Why the Great Rotation into small caps is just getting started (and 9 ETFs and stocks to consider)

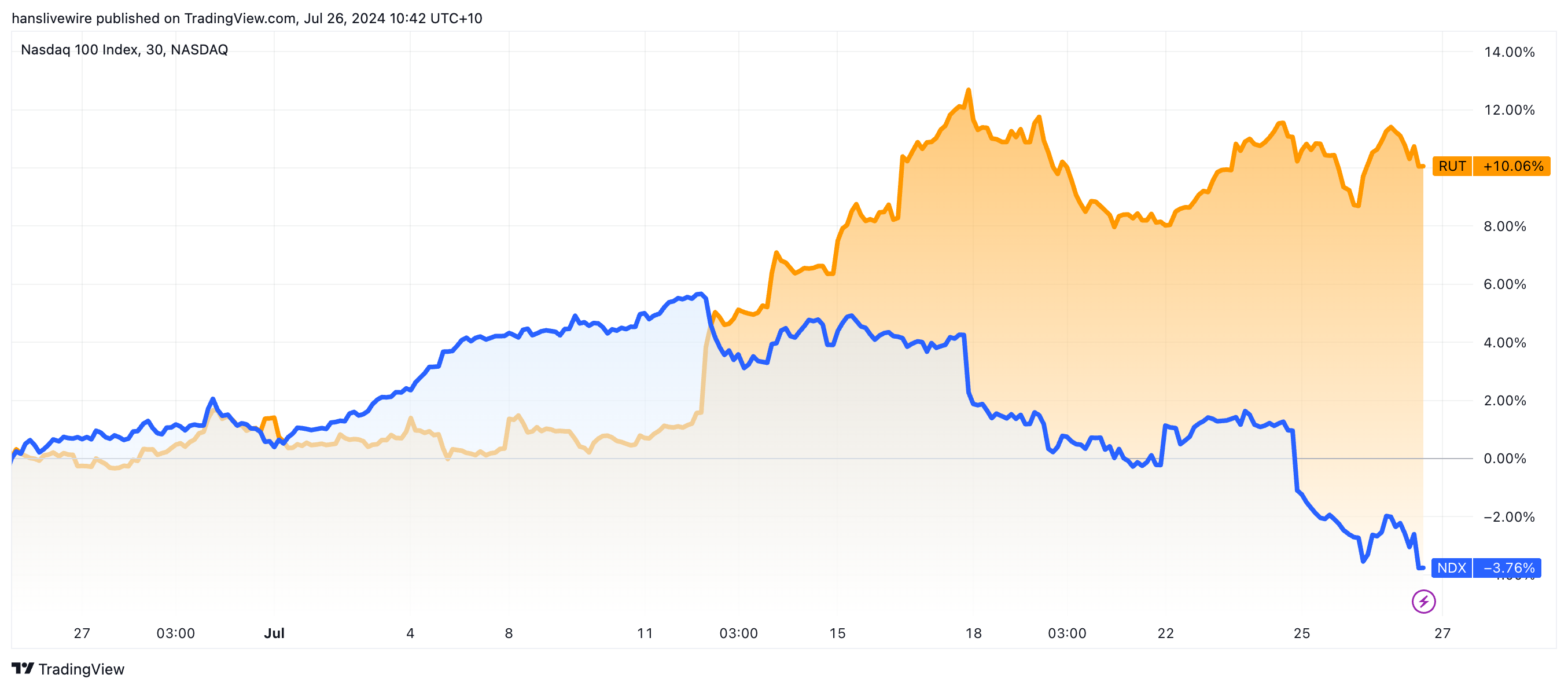

Unless you've been living under a rock, global markets have witnessed a remarkable shift in the past two weeks. After two years of Magnificent Seven dominance, attention is now turning to the benchmark US small-cap index. The Russell 2000 has surged nearly 10% in just one month, while the NASDAQ 100, home to mega-cap tech stocks, has dropped 3% over the same period.

It's led to the financial press coining this move as the "Great Rotation".

But as experienced investors can tell you, one month does not make a trend and paradigm shifts should not be confused for garden variety corrections.

So, for this wire, I've asked Sam Stovall, chief investment strategist at CFRA, to share whether he thinks this shift out of mega-cap tech is both real and here to stay. Stovall has five decades' worth of experience in the markets, most notably serving as chief equity strategist at S&P Global for more than 27 years.

What is causing the Great Rotation?

While others have hypothesised that the Great Rotation is being caused by increased conviction around the start of rate cuts or even the outcome of the US Presidential Election, Stovall argues it's down to earnings.

"I think the worry is that earnings are not going to come through as quickly as investors had anticipated, in particular as it relates to AI," Stovall said.

When I asked him why he thought this was occurring now and not earlier, he had this to say:

"I think it's a matter of fear and greed, the fear of missing out on this AI move which has been driven by greed. But as a result, we got to levels that were indicating that these groups were quite vulnerable to a potential sell-off," Stovall said. "I think that these sectors and markets were essentially being set up for some sort of disappointment and they got it," he added.

Stovall, being a numbers man at heart, threw out these additional stats to consider about where markets had moved to and why a move of this magnitude was always - to quote him directly - "just a matter of time":

- The S&P 500 was trading at a 15% premium to its 200-day moving average, which was a very lofty level.

- The S&P 500 was also trading at a 37% premium to its P/E ratio on forward earnings over the last 20 years.

- Technology (stocks) was trading at a 78% premium to its average P/E going back to the Dot Com bubble.

- When you look at the relative strength between the capitalisation-weighted S&P 500 and the equal-weighted 500 again, you've got to go back to 2000 to see this kind of outperformance.

Translation: Whatever measure you look at, stocks were due for a correction.

What sparked this rotation?

Earnings and cheap valuations may be the "why" in this story but guidance around the first interest rate cut from Federal Reserve Chair Jerome Powell likely sparked the "when".

"Now, we're pretty certain that the Fed will start to cut rates in September and I think that's what investors had been waiting for," Stovall said. "I think investors wanted to have a bit more assurance before rotating in."

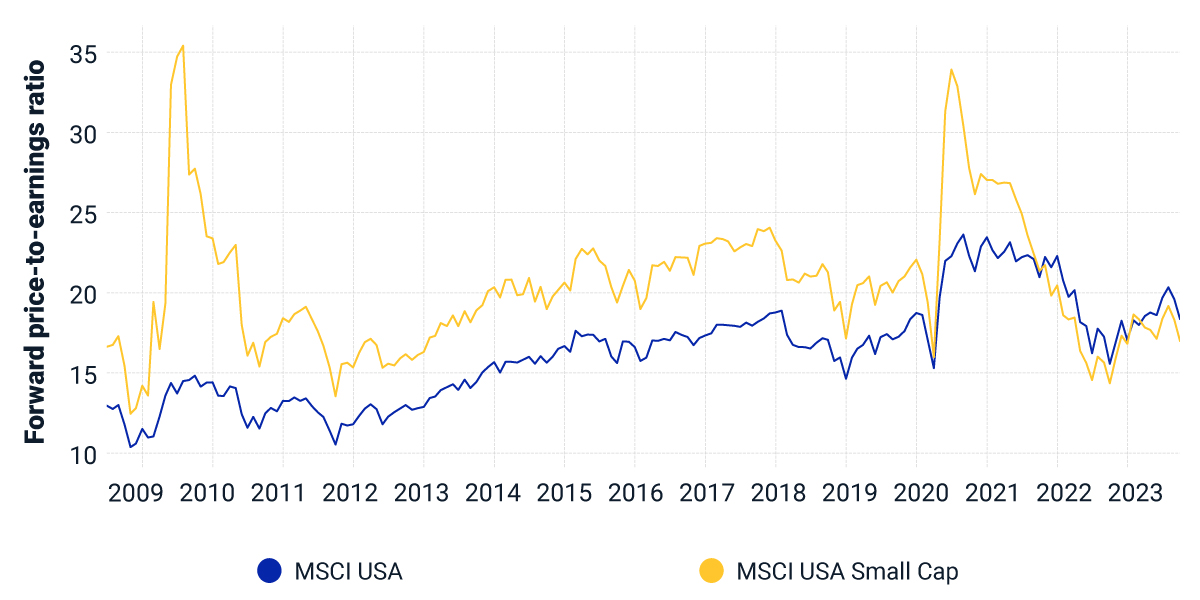

"Fundamentally, mid and small-cap stocks looked very attractive. They had been trading at a 30% and 35% discount to their 20-year average relative P/E," he added.

A graphic example of what Stovall is referring to is here:

Will this rotation remain exclusively in stocks?

I also asked Stovall whether he thought the Great Rotation would be a phenomenon exclusive to stocks (that is, investors, taking large-cap profits and putting them into small and mid-caps or people putting excess cash holdings exclusively into small and mid-caps.)

"I don't think that you're going to see an exclusive rotation into mid and small-cap stocks," he said.

"92% of the S&P 1500, which is the US Stock Market according to S&P Global, are large-cap. The rest, the small and mid-cap universe, represent 8% of the US stock market's total value. If you think that the mid and small caps can absorb the selling that investors might undergo from the large caps, that would be like thinking that you could drain one of the US Great Lakes into your backyard swimming pool."

"The bond market is substantially larger than the equity market. So if you add the bond market to mid and small-caps, then yes, I think investors are opportunists. They are going to jump from one lily pad to the next. Right now, the most attractive lily pads are mids, smalls, and bonds," he added.

Stovall's top investment ideas

For those who don't have exposure yet, then you have a whole range of options - starting with buying an ETF.

"If you're not comfortable with the mid and small-cap companies, you can certainly buy the S&P 500 Equal Weighted ETF, then that way, every stock is spread around," Stovall suggests.

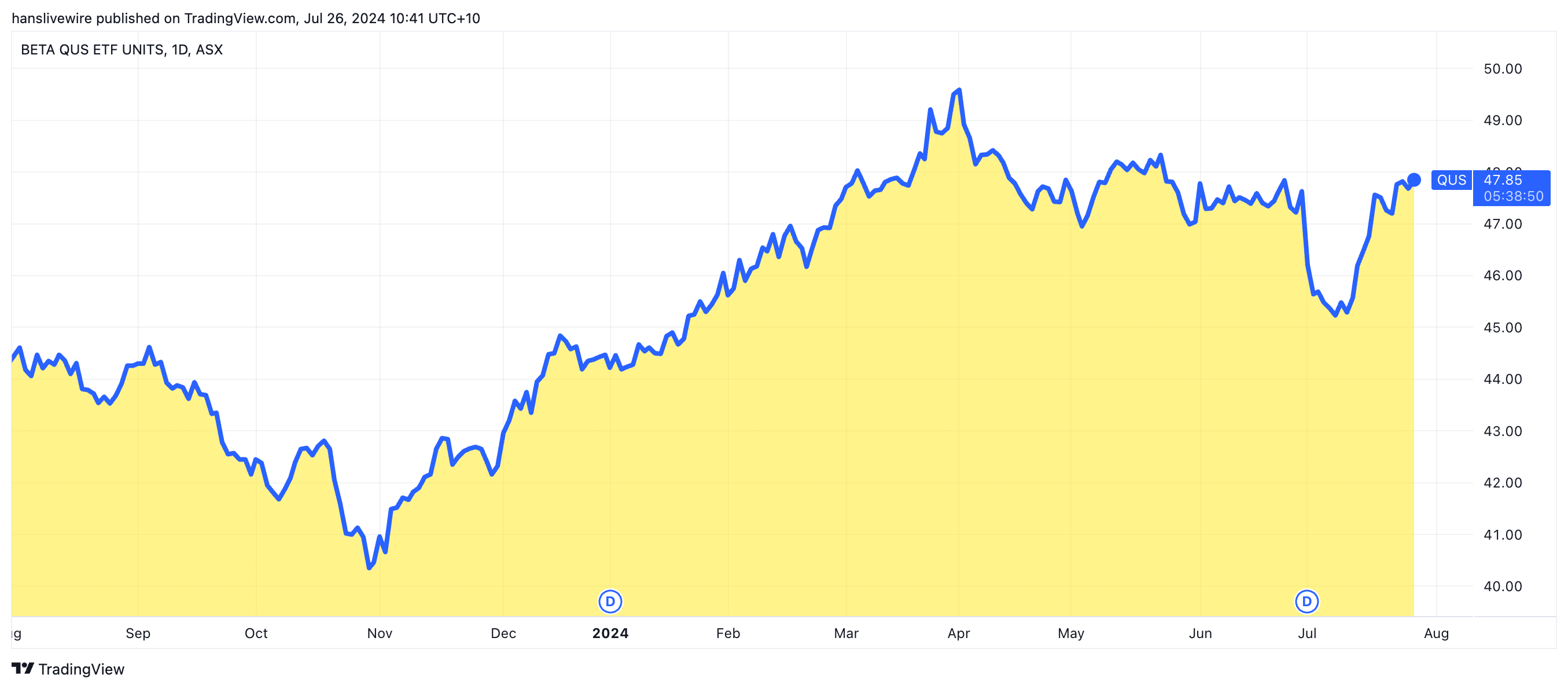

In Australia, Betashares offers unhedged and hedged access through the Betashares S&P 500 Equal Weight ETF (ASX: QUS) and (ASX: HQUS) respectively. For those with access to overseas markets, BlackRock and Invesco offer similar products.

Other ETF options include:

- The iShares Core S&P Small Cap ETF, which tracks the S&P 600 (NYSE: IJR). Stovall says he prefers tracking the S&P 600 to the Russell 2000 because "these companies require greater scrutiny. They have to be profitable and do so for an extended period before they are added to that index." The iShares Core S&P Mid-Cap ETF is the mid-cap equivalent to IJR and tracks the S&P 400. Its home ticker is (NYSE: IJH).

- For quality-minded investors, Stovall points to the Pacer Small Cap Cash Cows 100 ETF (NYSE: CALF).

- For the income-oriented investor, US markets have long tracked companies that can consistently raise their dividend payouts through the cycle (15 years or more). These companies are called the "Dividend Aristocrats" and they can be found in the Proshares S&P 400 Mid-Cap Dividend Aristocrats ETF (NYSE: REGL).

For the stock pickers out there, Stovall abides by these rules:

"I would say look for companies that have earnings growth expectations that are above the overall index. Look for the [company's] S&P 500 earnings and dividend quality ranking to be better. B+ is average but A-minus, A, and A-plus are all what you're after. Those are above-average rankings, meaning they have a superior track record of raising their earnings and dividends. Lastly, make sure the volatility of these stocks is below the market average."

Some of the CFRA team's most highly-rated stocks of late include:

- US regional banks, particularly East West Bancorp (NASDAQ: EWBC)

- US real estate, particularly Federal Realty Investment Trust (NYSE: FRT)

- Insurance firms, like Autonation (NYSE: AN)

Finally, what if you're a nervous nellie?

"My suggestion is to not allow your emotions to become your portfolio's worst enemy," Stovall says. "Let me remind investors that the speed with which the market gets back to break even after a decline of 10-20% has, on average, been only four months. So, by the time investors have worked themselves up into a frenzy, the market is probably already on its way back to break even," Stovall notes.

5 topics

11 stocks mentioned

3 funds mentioned