Why Renting Could be the New Black

AtlasTrend

Should you rent or buy? It’s the classic housing dilemma. However, with property prices being as high as they are, renting is increasingly looking like a more attractive option. While renting can be the more affordable option in the short term, it can also be the smartest – particularly when it comes to investing. Let’s take a closer look.

Why rent?

It’s common knowledge that property prices in Australia have risen significantly in the last few years. For those looking to buy their first home, particularly young Australians, the idea is becoming more and more beyond reach. Due to this, renting has become the enforced option for many. But is this necessarily a bad thing?

Home ownership might be the ‘dream’, but renting could be the smarter option. Higher property prices means higher mortgage repayments. Plus, you’ve also got council rates, insurance and the huge costs of actually buying the property to consider (according to the NSW Office of State Revenue, in NSW stamp duty alone on a $1,000,000 property is over $40,490.00).

While renting doesn’t come with this long list of expenses, it’s worth keeping in mind that it’s only the smarter option if you’re savvy and disciplined about investing the difference between the cost of renting and the cost to buy.

Renting gives you more flexibility and can open up other opportunities to invest

Ownership might provide more stability, but renting gives you more flexibility. It allows you to move around for work, upsize or downsize, and choose a neighbourhood that gels with your lifestyle and interests. For younger professionals who enjoy being close to the city, this makes renting an extremely attractive option.

On top of lifestyle and location benefits, renting also frees up your savings to invest in areas other than the property market. If done right, you can potentially build your wealth through other types of investments such as shares and bonds. Diversifying your investment portfolio across a range of investments rather than buying a single property means that your exposure to risk can be spread across a number of assets rather than being concentrated in just one asset.

The house price is just the start

As mentioned earlier, buying a home in Australia costs much more than the property’s price tag. According to realestate.com.au, some of the additional costs of home purchase and ownership include:

- Conveyance and legal fees (around $1800)

- Stamp duty (this can cost tens of thousands of dollars, depending on which State you live in and the price of your home – for a $1 million home, expect to pay around $40,000 in New South Wales)

- Pest and building inspections (around $600)

- Mortgage registration and transfer fees (this varies from State to State),

- Loan application or establishment fee (at least $500-600)

- Lender’s mortgage insurance (on a $1 million home, expect to pay around $15,000, assuming your deposit is less than 20% of the purchase price)

- Building insurance

From this information, you’re looking at around $56,000 for expenses plus a required lump sum of $100,000 (assuming a 10% deposit on a $1 million home). That’s a lot of money!

However, if you invested this amount for 30 years (the common length of a home loan) you could be looking at a very serious amount of money.

Simplify and leave your retirement living options open

By the time you’re ready to retire, will you even need such a big house? And you can’t predict how much it will be worth at that point in time. If you’ve been living in your own home for decades, it can be emotionally difficult to pick up sticks and sell your home in order to access the equity upon retirement, or if you can’t afford to hold it anymore.

Choosing to rent can allow you to downsize when you reach retirement, without having to worry about selling your home – which may not be in your best financial interests. It also gives you the freedom to move into a neighbourhood or community better suited to your interests (perhaps closer to your children) without needing to make the financial commitment of a property purchase or take responsibility for the property’s upkeep and maintenance.

Be a disciplined investor!

While renting is an ongoing expense, the potential silver lining is the opportunity to invest your savings in other areas. However, as mentioned earlier, this only works if you do your research and you’re financially disciplined. If you think you’ll spend the money you save from renting instead of investing it (particularly if you can afford to save), you’re probably better off servicing a mortgage and winding up with a solid asset.

However, if you do have financial self-control and smarts, then renting could well be the better option. So how does it work? Essentially, the goal is to invest the difference in cost between renting and paying a mortgage into an investment with potential growth opportunities such as the share market.

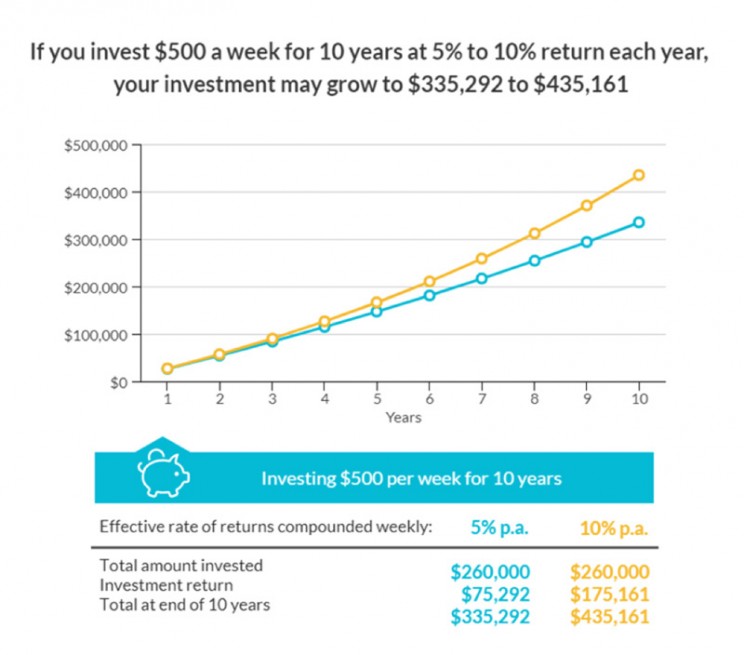

For example, if you’re paying $650 a week in rent for a place that would have a mortgage repayment of $1378 a week if you bought it, you should be putting at least $500-$700 a week into your investments if you are seeking a potentially better investment outcome than home ownership.

Illustrative example only. Investment returns are not guaranteed. Investment values fluctuate over time and can move up and down. Higher rates of return involve accepting greater investment risks.

The bottom line

It’s fair to say, renting could be the new black. Across several major cities, housing prices are unaffordable for many young professionals. With low rental yield growth and shifting attitudes towards the ‘dream’ of home ownership in Australia, renting affords you the less tangible benefits of geographical and lifestyle flexibility.

While it can certainly be a better option than buying in the short term, it’s also important to take advantage of the financial opportunities renting allows. Because when it comes down to it, investing the savings you make now can make a huge difference down the track.

For further insights from AtlasTrend, visit our blog.

4 topics

1 stock mentioned

Kent Kwan is a co-founder of AtlasTrend. He was formerly a Chief Investment Officer of an ASX listed company and prior to that was an international equities fund manager with JPMorgan.

Expertise

Kent Kwan is a co-founder of AtlasTrend. He was formerly a Chief Investment Officer of an ASX listed company and prior to that was an international equities fund manager with JPMorgan.