Why the US is still the dominant investment region (and how Aussies can access the opportunity)

Welcome to part three of the ‘Where in the World should you invest?’ series. This wire will look at the US. It's hardly an unknown investment region and certainly the region most Aussies invest in outside of Australia.

US stock markets are the largest and most liquid in the world. And despite its challenges, America is still a leading country for innovation, new technology, and entrepreneurship.

For each part of the world we are covering in this series, we reached out to a fund manager who invests in the region to answer the same five questions.

The previous investment regions discussed were Asia and LATAM, and you can assess those wires here:

- Where in the world should you invest? This region represents 55% of globally listed companies

- Where in the world should you invest? Commodities, tech, and fast growth define this region

Today we are exploring the USA with help from Alan Pullen from Magellan Financial Group.

.png)

USA

Key stats and food for thought

- The US is home to 4% of the global population

- 24% of global GDP

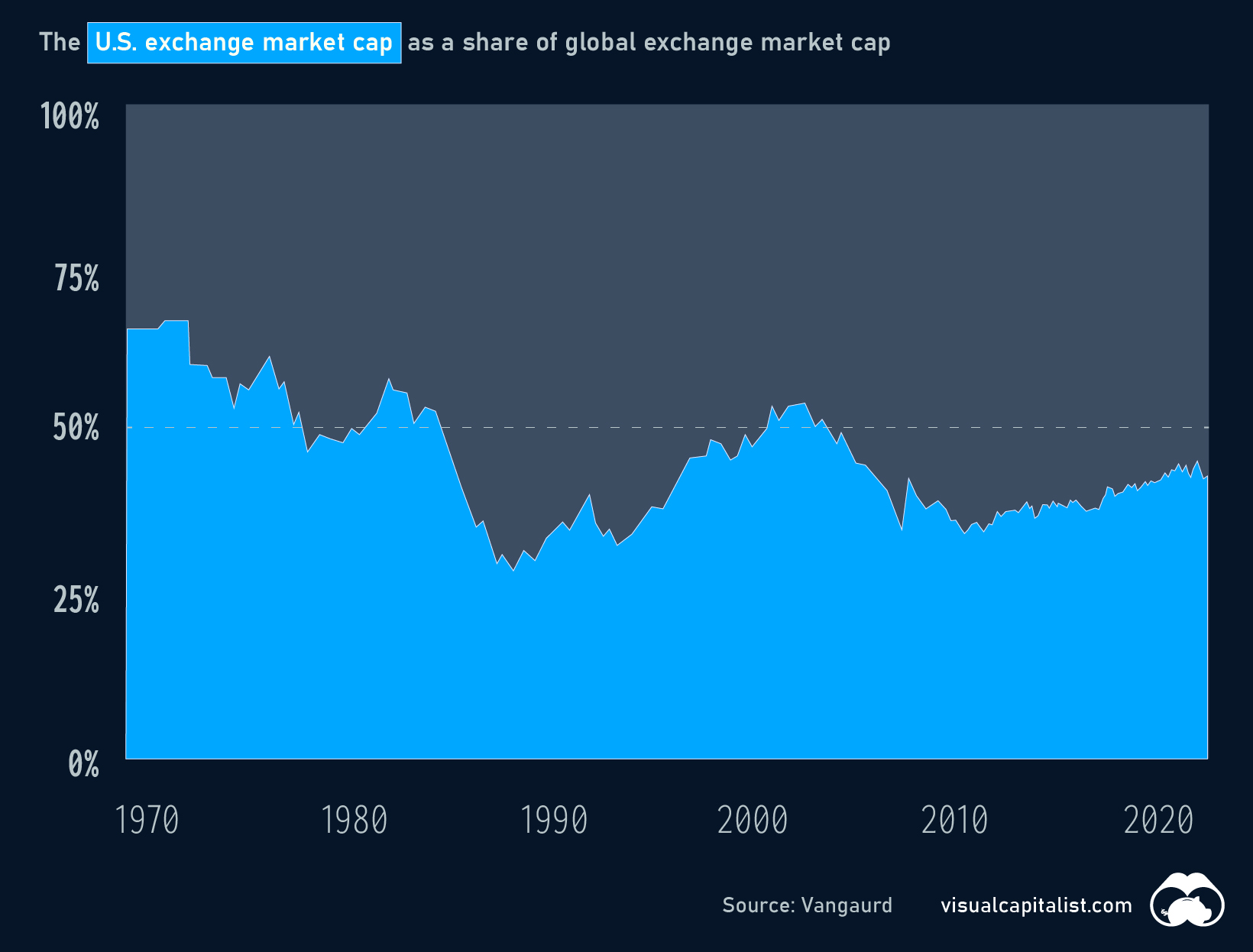

- 42% of global equities by market cap (up from around 30% since the GFC)

- The NYSE is the largest exchange in the world by market cap, at $22.8 trillion

- The NASDAQ is the second largest exchange, at $16.2 trillion

- Those two combined are bigger than the next seven largest exchanges combined (Shanghai is third, at $6.7 trillion)

What are the main characteristics of the investment region?

Why do you like the region as an investment destination?

What's really attractive about the US, is there's something for everyone and it's much more diversified with local markets like here in Australia.

Of course, it's really well-known for being the home of many technology leaders, (e.g. Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), Google (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Tesla (NASDAQ: TSLA)). You're reflecting all of the innovation coming out of Silicon Valley and other regions in the US.

But the US markets are also home to leading global companies across many different sectors. For example, McDonald's (NYSE: MCD) in quick service restaurants, Procter & Gamble (NYSE: PG) in consumer goods, Visa (NYSE: V) in payments, Coca-Cola (NYSE: KO). We all know what Coca-Cola does, and that's the point. It's a list of household names across a diverse range of industries and it just keeps going on.

Given the size of the US economy, domestic companies can grow to a significant size and become great investments. A company like Chipotle (NYSE: CMG), which is a Mexican-style quick service restaurant, it's largely domestic but it's delivered 19% compound returns for the last decade and is now a $58 billion company.

The US just offers so many opportunities for investors.

What are the major risks to the region?

It is a relatively safe investment destination in terms of investor protection, in terms of politics. It's noisy from time to time, but economically and politically, it's a reasonably stable part of the world.

There is a huge number of companies that are specialised, quite different from what you're seeing in the local markets. So it can require a different skillset in terms of the analysis. Having said that, it's definitely worth doing.

Of course, you've got to be aware of the usual tax and currency implications. But overall, it's a relatively safe destination.

What is the one thing that potential investors need to know before investing?

For a properly diversified stock portfolio, exposure to the US really is a must.

It's something you should be thinking about doing if you haven't already done it. You can organise access through most major online brokers, or global equity funds such as the Magellan Global Fund or Magellan High Conviction Fund will have exposure to US equities.

What is one stock in your portfolio that best represents the region?

Microsoft (NYSE: MSFT). It's a really good example of what the US region offers. It's a globally dominant, multinational with products readers will be familiar with, and it's a well-established, highly profitable business.

It's serving corporates and consumers with computer operating systems, work-based productivity software, servers, Xbox, LinkedIn, Bing search. I can go on, but you're getting the picture here. It's a dominant business with multiple drivers.

Microsoft also continues to lead in technological innovation. They're the second-largest type of scale cloud provider and the shift to the cloud is only in its early stages. And most recently they're taking the lead in generative AI through their partnership with OpenAI, the company behind ChatGPT. They're an early investor, owning 49% of OpenAI, and are embedding generated AI across their products suite.

It's delivered a strong return for investors but the long-term outlook remains bright for this innovative market leader.

How to invest in the US (some options)

- Magellan Global Fund (Open Class) (ASX: MGOC)

- Magellan High Conviction Fund (Managed Fund) (ASX: MHHT)

- iShares S&P 500 ETF (ASX: IVV)

- Vanguard US Total Market Shares Index ETF (ASX: VTS)

- BetaShares NASDAQ 100 ETF (ASX: NDQ)

- Global X ETFs Australia FANG+ ETF (ASX: FANG)

If we have missed any of the ways that you invest in this region - even if you own direct shares, or you would like to share an experience about investing in the US, please comment below.

4 topics

17 stocks mentioned

2 funds mentioned

2 contributors mentioned

.jpg)