Why the sell-off in the bond market matters to your investments

In July, Pershing Square founder and renowned hedge fund investor Bill Ackman made one of his famous big calls. He declared (on Twitter/X of all places) that he was short long-term US Treasury bonds. His full reasoning with a little bit of math is provided below:

Being short bonds suggests you think prices are going to fall and yields are going to rise.

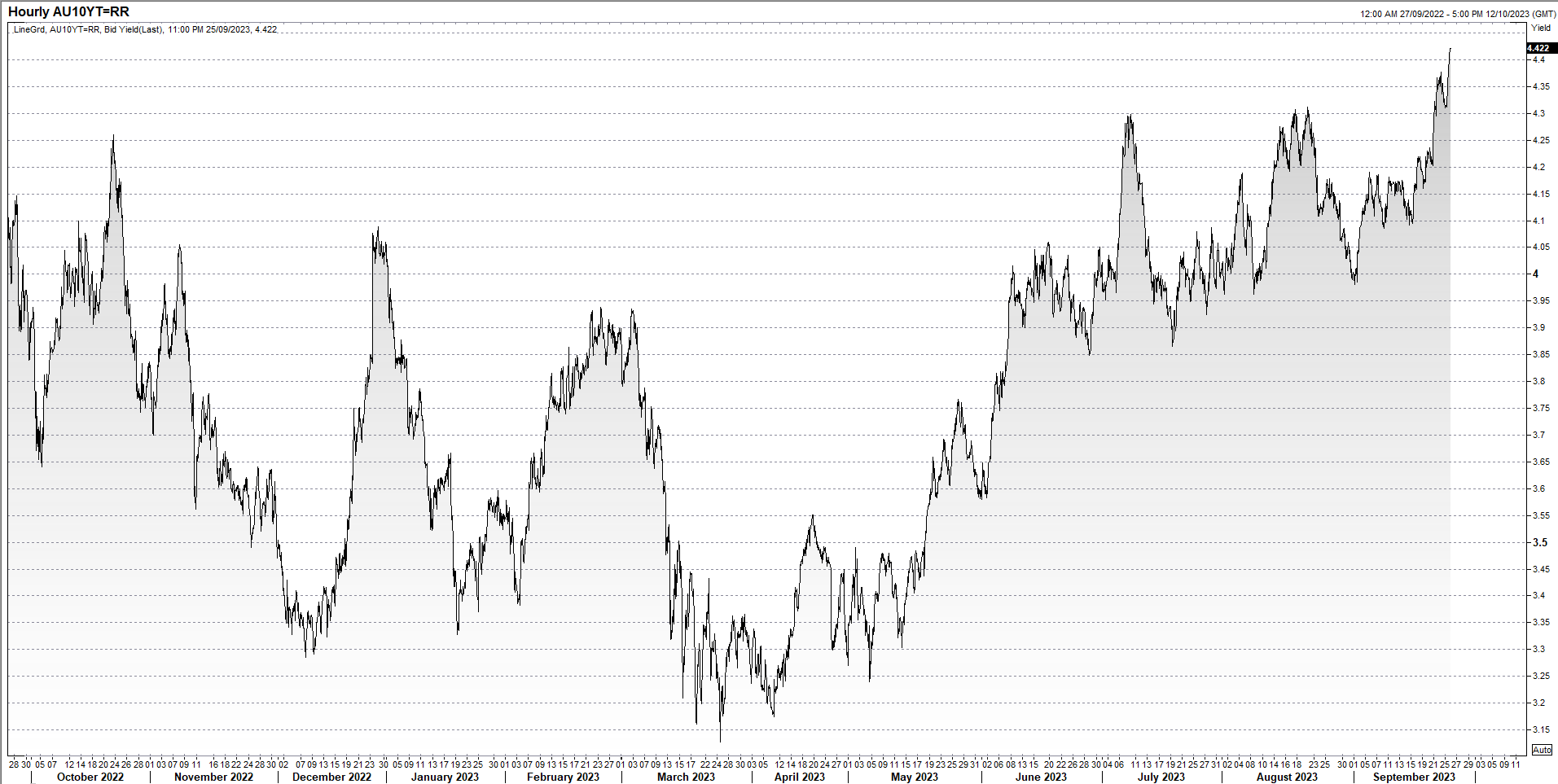

Let's see how that bet has done since he made that call.

Yields have surged, suggesting Ackman's bet has paid off - at least for now. And Ackman is not the only one betting against the world's largest bond market. Some sophisticated investors recently boosted their net short on short-term Treasuries (the bonds that expire in a couple of years or less) to the highest levels since 2006. This all happens even as retail investors are rushing into bond ETFs, despite one major US product (NYSE: TLT) trading at levels not seen since early 2011.

The same can also be said for Australian yields - which are at highs not seen for more than 12 years.

So why is Ackman right when so many other investors have been left out in the cold? This wire will attempt to answer that question. And whether you hold any bonds or not, our professional investors will pass on some advice about what to do with your positions.

The most significant reasons for the bond sell-off

Ackman's reasoning has alluded to some of it but there are three primary reasons for this year's continued sell-off in bonds.

The resilience of the global economy, or as Franklin Templeton's Chris Siniakov described it, "Crikey! We're a resilient bunch!".

"Data shows the pile of savings has largely been whittled away. Headline inflation in Australia peaked in Dec 2023 and is declining at a faster rate than its ascent into the peak but current CPI at 6% remains too high. Employment markets remain tight but signs of a more balanced labour market are coming through," Siniakov said.

"These components have ruled out the likelihood of rate cuts in 2023 and first half of 2024, resulting in government bond yield curves steepening," VanEck's Cameron McCormack said.

The second reason is the increase in government spending. More infrastructure and housing projects means governments need to borrow more money to fund those initiatives. The demand for more loans has only fuelled the sell-off.

And finally, central banks and their higher-for-longer mantra.

"This tone should shift rapidly when unemployment starts to trend higher. In the meantime, the US federal reserve continues to sell bonds through its balance sheet unwind (or quantitative tightening) programme which puts pressure on yields higher," Siniakov noted.

"Central banks also engaging in quantitative tightening and most governments repairing their budget deficit positions only gradually, the balance of supply and demand for bonds has deteriorated which is resulting in slightly higher term premiums," added Aaditya Thakur of PIMCO. Or, translating this sentiment, it means paying up more for safe assets.

The performance of the bond market this year has also raised another eyebrow

This year could mark the first time in history that the global bond market records three successive years of losses. So do our experts think that will happen?

"It will be close but unlikely. Higher yields have improved the carry cushion which quantifies how much yields relative to duration can increase before a bond investment return becomes negative," McCormack said.

"In Australia, which is a shorter duration bond market, it appears that we may just eke out a positive return. However, global markets, for example the United States, are longer duration markets which may just underwrite another negative year in 2023," Siniakov hypothesised before adding that he thinks investing in Australian bonds "make sense".

"Market pricing has now swung from pricing in a ‘hard landing’ to ‘no landing’ meaning recession probabilities implied by market pricing are very low. This leaves the market more vulnerable to downside growth and inflation surprises as we head into a period where monetary policy lags fade and the true impact of this aggressive monetary policy tightening begins to be felt in the real economy. We expect bond portfolio returns to provide near equity-like returns at a third to half the volatility over the medium term and investors should be, from a total portfolio perspective, looking to increase their allocation to bonds," Thakur said.

The traditional stock-bond correlation

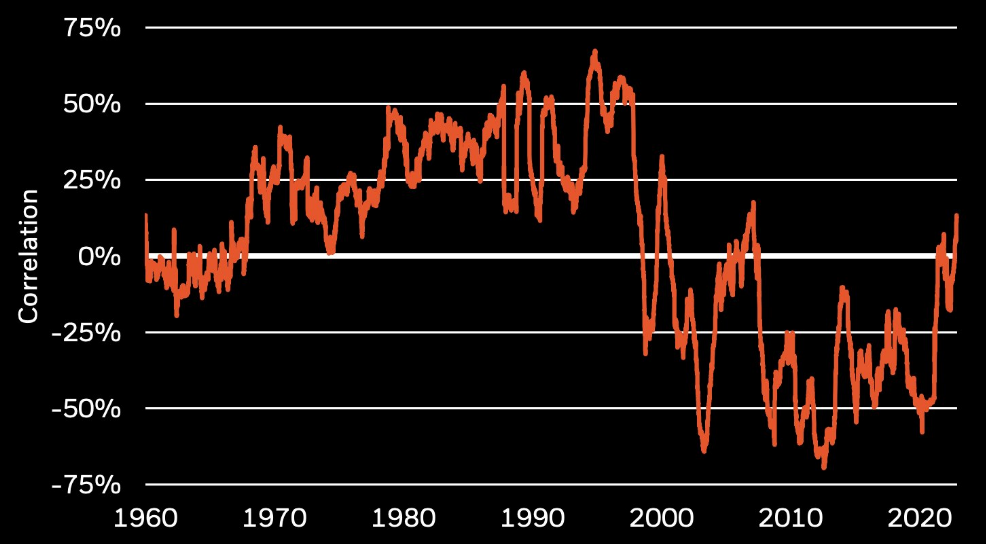

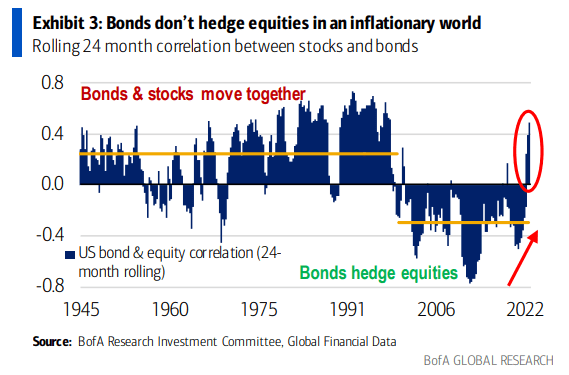

In a traditional world, stock and bond prices tend to move inversely to each other. That is, when stocks go up, bonds go down and vice versa. That has not happened since 2022, and depending on who you ask, this correlation is now well and truly dead.

BlackRock, for instance, think that the correlation is broken in a new regime of higher-for-longer inflation and interest rates.

In contrast, strategists at the Bank of America think the correlation is only useless in a certain kind of environment - one with high inflation. Between 1945 and 1995, the correlation worked in US assets because growth was strong and inflation was (for the most part) relatively under control. But the surge in inflation has taken that diversification benefit right out.

So what do our experts think?

"Often, during a rising real yield environment, the stock-bond correlation rises. But it is a common misconception that a positive stock-bond correlation means that bonds lose their diversification benefit. This is not the case and mathematically, the stock-bond correlation has to be less than one for bonds to still provide diversification benefit from a total portfolio sense. As we reach the end of hiking cycles, the stock-bond correlation will start to fall back to a more normal historical level therefore increasing the diversification benefit of bonds just when investors really need it," Thakur said.

"Long term studies over the last 100+ years show the stock-bond correlation was, in fact, positive 60% of the of the time. But, over the last 30-40 years when most of us grew up investing, we have lived in a disinflationary world largely due to macro factors such as the rise of China and technological advances. From an investment perspective, there aren’t too many places to hide in during inflationary regimes," Siniakov said.

What to do if you already hold bonds

Generally, investors concerned or wishing to insure themselves against economic weakness, can add duration to a bond portfolio as a way to benefit from government bond yields decreasing. For investors concerned about further yield increases, McCormack says he has noticed a big jump in inflows towards flexible products.

"Floating rate exposure has been very popular with our client base as a way to reduce duration risk while remaining invested in the bond market," he said.

It should be noted that VanEck have a range of products in this field - including a locally-denominated subordinated debt ETF (ASX: SUBD). Three new products are also coming soon, which will focus on short-term fixed income. These products target the 1-year, 5-year, and 10-year parts of the curve (labelled ASX: 1GOV, ASX: 5GOV, and ASX: XGOV respectively).

From the perspective of bond fund managers, the call is to average down.

"If you already hold positions in bonds that are high in quality, paying their coupons and expected to return principal at maturity, then hold on tightly to these securities. You should probably consider even adding to these positions. Be careful not to stray too far from these attributes though," Siniakov said.

What to do if you don't already hold bonds

"Get some bonds on your fork!," Siniakov quipped.

"The bond market is sending important signals. Yield curves are flat to inverse. That is, you are not being paid to position in the longer end of yield curves. So don’t! Inverted (or downward sloping) yield curves have been a very reliable signal for subsequent recession. It is more a matter for when, not if," he added.

Thakur agreed.

"Considering the current high yields for high-quality bonds, which are at their highest in 15 years, and taking into account the ongoing policy fine-tuning, we recommend that clients at least bring their bond allocation back to a neutral level in their portfolio," he said.

5 stocks mentioned

1 fund mentioned

3 contributors mentioned