Why NAB's new hybrid could jump on Friday

Friday will bring the last of the recent hybrid listings in the form of NAB's circa $2 billion plus* Capital Notes 5 security (ASX: NABPH). The big question is where will NABPH trade; that is, how much upside (if any) is left in the security?

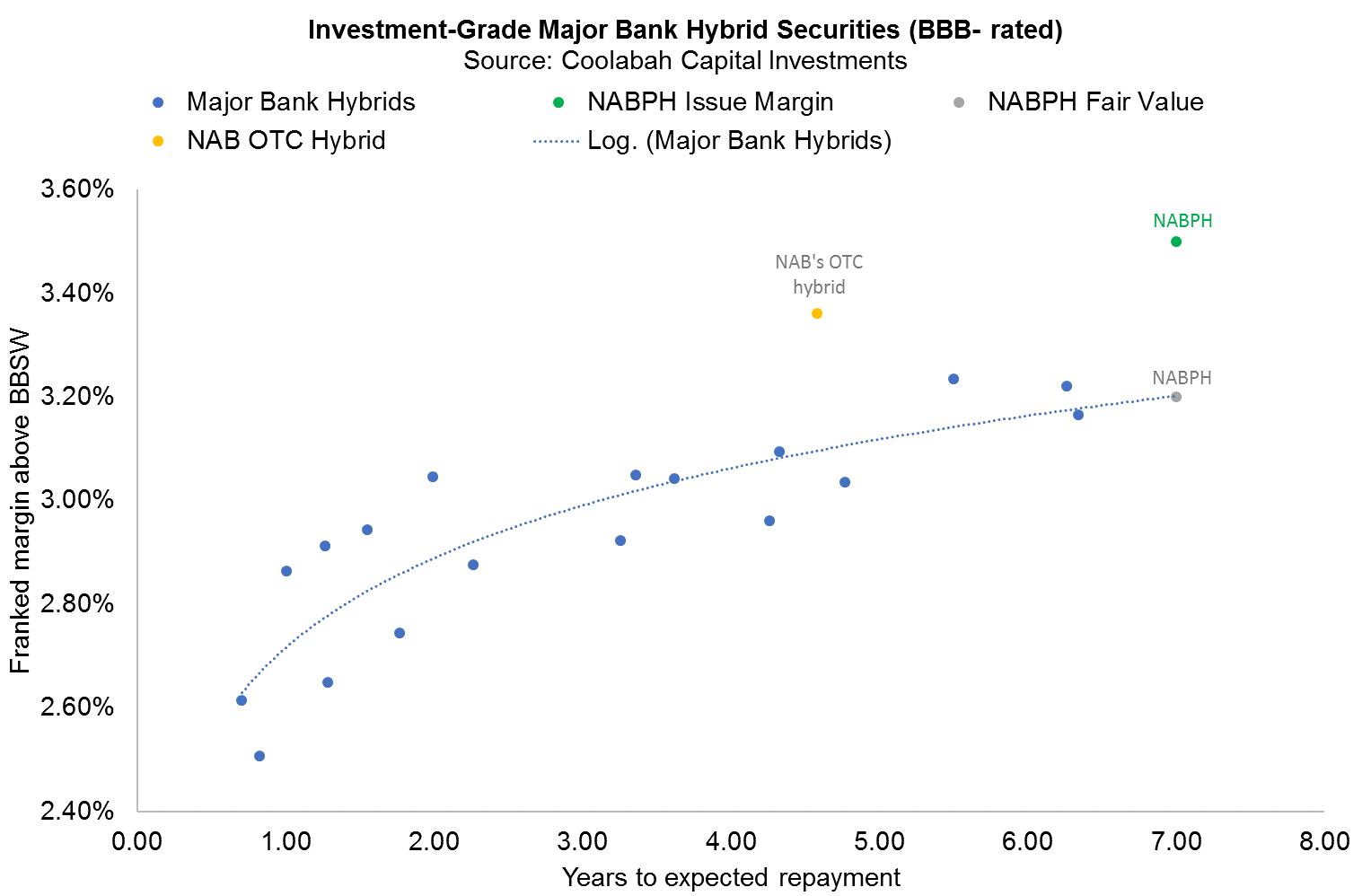

Recall NABPH priced on a fully franked margin of 3.50% above the quarterly bank bill swap rate, which was a generous credit spread for a security with an expected repayment---or so-called optional "call"---date of 7 years (on 17 December 2027 to be precise).

By generous, we mean a decent spread concession above and beyond the secondary fair value curve implied by hybrid prices on the ASX.

Prior to the launch of both the NAB and Westpac hybrids in November, Coolabah Capital Investments estimated that 5-year major bank hybrid spreads were sitting at about 3.09% above the bank bill swap. This represents the median spread over the five trading days through to and inclusive of 30 October. (The 7-year major bank hybrid curve was effectively sitting flat to the 5-year curve at this time.)

This in turn implies that NAB's new 7-year hybrid came with a concession of about 0.40% (40 basis points) relative to levels immediately preceding the transaction.

As I write, Coolabah estimates that the 7-year major bank hybrid curve is trading at about 3.20%, which imputes a fair value estimate for NABPH of $101.84. That is, about 1.84% of capital gains. If we then value the hybrid assuming that spreads normalise back to their late October levels, the fair value estimate increases to $102.47 (or capital gains of circa 2.5%). Coolabah believes there is further run-way beyond these levels because we are forecasting that major bank hybrid spreads will converge back to their pre-COVID levels around 2.6% above bank bills at the 5-year tenor point. In fact, there is a case that hybrid spreads should be moving back to their post-GFC tights around 2.4% above bank bills.

Now Westpac front-ran NAB's new issue by pre-emptively launching its own 6.25-year hybrid (ASX: WBCPJ) on November 4, some 12 days ahead of NAB, on a margin of 3.40% above bank bills.**

Given the pre-deal fair value for WBCPJ was around 3.10%, denoting a decent 0.30% spread concession, it is unsurprising that it has traded strongly since as its spread has compressed to 3.20%, boosting its price up to $101.09. If spreads continue to mean-revert down to 3.10%, WBCPJ's price will climb to $101.78. And, as noted above, we believe there is upside beyond these levels as hybrid spreads approach their post-GFC tights.

To be clear, Coolabah bought both NABPH and WBCPJ in size across our portfolios (including the ASX listed ETF HBRD) because we thought these securities were very cheap at the time.

We are also positive on the sector right now because of a proposal released by APRA, which will adjust the way banks calculate and report their first-loss equity capital, known as Common Equity Tier 1 (CET1) capital. This will result in the major banks' capital ratios increasing by about 1 to 1.5 percentage points according to APRA (thought there will be no actual increase in the dollar value of capital held). So whereas CBA currently reports an 11.8% CET1 ratio, this could be expected to increase to 12.8% to 13.3%.

All Aussie bank hybrids contain a clause that stipulates that they must automatically convert into bank equity if the bank's CET1 ratio declines to 5.125%. The current distance to default in the case of CBA would require its 11.8% CET1 ratio to shrink by 56.6% in order for a CBA hybrid to be converted into equity. Under APRA's proposal, CBA would have to suffer greater losses that reduced its new 12.8% to 13.3% CET1 ratio by between 60% and 61.5% to get down to the 5.125% hybrid conversion trigger.

Note that the new NABPH hybrid officially refinances NABPB, an old $1.72 billion hybrid that matures on Thursday, which should result in net cash of about $750 million being paid to current holders of NABPB that decided not to roll their interests into the new NABPH security. That cash will need to find a home somewhere.

After five new hybrid deals have come to market in the last couple of months via Challenger, Bendigo, Bank of Queensland, NAB and Westpac (and a sixth if you include Australian Unity), the supply pipeline looks a little more benign in the first six months of next year.

Coolabah is forecasting that NAB will repay NABHA in February at $100, which means another $2 billion of cash is going to be searching for yield. The door to this possibility opens at NAB’s AGM on Friday.

And we only have one unfunded hybrid maturity in the first quarter of 2021: Macquarie's $531m MQGPB hybrid on March 17. On March 22, Westpac's WBCPF will be repaid, pumping another $458m into the hands of holders (net of those who rolled into the new WBCPJ deal).

The next $282m maturity from Bendigo in June (BENPF) appears to have already been refinanced by the recent BENPH deal. And then we have three major bank hybrids likely to mature in September (ANZPD), October (CBAPE), and December (WBCPG).

While it is possible that one of these majors issues early in the first or second quarter of 2021, they also have the option of tapping the wholesale OTC market as NAB did with its very successful $600m issue this year. This will only serve to suck more supply away from the ASX. The benefit of an OTC issue it that it's much cheaper and faster than listing a hybrid on the ASX, and also puts these securities in the hands of more wholesale, rather than retail, investors, which is a regulatory positive.

One counter-argument is that NAB's OTC hybrid is trading quite cheap to the ASX curve from an investor's perspective. Whereas it is currently paying about 3.36% above the bank bill swap rate, the current ASX hybrid curve suggests fair value for the OTC NAB hybrid is a lot lower at 3.07%...

*We should find out the final size of NABPH tomorrow.

** Westpac could have waited until the first quarter of 2021 when it would have been ordinarily expected to refinance WBCPF, but chose to come to market much earlier than expected.

2 topics

5 stocks mentioned