Why private debt should be on investors’ radars in 2024

2023 was a year in which investors – from institutions to family offices and financial advisers – realised the value of including private debt in a diversified portfolio.

This trend is reflected in the continued growth of the global industry. Research house Preqin estimates total private debt assets under management will reach US$2.8 trillion by 2028, almost double the 2022 figure of US$1.5 trillion. (1)

Its broad acceptance as a source of stable income has coincided with a period of sustained public market volatility in which traditional asset classes such as equities and bonds have suffered bouts of underperformance.

Private debt funds generate returns by raising money from investors and lending it directly to medium-to-large-sized companies – in a similar manner to banks. Most funds focus on providing loans to companies or projects with an established financial history and market position.

The potential returns are reflected in the performance of Metrics’ three retail funds – which returned between 9.27% and 10.33% in the year to 30 November (2). Assets in these retail funds recorded double-digit growth over the same period to help push Metrics’ total assets under management across all categories of investors to more than $15 billion.

What’s ahead

It’s reasonable to expect similar returns in 2024 as many commentators forecast the Reserve Bank of Australia (RBA) cash rate will remain relatively stable over the next 12 months, even if it moves slightly in either direction.

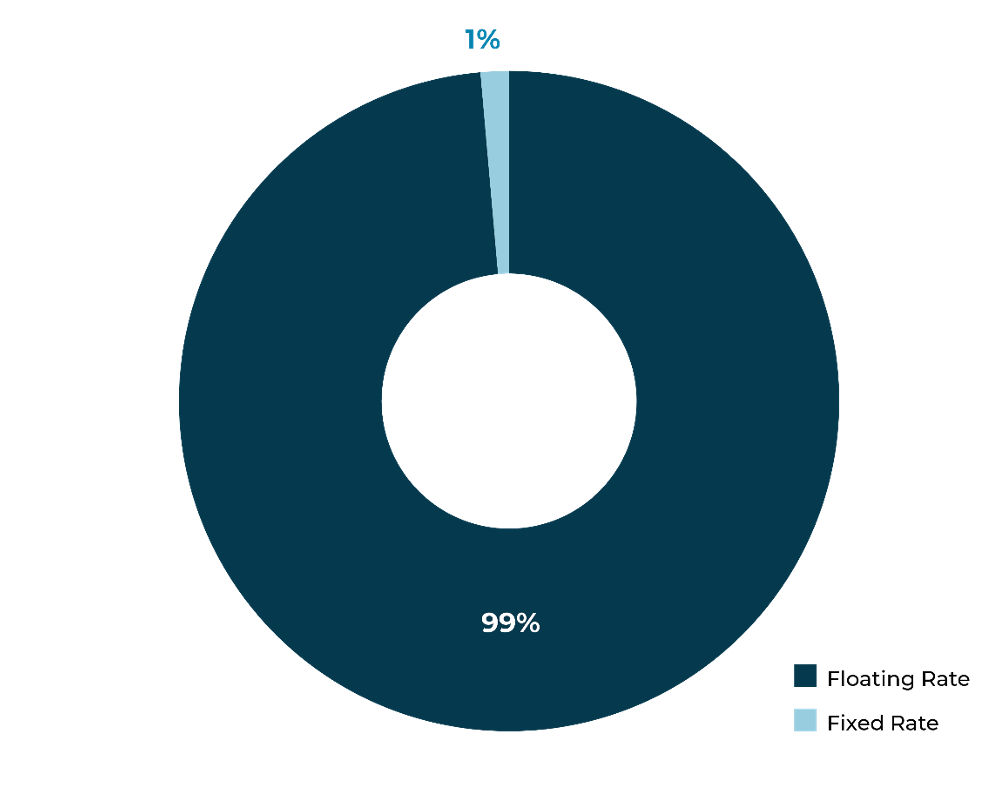

Private debt funds typically pay floating rate returns that rise with official interest rates. The Metrics Direct Income Fund, for example, has a target return of the RBA cash rate plus 3.25% p.a. net of fees (currently 7.60% p.a.).(3)

These floating rate returns provide a hedge against inflation to help investors maintain their purchasing power as the price of goods and services rise.

A well-run fund will be structured to negate risks in a still uncertain economic environment by maintaining a diversified portfolio of relatively short-duration loans that provide a consistent churn of repayments and help control liquidity risks.

Figure 1: Typical Australian private debt floating rate vs fixed rate split (4)

Beyond yield

There are additional benefits to private debt beyond the regular income (5) it typically delivers. Firstly, its general low capital volatility can add ballast to overall portfolio returns – a real advantage in an environment in which traditional fixed investments don’t always deliver the safe haven and downside protection they once did.

This stability is the result of its central characteristics. Firstly, Australian corporate debt is a lower-risk investment than equity because Australian corporate insolvency laws give priority to the interests of creditors in claims over the assets of a business.

Secondly, a skilled private debt manager seeks to negotiate appropriate loan terms, conditions and covenants, with borrowers to mitigate against any potential risk of loss.

And the loan security provided by those borrowers usually makes theoretical losses lower than those suffered by largely unsecured public debt which tends to dominate fixed income portfolios.

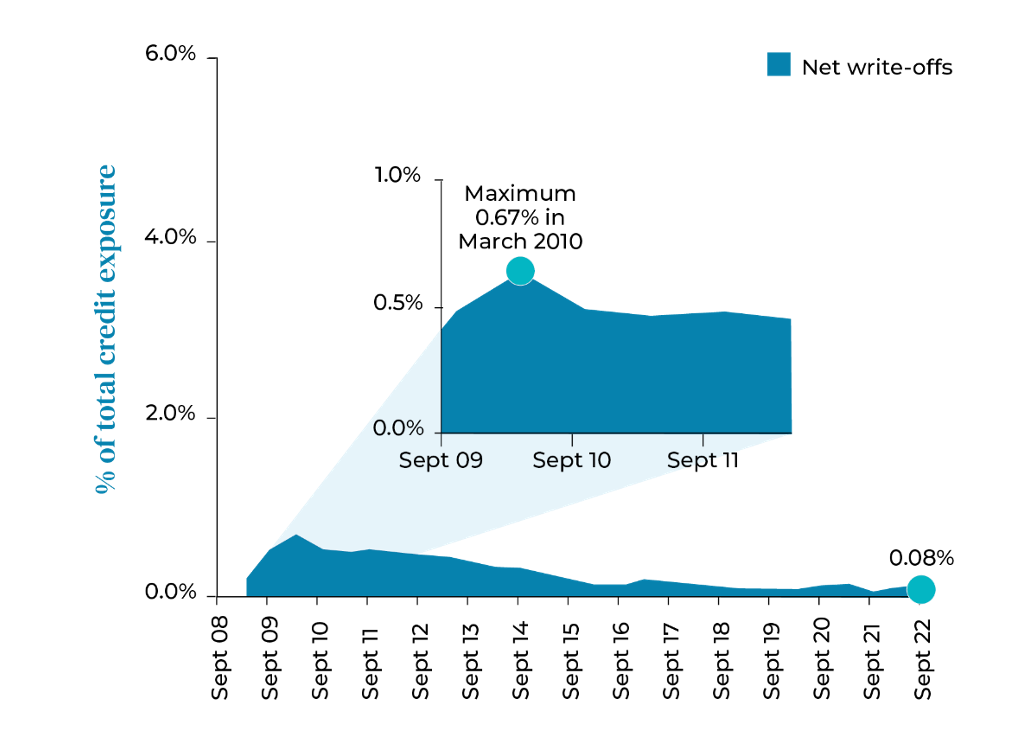

The historical track record of Australia’s corporate loan market – which has recorded low loss rates even in times of market disruption (6) – also provides additional assurance to investors that a solid portfolio will continue to perform across the economic cycle.

Figure 2. Major banks’ historical net write-offs

How to use it

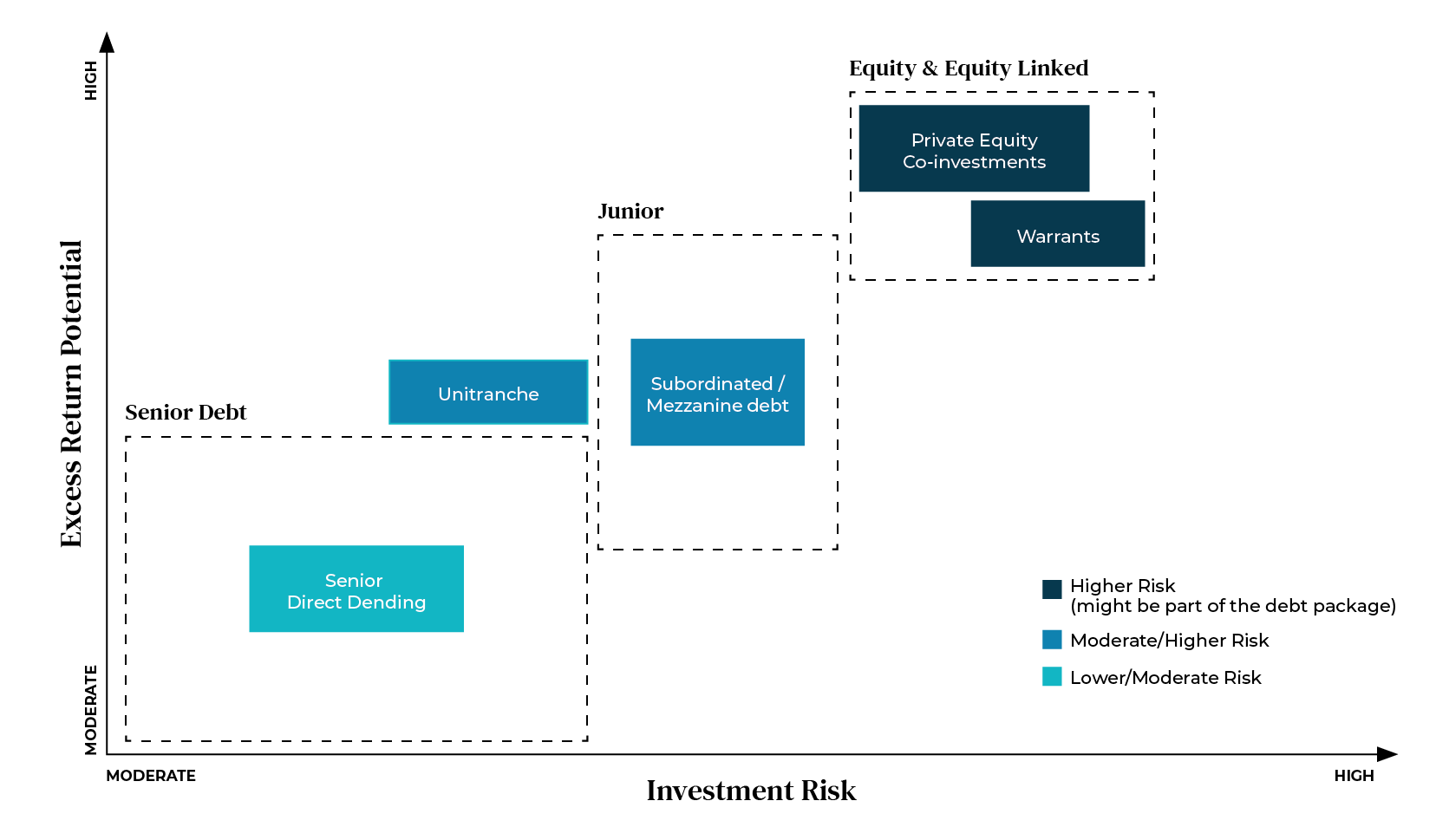

Private debt is a versatile asset class that can work in either the defensive or growth component of a portfolio – and sometimes even both at the same time.

Funds that hold relatively low-risk positions in senior secured or investment-grade debt may be suitable for defensive investors seeking an alternative to traditional bonds or hybrid securities. This style of conservative investment may have particular appeal in a rising rate environment as fixed-rate bonds typically incur losses as interest rates move higher.

Alternatively, funds that provide exposure to sub-investment grade debt or alternative parts of the capital structure – such as mezzanine or subordinated debt – can instead replace part of an investor’s allocation to equities. This category of holding produces a similar return to equities but carries less risk due to its position in the capital structure. It can thus appeal to people who are uncomfortable with the volatility of the share market by offering a source of more predictable returns.

Figure 3: Risk/Return spectrum of multi-asset credit

%20(1).png)

Australian investors’ preference for private debt has shifted as the local industry has matured. A decade ago, when the sector was in its infancy and understanding of private debt was limited, investors tended to prefer more conservative strategies with a focus on very high investment-grade borrowers.

Today, a broad cross-section of investors have a better grasp of the benefits of the asset class and are increasingly adding higher-risk debt to their portfolios too.

All signs point to this appetite continuing to increase in 2024 and beyond as the genuine benefits of allocating an appropriate proportion of capital to private debt become even better understood.

Creating possibilities across the risk spectrum

Metrics delivers innovative and award winning investment alternatives together with bespoke financing options for corporate borrowers. Learn more via our fund profiles below.

(1) (VIEW LINK)

(2) Returns relate to Metrics Direct Income Fund, Metrics Income Opportunities Trust and Metrics Master Income Trust. Past performance is not a reliable indicator of future performance.

(3) This is a target return and may not be achieved. RBA Cash Rate is currently 410 bps p.a. (4) Metrics.

(4) This chart uses the MCP Wholesale Investments Trust as an example of a portfolio of Australian private debt. As at 30 November 2023, the Trust contains a diversified portfolio of 299 loans. Fixed rate was 1.3% and floating rate was 98.7%.

(5)Income payments depend on the success of underlying investments.

(6) Major Bank APS 330 reporting. Past performance is not a reliable indicator of future performance.

1 topic

2 stocks mentioned

2 funds mentioned