Why these 3 charts matter for global investors

Ahead of the Pinnacle 2020 Virtual Summit, we asked three global equities managers to share a chart from their presentation and explain its importance and the opportunities they’re seeking to exploit.

Antipodes Partner’s Jacob Mitchell discusses the ‘New Green Deal’, an investment super cycle that few investors are taking notice of as companies look to benefit from Europe’s decarbonisation targets. For Hyperion Asset Management’s Tim Samway declining economic growth across global markets means it’s all about earnings growth built on market share increases, both delivered and forecast. Finally, Resolution Capital’s Andrew Parsons looks at how diverse the global listed real estate universe has become, a fact often underappreciated by investors.

In 7 out of the past 10 calendar years, investors have garnered better returns from global large shares relative to the domestic Australian share market … but is this trend set to continue?

Generational opportunities at attractive valuations

Jacob Mitchell, Antipodes Partners CIO and Lead Portfolio Manager

While the US has benefitted from open-ended COVID-19 induced income stimulus and deficits, Europe and parts of Asia are attempting to kick-start an investment cycle. Europe’s multi trillion-euro ‘New Green Deal’ announced in 2019 paves the way for a 10-year plus power investment super cycle that, so far, few investors are taking notice of.

The presentation slide we’ve opted to share ahead of the Pinnacle 2020 Virtual Summit highlights six companies that offer multiple ways of winning from Europe’s decarbonisation goals:

- Capital providers: utilities that are ‘greening the grid’

- Raw materials: aluminium demand is set to surprise due to the light-weighting requirements of EVs; even better when the power required to make the aluminium is hydro sourced

- Enablers: the makers of EVs, wind turbines and power semiconductors

This ambitious plan will change the way Europe generates, transmits, stores and consumes energy. It will require investment in renewables, reconfiguring grids, EV adoption and building renovation. We will provide more detail on the investment case for the beneficiaries during our presentation.

And the impact of COVID-19? Well, we think it accelerates this investment, as European politicians recognise the need to act. Not only does Europe have an investment plan, but there’s also a funding plan. The recent approval of the €750b Recovery Fund is Europe’s first step towards greater fiscal integration. Europe’s carbon emissions trading scheme – where emissions from power generators must fall 27% by 2030 versus 2018 – not only compels generators to ‘go green’ it provides the funding to subsidise decarbonisation in other sectors.

While many investors continue to chase growth at any price, we are seeing generational opportunities in businesses at the forefront of this super cycle trading at attractive valuations.

The biggest risk in global equities portfolios today

Tim Samway, Hyperion Asset Management, Executive Chair

For businesses there are two potential sources of revenue growth:

- Sharing in the growth of the overall economy; and

- Taking market share.

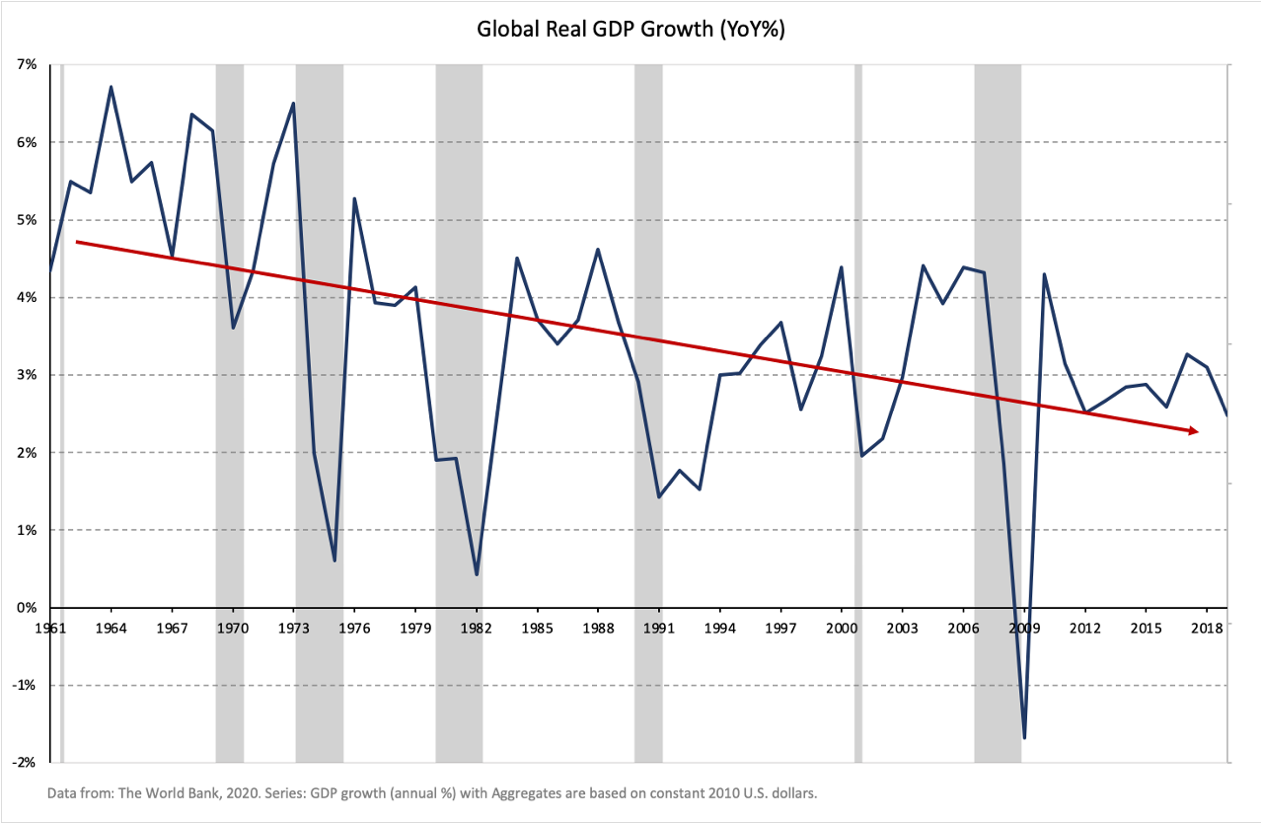

The biggest risk in global equities portfolios today is investing in businesses that rely on overall economic growth rather than market share growth. Why? Because global gross domestic product (GDP) growth, which is a measure of economic growth, has been contracting for decades and will remain low for decades to come. Population growth, low levels of competitive disruption and unfettered use of fossil fuels provided tailwinds to economic growth post WWII. As these factors reversed and became headwinds, GDP growth declined.

Click on the image to enlarge

This is why we believe the chart above is so important for investors today. It shows global GDP growth has been trending lower since the 1970’s. Recognising this fact matters because the effect on lower quality businesses (those unable to take market share) has not been readily visible to the investing public. The negative effect of falling economic growth on share prices of these businesses has been offset and balanced by the increase in valuations driven by falling interest rates. When interest rates moved to rock bottom post GFC, there was no further valuation uplift for low quality companies. Many have traded sideways for the last 10 years.

If you’ve wondered why a small subset of global companies is responsible for the majority of growth in global markets in the last 10 years, stop wondering.

It’s all about earnings growth built on market share increases, both delivered and forecast. Stellar share price performances in the last six months for companies like Square, Tesla and Amazon which are all rapidly building market share, provide strong support for this view.

The white paper Jason Orthman from August 2020 expands on this further and during my summit presentation I will share some insights into some modern business - businesses we feel are most likely to take market share and deliver superior investment returns while effectively managing the risk of low economic growth.

Listed Real Estate houses the (new) economy

Andrew Parsons, Resolution Capital CIO and Global Portfolio Manager

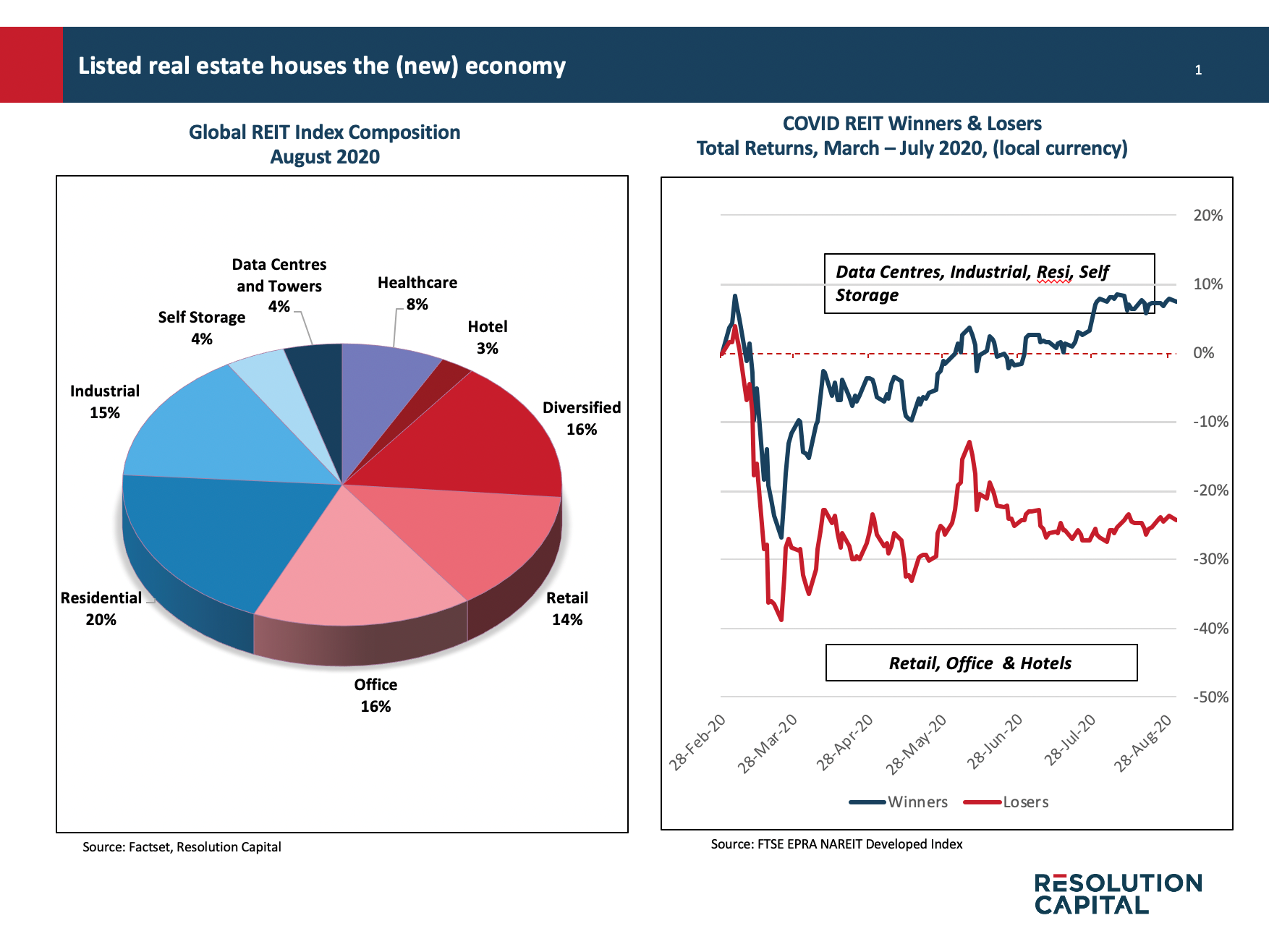

Much has been written about the downside risks for real estate as a consequence of COVID-19 including headlines about the death of the mall, empty hotels and the work from home (WFH) trend impacting the use of office space. Whilst the challenges for these segments are significant, long-term value opportunities will emerge. Equally if not more importantly, the listed real estate market also offers significant investment opportunities in sectors that are part of the economy’s growth corridors.

Click on the image to enlarge

The slide we have chosen demonstrates how diverse the global listed real estate universe has become. It is often underappreciated by investors that the global listed market can provide access to many real estate sectors not available in the private markets and the quality of the platforms.

Over the past 15 years, capital has been redirected from the traditional retail and office property to the new economy sectors relating to ecommerce and digitisation such as logistics and data centres. Furthermore, it also provides a growing exposure to basic needs real estate including multiple formats of residential including apartments, single family homes, manufactured home communities as well as student housing. Healthcare also is a growing segment with the ageing population demographics providing support for medical office buildings, life science facilities and seniors housing.

During the summit, we will highlight the acceleration of some secular trends impacting the real estate sector and the importance of building a diversified portfolio of good quality real estate with robust balance sheets that can deliver attractive risk adjusted through-cycle returns.

Register for the Pinnacle 2020 Virtual Summit

Hear from some of Australia’s most experienced investors in Global Equities as they discuss the key trends shaping the sector and how investors can gain exposure. There’ll also be an opportunity for viewers to ask questions during a Q&A session hosted by Morningstar’s Andrew Miles.

You can register for the session here, or view the entire event calendar here.

Important Information: Please be advised that the Pinnacle Virtual Summit 2020 is designed for sophisticated investors only

3 topics

3 contributors mentioned