-based suburban stores thrived.

Martin Currie’s Power says Woolworths’ stronger online presence and supply chain benefits saw it triumph over Coles during the half. The fact that a higher proportion of Coles stores are located in malls – which many were forced to avoid during lockdowns, habits that have continued to some degree – also dented Coles’ relative performance.

“The big thing we’re all watching now is how quickly shopper habits will normalise. It is happening, but very slowly,” Power says.

“It all depends on the degree speed and size at which normality returns to shopper habits.”

Beyond the largest duo Coles and Woolworths, who traditionally swapped the leading position as their long-running price war rolled on, Metcash (ASX: MTS) was the biggest supermarket COVID beneficiary. This came down to its large independent grocery store network IGA along with its Mitre 10 and Home Hardware stores.

“Prior to COVID, it was a declining business, but it won a lot of market share,” says Power.

“But over the last couple of weeks, we’ve seen that market share trend starting to reverse. The question is, will they give back all that market share or just part?”

Coles and Woolworths are the two that will be impacted most heavily by the normalisation trends, he says.

Profit margins were also an upside this half, having been flat in recent years, and widely tipped to remain so, in the face of amped-up competition from the likes of Aldi and the looming encroachment of Amazon’s Fresh grocery network in Australia.

“And in these first-half results, they actually both improved their margins. But looking forward, sales are going to come down a lot and they’ll have to pull out costs,” says Power.

“What happens to their margins will be dictated by how much covid costs can come out.”

Are Coles, Woolworths and Metcash share prices overheated?

Morningstar director and equity analyst Johannes Faul believes both Coles and Woolworths shares are trading about 30% above what they’re worth. He believes the short-term pandemic-related food sales bounce in food sales is exactly that – and unsustainable. This is also something both CEOs were at pains to emphasise during their analyst calls in the last fortnight. Morningstar’s short-term outlook for both companies elevated slightly during the last year, but its long-term view was essentially unchanged.

The looming headwinds in the second half, including the expiry of JobKeeper in a few weeks, ongoing sluggishness in population growth as international flights remain grounded, and market costs for physical stores ramp up again after the COVID-period lull.

The same goes for their liquor stores, which delivered double-digit revenue growth during the first half of fiscal 2021. Woolworths is getting out of alcohol retailing soon, set to offload its more than 1,500 Dan Murphy’s and BWS stores from June.

On the other hand, Martin Currie’s Power says the elevated share prices of Coles and Woolworths – which at their recent highs traded at PE multiples of 26-times and 28-times respectively, far exceeding the levels of recent years – were a sign of the certainty the stocks provided through a tough period.

“They traded at PE levels we haven’t seen in a long time, and the reason for that is they provided certainty in a really uncertain world – plus official interest rates were zero,” says Power.

Do you own Coles, Woolworths or Metcash, and how have your positions changed?

The strategies of Martin Curries’ alpha-plus and absolute return strategies vary significantly.

“But generally, we own very few holdings in what I call the consumer stalwarts, these bulletproof consumer companies including Woolworths, Coles and Wesfarmers,” says Power.

“In our alpha fund, the only one that we currently own is Coles, and that’s a small position, only slightly overweight the index.”

Going into COVID, the team owned large positions in supermarkets, initially in Woolworths and then Coles. But given their “dramatic outperformance” during COVID, they trimmed these holdings.

And Metcash?

“We’ve thought a lot about it over the last year. There’s no doubt it was a major short-term beneficiary, but we still had structural questions markets around its business.”

“We took the view that the benefits to Metcash would only be temporary.”

Dividend yields a bright spot

Looking ahead, dividends remain one of the more reliable components for Coles and Woolworths, which have the added benefit of franking. During the first half of 2021, Coles’ fully-franked dividend increased 10% to 33 cents a share, with a payout ratio of 80% inside management’s target range of between 80% and 90%. Morningstar expects Coles’ payout ratio to average 85% over the next decade.

And Woolworths will pay a fully-franked interim dividend of 53 cents a share, with a payout ratio of 59% of underlying earnings.

Want more earnings season Q&As like this?

Hit like so we know that we know you want more of this type of content.

Throughout February, my colleagues Bella Kidman, Patrick Poke, Mia Kwok and Angus Kennedy also published similar Q&As on Livewire readers' most-tipped big caps and small caps. Hit FOLLOW on our profiles to be notified when these wires are published.

4 topics

3 stocks mentioned

2 contributors mentioned