Why the move to clean energy won’t be enough

.jpg)

Betashares

2020 was planet Earth’s hottest on record - a fact that many would be forgiven for missing in what can only be described as a tumultuous year. Outside of the COVID pandemic, global weather patterns appear to have become more extreme. Australia has been at the forefront. Unrelenting bushfires tore through the country last summer and more recently, after years of drought, severe floods have devastated regional populations.

Climate change means we may face more frequent and severe weather events such as those mentioned above. The increase in physical risks can themselves enhance financial and economic risk.

In the face of this, for one of the first times in history, we have seen governments and corporations across the globe coordinate and collaborate on an agreed goal of net-zero carbon emissions by the turn of the half-century.

In December 2015, 196 nations signed a landmark and legally binding international treaty on climate change, with the goal to limit global warming to around 1.5 degrees Celsius compared to pre-industrial levels. This was known as the Paris Agreement.

Many go as far as to call climate change the ‘defining challenge of our age’. Regulators and policymakers are also becoming increasingly focused on the urgency of decarbonisation, increasing the importance from an investment context.

Decarbonisation - the systematic effort of governments and corporations to reduce ‘carbon intensity’, lower the amount of greenhouse gas (GHG) emissions and align themselves with a low-carbon economy.

Whilst the physical risks have been discussed

for a number of years, climate change has now become an economic reality.

Current spending not enough

The agreements have already been made and targets set. Companies and governments around the world are committed to reaching a net-zero target by 2050. However, we are currently falling far short of these targets and the only way to meet them is a significant ramp up in spending and activity.

According to a report released in September 2020 by the Energy Transitions Committee (ETC), a coalition of senior executives from 45 energy producers, financial institutions and environmental groups, the additional investment required to achieve a net zero carbon-emissions economy by 2050 will be US$1-2 trillion p.a.

If we are to meet a goal of net-zero by 2050, it is estimated that the current annual investment needs to triple to USD 1-2 trillion per year.

Whilst from a survival standpoint this is crucial, it would also result in monumental flows of capital into companies at the forefront of emissions-reducing innovation.

Taking China as an example, to meet these targets would require a doubling of their annual solar investment and quadrupling of their wind investment. This is before taking into account the spending required to develop hydrogen and efficient energy storage. (i)

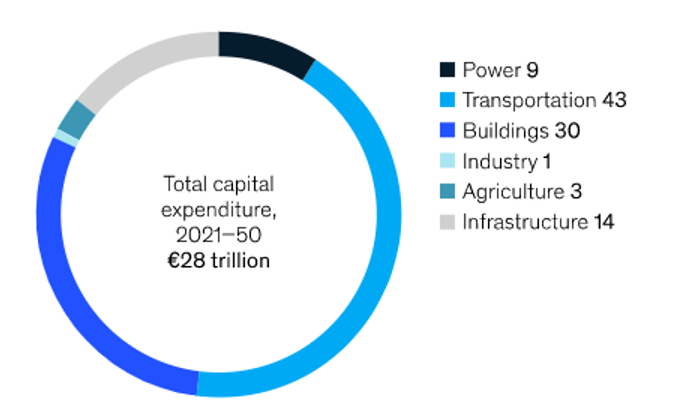

Europe is often considered the pioneer when it comes to green initiatives from a government level. With this said, according to projections from McKinsey, the European Union alone requires EUR 28 trillion in investments over the next 30 years to reach net-zero. (ii)

Figure 1: % of total capital expenditure in the 27 EU countries, 2021-50, to achieve net-zero emissions

Source: McKinsey & Co, Report: How the European Union could achieve net-zero emissions at net-zero cost, 3 December 2020

What matters for investors is not only the physical impacts of climate change, but also what these mean from a portfolio context.

Ignoring climate risk in portfolios has become a risk in itself. Conversely, the current and projected flow of capital into innovative decarbonisation solutions and technologies represents a global mega-trend that may provide multi-decade investment opportunities of a scale previously unseen.

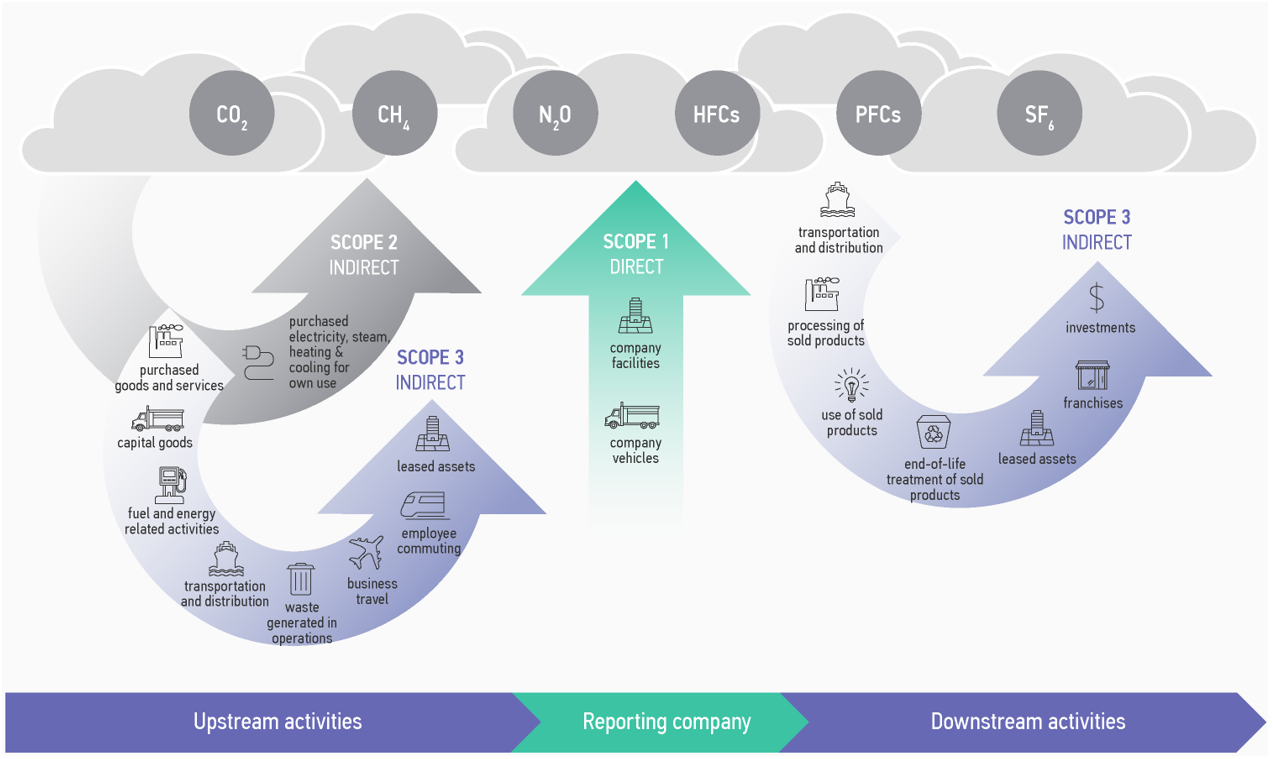

Different scopes of emissions

Every company is responsible for three types of carbon emissions. In order to achieve net-zero, significant spending is required across all three:

- Scope 1: Direct emissions from owned or controlled sources

-

Scope 2: Indirect emissions from the generation of purchased energy

-

Scope 3: Indirect emissions (not included in Scope 2) that occur in the value chain of the reporting company, including both upstream emissions (from purchased goods) and downstream emissions (from sold products).

Figure 2: Emissions across the supply chain

Source: Greenhouse Gas Protocol

Up until now, the majority of corporate focus from an action and reporting perspective has been on reducing their own Scope 1 and Scope 2 emission activities. However, this does not consider any of the substantial emissions a company is responsible for outside of its own operations - including supply chain emissions as well as those from the use of sold products. These are incorporated under Scope 3.

In order to progress to a holistic climate response, it is essential that companies reduce Scope 1 and 2, however more development is required in terms of Scope 3.

In fact, the majority of total corporate emissions come from Scope 3 sources. (iii)

Beyond renewable energy

Given the burning of fossil fuels to produce energy is a major contributor to greenhouse gas emissions, a move towards clean renewable energy will clearly be important. According to the United Nations Intergovernmental Panel on Climate Change (IPCC) projections (iv), the renewable share of energy production would need to increase from around 15% at present, to at least around 60% by 2050.

Government spending on renewable energy generation is, however, only one high profile component. The deep cuts to carbon emissions that will be required to limit global warming cannot be achieved by clean energy alone - particularly given their own significant land and material requirements in areas such as wind and solar.

The total solution is much broader. Outside of government initiatives, arguably the most immediate and deepest cuts will come from companies that can reduce their own carbon emissions and the solutions and technologies enabling them to do so.

Beyond phasing out fossil fuels and replacing them with clean energy sources, in order to meet emissions targets we will simultaneously need to update the efficiency of nearly every building on earth, improving insulation, power sources and building efficiency. Additionally, all internal combustion powered transport will need to be electrified, traditional agriculture will need to be modernised and regenerative practices implemented.

Using Europe as an example again, from McKinsey’s projections of capital expenditure required across different segments, power represents less than 10% of the total capital expenditure required. (v)

Five climate innovation pathways

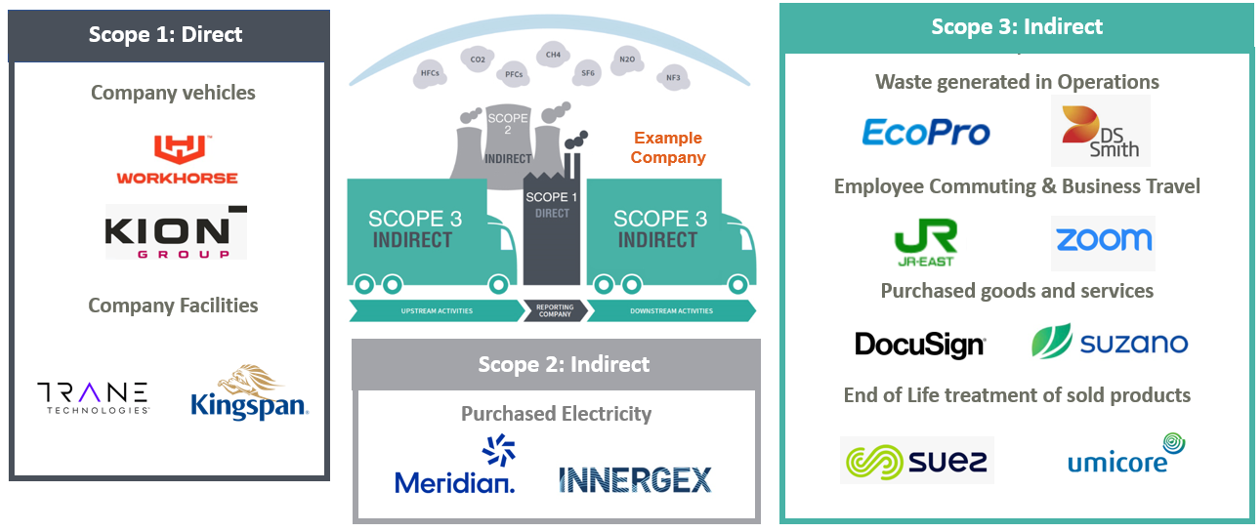

Climate change innovation can be segmented into five key areas where action needs to be taken and that are most likely to benefit from large flows of capital towards decarbonisation initiatives. (vi)

Each of these five segments contains either pureplay decarbonisation companies or those enabling the transition of others across the entire value chain.

1. Green energy

Companies that provide or enable renewable energy generation from solar, wind, hydro, ocean, tide and geothermal sources. Renewable energy generation is a climate change mitigation solution that contributes directly to the reduction of fossil fuel energy generation and greenhouse gas (GHG) emissions.

2. Green transportation

Companies focused on climate change solutions that enable reduction of GHG emissions from fossil fuel combustion in internal combustion engine (ICE) vehicles. This also includes companies in public transport that enable a modal shift from ownership and usage of private ICE vehicles.

3. Water and waste improvements

Companies that provide water and waste management services that enable energy saving, sustainable treatment of waste and avoidance of landfill GHG emissions from decomposition.

4. Enabling solutions

Solutions that indirectly enable reduction of GHG emissions from energy generation, combustion in ICE vehicles and more efficient operation of buildings and industrial processes.

5. Sustainable products

Companies that offer products from sustainable raw materials, products that enable reduction of GHG emissions in the production stage, use phase and/or end of life phase.

Figure 3: Examples of companies enabling others to reach emissions targets

Source: BetaShares, iClima

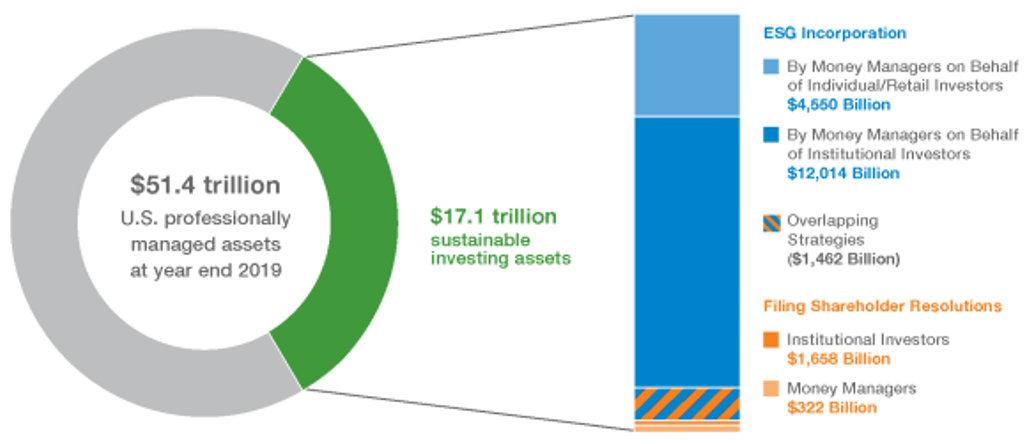

Sustainable investing tailwinds

Sustainably invested assets now account for more than one in every three dollars under professional management in the U.S. (vii)

Figure 4: Size of sustainable investing assets in U.S.

Source:

The US SIF Foundation's 2020 Report on US Sustainable and Impact Investing

Trends

Institutional asset owners worldwide now routinely incorporate environmental, social and governance (ESG) factors into their investment decision-making. According to a survey by Morgan Stanley, 95% of institutional asset owners are integrating or considering integrating sustainable investing in all or part of their portfolios. 57% envision a time when they will only allocate to managers with a formal ESG approach. (viii)

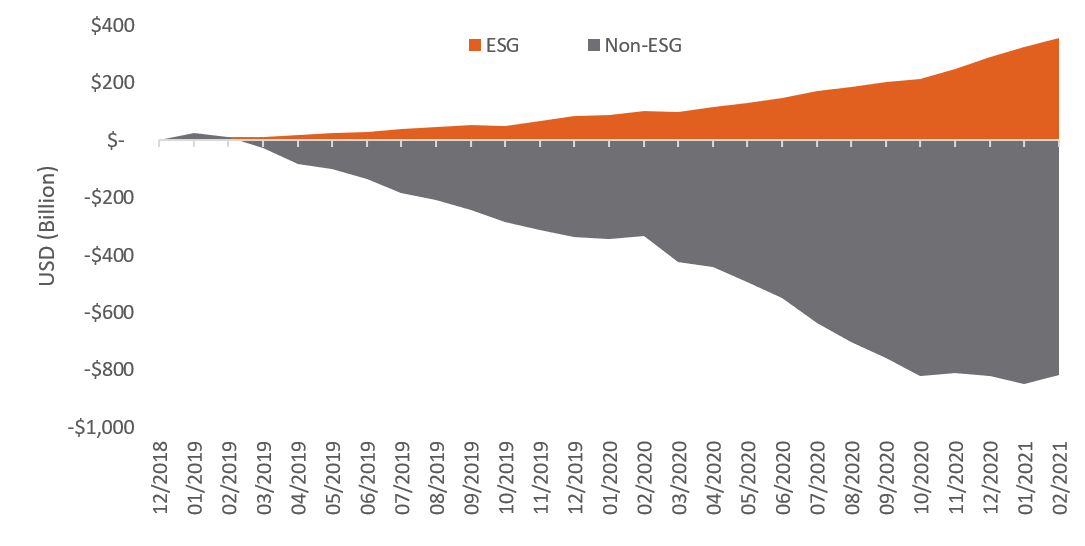

This seismic shift in investor preference is easily visible when looking at flows into investment funds across the globe as shown in Figure 5.

Figure 5: Cumulative Monthly flows into Global Equity Funds

Source: Morningstar, BetaShares. Morningstar universe defined as Global Open-End Equity Fund. ESG defined as funds with ‘Intentional Attributes: Sustainable Investment – Overall’

Whilst a focus on sustainability appears key for fund managers looking to attract assets, the rising scrutiny from investors, regulators, and consumers when it comes to sustainability is also critical to individual company directors looking to attract capital for their organisations.

Approximately 40% of global companies already have a confirmed emissions reduction target. (ix) However this number is expected to grow as companies ensure they meet ESG criteria. In order to do so, companies will need to reassess supply chains and increase spending on climate change solutions and innovation.

Transition risks to traditional assets

An additional, although relatively new, category of risk can be defined as ‘transition’ or ‘stranded-asset’ risk.

Transition risks can occur when moving towards a greener or less polluting economy. Such transitions could mean that some sectors of the economy face big shifts in asset values or higher costs of doing business.

One example is energy companies. If government policies were to change in line with the Paris Agreement, results from a 2015 study by the University College London suggest that globally a third of oil reserves, half of gas reserves and over 800 per cent of current coal reserves should remain unused from 2021 to 2050. (x)

This has the potential to lead to large asset write-offs by companies holding these assets on their balance sheets, and have large ramifications for banks, insurance companies and the end investors with exposure to these areas.

This is one of many reasons why sustainability screens play an important role when constructing portfolios. Investors should be aware of the fossil fuel involvement of companies within their portfolio and consider specific exclusions if looking to mitigate transition risk, even when focusing on decarbonisation enablers.

How to invest in pure-play decarbonisation companies?

‘Impact investing’ – defined as investing in areas, companies or projects delivering specific positive social and/or environmental impacts - has historically been limited to private markets, which can be illiquid and often only accessible to large institutional investors.

The universe of listed companies operating in these areas has increased, although it remains difficult to navigate. Investors may choose to invest in listed companies whose primary activities directly contribute to decarbonisation, such as electric vehicle manufacturers or renewable energy suppliers, however picking individual winners can be difficult and due diligence on revenue streams and fossil fuel involvement is time consuming.

ETFs have democratised the way investors can gain exposure to asset classes, sectors and thematics, which historically were very difficult to access. Impact investing is no different, and there are a growing number of ETFs here in Australia and globally that enable investors to address and mitigate the effects of climate change through their investments, and benefit from the climate change mega-trend. ETFs offer investors access to a diversified portfolio, without requiring large investment amounts and without necessarily having to pay high ‘active-management’ fees.

Lead the fight with one trade

The BetaShares Climate Change Innovation ETF (ASX Code: ERTH) has been designed to provide investors with exposure to some of the world’s leading companies at the forefront of innovations designed to tackle climate change. To learn more, please visit our website.

Footnotes

(i) The Energy Transitions Commission – China 2050: A Fully Developed Rich Zero-Carbon Economy, July 2020.

(ii) McKinsey & Co, Report: How the European Union could achieve net-zero emissions at net-zero cost, 3 December 2020

(iii) Greenhouse Gas Protocol – Corporate Value Chain (Scope 3) Accounting and Reporting Standard, April 2013.

(iv) IPCC Special Report, Global Warming to 1.5°C, October 2018

(v) McKinsey & Co, Report: How the European Union could achieve net-zero emissions at net-zero cost, 3 December 2020

(vi) (VIEW LINK)

(vii) (VIEW LINK)

(Viii) Morgan Stanley Institute for Sustainable Investing – Sustainable Signals, Asset Owners See Sustainability as Core to the Future of Investing, December 2019.

(ix) UNEP (2018). The Emissions Gap Report 2018. United Nations Environment Programme, Nairobi

(x) McGlade, C., Ekins, P. The geographical distribution of fossil fuels unused when limiting global warming to 2 °C. Nature 517, 187–190 (2015).

3 topics

2 stocks mentioned

.jpg)

Alistair is responsible for supporting Institutional and Intermediary Broker channels. Prior to joining BetaShares, he was based in London, working at European ETF provider Lyxor Asset Management.

.jpg)

Alistair is responsible for supporting Institutional and Intermediary Broker channels. Prior to joining BetaShares, he was based in London, working at European ETF provider Lyxor Asset Management.

.jpg)