Why the ASX is trading like a recession is coming (and the NASDAQ isn't)

On 3 May 2022, the Reserve Bank of Australia hiked the cash rate target by 25 basis points, to 0.35%. In the last paragraph of that day's decision statement, the Board wrote the following:

"The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time. This will require a further lift in interest rates over the period ahead."

Since then, the RBA has hiked that rate by 400 basis points (4%) and still isn't ruling more out, even if it creates a much larger risk of recession.

Equity market investors have worked this out and it shows in the price action. The ASX 200 has effectively completed a round-trip, with the index roughly back at May 2022 levels (7200). Even the P/E ratio and ASX earnings yield have barely shifted an iota in the past 13 months! Until very recently, this was also the case in the bond market with the 10-year yield hovering in the mid-3% range.

It's a far, far different story in the US, with the NASDAQ up 37% in the last year and the Barclays AI basket up nearly 50% in that same time period.

So how did we get here, why are we here, and more importantly what happens now?

Those three questions are just some of the pressing issues we are tackling in this month's edition of Livewire's Signal or Noise. Sitting alongside me is regular panellist Diana Mousina, deputy chief economist of AMP. They are also joined by two market veterans who have more than 50 years of experience between them.

- Simon Doyle, CEO and CIO at Schroders

- Mark Gardner, CEO and Head of Equities at MPC Markets

This episode was taped on Wednesday 28 June, 2023. You can watch the video, listen to the podcast, or read an edited summary below.

EDITED SUMMARY

The hardest question the panel has been facing

All three panelists gave similar answers to this question - and it all concerns a) where and when is the recession coming and b) why do equities continue to march higher despite the headwinds? For their complete responses, watch the video.

Topic 1: Mixed messaging from economic data

Diana: SIGNAL - There are some signals from the data about what is happening month-to-month in the Australian economy. But you need to be looking at the data in concert with the overall big-picture trends in markets.

Mark: NOISE - The pandemic changed many things but chief among them is the way economic data and trends are measured. Thus, the data itself is noise but the implications for rate hiking cycles can be taken as a signal.

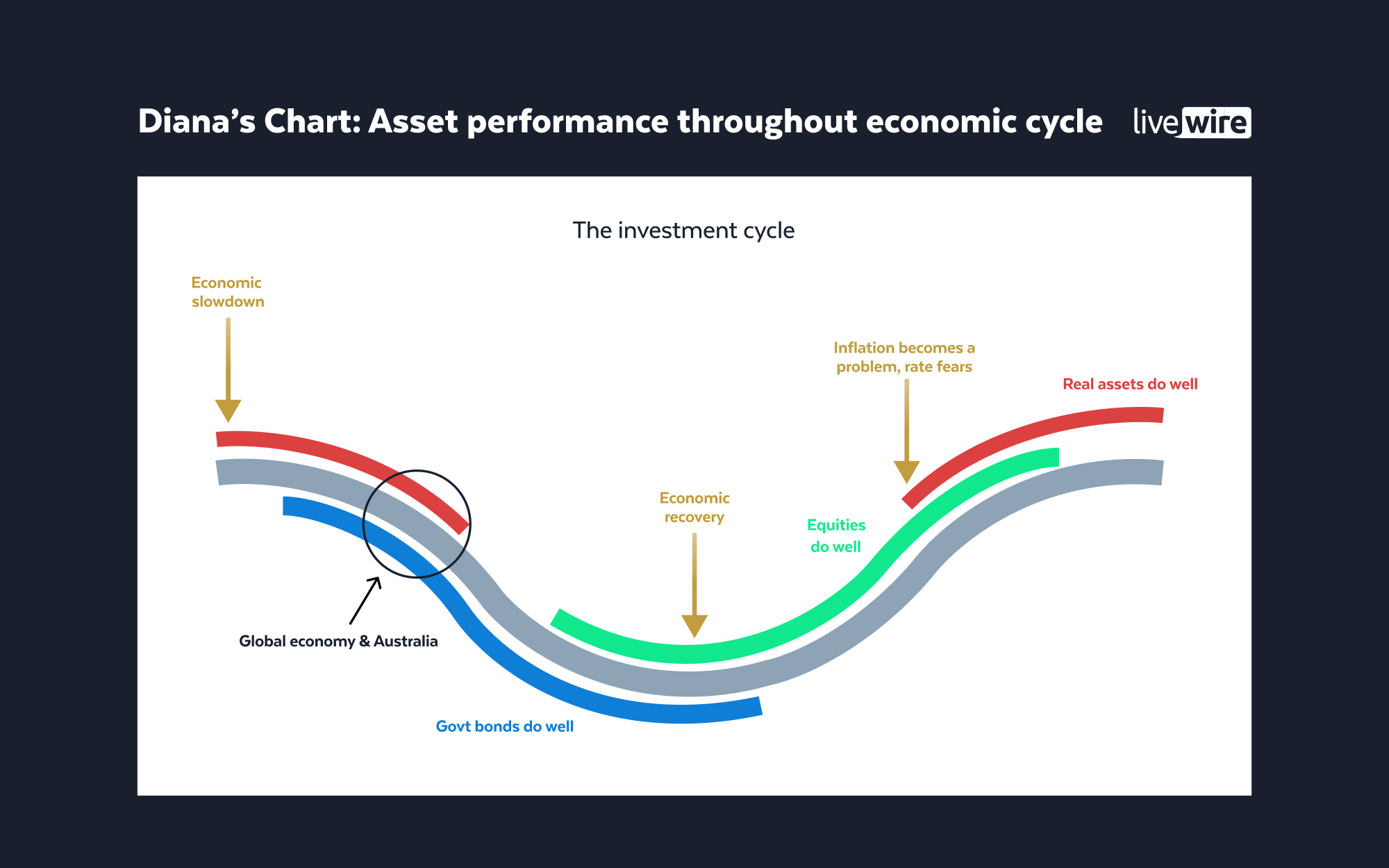

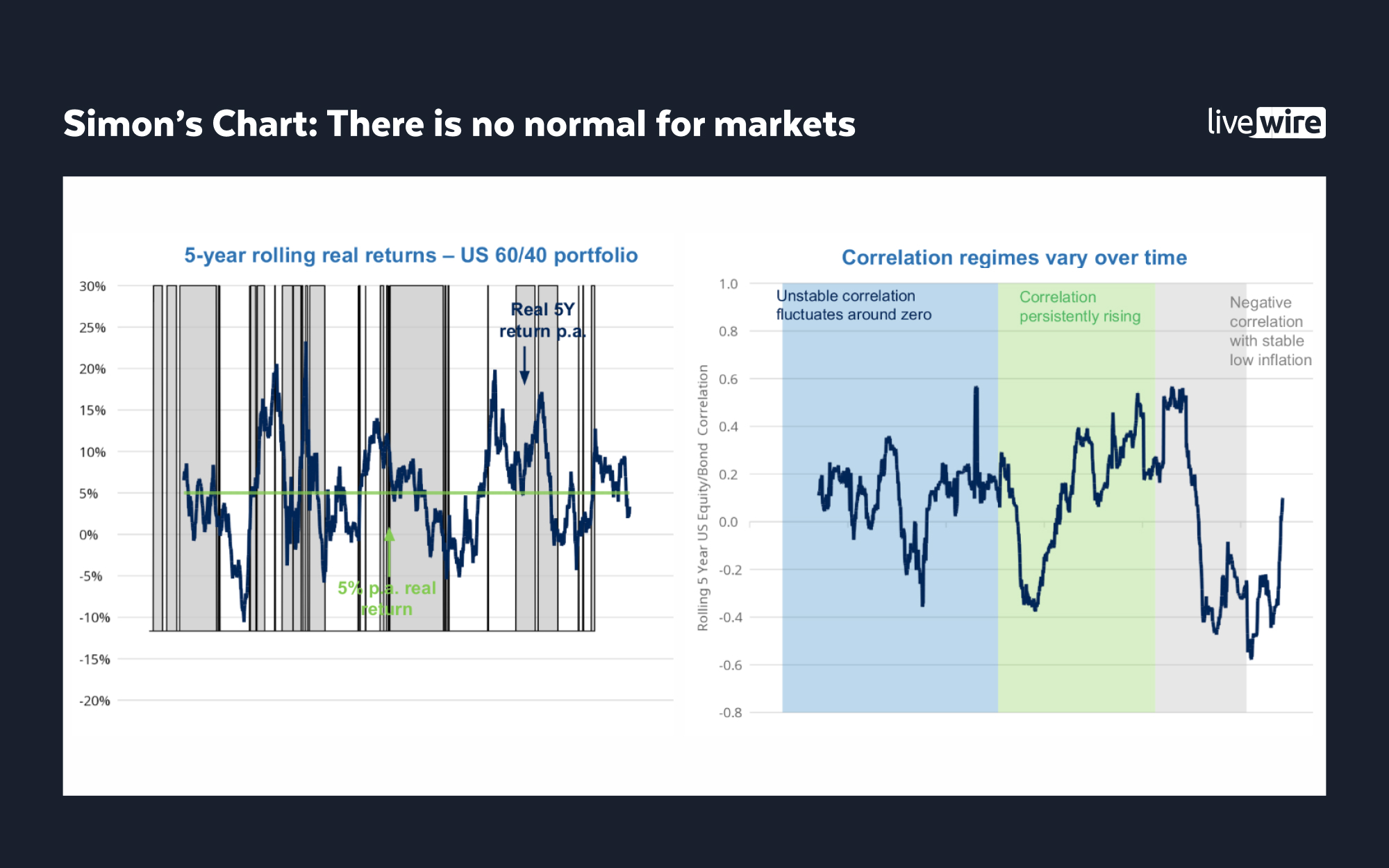

Simon: NOISE - All the complex messaging from data is just a reflection of how complex the modern economy actually is. Simon also points out that there are a lot of problems with how backward-looking data can be. He takes more signal from the accumulation in interest rates and how it affects valuations across asset classes.

Education: Lagging, Coincident, and Leading Indicators

As a special treat, Diana shared with us the importance of understanding the difference between lagging, coincident, and leading indicators. She also shared with us examples of those indicators, how they are calculated, as well as which ones will matter most to your money. And yes, although the stock market is not the economy, stock markets can also count as a leading indicator. For the complete explanation, watch the video.

Topic 2: Is time running out for "The Magnificent Seven"?

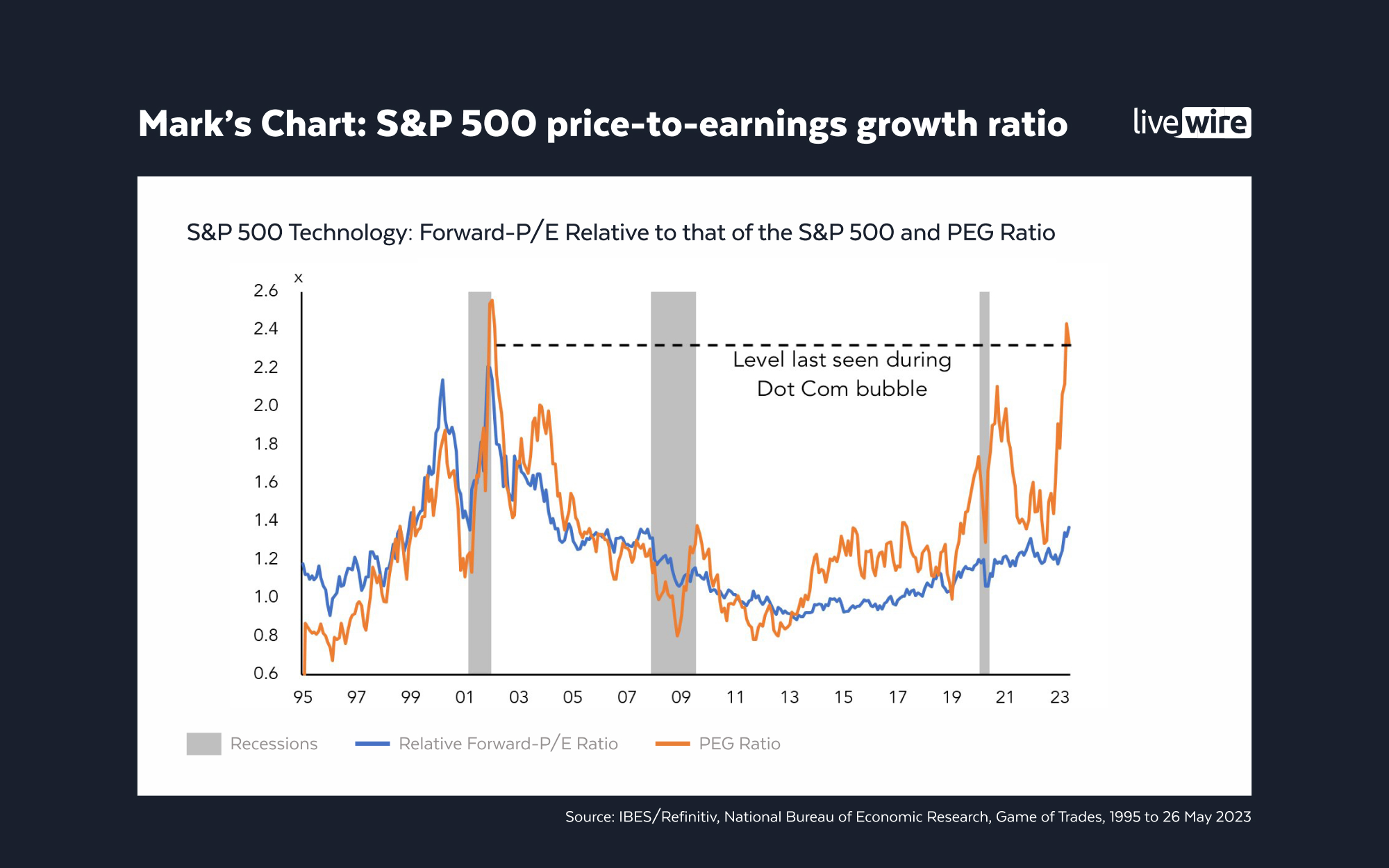

Mark: NOISE - The horse has bolted way, way too early in Mark's view. He cannot believe the valuations that are being asked for these stocks, and argues the run we've seen of late smells a lot like 2001. He also emphasises that there is a big difference in quality between our local tech sector and the American tech sector.

Simon: NOISE - There is still an inherent desire to put money into risk assets and the AI story is attracting a lot of that interest. After all, it's hard to justify buying any company (even NVIDIA (NASDAQ: NVDA) when it's on 200x P/E). He wants to see more earnings come through and expects a repricing in the US given Australian stocks are more priced for a recession.

Diana: SIGNAL - Diana views the AI rally as short-term noise and long-term signal. She argues that it's still not clear which companies will gain the most from this megatrend. Because of this, she says it would be wise to have exposure to a broad range of names that could be positively affected by AI.

Topic 3: Two reliable indicators of recession flash bright red

Simon: SIGNAL - While Simon doesn't buy the oil price argument, he strongly suggests that you do not ignore the yield curve inversion taking place right now in both the US and Australia.

Diana: SIGNAL - Diana agrees with Simon, especially around the yield curve indicator. While the correlation in Australia is poorer than it is in the US, that's simply because we haven't had as many recessions as our stateside counterparts. AMP currently predicts a 50-60% chance of an Australian recession in the next 12 months.

Mark: SIGNAL - Lower oil prices are not actually a bad thing when it comes to the cost of living. Mark looks beyond the inversion headlines and is interested in the depth of the inversion.

Both Simon and Mark are very defensively positioned in these markets. Simon is holding "at least" 1/3 of his fund in cash, not including duration or fixed income investments. In contrast, 20% of Mark's recommended portfolio is in bonds/bond ETFs and another 10% of it is in cash. For the more adventurous, Mark also points to bank hybrids and even the short NASDAQ ETF (ASX: SNAS).

The Charts to Watch

For more on the market outlook, you can read this piece featuring the views of Morningstar's Matt Wacher, Longview's Harry Colvin, and Barclays' Ajay Rajadhyaksha.

.png)

4 topics

2 stocks mentioned

3 contributors mentioned