Why there is "no reason" to be excessively bearish on risk assets

The economic distortions of the past few years have produced tectonic shifts in the global investment landscape. The massive fiscal stimulus and near‑zero interest rates seen during the pandemic have given way to tighter monetary policies and sharply higher bond yields.

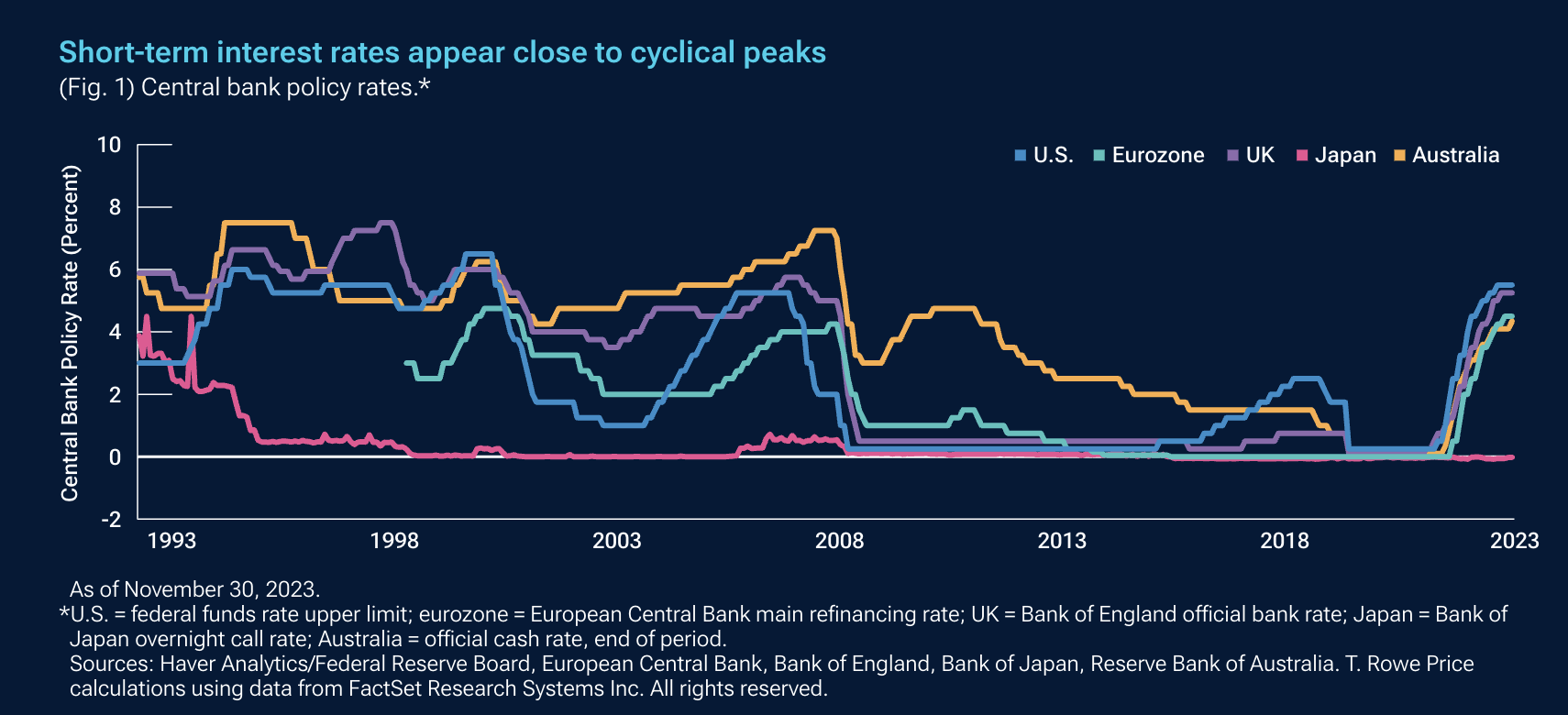

While the U.S. Federal Reserve and other major central banks have made progress against inflation and policy rates appear close to their peaks, our analysis is that the Fed is likely to hold rates steady in 2024.

Monetary policy effects typically are felt with a lag, so global economic growth remains at risk. The eurozone already is in recession, and China’s post‑pandemic recovery has been disappointing. However, the U.S. economic outlook is more encouraging, as corporations and consumers both have proven less sensitive to higher rates compared with other major global economies.

In this wire, we'll share our key asset allocation calls across bonds and equities for 2024.

Bond volatility moves to the long end

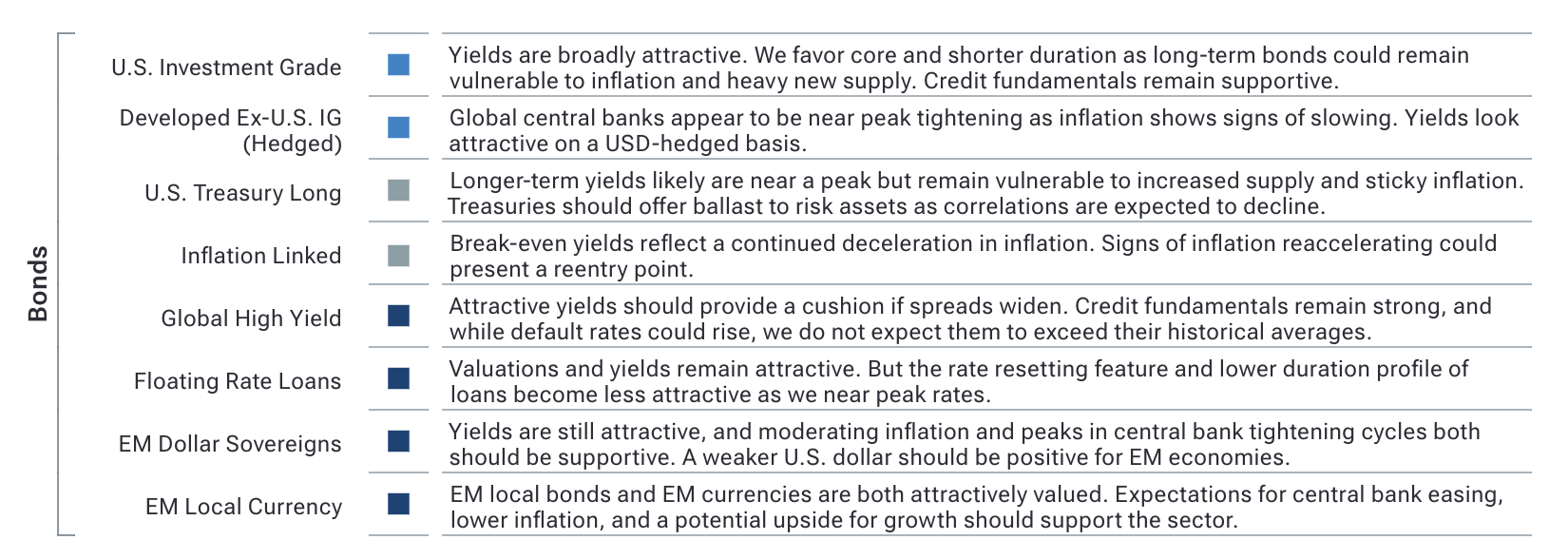

Uncertainty is likely to keep fixed income volatility high in 2024. But if major central banks remain on hold, volatility is likely to move to the long end of the yield curve, as opposed to the sharp moves seen at the short end as central banks tightened.

As of late November, futures markets were pricing in four Fed rate cuts in 2024, anticipating that the U.S. central bank will ride to the rescue if the U.S. economy falls into recession.

However, we believe the failure of the Fed and most other developed market central banks to get ahead of inflation following the pandemic makes them more likely to keep policy rates at relatively high levels through much of 2024.

Structural forces such as deglobalisation, lower labour force participation rates, and energy price pressures also could make inflation stickier than in past economic slowdowns, further discouraging central banks from easing monetary policy.

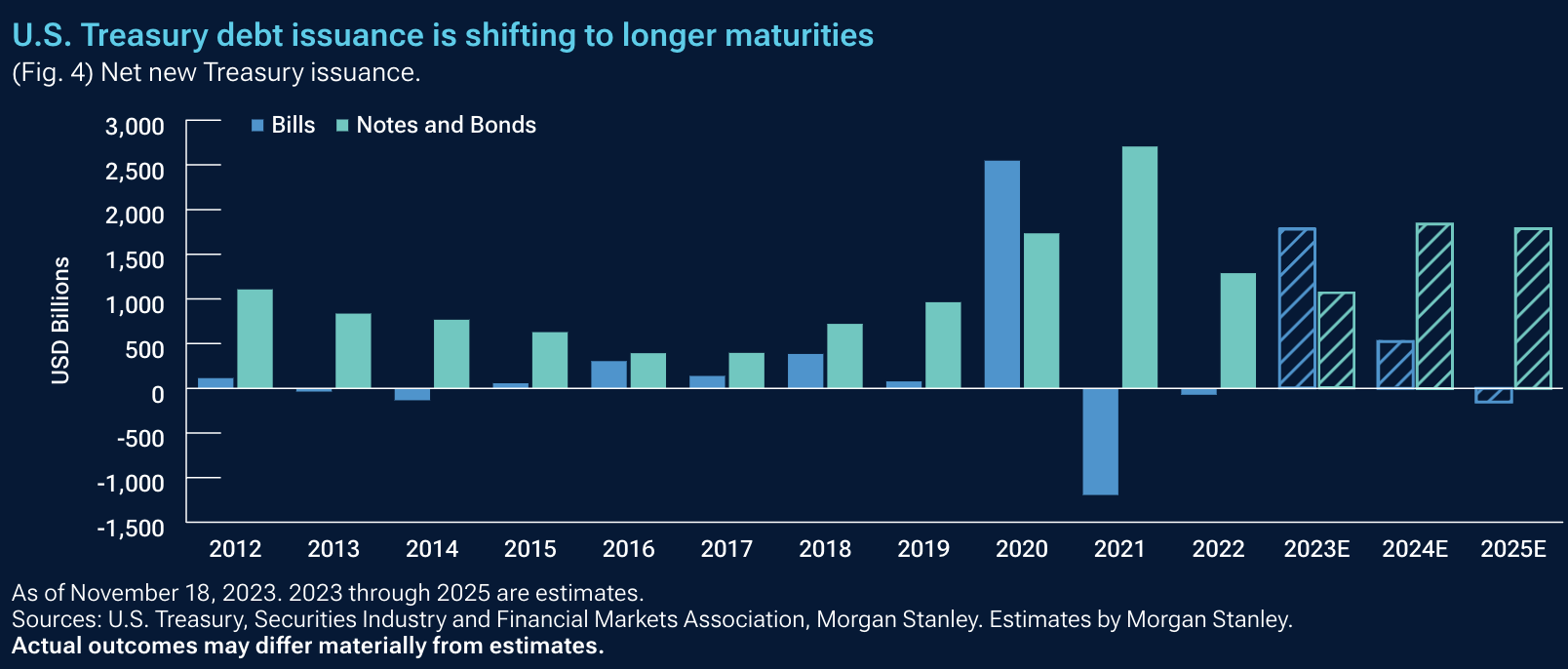

Surging U.S. Treasury issuance also could keep upward pressure on longer‑term yields. This issuance shift is the basis for one of our highest‑conviction calls: that yield curves will steepen in 2024. Although yields on high‑quality sovereign debt may have peaked in late 2023, they still could move higher. Accordingly, we think curve steepening is likely to be a more significant factor than the outlook for interest rate levels.

Another implication of the surge in government bond issuance is that it could crowd corporate borrowers out of the market—or at least force up their funding costs. This could make companies less likely to spend on capital projects or hire more employees, reducing support for the global economy.

Looking more closely at the corporate bond market, attractive yields should continue to support demand for high-yield bonds, even though credit spreads—the yield differences between bonds with credit risk and high‑quality government bonds with similar maturity dates—appear less compelling, trending near historical averages as of late November.

Looking beyond the tech giants

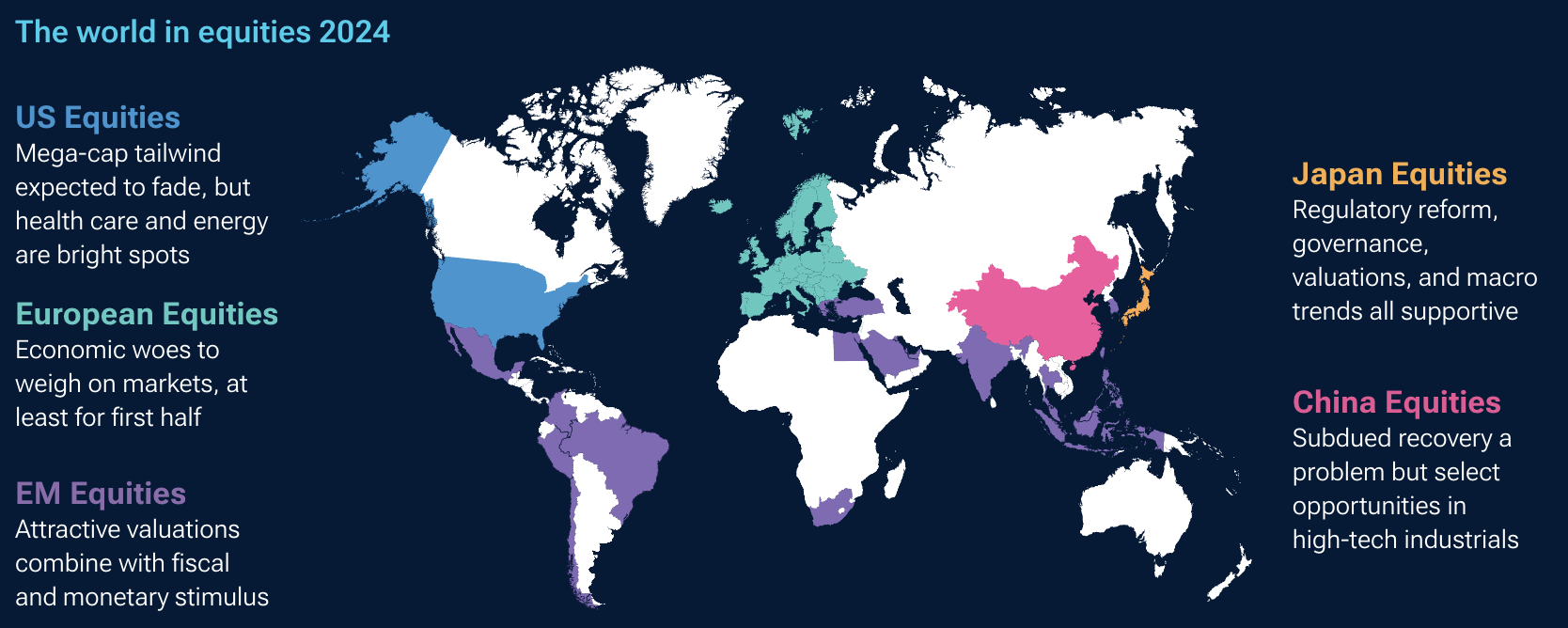

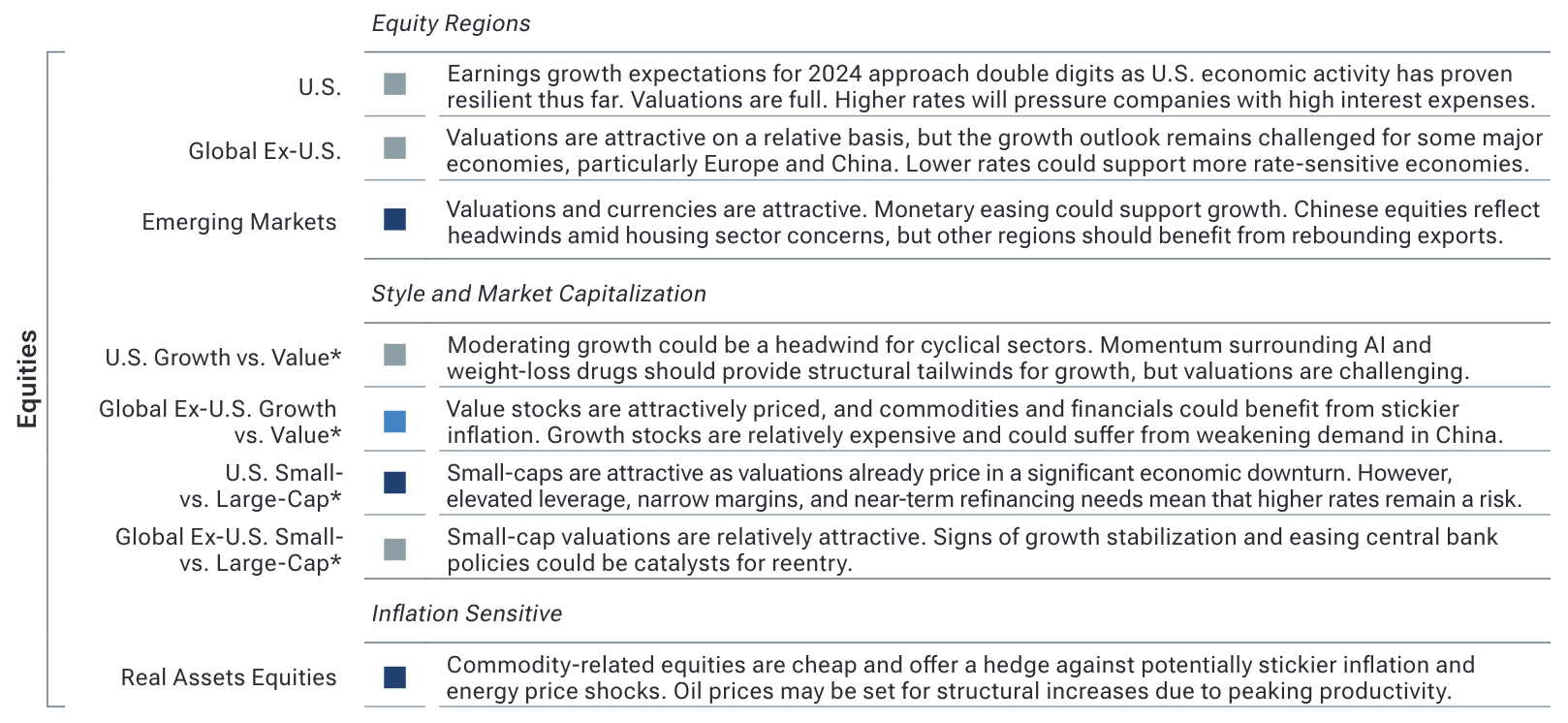

The global equity rebound in 2023 was dominated by a handful of mega‑cap U.S. technology stocks. However, positive fundamentals in some regional markets and innovations in other key sectors should help expand the opportunity set in 2024.

Despite the macroeconomic uncertainties, we see no reason for investors to be excessively bearish.

Market segments that don’t trade at nosebleed valuations, such as small‑ and mid‑cap stocks and real assets equities, look appealing on a relative basis. If we see a spike in volatility and a market sell‑off, it could be an opportunity to buy stocks.

However, we also don’t think this is the right time to take large tactical allocation bets. The recent “dis‑inversion” of the U.S. yield curve could augur volatility in both stocks and bonds in the months ahead. We think the best approach heading into 2024 is to remain broadly neutral on risk assets, including equities.

Emerging market (EM) equities are attractively valued relative to developed markets. We see selective opportunities in China but the growth outlook for China is less positive, as efforts to stimulate demand so far have been relatively ineffective. Beijing’s decision to allow its 2024 budget deficit to exceed 3% of GDP was a step in the right direction, but it’s not clear whether policymakers will go further. This uncertainty is reflected in relatively low valuations in China’s equity markets.

Within the developed markets, near‑term prospects for European equities look less attractive relative both to other developed markets and to the EMs. As the business cycle rolls over, demand is likely to weaken and profit margins could come under pressure. Companies with more robust margins are likely to navigate this environment more effectively but also will sell at higher valuations.

As Europe approaches a business cycle recovery that is likely later in 2024, further opportunities should arise in those markets, where valuations overall are likely to still be reasonable.

Japanese equities continue to look relatively attractive. The Japanese yen appears undervalued and will likely appreciate should the Bank of Japan change its monetary policy. While a stronger yen historically has been seen as a negative for the export‑driven Japanese economy, its potential impact going forward is unclear given the positive momentum and potential for repatriated flows by domestic investors. For foreign investors, however, Japan has the triple merits of reasonable valuations, a cheap currency, and structural reform.

Key sector themes

Technology/AI: Attractive opportunities could include semiconductor companies that are developing leading‑edge chips, tech service firms that help companies scale and enhance their AI capabilities, and data centres that benefit from increased demand.

Health Care: The U.S. Food and Drug Administration’s approval of a class of diabetes medications for use as weight‑control drugs has the potential not only to change patient outcomes but also to remake healthcare economics, given that obesity is a contributing factor to many other conditions.

Energy and Commodities: Energy and other commodity‑related stocks could prove to be attractive hedges in 2024 if inflation is stickier than expected and/or if geopolitical factors trigger another energy price shock. These sectors also could be a major focus for investors as countries and firms push ahead with decarbonisation programs.

2024 Global Market Outlook

Recession risk. Tightening credit. Mixed economic signals. Tectonic shifts in the market have created opportunities for investors who can adapt to the new normal. Join our chief investment officers as they identify the key investment themes shaping markets in 2024.

Monday, 11 December at 11:30am

Register for webinar here

3 topics