Why Telstra is undervalued and set for solid growth

The market is rallying behind Telstra (ASX: TLS) after its FY24 results met analyst expectations and the narrowed FY25 guidance fuelled optimism for a higher dividend outlook.

Telstra’s FY25 EBITDA guidance range was tightened to $8.5 billion to $8.7 billion (previously $8.4 billion to $8.7 billion) on better-than-expected performances across several business lines and solid cost control.

With mobile price hikes on the horizon, a successful cost-out strategy and a narrowed guidance – can Telstra finally capture some upside after four years of trading sideways?

IML's Daniel Moore says this Telstra result ticks all the boxes and paves the way for solid medium-term growth, no matter the economic backdrop. He shares his key takeaways below.

FY24 Key Numbers

- Revenue +1% to $22.9 billion

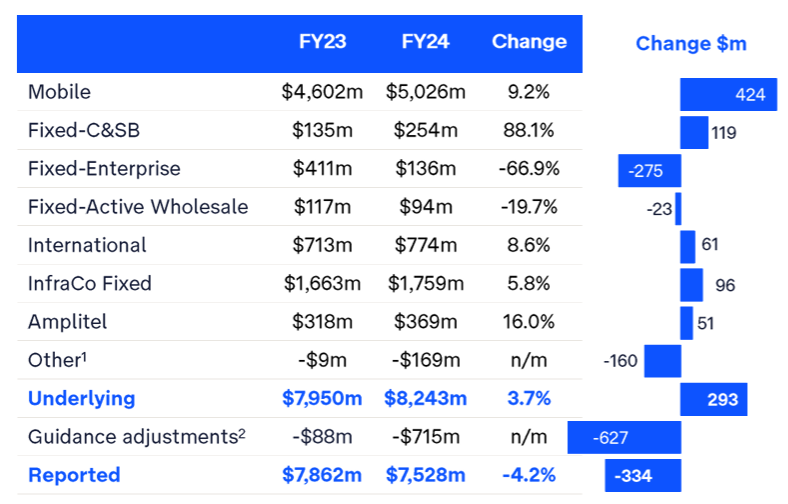

- Reported EBITDA -4.2% to $7.2 billion

- Underlying EBITDA +3.7% to $8.2 billion

- Reported NPAT -12.8% to $1.8 billion

- Underlying NPAT +7.5% to $2.3 billion

- Total dividend for FY24 +5.9% to 18 cents per share

- T25 strategy is on track including growth targets for underlying EBITDA, EPS and ROIC

The reported results include $518 million of write-downs for its troubled enterprise business, restructuring costs and M&A adjustments.

1. What was the key takeaway from this result?

The result was very solid and in-line with expectations. The key takeaway is that they’ve lifted the bottom end of their guidance and the business is looking very healthy. Telstra is growing profits, lowering costs and improving customer satisfaction.

2. Were there any surprises in the result that you think investors should be aware of?

The mobiles business continues to perform very well. Subscriber growth was 4%, which is well-above population growth but ARPU (average revenue per user) or price growth was a bit towards the light side at 2%. Overall mobile earnings rose 9%, so a really solid performance.

The other key factor was cost. Despite quite an inflationary environment, underlying expenses fell 0.4% year-on-year. When we look at the outlook for next year, Telstra expects costs to fall another $228 million. This is quite a remarkable feat given the economic environment.

3. Would you buy, hold or sell Telstra on the back of this result?

Rating: BUY

The business has clear network leadership after several years of investment. They’ve digitised a lot of their business which allows them to continue to take costs out in an inflationary environment. The network leadership allows them to keep lifting prices while customer satisfaction continues to improve.

We see good medium-term growth in the mid-to-high single-digit range and in most economic environments, which we think is quite unique and undervalued in the share price.

4. Are there any risks to Telstra or the telco sector that investors should be aware of?

Enterprise is the weakest part of the Telstra business and the result flagged a 2.2% fall in earnings. We’re seeing some revenues, particularly around calling applications, move away from legacy voice platforms to applications like Microsoft Teams. We’ve just moved away from our fixed-line phones with Telstra to Teams. So enterprise profits are under pressure from that structural change.

The weaker economic environment also takes a toll on professional service revenues as companies look to reign in costs in what are relatively challenging times.

5. From 1 to 5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX today? Are you excited or cautious about the market in general?

Rating: 4

The market is generally quite expensive and some pockets are a five – that being banks and retailers. Anything AI-related is also extremely expensive.

There are definitely pockets of value in sectors that are less tied to strong economic growth, operating in more staple-like industries. We like Telstra, Brambles (ASX: BXB) and Aurizon (ASX: AZJ). Insurance broking is another sector in which the performance is less tied to the economy and able to deliver mid-to-high single-digit earnings growth in most environments.

We think the businesses that provide stability and consistent growth have been undervalued in this market.

3 topics

3 stocks mentioned

1 contributor mentioned