Why now is the time to favour bonds over term deposits

When people talk about the merits of different asset classes I often find the tone frustratingly binary. Most well diversified investment portfolios should include cash, bonds, shares, property, alternatives etc… and it is not normally a simple binary decision about including one asset class and excluding another. The focus should be on the appropriate weightings for each asset class within a portfolio. This decision is a personal one that depends on risk tolerance, age and size of portfolio amongst other factors.

Let’s look at two different defensive asset classes – term deposits and bonds. The returns available on both have increased dramatically since the RBA started raising the cash rate – see chart below. The aim is not to tell you what your allocation to each should be, rather helping you to understand the strengths and weaknesses of each which should help decisions around allocations.

Source: Bloomberg

All investment decisions come down to risk and return. Term deposits are very low risk, especially under the $250k threshold, and yet the returns are considerably more attractive than they were a couple of years ago. Those that think that there is no risk in term deposits should refer the experience of depositors in Icelandic banks during the GFC. The unthinkable can happen!

Term deposits offer relative safety and security, but you do pay a price for lack of flexibility. You may lock in an attractive rate of, say, 5% for 12 months however should you need liquidity it has become a lot harder and more expensive to break term deposits. One of the lessons learned during the GFC was that bank liquidity is central to a healthy functioning economy. This is why there are steep penalties for breaking term deposits and in most cases a minimum of 31 days' notice.

If you are investing less than $250k most term deposits are effectively backed by a Government guarantee through the Financial Claims Scheme. So, term deposits get a tick for safety and security. In the current environment, they also look quite attractive from a return perspective. However, they are inflexible – so if you are uncertain about your liquidity requirements then it would be best to keep them short.

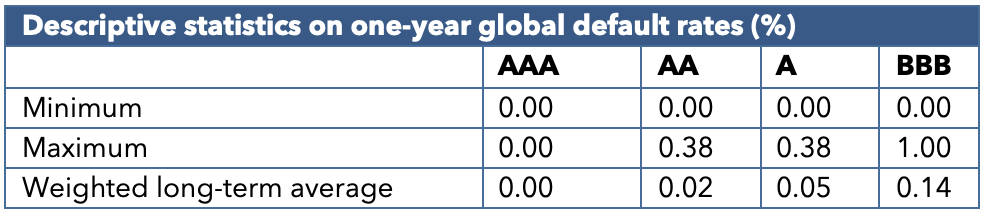

In contrast, bonds offer slightly higher risk and returns however they also offer greater flexibility. Currently, we are seeing new BBB-rated bonds offering returns of 6% - 6.5%. Is that additional return worth the risk? The additional risk, in the investment grade part of the market, is quantifiable to an extent. The table below is from the 2023 Standard & Poor’s Default Study which includes data back to 1981. It shows that the long term weighted average default rate in BBB* rated bonds is 0.14% in any year – that is 1 in every c.714 BBB rated bonds would be expected to default**. The risk is materially less amongst higher rated bonds.

This is a very small increase in risk for quite a healthy uptick in return.

Unlike term deposits which have no capital fluctuations, the capital value of bonds can go up, or down, however, if you hold a bond to maturity, you should have a known outcome. Fixed rate bonds are more affected by capital fluctuations than floating rate bonds however when we are at, or near, the top of the interest rate cycle, chances are that movement might work in your favour.

This is one of the other key benefits of fixed rate bonds at this point in the cycle. They give you the ability to lock in a consistent income return of, say, 6%+ now. When interest rates fall, you will keep collecting that income and you are likely to benefit from some capital uplift.

One of the other drawbacks of term deposits is refinancing risk. If you are regularly rolling term deposits, then you are at the mercy of the market at every time you roll. This is likely to work in your favour as interest rates are rising however the corollary is also true. If you lock in 5% for the next 12 months there is no way of knowing the level that term deposit rates will be in a years’ time. In contrast in a bond where you have locked in that return for the life of the bond.

Whilst flexibility was one of the other key drawbacks of term deposits, it is a strength of bonds. In normal market conditions an investment grade bond would usually be able to be sold within a few days.

Timing of cashflows is also relevant with term deposits only paying interest at the end of the term compared to bonds which pay income twice or four times a year.

As mentioned, there is room for both term deposits and bonds in a portfolio. Especially given the returns on both are relatively attractive at present. My personal view is that bonds currently offer a healthy yield premium over term deposits for only a relatively minimal increase in risk and much greater flexibility. The ability to lock in attractive returns at, or near, the top of the interest rate cycle also makes bonds look very appealing at present. So, I am currently favouring a stronger weighting to bonds over term deposits.

*BBB is the weakest investment grade rating.

** Note that a default does not automatically mean a 100% loss.

4 topics

Darryl is a fixed income specialist who has spent almost 25 years working in the financial markets. After graduating from university in New Zealand Darryl worked in Auckland at UDC Finance, an asset financing subsidiary of ANZ, as a credit...

Expertise

Darryl is a fixed income specialist who has spent almost 25 years working in the financial markets. After graduating from university in New Zealand Darryl worked in Auckland at UDC Finance, an asset financing subsidiary of ANZ, as a credit...