Why it's the worst time to invest in US stocks in 20 years

.png)

For this week's Charts of the Week wire, we’ve chosen two themes – the equity risk premium and the business cycle – and applied them to a slew of different nations across three continents. The charts and results are gained using Macrobond's Change Region function, which allows users to replicate similar analyses for any number of regions or countries.

It appears to be the worst time in 20 years to invest in US stocks as opposed to bonds – but the reverse is true in Brazil and China.

Turning to our business cycle “clocks,” we show how much more pessimistic sentiment is in Germany than in Spain or Italy.

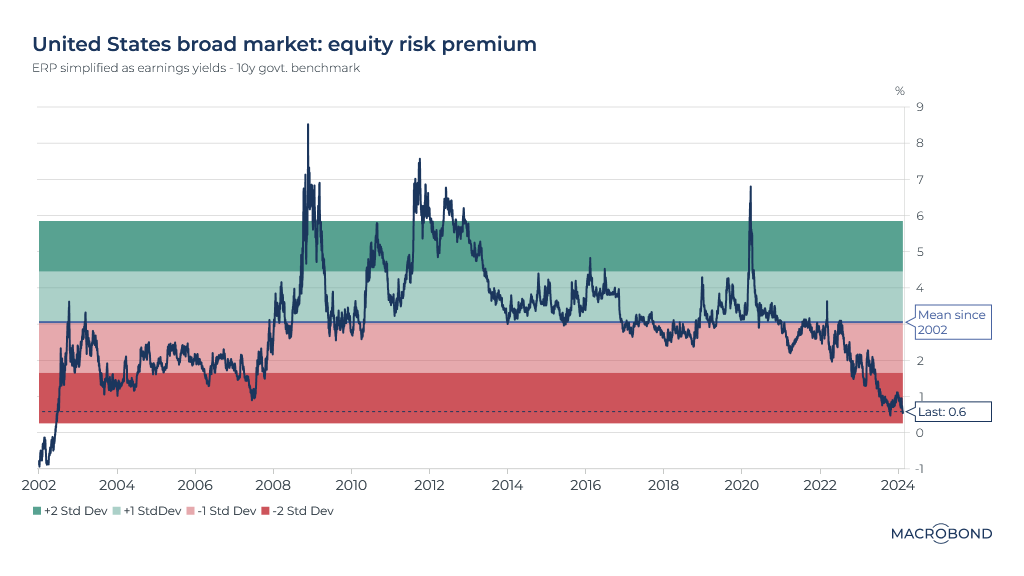

Equity risk premiums: US stocks seem unrewarding versus bonds

Stocks are supposed to be riskier than bonds in exchange for higher returns over time. However, in the US, that risk comes with less reward these days. With interest rates holding near the highest in almost two decades, portfolio allocation between bonds and stocks is more important than ever.

This chart creates a simplified “equity risk premium” for US stocks: it subtracts the 10-year Treasury yield from the equity earnings yield. A negative reading (last experienced in 2002) means bonds returned more than stocks.

We aren’t back there yet, but we are close. Last year, the risk premium dropped through its 2007 low, and we are barely above zero.

Today, equity valuations remain high, and bond yields have risen significantly, limiting the excess returns investors can generate from stocks.

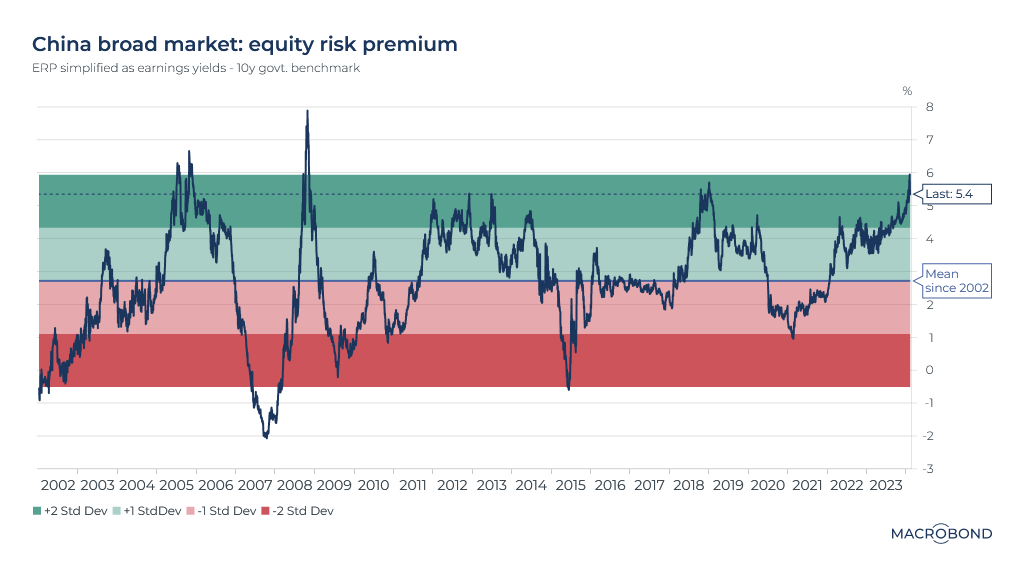

Equity risk premiums: China – an attractive entry point?

The picture is quite different in China. The equity risk premium has surpassed 5%. Soon, it might be more than two standard deviations away from the average. Our charts use colour coding to denote standard deviation ranges from the norm.

As China loosens monetary policy while stock prices remain in the doldrums, the unpopular equities market appears to be at its most attractive entry point since 2008.

Speaking of 2008 (and 2007), note how the equity rate premium swings outside the two-standard-deviation range in both directions during and after the global financial crisis – showing the effect that a crash, crisis-fighting rate cuts and the first stages of recovery can have on this measure.

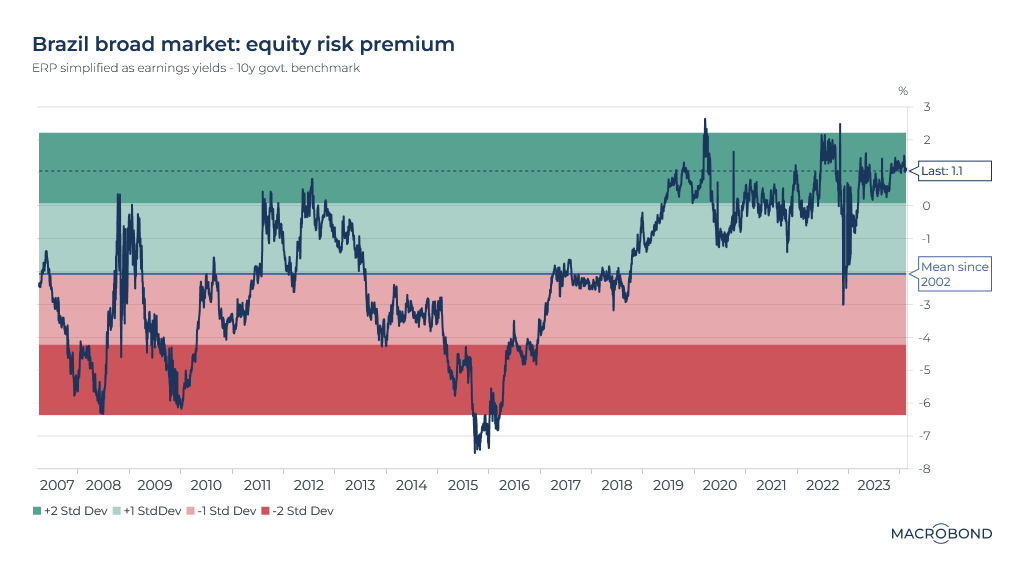

Equity risk premiums: Brazil – a different world

Like China, Brazil also appears to offer an attractive entry point for stocks. The equity risk premium has wavered near a multi-decade high since 2019.

What’s notable is how different the average ERP is for Brazil over the past 22 years: negative 2 percent, versus positive 3 percent in the US. Bonds are historically more attractive than stocks given the risks.

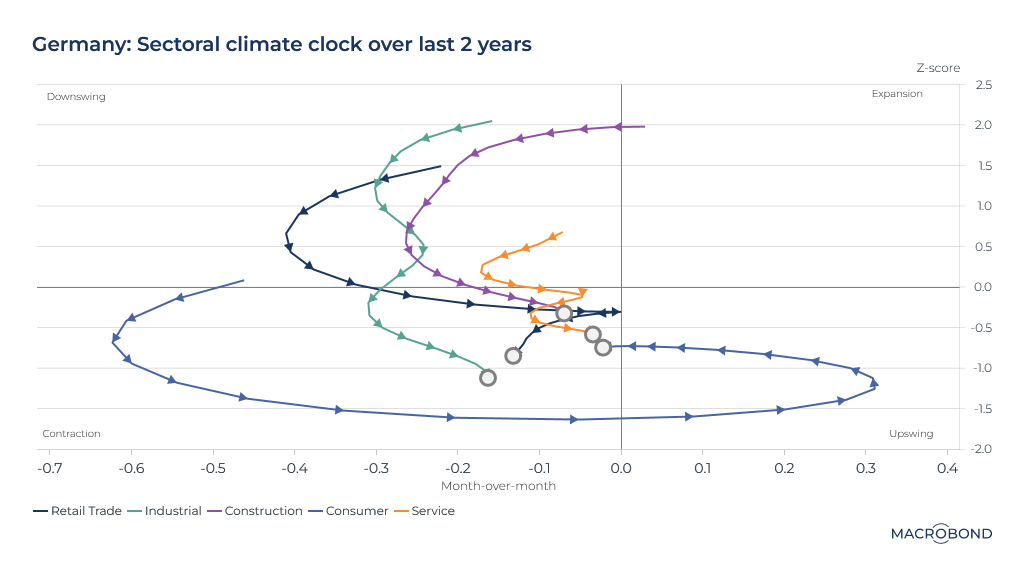

Business confidence clocks: German doldrums

Our second trio of charts use the “business cycle clock” visualization, which tracks an economy through expansion, downswing, contraction and upswing phases.

They rely on the results of local surveys of executive sentiment, plotting a month-on-month trajectory using two variables: month-on-month change (the X axis) and the Z-score, i.e. the latest reading’s statistical divergence from the three-year average (the Y axis).

Business confidence in Germany remains in the doldrums, as this “clock” shows. We’ve broken down Europe’s largest economy into services, consumer, construction, industrial and retail sectors for greater granularity.

All sectors are in contraction. The consumer sector was in an upswing, but that just ended. A potential retail recovery stalled in mid-2023.

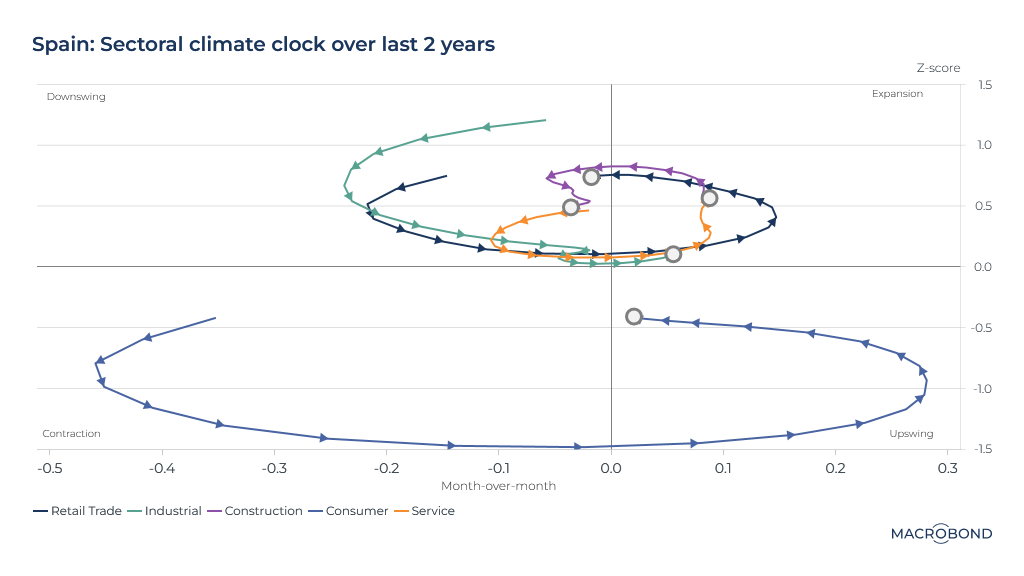

Business confidence clocks: Mostly optimism in Spain

This trio of charts also focuses on the eurozone, demonstrating the challenge of running a single monetary policy for divergent economies.

Even after the 2022-23 run of rate hikes, Spain’s “clock” looks quite healthy by comparison to Germany.

The consumer sector is an outlier, much weaker historically than its peers and heading from upswing to contraction. Services and industrial sectors are expanding. Construction and retail are only just in downswing territory.

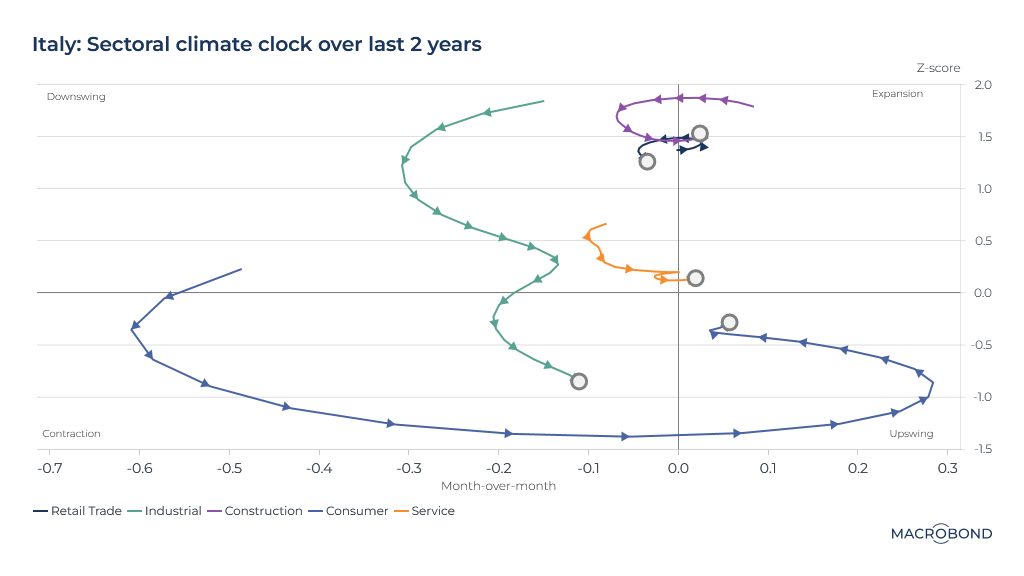

Business confidence clocks: a mixed picture in Italy

Our Italian “clock” is notable for how dispersed the various business sectors are, as opposed to the more uniform trends in Germany and Spain.

Retail and construction business confidence remains high in absolute terms, though both are straddling the line between expansion and downturn. Services confidence is right on the historic average, with little change month-on-month. And the industrial sector is in the grip of sustained deterioration. The consumer sector has recovered from a much worse downturn than the other sectors, but its recovery is stalling.

4 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)