Why the recent US turmoil is a storm in a bean (counter's) cup

Our analysis indicates the problems are largely contained to those banks with high uninsured deposit ratios, and high customer concentration. Banks that satisfy all of these factors probably comprise less than 3% of the banking system. However, a pullback in bank lending should be expected, which will be a headwind to GDP growth and could hit the commercial real estate market particularly hard.

Bank failures are common

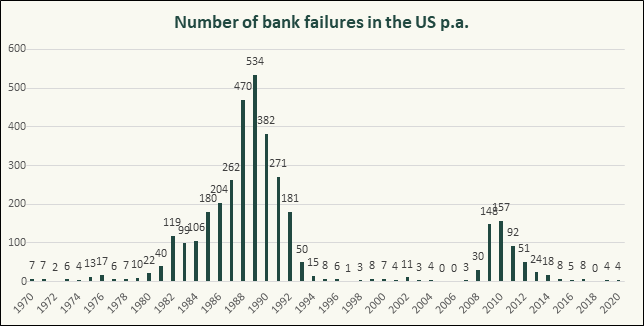

Bank failures are common in the US. This chart illustrates the number of bank failures in the US annually from 1970 to 2020. During that fifty-year period, there were only three years where a bank failure did not occur.

Source - FDIC

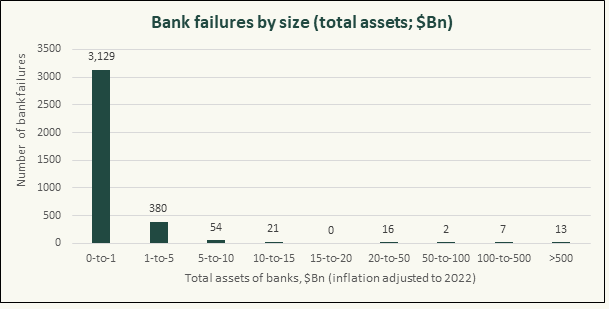

Most of these banks are tiny with 90% of the failures having less than $5Bn in assets and there have only been seven banks with more than $100Bn in assets that have failed.

Amid these failed banks, SVB, First Republic, and Signature are relatively large, which is why they have garnered so much attention. However, the key word here is ‘relatively’ and in absolute terms these banks remain minnows.

List of largest US bank failures and bailouts

|

Rank |

Name |

Year |

Assets |

|

1 |

Bank of America (1) |

2009 |

2,007 |

|

2 |

Citibank (1) |

2008 |

1,641 |

|

3 |

Washington Mutual |

2008 |

417 |

|

4 |

MBNA |

2009 |

218 |

|

5 |

First Republic Bank |

2023 |

213 |

|

6 |

SVB Financial Group |

2023 |

212 |

|

7 |

Countrywide |

2009 |

161 |

|

8 |

Continental Illinois |

1984 |

112 |

|

9 |

Signature Bank |

2023 |

111 |

|

10 |

Merrill Lynch |

2009 |

84 |

|

50 |

Silvergate |

2023 |

11 |

Source – FDIC, Pella Funds Management

(1) Technically failed but was bailed out during the GFC as they were deemed “too big to fail”

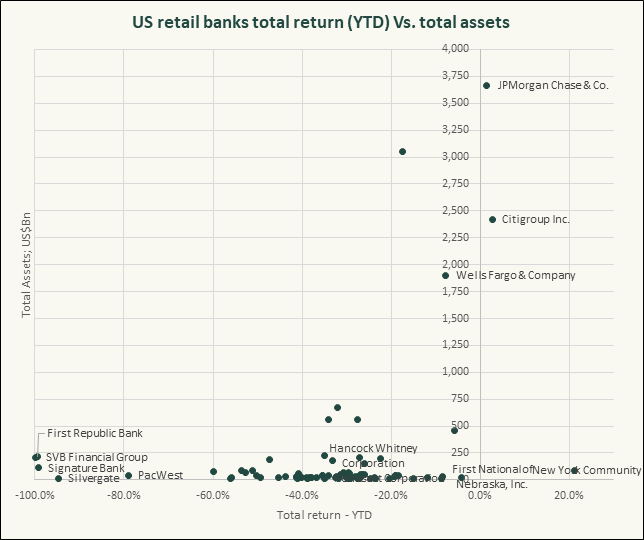

The chart below illustrates the share price performance of US banks versus their total assets. It demonstrates that all the banks that have failed to date are relatively small with none of them having more than $220Bn in total assets as of December 2022 (leading into the turmoil). This only provides partial comfort because the US has a lot of small banks and if they were to all fail, it would amount to approximately $4T in assets, which would be a big deal.

Characteristics of recent bank failures

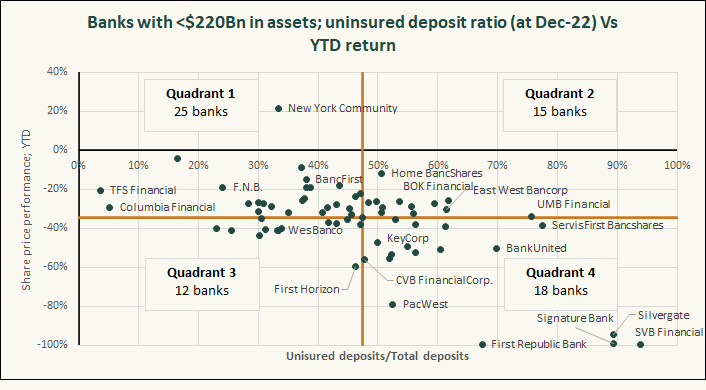

Another common feature of the recent bank failures is that they had high uninsured deposit ratios at Dec-22, leading into the crisis. The chart below illustrates the uninsured deposit ratio and total return for 70 listed US banks with less than $220Bn in total assets as of 31 December 2022. The chart is divided into quadrants according to the group’s total return and uninsured deposits. We make the following observations of this chart:

- Uninsured deposit ratio is an important determinant of these banks’ returns – banks with low uninsured deposit ratio have tended to outperform their peers (quadrant 1) and banks with high uninsured deposit ratios have tended to underperform their peers (quadrant 4).

- All the banks that have failed to date had extraordinarily high uninsured deposit ratios.

- However, the extreme uninsured deposit ratios in isolation aren’t always a determinant of share price performance as there are a handful of banks with high uninsured deposit ratios that have not performed as badly such as ServisFirst Bancshares and UMB Financial.

- This is further demonstrated by the collapse in PacWest, which had a large, but not extreme, uninsured deposit ratio.

Returns = YTD total return for shareholders

Figures at Dec-22 to demonstrate figures going into the Mar-23 bank turmoil

The big question is what is the other factor that will determine if a bank fails or not? In all cases the third issue (after size and uninsured deposit ratio) has been concentrated exposures, but the concentrated exposure has differed between the failed banks. For Signature and Silvergate, the issue was exposure to crypto, for SVB it was Silicon Valley companies, for First Republic it was exposure to wealthy retail clients, and for PacWest the issue is high exposure to commercial property.

What does this all mean?

The current US bank turmoil appears to be predominantly concentrated in:

- Smaller banks

- High uninsured deposit ratio

- Concentrated exposure

To quantify the size of the potential issue, excluding the four banks that have already failed, there are 20 banks that satisfy the smaller bank and uninsured deposit ratio, and these banks have an aggregate $846Bn assets. Overlaying the concentration requirement brings that exposure down.

US Banks with less $220Bn in assets and >50% uninsured deposit ratio (at Dec-22)

|

Bank |

Uninsured deposit ratio |

Total assets |

|

Zions Bank |

52% |

89.5 |

|

Comerica Incorporated |

60% |

85.4 |

|

Western Alliance Bancorp |

56% |

67.9 |

|

East West Bancorp |

62% |

64.1 |

|

Synovus Financial Corp. |

51% |

59.9 |

|

Cullen/Frost Bankers |

54% |

52.9 |

|

BOK Financial |

62% |

47.8 |

|

PacWest |

52% |

41.2 |

|

Associated Banc-Corp |

53% |

39.4 |

|

UMB Financial |

76% |

38.9 |

|

BankUnited |

70% |

37.2 |

|

Hancock Whitney |

51% |

35.3 |

|

Texas Capital Bancshares |

60% |

28.5 |

|

First Hawaiian |

61% |

24.7 |

|

Bank of Hawaii Corp |

52% |

23.6 |

|

Home BancShares |

51% |

22.9 |

|

WSFS Financial |

56% |

19.9 |

|

Independent Bank |

55% |

18.3 |

|

First Merchants |

56% |

17.9 |

|

TowneBank |

56% |

15.9 |

|

ServisFirst Bancshares |

78% |

14.6 |

|

Total |

58% |

845.9 |

Source – Pella Funds Management

^ used figures at Dec-22 to demonstrate features heading into the Mar-23 turmoil

Failure of all these banks would have a material impact on the US economy, but that is unlikely as we doubt all those banks have concentrated exposures. Further, some of those banks have reduced their uninsured deposit ratio meaningfully since Dec-22; for example, EastWest Bank's uninsured deposit ratio is now only 41%. So, the value at risk is something lower than $846Bn, but we don’t know exactly what that number is. If we assumed inclusion of high concentration risk brings the size of the exposure to around $500Bn the issue would be approximately 3% of the US banks’ total assets, and about the same size as the banks that have already failed. This matters, but it is highly unlikely to be devastating for the US economy.

Our conclusion is that, based on the current factors driving US regional banks’ share performance, the risk to the US economy and market from ongoing bank failures is not extreme and is not something we are losing sleep over.

Focusing on impact of current failures

While we aren’t losing sleep about the impact on the broader US economy from bank failures, that doesn’t mean there will be no impact, and we expect the recent bank turmoil to contribute to a slowdown in lending in the US, particularly to the commercial real estate sector.

We refer to the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices, which is a quarterly survey of up to 80 large domestic banks and 24 branches of international banks, to get a clearer picture of credit and lending. Noting also that the survey is considered by The Fed in its rate setting meetings.

The survey divides banks into three categories:

|

Category 1 |

Category 2 |

Domestic assets |

|

Large |

Largest banks |

≥$250Bn |

|

Mid-size |

$50-250Bn |

|

|

Others |

Others |

≤$50Bn |

Source – Federal Reserve

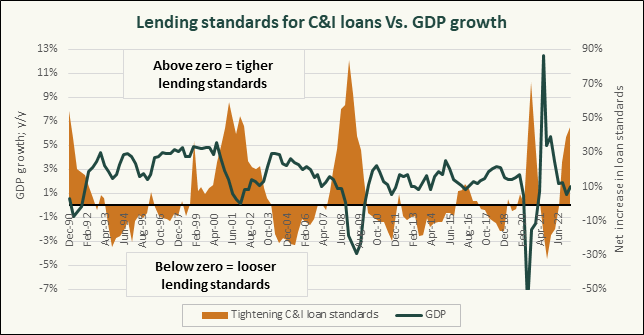

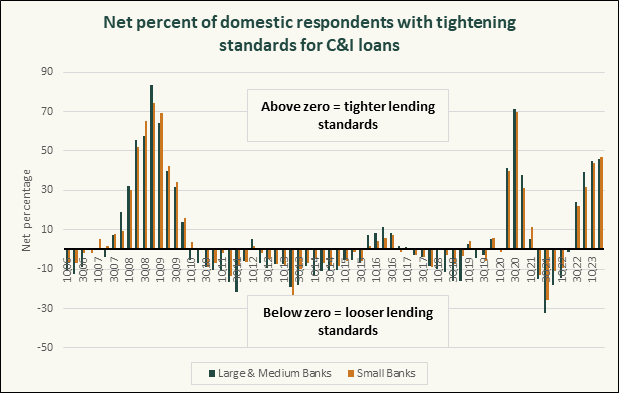

The survey has demonstrated a strong relationship with GDP growth. For example, the lending standards for commercial & industrial loans (C&I) has a demonstrably strong negative correlation (-0.55) with GDP growth. This can be observed in figure below and has been demonstrated in academic studies[1]. So, this survey does provide strong explanatory power on the direction of US economic activity.

Credit standards for C&I loans have increased substantially since mid-last year, are high, and continue to increase. The most recent survey was concluded in Apr-23 and our best guess is that standards have tightened further since then. In the April survey banks expressed that they expected to tighten credit standards during 2023, with the key reasons being “a less favorable or more uncertain economic outlook… as well as reduced tolerance for risk, deterioration in customer collateral values, and concerns about banks' funding costs and liquidity positions”. Further, in comparison to the largest banks, mid-sized and other banks more frequently cited concerns regarding their liquidity positions, deposit outflows, and funding costs as reasons for tightening.

Based on these data, it is a fair bet that the banking turmoil, driven by deposit outflows, will result in tightening lending standards. This is highly likely to have a negative impact on economic activity, but the real question is which parts of the economy will be hit the hardest?

This table illustrates the share of several components of the US banking system. It illustrates that small banks account for 67% of US commercial real estate loans. Pella believes that this is likely to be the area most impacted by a pullback in small bank commercial lending.

Abbreviated share of US banking system as of 30 Apr-23

|

Large banks |

Small banks |

Foreign banks |

|

|

Securities in bank credit |

70% |

25% |

4% |

|

Commercial and industrial loans |

55% |

27% |

18% |

|

Residential real estate loans |

62% |

38% |

0% |

|

Commercial real estate loans |

29% |

67% |

4% |

|

Consumer loans |

82% |

18% |

0% |

|

Other loans and leases |

61% |

18% |

21% |

|

All other |

52% |

16% |

32% |

|

Total Assets |

58% |

29% |

13% |

|

Deposits |

62% |

31% |

7% |

|

Borrowings |

38% |

23% |

39% |

|

Net due to related foreign offices |

-124% |

10% |

213% |

|

Other liabilities |

66% |

15% |

19% |

|

Total liabilities |

57% |

29% |

14% |

Source – Pella Funds Management

Conclusion

Bank failures in the US are relatively common, but they are typically small banks. While SVB, First Republic and Signature make the top ten bank failures of all time, they are still small banks relatively speaking. Other characteristics of the recent bank failures are that they had high uninsured deposit ratios and large and concentrated exposures to one area (crypto, wealthy retail clients, Silicon Valley). These characteristics narrow down the share of banks that are susceptible to failing to the low single digits of the total US banking system, suggesting the current turmoil is unlikely to result in a full-fledged credit crisis. However, it is resulting in a pullback in lending by all banks. In coming periods, we expect smaller banks to retreat from lending, particularly commercial lending, further than large ones. One area of the economy acutely exposed to small bank lending, and therefore more at risk from a pullback in small bank lending, is commercial real estate.

Therefore, the recent banking turmoil is not causing us to lose much sleep, but it COULD be of serious concern to investors in commercial real estate. From a stock market perspective, the risk of failure should be confined to the smaller banks, but there will be negative spillover effects to the entire banking sector from the increase in funding costs, as well as from the regulatory (over)reaction to the recent turmoil.

[1] Lown and Morgan, Journal of Money, Credit and Banking; Bassett et al, Division of Research & Statistics and Monetary Affairs, Fed Reserve.

5 topics