Why Schroders likes smaller companies in this space and 6 themes to watch

Interest in private markets has grown sharply in recent years. Companies are not only staying private for longer but the bulk of companies earning more than $100 million in revenue are now private.

It’s a dynamic space and opinions vary on where the sweet spot for investing might lie. More often than not, fund managers talk about the larger private companies that might be closer to IPO. But for Rainer Ender, global head of private equity for Schroders Capital, it’s all about the small end of town.

In a recent presentation, Ender explained why smaller private companies hold the greatest appeal, the opportunities across private markets, and the six themes Schroders focuses on for its investment selection.

Why the small end of town holds the best opportunities

While larger private companies might be the preferred realm of some of the biggest investors, Schroders prefers lower to middle-market companies. What this looks like is companies with average enterprise values of $200 million, revenues of $100 million, EBITDA of $20 million and leverage of 3.5x.

There are a few reasons for liking this space.

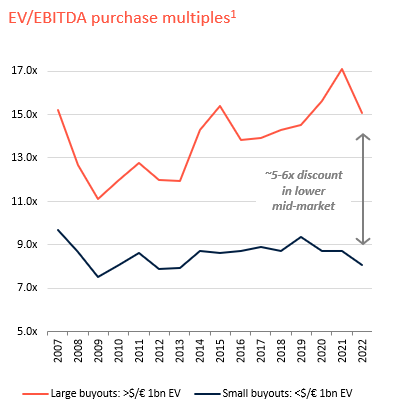

One is the cost to invest is substantially lower compared to larger companies.

“The gap has widened around 6x for EV/EBITDA purchase multiples between small companies and large companies," says Ender.

Source: Schroders Capital, 2023. Based on data on North American and European market from CapitalIQ and the Bair Global M&A report.

What this translates to is the ability to generate higher revenue as a result of growing the business to a large company.

Another reason is the low level of competition. Given the popularity of larger businesses, there is a high demand for investment and few competitors in this space.

“Large buyout firms only account for 9% of the funds but have attracted 62% of the capital. By contrast, small/medium buyout funds account for 91% of the funds raised, but only attract 38% of the capital,” says Ender.

This means that Schroders can be more selective in their approach while having plenty of choice across the board.

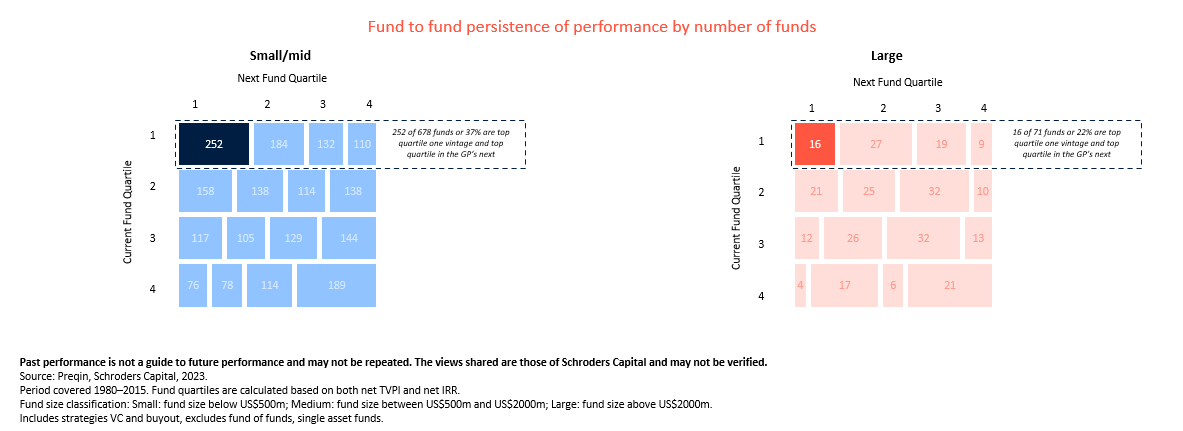

Ender also points to greater consistency of performance in smaller companies.

“Small companies are typically more consistent performers. Good performers typically stay good while poor stay poor. It can be like throwing darts for the large end of town – a good performer this year might be next year’s worst performer,” says Ender.

In saying this, Schroders does still include large buyout private companies in their portfolios, but the bulk (60-70%) is in small/mid buyout companies. It also incorporates venture capital/growth companies in the remit.

The six themes Schroders watches

Ender notes there are six key themes that investments typically fall under within the portfolio.

These include:

- Healthcare which has been resilient and Schroders has a strong view on the outlook for subthemes like digital health.

- Technology and innovation, especially in areas like cybersecurity which are requiring increasing volumes of spend.

- Buy/build strategies that can be accretive and occur over time. It has allowed time diversification in the portfolio.

- US and Europe/UK, with the bulk of the buyout focus in these regions.

- China and India: Schroders is positive on the demographics in these countries. While US PE investors have come to a standstill in China, it is still a growth engine for the world. Ender argues that India’s private equity space is underdeveloped compared to its size, offering great potential.

- Sustainability and Impact: It’s no secret that sustainability and impact are becoming increasingly important and a global focus. Ender believes it will be a significant driver for service businesses.

Schroders is overweight in Europe at present but expect the deals they are looking at in the US to balance that out. The primary sectors they have invested in are healthcare and technology, which is unsurprising given the tremendous potential in these spaces.

The key characteristics of the companies Schroders invest in

Schroders looks for transformational growth in the companies it invests in.

“What this means is companies with a clear change plan for growth and driven by innovation,” says Ender.

Taking this further, Schroders likes quality companies that are leaders in their field and have pricing power and recurring revenue streams – an essential trait for inflationary periods. Ender gives the example of Microsoft which could increase its prices tomorrow and customers would simply pay.

There’s also a question the Schroders team asks itself before investing.

“Will the market still appreciate this business model in 10 years’ time? If the answer is yes, then we’ll invest. If it’s no, we won’t touch it,” says Ender.

It's a question that any investor could take on board before investing, regardless of the asset type.

Some examples of investments that Schroders has made include ]init[ and Unirac.

Init is a German digital transformation agency that processes transactions for the German government and Schroders invested in 2019.

“Init is one of the few end-to-end IT service providers with a great reputation and it benefits from strong market growth,” says Ender.

Schroders has since sold some of its stake onwards and has seen a 60% compounded annual growth rate in revenue between 2019.

Unirac is a “leading North American manufacturer of solar PV mounting systems recognised as a fully integrated, one-stop-shop solar mounting solutions platform.”

Schroders likes the ESG angle it offers, as well as its value creation plan with expected organic market growth due to the secular tailwinds created by growing demand for renewables along with M&A to foster geographic expansion and broaden the product offering.

A positive outlook

The large buyback space had an "overly euphoric" 2021 and has since eased off substantially, but Ender notes that the smaller end was much more constrained and thus has been less volatile. There's plenty of dry powder in the small buybacks space and, as it hasn't experienced the same peaks and troughs as larger peers, less volatility.

It's a positive endorsement of a space that other firms might generally steer clear of and Ender is seeing plenty of opportunity going forward. That said, there are always risks in any investments let alone the often less opaque private equity space.

From that perspective, Ender argues it pays to be selective and stick to a focus on high-quality leaders with a focus on transformational growth. It's certainly the approach that Schroders takes.

2 topics